Most people are still unaware that what is happening this week is setting the tone for August and may determine the market direction for the entire summer.

Three major variables—the Federal Reserve's interest rate decision, tech giants' earnings reports, and the White House's digital asset report—will be released simultaneously, just before the historically weakest season for the crypto market arrives.

Traders find themselves at an awkward crossroads: should they position themselves for a rebound in advance, or prepare for a wave of liquidity withdrawal?

As noted in the latest report from 10xResearch: "We are approaching a critical moment: the most important events on the calendar—corporate earnings, the White House's digital asset report, and the FOMC meeting—are about to be settled before summer arrives. Given that the cryptocurrency market has historically performed poorly in August and September, traders are facing a dilemma." Their real-time indicators also suggest that today's movements are likely to set the tone for the entire summer's market.

Complicating matters, the market is not just waiting for an answer on interest rate cuts, but is looking for a directional signal. Will it shift towards easing, continuing to push Bitcoin and Ethereum higher? Or will it remain stagnant, bringing a downpour to the market?

Next, Rhythm BlockBeats has compiled macro information regarding interest rate cuts and tariffs, as well as traders' views on the upcoming market situation and mainstream coin trends, to provide some directional references for trading this week.

This Week's Macro Data Triple Play

From Wednesday to Friday, the U.S. will release three key economic data points—GDP, core PCE, and non-farm payrolls—together forming three benchmarks for the starting point of interest rate cuts in this cycle, guiding market sentiment as much as this week's Federal Reserve meeting.

July 30 (Wednesday): The preliminary GDP for Q2 will be released, expected to be +1.9%, a significant recovery from Q1's -0.5%. If the actual value rises further, it may be interpreted by the market as "soft landing still in progress," thereby suppressing demand for early interest rate cuts.

July 31 (Thursday): The core PCE inflation for June will be published, estimated to grow 2.7% year-on-year, which is the inflation indicator most closely watched by the Federal Reserve. If it comes in slightly below expectations, it may enhance market bets on interest rate cuts this year; if it unexpectedly rises, it could trigger adjustments in short-term risk assets.

August 1 (Friday): The non-farm employment data for July will be released, with expectations of 115,000 new jobs and a slight increase in the unemployment rate to 4.2%. This will directly impact the Federal Reserve's judgment on whether "the labor market has significantly cooled," and could be a key piece in determining the policy tone.

Low Expectations for Rate Cuts Tomorrow

The Federal Reserve will hold its FOMC monetary policy meeting from July 30 (Tuesday) to 31 (Wednesday), with the market generally expecting the benchmark interest rate to remain unchanged in the 4.25%–4.50% range. Polymarket's prediction market shows that as of July 29, the probability of the Federal Reserve maintaining rates is as high as 97%, while the probability of a 25 basis point cut is only 3%.

In other words, the market does not expect an actual rate cut this time, but is waiting for a "signal for rate cuts."

Nick Timiraos, the "voice of the Federal Reserve," wrote in The Wall Street Journal: "Federal Reserve officials do believe that cuts will eventually be necessary, but they are not ready to do so this week." "Whether Powell will release hints about a September rate cut during the press conference will be a focal point for the market."

Several institutions have pointed out that the current U.S. policy environment is extremely loose, and if a rate cut occurs too early, it may exacerbate asset bubble risks, thereby weakening the Federal Reserve's ability to respond to future crises. Additionally, Trump's ongoing pressure on Powell may undermine the Federal Reserve's independence, making policy statements more politically sensitive.

According to reports from AP News and MarketWatch, a three-way split has emerged within the Federal Reserve:

The hawkish camp (e.g., Michelle Bowman): believes that a rate cut is "premature" and that inflation is not yet truly under control.

The dovish camp (e.g., Christopher Waller): advocates for releasing easing signals early, supporting "a July rate cut."

The majority of the wait-and-see camp: emphasizes "continuing to observe more data," maintaining a "data-driven" stance, leaning towards a cut at some point later this year.

This division may be brought to the forefront this week, becoming a source of significant market volatility. Whether to release a "rate cut path" signal will be Powell's biggest test this week.

This also means that even if the policy remains unchanged this week, any dovish hints in the statement or press conference will be quickly interpreted by the market as a signal for "early bets on rate cuts."

Market Reaction to Tariffs is Tepid

Last weekend, the Trump administration reached a new trade agreement with the European Union, avoiding a potential full-blown tariff war that was set to begin on August 1.

However, this did not excite the market. U.S. and European stocks reacted tepidly: the S&P 500 index rose slightly, while the Stoxx 600 index fell. Both indices briefly strengthened during the day but gave back gains near the close.

Some economists believe: "The market is no longer focused on the U.S.-EU trade agreement, but is in urgent need of another new catalyst."

Especially for Europe, the agreement's content is not considered "reciprocal." German Chancellor Friedrich Merz and French Minister for European Affairs Benjamin Griveaux have both publicly stated their hopes for more open trade in the future. Meanwhile, Trump reiterated on Monday: "It is very likely that a uniform tariff of 15% to 20% will be imposed on countries that do not sign trade agreements with the U.S."

