The market is merely a reflection of emotions. Once you can control your emotions and hedge against your own foolishness, good things will happen.

Written by: Dyme

Translated by: Luffy, Foresight News

The market is quite interesting. It often rewards bad behavior, but ultimately it always reverts to the mean. Those who never consider this will eventually reap what they sow and become humble.

Recently, several people have asked me how I achieved stable and significant profits from scratch, surpassing my previous trading results and setting new highs for my portfolio.

In short: deep surrender, foolish mistakes, and luck.

My "zero" is different from others, but it also has similarities. It was never literally having nothing; rather, it was a mental collapse, a complete abandonment of myself.

I failed in all my attempts and had to slowly crawl out of the dark abyss. Then, I made a comeback. You have no idea if I’m playing a role-playing game. I’m not, but you don’t have to believe me.

I have never concentrated on writing down these experiences; I’ve only shared some snippets over the years. My friends and many long-time followers know what happened. I went from a "foolish top signal" to "now Dyme seems to have a clear understanding of the market."

Unless you can understand the pain I went through, you won’t gain any useful information from this article. So, buckle up; we are about to embark on a journey. It will be a long story.

If you don’t want to hear my boring story, you can jump straight to "what you want to see (the highlights)." It’s time to sort through these experiences.

2019

After working for about four and a half years at a job I didn’t like, I finally quit. I had been a staunch supporter of Bitcoin for many years. But seeing others get rich through leveraged trading, I wanted to give it a try, so I planned to take six months off work to focus on learning trading.

At that time, I knew nothing about chart analysis and trading, yet I started trying options and stock trading, learning to draw lines on charts. Anyone who remembers my early charts knows they were a complete mess, and my judgments were often wrong. More importantly, I had no concept of risk management.

However, I realized that understanding market signals seemed increasingly important. I had been fiddling with those amateur-level charts, and after 2017, my online friends were getting better at it.

Many of us became very wealthy in 2017, but as Bitcoin plummeted 80%, wealth slipped through our fingers. I guess I wasn’t the only one who thought, "It’s time to learn chart analysis so I won’t lose so badly again."

In 2019, I had about two to three thousand followers, mostly cryptocurrency enthusiasts.

I didn’t enter this field to become famous; I just wanted to focus on trading for six months and learn some basics, like chart patterns and moving averages. I didn’t know what was useful and what wasn’t, but I had to try.

I had savings to sustain my living for six months and could also receive unemployment benefits. My life was secured for the foreseeable future.

So, in August 2019, considering my years of work experience, I asked my employer to lay me off (as is well known, they never opposed applying for unemployment benefits). They agreed.

Unfortunately, shortly after that, Bitcoin peaked in 2019, and the market remained volatile and flat until mid-2020. It was the worst timing; I happened to quit and fully commit to trading at that moment.

I finally had time to think, learn, and do those things I never had time for while working 40 to 50 hours a week, but of course, I also had to bear all the risks and downsides that came with this freedom.

I started taking action. I traded call options on the S&P 500, speculated on stocks, studied charts daily, and tried to make at least $100 to $500 a day. In the year leading up to 2020, the cryptocurrency market was bleak, and I only had sporadic profits, but I managed to persist.

If I hadn’t been a complete novice at that time, the trading environment would have actually been quite good.

2020

Everything was going relatively smoothly because I logged into my account daily to share my (terrible) opinions, and my follower count was increasing. I occasionally made profits, and my account balance was generally on the rise. People appreciated that I shared valuable information online because not everyone had the time to think about these things (after all, they had to work). Although I lost a lot of money, I could always quickly recover my losses. For a novice, that was acceptable.

Leveraged trading became my lifestyle. I stared at 15-minute charts, trading with 20x leverage, desperately trying to extract some benefits from the market until February 20, when my positions hit an all-time high, and I finally believed I was doing quite well in trading.

Then, the "nuclear weapon" of the COVID-19 pandemic hit.

Almost in the same week, my unemployment benefits also expired.

So, my original plan to learn for a while and then find a proper job was instantly shattered. It felt like the end of the world—a new virus had emerged.

