Ether ETFs See $65 Million Inflow As Bitcoin ETFs Return to Strong Inflows

Markets opened the week on a bullish note, with crypto ETFs attracting solid inflows as investor confidence surged. Bitcoin ETFs regained momentum after last week’s mixed performance, while ether ETFs continued their relentless inflow streak, now hitting an impressive 17 days.

Bitcoin ETF activity was concentrated in just a handful of players. Blackrock’s IBIT dominated the day with $147.36 million in inflows, cementing its role as the market leader. Fidelity’s FBTC followed with $30.88 million, and Grayscale’s Bitcoin Mini Trust chipped in $10.98 million.

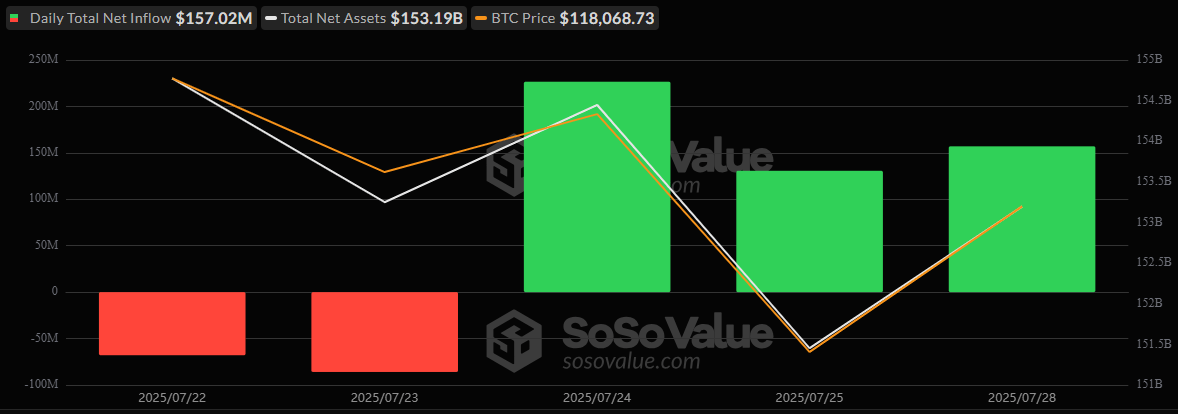

However, it wasn’t all green. Ark 21shares’ ARKB lost $17.45 million, and Bitwise’s BITB saw $14.76 million exit. Still, net inflows closed strong at $157.02 million, with $3.34 billion in value traded and net assets rising to $153.19 billion.

Bitcoin ETFs inflow recovery. Source: Sosovalue

Ether ETFs, meanwhile, kept the inflow streak alive despite facing significant pushback from two major funds. Blackrock’s ETHA single-handedly carried the day with $131.95 million inflow, but that dominance was partially eroded by Fidelity’s FETH posting a $49.23 million outflow and Grayscale’s ETHE bleeding $17.58 million.

Even so, the sector managed a $65.14 million net gain, pushing net assets to a record $21.53 billion, with $1.91 billion traded.

Both asset classes remain on strong footing, but ether’s consistency continues to steal headlines, especially as it nears the psychological $22 billion ETF milestone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。