Author: Buttercup Network & Thejaswini

Translation: Shaw Golden Finance

In 2025, the rebels did not storm the banks. They applied for a license from the Office of the Comptroller of the Currency (OCC).

I am struggling to understand the entire "GENIUS Act" phenomenon.

The more I think about it, the more absurd it seems. So please bear with me as I explain how we moved from "rapid action, breaking the norm" to "rapid action, compliant regulation."

The act has been signed into effect, and now we finally know all the rules. Stablecoins are regulated, no longer mysterious, and we are clear about who can issue them, who regulates them, and how the entire mechanism operates. But this naturally raises a question: what does all this mean?

If you ask cryptocurrency practitioners, they will be excited, saying this is the moment for cryptocurrency to go mainstream, a regulatory revolution that changes everything. They will enthusiastically talk about "regulatory clarity," "institutional adoption," "the future of currency," while tightly holding that 47-page act as if it were the Constitution.

If you ask a U.S. Treasury official, they will elaborate on how this has solidified the dollar's dominance more than ever, how it makes everything safer and more reliable, how it brings investment back to the U.S., and all those bureaucratic clichés.

Who are the winners here? On the surface, it seems to be both sides. But to be honest: the greater benefits still flow to the regulators. Cryptocurrency and Bitcoin once aimed to crush banks and end the dollar's hegemony. Now, they hope banks will issue dollar-backed cryptocurrencies.

The core contradiction is that banks are actually fearful of stablecoins, which is entirely reasonable. They see trillions of dollars potentially fleeing traditional deposits to zero-yield, fully reserved digital tokens. So what did Congress do? They prohibited stablecoin issuers from paying interest, essentially to protect banks from their own fear of competition.

The law states:

"No authorized payment stablecoin issuer or foreign payment stablecoin issuer may pay any form of interest or yield (whether in cash, tokens, or other compensation) to any holder of a payment stablecoin solely for holding, using, or retaining any payment stablecoin."

Meanwhile, cryptocurrency is working to build a trustless, decentralized alternative to traditional finance. Today, you can send stablecoins on-chain through an embedded widget in a venture-backed application… while that application settles with a licensed issuer… which collaborates with JPMorgan Chase. The future is here. It looks just like the past—only with a better user experience and more regulatory paperwork.

The "GENIUS Act" has created this marvelous Rube Goldberg machine where you can have revolutionary blockchain technology, but only if you:

Obtain approval from the Office of the Comptroller of the Currency

Maintain a 1:1 reserve ratio of U.S. Treasury securities

Submit monthly proof documents signed by the CEO and CFO

Allow authorities to freeze your tokens on command

Commit to never paying interest

Limit business activities to "issuing and redeeming stablecoins"

The last point is particularly interesting. You can completely change the financial industry, but if you try to use that revolutionary finance to do anything else, that is absolutely not allowed.

What we are witnessing is a movement that was supposed to be anti-establishment being institutionalized. Circle and other existing stablecoin issuers are cheering because most of them are already compliant, so now they can watch their less-regulated competitors get kicked out of the "sandbox."

Meanwhile, Tether faces a life-or-death choice: either become transparent and accountable or be banned from U.S. exchanges by 2028. For a company that started with opacity and offshore banking, this is akin to asking a vampire to work during the day.

Of course, Tether itself doesn't need to care too much about this. Its market cap is as high as $162 billion, larger than Goldman Sachs and most countries' GDP, frankly larger than the entire regulatory body trying to oversee it. When you reach such a scale, "comply or leave" sounds more like a suggestion than a threat.

The "Libra clause"—which essentially prevents large tech companies from issuing stablecoins at will—was named after Facebook's failed attempt to create a global digital currency. Remember when everyone was worried that Facebook might undermine sovereign currencies? Now we have established a system where if Facebook wants to issue a digital token that cannot pay interest and must be fully backed by U.S. Treasury securities, it needs unanimous approval from the Federal Reserve.

Then there are the actual economic reasons explaining why everyone suddenly started paying attention to this issue. U.S. merchants currently pay 2% to 3% in fees to Visa and Mastercard for every transaction, which often becomes their largest expense after payroll. Meanwhile, stablecoin payments for large settlements might only cost a few cents, or even less than 0.1%, because blockchain infrastructure does not require a massive network of banks and credit card processors to take a cut. When annual card processing fees reach $187 billion, keeping that money in merchants' pockets is real cash. It's no wonder Amazon and Walmart are interested in stablecoin solutions. If you can send digital dollars directly, why pay fees to credit card giants?