I managed to short the market and turned 0.5 Bitcoin into 1 Bitcoin using 50x leverage during the market crash triggered by the pandemic. That week, that was the only thing that went smoothly; my stocks were severely hit, and I was sure my income was doomed.

It was as if fate had conspired to force me to fully commit to trading.

Fortunately, Jerome (the Federal Reserve Chairman) and his "money printer" saved the world.

What happened next is well known. The market soared over the course of a year. It was truly a peak period of "only up, no down." While the market allowed people to profit, it was also absurdly ridiculous.

FTX

Nothing is more thrilling than leveraged trading in a rising market. I had some experience, but it was limited, and I knew very little about the macro environment. I only knew that Jerome was printing money, and the market would surely rise because of it.

Then, our "savior" arrived, promising to lead us into a paradise and would never do anything terrible.

At that time, we had no idea that FTX was about to take us on a lifelong unforgettable "journey."

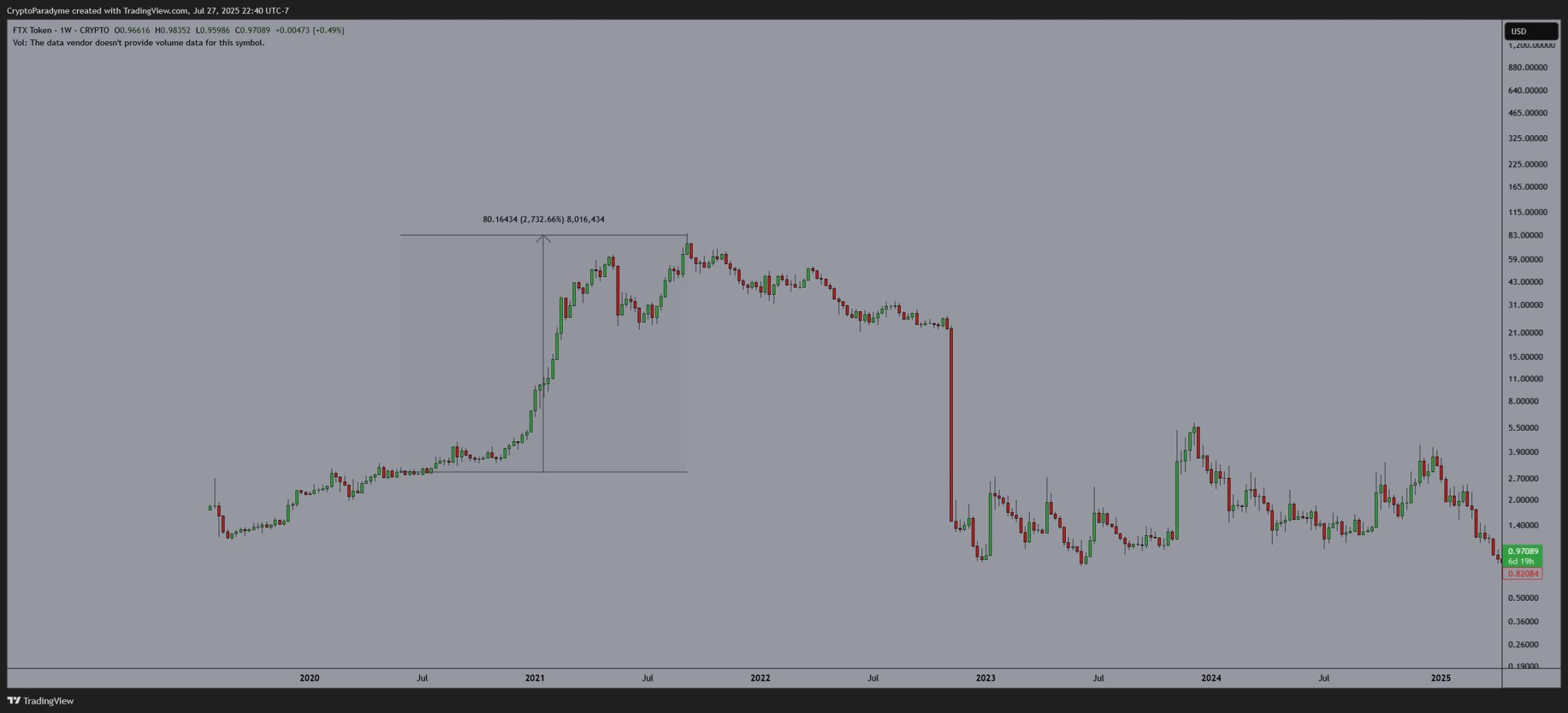

I deposited about $4,000 to $5,000 into FTX and bought FTT (FTX platform token) multiple times at prices between $2 and $4.

