Institutional Flow Shift? Ether ETFs Soar While Bitcoin ETFs Post Modest Gains

Ether ETFs are rewriting the playbook. For the week ending July 25, ether ETFs brought in another record $1.85 billion, marking their 11th consecutive week of inflows and their second-highest weekly inflow since launch. In sharp contrast, bitcoin ETFs managed just $73 million in net inflows, as outflows earlier in the week kept gains subdued.

Ether ETFs: $1.85 Billion Surge and Record-Breaking Streak

Ether ETFs were in overdrive, posting inflows every single day of the week, capping a historic streak of 16 consecutive inflow days. The heaviest single-day inflow was Tuesday, July 22, when the category absorbed $533.87 million. 6 ether ETFs posted green weekly entries:

Blackrock’s ETHA: +$1.29 billion

Fidelity’s FETH: +$382.89 million

Grayscale’s Ether Mini Trust: +$171.75 million

Bitwise’s ETHW: +$34.63 million

Vaneck’s ETHV: +$3.95 million

Franklin’s EZET: +$2.84 million

However, Grayscale’s ETHE (-$42.03 million) and 21Shares’ CETH (-$374.05k) were the only minor blips for ether in another super-dominant week.

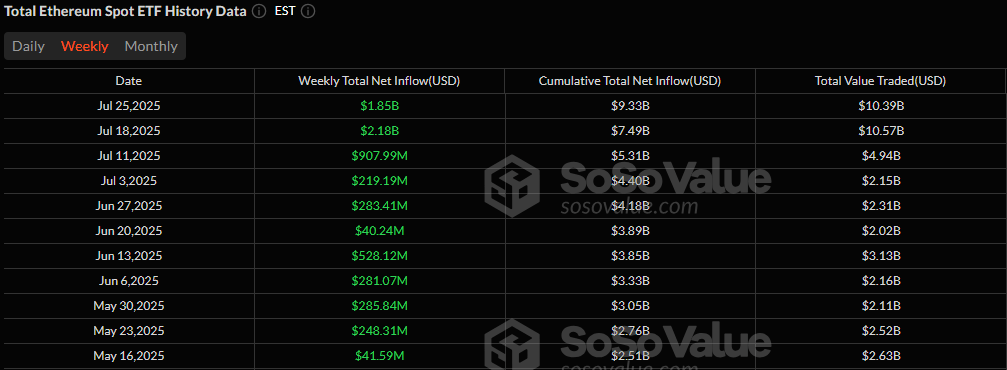

11 weeks of consecutive gains for Ether ETFs. Source: Sosovalue

Bitcoin ETFs: Modest Recovery After Midweek Wobbles

Bitcoin ETFs saw 3 consecutive outflow days at the start of the week, but two strong sessions helped the category finish in green. The biggest inflow came on Thursday, July 24, with $226.61 million flowing in. Still, overall enthusiasm appears tempered compared to previous billion-dollar weeks. This was reflected in the mixed weekly flows:

Blackrock’s IBIT: +$267.88 million

Vaneck’s HODL: +$62.04 million

Grayscale’s Bitcoin Mini Trust: +$27.18 million

Bitwise’s BITB: +$4.67 million

Franklin’s EZBC: +$3.45 million

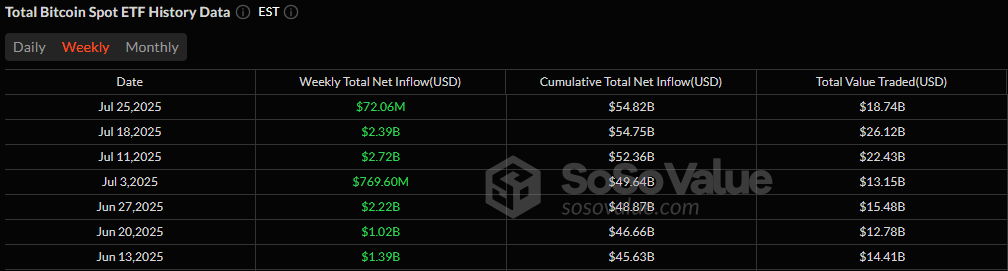

7 weeks of gains for Bitcoin ETFs. Source: Sosovalue

Despite the net weekly gain, the outflows were quite significant, with Fidelity’s FBTC registering a -$123.23 million exit, Ark 21shares’ ARKB seeing a -$90.20 million fund departure, and Grayscale’s GBTC logging a -$79.74 million exit too.

The weekly roundup of the trading action shows that bitcoin ETFs still dominate total AuM (Assets under Management) but may be ceding momentum to ether ETFs as more institutions diversify.

ETH ETFs now account for 4.3% of ether’s market cap, underscoring accelerating institutional interest. The combined inflows for the week of $1.92 billion signal a robust risk appetite despite market volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。