Then there's that feedback loop that no one wants to mention, which is somewhat frightening. If stablecoins really succeed, we could be talking about trillions of dollars in issuance—then a significant portion of the demand for U.S. Treasuries would come from stablecoin reserves.

This sounds good until you realize that the demand for stablecoins is inherently more unstable than traditional institutional buyers. If people lose confidence in stablecoins and start redeeming en masse, all those Treasuries would flood the market at once. Suddenly, the U.S. government's borrowing costs would depend on the mood swings of cryptocurrency Twitter users. It's like tying your mortgage payments to the emotional fluctuations of day traders. The Treasury market has seen a lot, but "algorithmic sell-off pressure from panicked stablecoin users" is a first.

The most exciting part of all this is that it reflects the journey of cryptocurrency from anarchic currency to institutional asset class. Bitcoin was supposed to be a peer-to-peer electronic cash system that did not require a trusted third party. Now we have federal laws ensuring that digital dollars can only be issued by widely trusted, heavily regulated third parties, which must also report to even more trusted fourth parties.

The law requires stablecoin issuers to be able to freeze tokens on the blockchain network at the request of authorities. This means that every so-called "decentralized" stablecoin must have a centralized "kill switch." This is not a flaw; it is a feature.

We have successfully created a censorship-resistant currency with mandatory censorship capabilities.

Don't get me wrong. I absolutely support regulatory clarity and dollar-backed stablecoins. This is indeed great: crypto innovation has real rules, and the mainstreaming of digital dollars feels like a genuine revolution. I fully support it. But let's not pretend this is a generous and enlightened act from regulators. The regulators did not intervene because they suddenly became enthusiastic about crypto innovation. Rather, someone walked into the Treasury and said, "Hey, what if we could get the whole world to use more dollars, but in digital form, and make them buy more Treasuries to back those dollars?" Suddenly, stablecoins transformed from "dangerous crypto things" into "excellent tools for consolidating dollar hegemony."

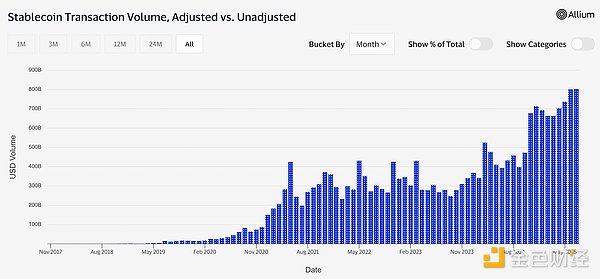

Every time a USDC token is minted, it means another U.S. Treasury security is sold, and with $242 billion in stablecoins, that translates to billions of dollars directly funding Washington and driving global demand for U.S. government debt. Every cross-border payment means another transaction that does not involve euros or yen, and every time a U.S. stablecoin is listed on a foreign exchange under regulation, it means another foothold for the U.S. monetary empire.

The "GENIUS Act" is the most ingenious foreign policy tool disguised as domestic financial regulation.

This indeed raises some thought-provoking questions about what we are actually building. What happens when the entire cryptocurrency ecosystem becomes an appendage of U.S. monetary policy? Are we creating a more decentralized financial system, or merely constructing the world's most complex dollar distribution network? If 99% of stablecoins are pegged to the dollar, and every meaningful innovation requires approval from the OCC, have we inadvertently turned this revolutionary technology into the ultimate fiat currency export business? If the rebellious energy of cryptocurrency is channeled into making the existing monetary system more efficient rather than replacing it, then as long as payments can proceed smoothly, does anyone really care?

Faster speeds, we all make money? These may not necessarily be problems. It's just that when all this started, no one thought we would be solving these issues.

Listen, I have been mocking this approach non-stop, but the fact is it might actually work. Just as we evolved from wildcat banking in the 1930s to the Federal Reserve System, we might be witnessing cryptocurrency grow from its chaotic adolescence into a mature, mundane, yet systemically important part of financial infrastructure.

To be honest? For that 99.9% who just want to transfer money quickly and cheaply without considering monetary theory or decentralization ideals, this might be exactly what they need.

Banks are already preparing to become the primary issuers of these newly regulated stablecoins. JPMorgan Chase, Bank of America, and Citigroup are all gearing up to offer stablecoin services to their clients. The institutions that cryptocurrency originally aimed to disrupt are now becoming the main beneficiaries of regulatory approval for cryptocurrency.

This is not the revolution anyone expected, but it may be a revolution that everyone can experience. And from a certain strange perspective, it could be considered a stroke of genius.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。