Original Authors: Shao Jiadian, Huang Wenjing

In the past two years, many people involved in payments, wallets, and crypto products have been quietly paying attention to one direction: U Card.

Simply put, it allows users to deposit USDT/USDC, and the system converts it into Hong Kong dollars or US dollars, which can then be used with a physical or virtual card to swipe at POS, bind to Alipay, or even withdraw cash from ATMs. You may have used it before without realizing its essence.

So the question arises: If I want to start a U Card project from scratch, where is the best place to begin that is the least troublesome, most cost-effective, and quickest to implement?

My answer is clear: Hong Kong.

Why Hong Kong is the Top Recommendation?

It’s not because Hong Kong has the loosest regulations, but because it can realistically operate, structurally supports it, and has partners available.

- Hong Kong has clear regulatory boundaries: currency exchange requires MSO, stored value falls under SVF, and currently, no additional license is needed for stablecoin custody;

- Crypto assets can be managed through custodians (like Fireblocks) without involving license applications;

- There are abundant local BIN partners, MSO service providers, KYC vendors, and payment clearing network resources;

- In practice, project parties can avoid the definition of stored value through structural design (instant authorization + custodial wallets), gaining breathing space in a gray area.

It’s not that having no regulation is best, but having regulation that is clear and workable is the ideal soil for U Card entrepreneurship.

What Do You Need to Prepare for U Card in Hong Kong?

A compliant and implementable U Card structure requires at least five core partners behind it:

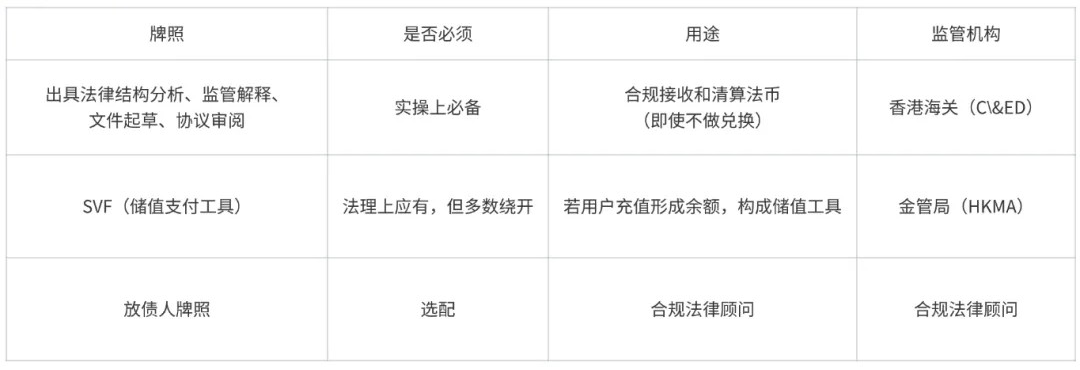

What Licenses are Involved in U Card?

Current practical situation:

- Card projects like RedotPay have not obtained SVF but have actively disclosed “non-stored value tools,” emphasizing “not a wallet” and “not a balance,” using MSO to legitimize the currency exchange function;

- These cards essentially operate on a “token payment + real-time authorization + third-party channel clearing” structure that circumvents SVF.

Why is No One Obtaining SVF? Why is Regulation Not Taking Action?

The reason is simple: high costs, low returns, and a wait-and-see attitude from regulators.

- SVF has a very high threshold: requires a paid-in capital of 25 million HKD, technical review by the Monetary Authority, three-tier risk control, and ongoing reporting;

- U Card projects have a relatively small operational scale: user numbers are not yet large, complaints are few, and there is no systemic risk;

- Regulators currently have a wait-and-see attitude: HKMA may view these U Card products as “not yet affecting monetary stability, observable gray area activities”;

- Compliance design is smart enough: most U Card projects are “designed not to form platform balances,” using “instant clearing + no retained funds” logic to avoid stored value attributes.

My judgment is: once these products experience explosive growth in the future (for example, 100,000+ users), there may be a wave of SVF clearances.

Is MSO Really Necessary?

Legally speaking, if you are not exchanging fiat for fiat and not doing cross-border remittances, MSO is indeed not a heavily regulated entity;

However, in practice, banks, clearing institutions, and payment providers will all require you to provide MSO. Otherwise:

- Banks will not provide you with a deposit account;

- Clearing institutions will not accept your fiat;

- Investors will also question your compliance capability regarding funding channels.

