Ethereum treasury enterprises must find a balance between the liquidity and yield optimization of ETH.

Written by: James Rubin

Translated by: Saoirse, Foresight News

Wall Street investment bank Bernstein pointed out in a report on Monday that there are significant differences between Ethereum treasuries and Bitcoin treasuries in asset management: Ethereum treasuries earn yield through staking, but this process comes with risks such as limited liquidity and smart contract security, requiring enterprises to find a balance within the constraints of capital deployment.

Analysts believe these factors are key considerations for enterprises when balancing the liquidity of Ethereum assets with "yield optimization."

Analysts noted: "If an Ethereum treasury stakes ETH for yield, while staking contracts generally have liquidity, unlocking may sometimes require a queue for several days. Therefore, Ethereum treasury enterprises must find a balance between the liquidity of ETH and yield optimization. Additionally, more complex yield optimization strategies, such as re-staking (e.g., Eigenlayer re-staking model) and DeFi-based yield generation, also need to address smart contract security risk management issues."

Bernstein added: "The advantage of the Ethereum treasury model is that staking yields can provide actual cash flow for operations, but liquidity risks and security issues still need to be a focus."

Staking refers to the process of locking tokens in a network to support its operation. Proof-of-Stake networks like Ethereum and Solana differ from Proof-of-Work systems like Bitcoin, which rely on resource-intensive mining operations.

Currently, an increasing number of enterprises are beginning to build Ethereum treasuries. Bernstein mentioned that Ethereum-related companies, including SharpLink Gaming (SBET), Bit Digital (BTBT), and BitMine Immersion (BMNR), collectively held 876,000 ETH as of July.

Last week, BMNR's Ethereum holdings surpassed $2 billion, and the company stated its goal is to hold and stake 5% of the total Ethereum supply. SharpLink holds over $1.3 billion worth of ETH.

"Driven by digital dollars and tokenized assets, the growth of the internet financial economy will drive the expansion of trading and user scale in the Ethereum ecosystem (including Layer 2 chains operated by platforms like Coinbase and Robinhood). As a native underlying asset, Ethereum is expected to realize value appreciation from this growth, relying on staking yields generated from transaction fees and a token buyback and burn mechanism."

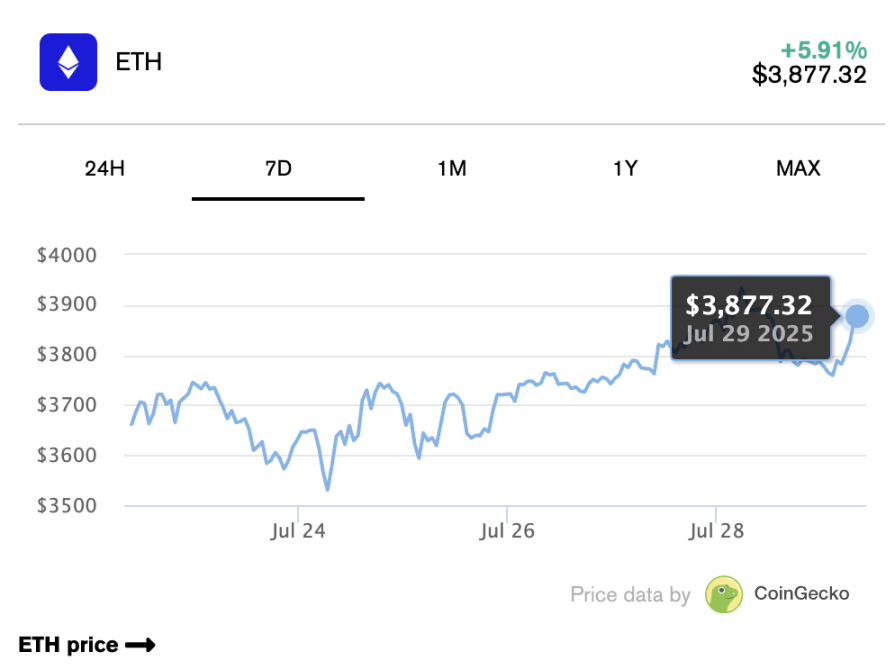

Ethereum briefly surpassed $3,900 in trading on Monday, reaching a new high since early December, before retreating. Over the past month, the asset has risen more than 50%, with its increase closely related to the rise of Ethereum treasuries, improvements in the Ethereum ecosystem following the passage of the "GENIUS Act," and market recognition of its application potential.

Multiple analysts predict that ETH may break its previous all-time high of $4,800 this year, with BitMEX founder Arthur Hayes recently even predicting that ETH will reach $10,000 within the year.

Tom Lee, chairman of BitMine Immersion, stated in a report on social media platform X that based on the reset value provided by research analysts, ETH could reach 18 times its current price, approximately $60,000. Of course, as a holding enterprise, BitMine's predictions are inevitably biased by its interests.

The Ethereum treasury model draws on the experience of Strategy (formerly MicroStrategy). After years of poor performance and a depressed stock price, the company transitioned from software development to Bitcoin purchases in 2020, with its Bitcoin holdings currently valued at nearly $72 billion at current prices. However, analysts pointed out that "the risk management of Ethereum treasuries is more complex than that of the Strategy model."

Analysts stated: "Michael Saylor insists on keeping Bitcoin in liquid form on the balance sheet, not obtaining passive income through lending. Strategy places extreme emphasis on asset-liability management (ALM) and liquidity management."

"Moreover, Strategy often adjusts between debt financing and equity financing based on market sentiment to maintain a conservative level of debt."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。