FTT skyrocketed by 3000%. Suddenly, I had $40,000 to $50,000 in my leveraged account. I had never had so much money before. (This was the first warning sign.)

I deposited more funds to engage in more leveraged trading because my FTT was staked and couldn’t be used as collateral. At that time, I was emotionally fully invested in the FTX ecosystem.

I still can’t believe this chart is real.

The day my follower count reached 10,000 was also the day the "only up, no down" market began. This world never ceases to surprise.

I went from someone who only replied to others' tweets to a somewhat well-known figure.

In the following months, despite the absurdly good market conditions, my physical and mental health deteriorated. The lockdown policies in my area were very strict. I gained weight, going out only two or three times a week. My daily routine was a mess. I became almost familiar with the delivery drivers from DoorDash, consuming 4,000 to 5,000 calories a day to cope with the despair and misfortune brought by the pandemic.

Those days were terrible.

But I was making a fortune in the market, able to pay my bills, and all my assets were rising, so I kept increasing my investments.

I often used 10 to 20 times leverage. Sometimes I could make $40,000, and other times I would lose $20,000.

I also engaged in lending, trading perpetual contracts for profit, and blindly invested in various emerging altcoins (like COPE).

I often stayed up late because I didn’t like waking up early, and since I wasn’t working, I started staying up until the market opened, making a few trades, and then sleeping until 4 PM.

This wasn’t good for my health either.

Additionally, I earned a decent income by referring others to sign up. During peak weeks, I could make $1,000 a day.

I used this money to trade and cover some losses.

I caught several upward trends in Dogecoin, SOL, Bitcoin, and various altcoins.

I was a typical bull market "genius."

The market rewarded me.

https://x.com/CryptoParadyme/status/1388019214515118080

My highest account balance on FTX was about $250,000, mainly due to SOL, FTT, and Bitcoin.

Later, SBF (the founder of FTX) reduced the daily withdrawal limit for accounts without KYC (identity verification) from $9,000 to $2,000. In hindsight, this might have been the first warning sign of his later legal troubles, but who knew?

I would withdraw money every few days, but that money was actually still trapped in FTX, and I was greedy, wanting to earn more. I calculated that to withdraw all my money would take about 120 days, and I would have to log in daily to make withdrawals.

Part of the responsibility lay with SBF’s new regulations, but it was also on me. Because there was a moment when I indeed thought, "I should withdraw this $250,000 and improve my life."

I could have withdrawn all my money before FTX went bankrupt.

Even after the market peaked in November 2021, I continued to gamble. I was no longer trading; I was going against the trend. Even when market buying pressure dried up, I was still going against Bitcoin’s cycle.

Every day brought new losses, and with my constant withdrawals and losses, my account balance quickly went to zero.

I lost two-thirds of my funds on FTX because I forced trades. Most of my trading career was spent in a "only up, no down" market, and no one reminded me to change my strategy, except for Jim and Insilico. At the time, I thought they were just annoying bears, but they were among the few who accurately identified the top. For that, they deserve credit.

During that time, there were no once-in-a-lifetime entry opportunities, only endless pain.

2022

Things got worse.

In the first week of 2022, one of the most important people in my life, my grandmother, passed away.

We had known this day would come, but that didn’t make it any easier to accept. She had been suffering for a long time, and we felt some comfort knowing she could finally rest.

With the loss of family, a bleak outlook, and the market still showing no signs of rising, I was purely relying on luck. A few months later, I inherited some money. It wasn’t much, but it was something.

Because of the special source of this money, I held it in deep reverence. But in any meaningful sense, it wasn’t enough to change my life.

So, like a gambler, I tried to invest in dividend stocks to earn income on my father’s advice, but I lost 20% in just four to five months.