Moreover, Hong Kong is about to launch the “VA MSO” system, which will clearly regulate virtual asset exchange businesses.

So: MSO is not legally “mandatory,” but in reality, it is “indispensable.”

Who Will Handle the Exchange from U to Fiat?

This is the most easily misunderstood yet crucial aspect.

- In practice, the “exchange” is not completed by Fireblocks, Circle, or exchanges;

- Most project parties complete the flow of funds from USDT/USDC to Hong Kong dollars or US dollars through local OTC service providers.

The actual process is as follows:

- Users deposit USDT/USDC into the platform's custodial wallet (like Fireblocks);

- The project party or clearing agent transfers this asset to a local OTC;

- The OTC uses its bank account to deposit fiat into the project’s affiliated MSO or payment clearing account;

- The fiat flows to the end user or merchant account when swiping the card or withdrawing cash.

The advantage lies in flexibility, quick arrival, avoiding exchange scrutiny, and not needing to explain compliance on-chain paths.

A few large-scale projects also connect with EMI/PSP (like Checkout.com, XanPool), but the threshold is too high for small teams, and the current market primarily relies on OTC clearing as the mainstream path.

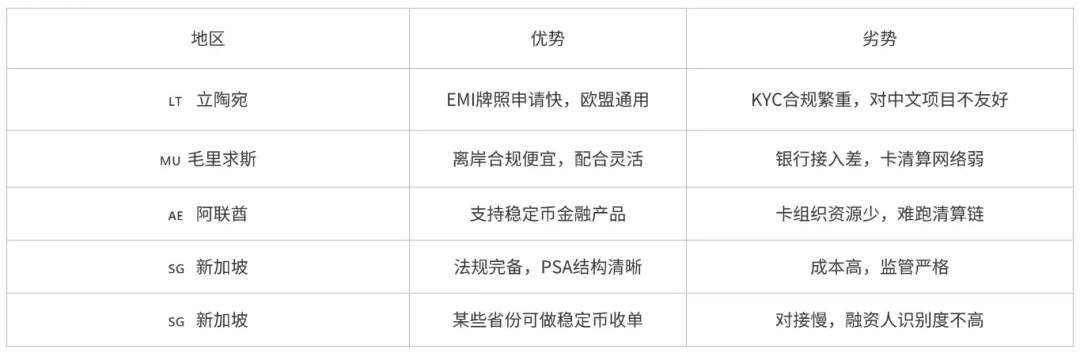

Besides Hong Kong, What Other Low-Threshold Regions Are Available?

In summary: Hong Kong remains the best place to operate, with high bank acceptance and regulatory buffers.

Finally: What Can We Do for You as Web3 Lawyers?

If you are preparing a U Card project, considering connecting with card issuers, or launching a stablecoin acquiring structure, we can provide you with full-process compliance support, including but not limited to:

(1) Structural Design and Regulatory Explanation

- Assess whether SVF regulation is triggered and whether MSO must be held;

- Plan funding paths and responsibility isolation structures;

- Draft structural disclosure documents, on-chain/off-chain interaction diagrams, and risk prevention explanations.

(2) Core Compliance Document Writing and Customization

Assist in preparing the following compliance documents according to the requirements of card organizations like Visa / Mastercard:

These documents are not only the compliance baseline but also your “ticket” to successfully issuing cards and going live.

(3) Landing Support and Negotiation Assistance

- Assist you in connecting with MSO license holders, BIN sponsors, and payment clearing networks;

- Review cooperation agreements, liability clauses, and AML sharing mechanisms;

- Prepare structural diagrams, legal explanations, and risk disclosure materials for financing/due diligence.

Compliance documents are not just a process; they determine whether you can legally go live, access funds, and allow others to do business with you with confidence.

Conclusion

U Card is not just a new feature of a wallet, but a definitive model for crypto assets to truly enter real payment scenarios. You can continue to hesitate about “whether it can be done,” or you can use clearer structures and more secure paths to start running first and fix the road later. Standing on the compliance baseline, we can work together to make crypto payments more like “payments” rather than “gray area activities.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。