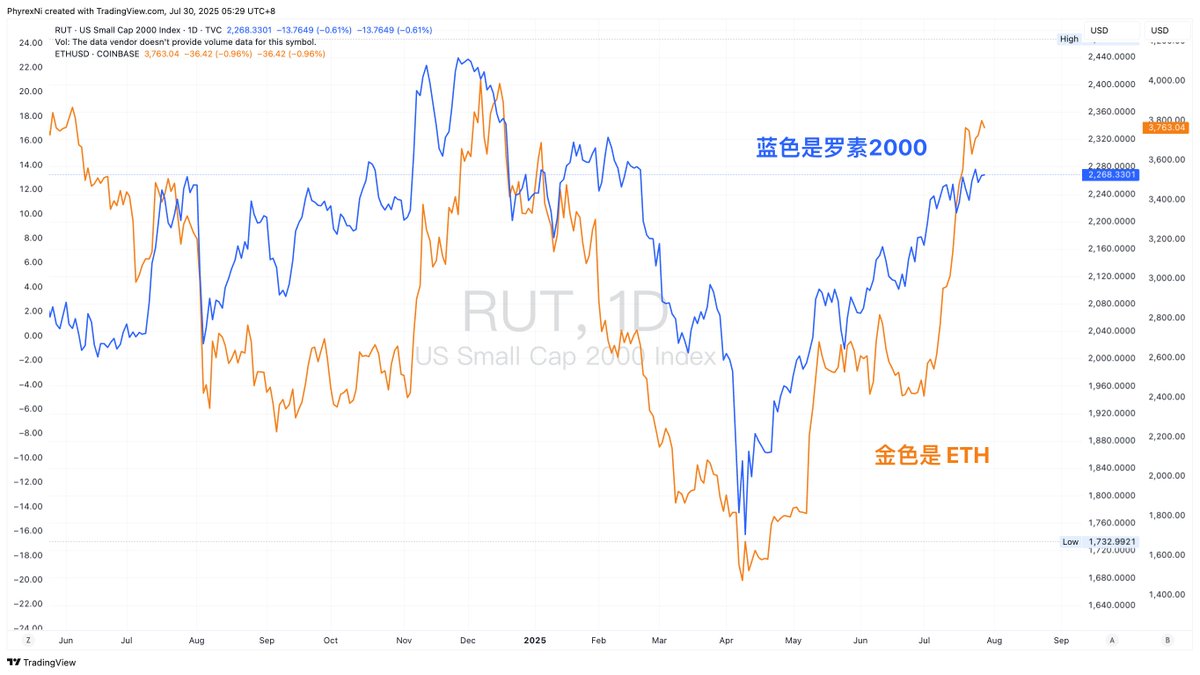

Last week, we also analyzed the price trends of ETH and its comparison with the Russell 2000. After a week of changes, we can still see that both maintain a high level of consistency, which indicates that our ongoing inference about investors' game of sector rotation is correct.

Although many funds hope to drive the emergence of altcoin season through the rise of ETH and small-cap stocks, the lack of liquidity and the tightening monetary policy have resulted in investors' risk appetite not significantly shifting.

Therefore, the difficulty of sector rotation remains quite high. The only difference is that we can indeed see significant capital inflow into the ETH spot ETF through the primary and secondary data of ETFs. Even though the purchasing power in the primary market has decreased after entering this week, the trading volume in the secondary market remains at a relatively high level.

Unlike BTC's IBIT, ETHA's trading volume far exceeds the trading volume at the end of 2024, indicating that current ETF investors still have a strong interest in ETH. If supported by the SEC's physical delivery and BlackRock's ETH staking, there is still some imaginative space.

However, for most altcoins, even if the price of ETH rises, the lack of sufficient overflow capital and liquidity makes it difficult to bring about sector rotation, let alone an altcoin season. Especially since most ETF investors, even if they take profits, may not choose to invest in altcoins in the cryptocurrency market.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。