Clearly, during a rate hike cycle, no one wants dividend stocks.

I didn’t want to risk that money anymore.

So I saved the cash (this was the first sign that I was starting to learn), putting it in an account I would hardly check. I needed to think, and I didn’t understand the market at that time.

Hitting Rock Bottom

Until early 2022, stocks were generally still rising, and I was doing reasonably well in stock trading.

My brokerage account balance peaked at $120,000 in 2021, while I had started with about $20,000, which was quite good for a novice.

Interest rates had been low for 14 years, and I had no idea what I was doing. I had made money over the past two years by going long on the S&P 500 index, so I continued to randomly draw lines, trying to make big bets.

Months passed. I occasionally shorted but didn’t make much money. Losses piled up again and again. I also tried to catch the bottom.

What people don’t remind you in trading is that both losses and gains compound. But the mental fatigue from consecutive losses does too, just as the previous euphoria made me blind to potential downturns.

My need for income grew, leading me further down the path of risk as I sought to recover losses.

I was trading based on emotions; at that time, I was still quite overweight, and lockdown policies were still in effect. I lost a lot of weight and wiped out my entire portfolio.

Then I finally hit rock bottom. In a moment of extreme instability, I put my last $40,000 of personal funds into some call options on the S&P 500 index because the market finally showed some signs of improvement. I promised myself I would never make such a mistake again.

Jerome raised interest rates again. The market crashed. Within hours, I lost about $30,000 to $35,000.

In hindsight, I feel like I was escaping the grief of my grandmother’s passing, trying to push myself into a corner to feel some pain. Those days were not easy; it was a chaotic time in my life.

I think I had about $8,000 to $10,000 left (not counting my personal retirement account and the inherited money, which I considered off-limits), along with a pile of worthless silver.

My confidence was completely shattered.

This was my "zero."

I think I lost over $400,000 in total. However, I never did a comprehensive tally.

Everyone’s "zero" is different. It’s never literally zero, but for me, it meant that the efforts of the past few years had been in vain, and I needed to make a change.

My full-time trading attempts from 2019 to 2022 ultimately ended in failure.

I had bills to pay, and my money would run out in two to three months.

My most foolish move might have been to use my meager funds to try to recover losses. Fortunately, I suppressed that thought.

I started selling physical assets to pay bills, even selling some silver to cover rent, something I had never done before.

I began looking for a job. But I was emotionally shattered, and I was a mess. In that state, I couldn’t find work. I think in 2022, many of us might have felt similarly.

My parents had to step in several times to help me pay bills.

I had been self-sufficient for years, and now I had to ask my parents for help to avoid being kicked out. It was incredibly difficult.

I found some online gigs to make money, barely scraping by, but that money was nowhere near enough to live on.

The situation had deteriorated to the point of being unbearable; it was perhaps the most humbling moment of my life.

I focused my energy on going to the gym and thinking about the market. I even temporarily stepped back from Twitter several times. I didn’t know what to do next.

I spent a lot of time in the library. I read many books on macroeconomics; I don’t know how much I retained, but it did provide some comfort.

2023-2024

In May 2023, I did something responsible—I found a job.

Once I stabilized and my income could meet foreseeable needs, in August, I used the money my grandmother left me to buy some Bitcoin for about $25,000. It wasn’t much, but it was the first significant investment I had made in over a year.

I didn’t make this decision lightly. I spent months thinking, researching the market, and rebuilding my cash reserves.

Again, this money wasn’t much (less than $100,000). I knew Bitcoin would continue to rise, and I did what I thought was responsible.

I also invested some of my meager personal retirement account funds into Bitcoin through the Grayscale Bitcoin Trust (GBTC), betting that a Bitcoin ETF would be approved.

I set these investments aside and didn’t pay attention to them. To this day, I haven’t cashed out these funds into my bank account, but I have realized some profits at different times.

I continued working, steadily accumulating Bitcoin.

I believe my grandmother would be pleased with the appreciation of these investments; this last act in her life pulled me from the depths and pointed me in the right direction.

I kept working. But I drew on the experiences I had accumulated in the market over the years and learned from past mistakes.

I bought more Bitcoin and SOL. I deposited money into other accounts weekly (out of sight, out of mind).