This means that the market's previous biggest concern, the "30% cliff," has been eliminated. Although 15% is still a high rate, the predictability of the tariff policy itself is enough to be a positive factor.

In this regard, trader The Investors Side (@InvestorsSide) believes: "This is certainly not a clean handshake moment—but what the market needs is not peace, but predictability. And that is precisely what this agreement brings in the short term."

He believes that compared to levels before 2024, a 15% tariff is still high, but it eliminates the most explosive scenario of a sudden 30% tariff cliff in August, which is a victory for risk sentiment.

He also believes that the extension of the tariff suspension period between the U.S. and China by another 90 days confirms that the two major economies will reach an agreement over time, allowing the market to fully recover from the event in April that led to a more than 20% drop in the stock market.

At least on the tariff issue, traders can finally stop encountering "black swans" and refocus their attention on earnings reports, interest rates, and the prices of cryptocurrencies themselves.

$900 Million in Turnover, BTC Remains Strong

This month, Bitcoin has remained near historical highs, showing no signs of the typical market bubble. Implied volatility and funding rates (often indicators of excessive speculation) have remained low, indicating that investors believe this round of gains is more stable.

Most importantly, several technical indicators that were previously seen as "bubble signals" have not sounded the alarm: implied volatility (IV) remains low; funding rates are moderately normal; and leverage ratios have significantly decreased.

Multiple analysts have pointed out that since the launch of the spot Bitcoin ETF earlier this year, the market structure has quietly changed: "More and more traditional funds are beginning to allocate Bitcoin through ETF channels, no longer relying on contracts and leverage, and are no longer following a buy-high-sell-low retail model." This has made market performance more stable and turned pullbacks into "buying" rather than "shorting" opportunities.

Nick Forster, founder of the on-chain options platform Derive, also agrees with this shift, stating: "The $150,000 predicted by Mike Novogratz is no longer a fantasy." "The options market currently gives a probability of 52% that Bitcoin will reach $150,000 by the end of the year."

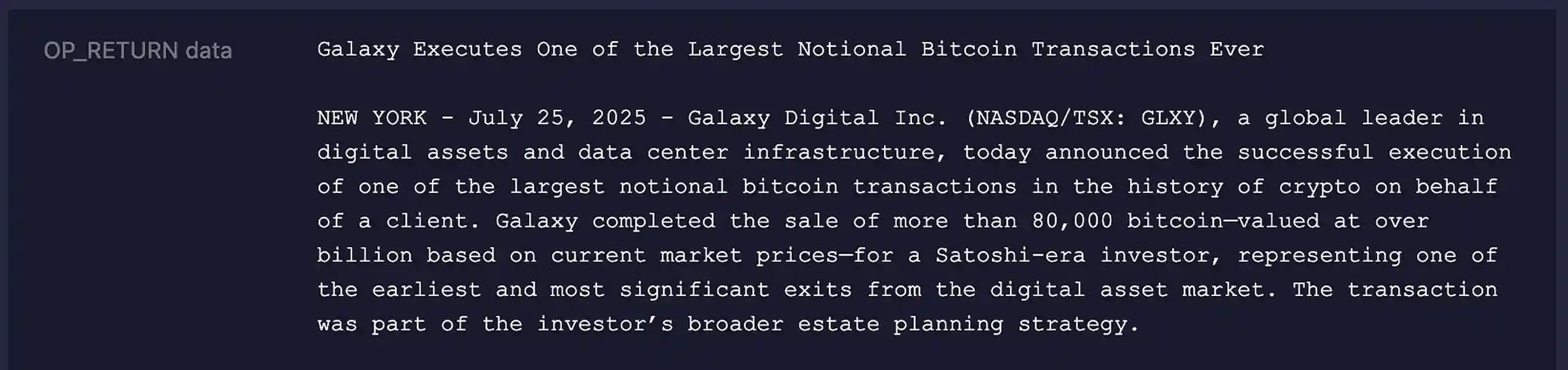

This week, Bitcoin completed an astonishing "large-scale transfer" event—80,000 BTC, worth about $9 billion, was awakened, sold, and circulated from a cold wallet dating back to the Satoshi era. This transaction, led by Galaxy Digital, became the largest known legacy transfer sale in cryptocurrency history.

According to analysis from the account @TheInvestorsSide, this transaction was highly anticipated by the market, but the actual volatility was far lower than expected: "Despite the massive scale, BTC only briefly dipped below $115,000, and a few days later rebounded to $119,000."

What does this indicate? He believes: "Bitcoin barely maintained the $9 billion sell-off, which tells us everything we need to know. The natural market trajectory is still upward, and if BTC can overcome macro resistance next week, my next short-term target is $130,000."

Renowned on-chain analyst and co-founder of Checkonchain, James Check (@Checkmatey), provided a more detailed review: "This was a very traditional benign sale. Galaxy helped the client complete the transfer and published news on-chain using OP_RETURN."

Interestingly, he pointed out that Galaxy also "conveniently" sent back a transaction output with 1 satoshi to the original address—widely interpreted as a middle finger to those attempting to "legally seize these BTC."