About three years later.

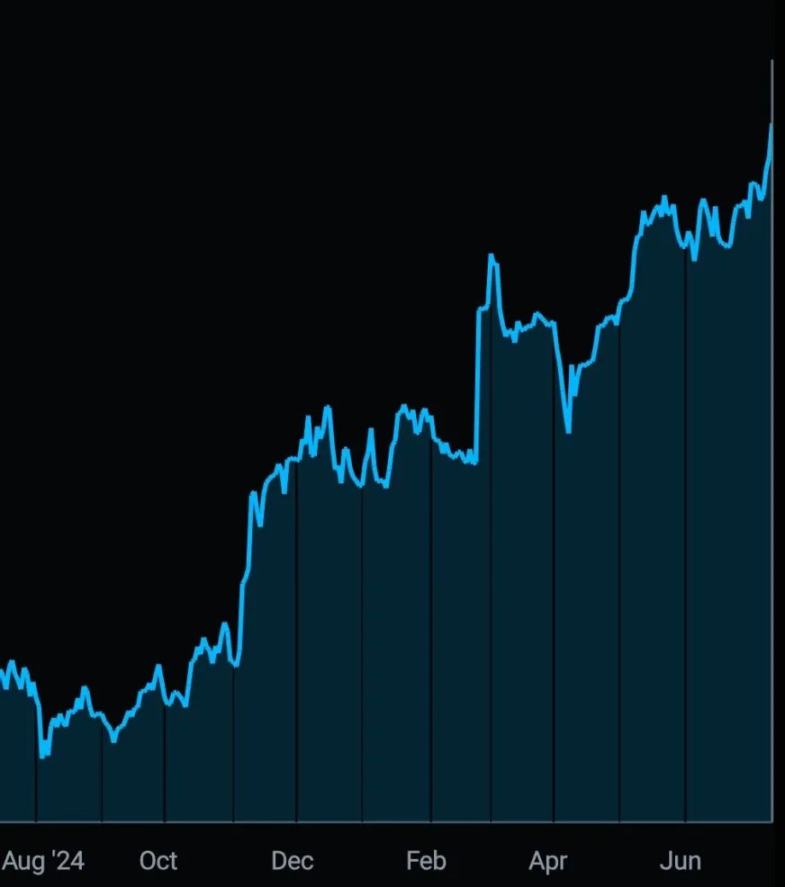

Everything started to go smoothly. Now, my portfolio has set new highs multiple times.

Since mid-2023, I have been able to profit steadily and minimize losses.

I finally know how to do this correctly.

My portfolio value

What You Want to See (Highlights)

Did you jump straight here? That’s okay.

I guess you’ve realized I’ve done a lot of foolish things, and maybe you’ve done some too (you definitely have).

I completely changed the way I trade and invest in the market.

I became focused, rarely sold, and looked for multiple factors influencing my trades. I increased my investments when I was confident and responsibly took a portion of my income to invest, rebuilding my cash reserves.

I had several big successful trades. Besides Bitcoin, there were ARM, COIN, SPY, SOL, DOGE, and other meme coins.

These trades brought me substantial returns because I understood the narratives behind them, patiently investing during key moments of market panic, and decisively taking profits when I felt the market was about to peak.

Once I exited a trade, I would set aside a portion for long-term holding and then look for the next opportunity.

These $10,000 to $20,000 gains quickly turned into six-figure profits, allowing me to enjoy a pleasure that only a few can experience: the magic of compounding.

Make good use of compounding. Because as your portfolio grows, the effects of compounding become increasingly apparent.

90% of my trades are through holding quality assets in spot, and sometimes I add a few options.

Painful Lessons

Mindset

Making money no longer gives me the same euphoric thrill it once did. Of course, making money is a "good thing" for me and my portfolio. But you are a capital manager, and you must strive to grow your account. You made $10,000 last week, but how did your quarterly performance look?

If you feel "excited" about a trade, you are likely trading for the wrong reasons. In terms of increasing and preserving capital, you need to be a ruthless operator.

Recognizing Reality

Cash or assets in exchanges are not real. They are all fake.

"Fake, all fake. It’s a scam, a trap. Like fairy dust. It doesn’t exist. Never realized. Irrelevant, you can’t even find it on the periodic table… this is not real."

Get your money out into your hands, or someone will always take it from you.

Leverage

Use leverage sparingly and responsibly. Throughout this entire trading cycle, I’ve probably only done leveraged trading four times. I’ve tried many times, but leveraged trading no longer excites me. I still trade options weekly, but the scale is just a small fraction of what it used to be; it’s just icing on the cake.

Follow the Money

Easier said than done, but clearly, last year’s meme coin frenzy was a great opportunity to make money. So I participated, but my positions were always small. Small bets, big returns.

With a few coins, I turned 1 to 5 SOL into 40, 50, or even 100 SOL.

I also had a few losses (Boden coin cost me $100,000, along with RTR coin and various other scam coins). However, because I controlled the risk scale, the losses are now just a minor annoyance rather than a real threat.

Just don’t get trapped in the dilemmas of any market you’re focused on.

Grasp the Narrative

Whether it’s AI, Solana Summer, Bitcoin ETFs, or Ethereum’s decline, various narratives will emerge, and charts often reveal the market direction. Is anyone buying during a downturn? Then you buy too.

Bitcoin? BlackRock is buying heavily, and other institutions are following suit. Then follow along.

AI? Great. Going long on Nvidia was (and may still be) a great trade.

HOOD (Robinhood)? The bank for young people. Then follow along.

Don’t go against the trend. Is the market continuously rising? Then go with the flow until things become unreasonable.

Hold Spot with Confidence

Spot positions have no closing price and no maintenance cost. I really wish someone had told me this earlier. If you want to trade perpetual contracts, make sure to keep your core capital separate from your trading account. Don’t put all your net worth into the perpetual contract account.

I fell into the trap of leverage in my early years, thinking it was the "only way" to make money.

Accept Losses

The market doesn’t care how smart you are. If you’re losing badly, accept the loss and start over. Don’t hold onto the illusion that trades will turn in your favor, especially when you’re using leverage.

Market Psychology is Real

Looking back at 2023 and 2024, many meaningless events led to market crashes. Even on the charts, breaking support levels can be a bullish signal.

Think from the perspective of those who are less smart than you. When they feel fear, do the opposite. Focus on longer time frames, and mark your price levels. Sell a little when the market is overly optimistic; buy when it’s down.

Typically, when the liquidation volume in cryptocurrency exceeds $1 billion (in the downward direction), it’s time to buy. However, as the cryptocurrency market grows, this number may need to be adjusted.

Time is Your Greatest Asset

Everyone has time until the end of life. You can leverage time through patience.

Learn to Observe the Market

This sounds simple, but one of the mistakes I made at the market top was not recognizing shifts in market conditions, such as interest rate changes, cryptocurrency bear markets, etc.

In hindsight, it was clear that people were no longer making money broadly, and the market landscape had changed.

It’s okay not to make money for a month or two.

Waiting for opportunities is a good thing. Identify extreme market conditions and take advantage of them when significant movements occur.

The market will give you opportunities for compounding growth; all you need to do is stay calm and seize those opportunities.

If you trade to make money, you will emotionally lean towards needing to make money every day, leading to forced trades.

When you become a calm spot swing trader, you will have the patience and insight to think things through.

Stay Focused

Managing 40 positions is something only a fool would do unless you treat it as a full-time job. You only need 1-3 good trades and to increase your position size.

When you have the capability, a blind robo-advisor is a good place to store cash.

Hedging your excitement and foolishness through a third party has been a huge breakthrough for me. Most of them don’t do anything fancy; they just invest in index funds and let it ride, charging only a few basis points in fees.

I can’t describe how good it is to have a real wealth manager or robo-advisor where you deposit your money and never have to worry about it again. Trust that the market will rise in the long term and let them do what has worked for decades.

This is especially useful if you’re not familiar with technical analysis or are struggling with trading.

The market is merely a reflection of emotions; once you can control your emotions and hedge your foolishness… good things will happen.

I believe this narrative reflects my memories as accurately as possible.

I hope you enjoyed reading this article. I hope it can help some people. Never resort to self-harm (I almost did).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。