However, from an on-chain perspective, Check is more focused on structural capital flows: "This is not a simple wallet migration, but a real change of ownership. Whether sold over-the-counter or on exchanges, on-chain transactions must be completed, and capital is thus re-priced."

He emphasized that multiple indicators such as market capitalization, active addresses, and capital movements accurately reflect this event; the price only retraced 3.5% before quickly recovering.

Check pointed out that this is a typical pullback-rebound pattern that occurs in the middle of a bull market, referred to as the "Dali Llama recovery pattern": "Even occurring on a weekend, the on-chain data and market response remain surprisingly stable, and Bitcoin is heading for higher levels."

ETH Hits $4000

According to the latest data from the options market: Bitcoin's December implied volatility is only 30%, indicating that investors expect a stable upward path; Ethereum's December implied volatility, however, is as high as 60%, nearly double that of Bitcoin.

This seems to show that Bitcoin is more like a steadily rising main wave; while Ethereum may experience a more intense, non-linear explosion.

The performance of ETH also confirms this: the main focus over the past two weeks has been ETH's significant rise, soaring from $2600 to nearly $3800. ETHBTC has remained low after Bitcoin repeatedly broke historical highs, until it reached $123,000, after which it was Ethereum's turn. It surged from $3000 to $3800 in just 5 days, a 27% increase, with very limited downside.

According to @TheInvestorsSide: "The Ethereum ETF has seen daily inflows surpassing the Bitcoin ETF for six consecutive days, setting a historical record of net inflows for 16 straight days."

He stated that this is a typical Wall Street sentiment rebound: "After months of neglect, Wall Street is re-embracing ETH, leading me to believe we will see ETH break $5,000 in the medium to short term."

Nick Forster, founder of the on-chain options platform Derive, provided a more direct prediction: "The probability of Ethereum rising to $6,000 by the end of the year has surged from less than 7% in early July to over 30%." He views this as a "massive repricing of tail risks."

This aligns with the judgment of Charles Edwards, founder of Capriole Fund, who believes ETH will reach a new all-time high within the next "6 to 12 months."

Analyst Viktor revealed another layer of funding logic—the reflexive cycle of ETH funding companies is accelerating this process:

The most notable examples are Sharplink Gaming and Bitmine, led by Tom Lee. Sharplink Gaming's stock price increased nearly fivefold within two weeks at the beginning of July. The team took advantage of this momentum to sell newly issued shares and used the proceeds to buy back ETH, with weekly purchases reaching as high as $400 million. Its mNAV is currently 2.3, and if the valuation remains high, this "sell stock to buy coins" behavior is expected to continue. Bitmine announced that after completing a $250 million private placement in just 10 days, it now holds over $1 billion in ETH. It is continuously financing through ATM (issuing new shares at market price) to acquire ETH.

"These altcoin fund companies are forming a self-reinforcing funding loop through rising stock prices—financing—buying coins," Viktor added: "The strength of $ETH naturally drives up some 'ETH test coins,' especially in the DeFi space, where $CRV, $FXS, and $CVX have all doubled. $ENA has also skyrocketed from the bottom, increasing by 125%, but the final stage of the rise may be due to the early announcement of the establishment of the $ENA fund company. This company is named StablecoinX, with the trading code $USDE. It is crucial to exercise caution when purchasing stocks of altcoin fund companies."

In the latest internal report "The Alchemy of 5%" by Bitmine Chairman and Fundstrat co-founder Tom Lee, he bluntly stated: "Wall Street generally believes that Ethereum will be one of the most important macro trades of the next decade."

His prediction for BTC is that it will reach $250,000 by the end of 2025. His target price for ETH is set at $60,000, with the following reasoning: ETH is the main platform for Web3, DeFi, stablecoin issuance, and staking; the spot ETF has improved the entry path; fund companies provide structural buying; inflation and macro cycles will boost the premium of crypto assets.

In his view, this market cycle is not a traditional "speculative bull market," but rather an institutional-level main upward wave cycle shaped by ETFs, funding companies, and on-chain liquidity.

Traders Enter SUI

The token has a daily trading volume of $4.7 billion and a market capitalization of $9.98 billion, showing an upward trend with further potential for growth. As SUI recovers from the market pressures typically seen during long-term volatility periods, traders are beginning to reassess it.

Renowned cryptocurrency analyst Ali Martinez analyzed that the SUI token has broken out of a symmetrical triangle pattern on the daily chart—this is a classic technical formation that usually accompanies significant price volatility. A breakout from a symmetrical triangle pattern is typically interpreted as a shift from market uncertainty to clear directional momentum, in this case, upward.

Ali Martinez mentioned that as long as the investment flow continues, if a breakout above the $4.50 resistance level is confirmed, it could guide the price further towards $8. He also explained that the triangle pattern signifies the end of a consolidation phase and the beginning of a trend reversal.

According to Reuters, institutional investment firm Canary Capital has submitted the first spot SUI ETF application to the U.S. SEC, with documents indicating that if approved, SUI will become one of the first mainstream Layer-1 tokens to gain access to traditional ETF channels. This process is seen as an important prelude to driving institutional funds into SUI.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。