Author: Prathik Desai

Translated by: Block unicorn

Institutional investment strategies in cryptocurrency are rapidly expanding beyond the Bitcoin standard, but not all altcoins deserve a place in corporate reserves.

This trend began with the bold attempts of Strategy (formerly MicroStrategy) and has now evolved into an institutional movement worth over $100 billion, encompassing more than a hundred publicly traded companies. As the next wave of adoption unfolds, institutions face a more complex question: which altcoins (if any) are worthy of corporate reserve allocation beyond the established trio of Bitcoin, Ethereum, and Solana?

The answer lies in a fundamental assessment of these assets: do they provide the sustainable yield generation, genuine economic utility, and infrastructure depth necessary to support large-scale adoption that institutional CFOs truly need?

Building cryptocurrency reserves has become a common practice for corporations. Bitcoin was the first to prove that cryptocurrency could appear on corporate balance sheets. Michael Saylor pioneered this model five years ago through Strategy, and his approach has become a template for many other companies.

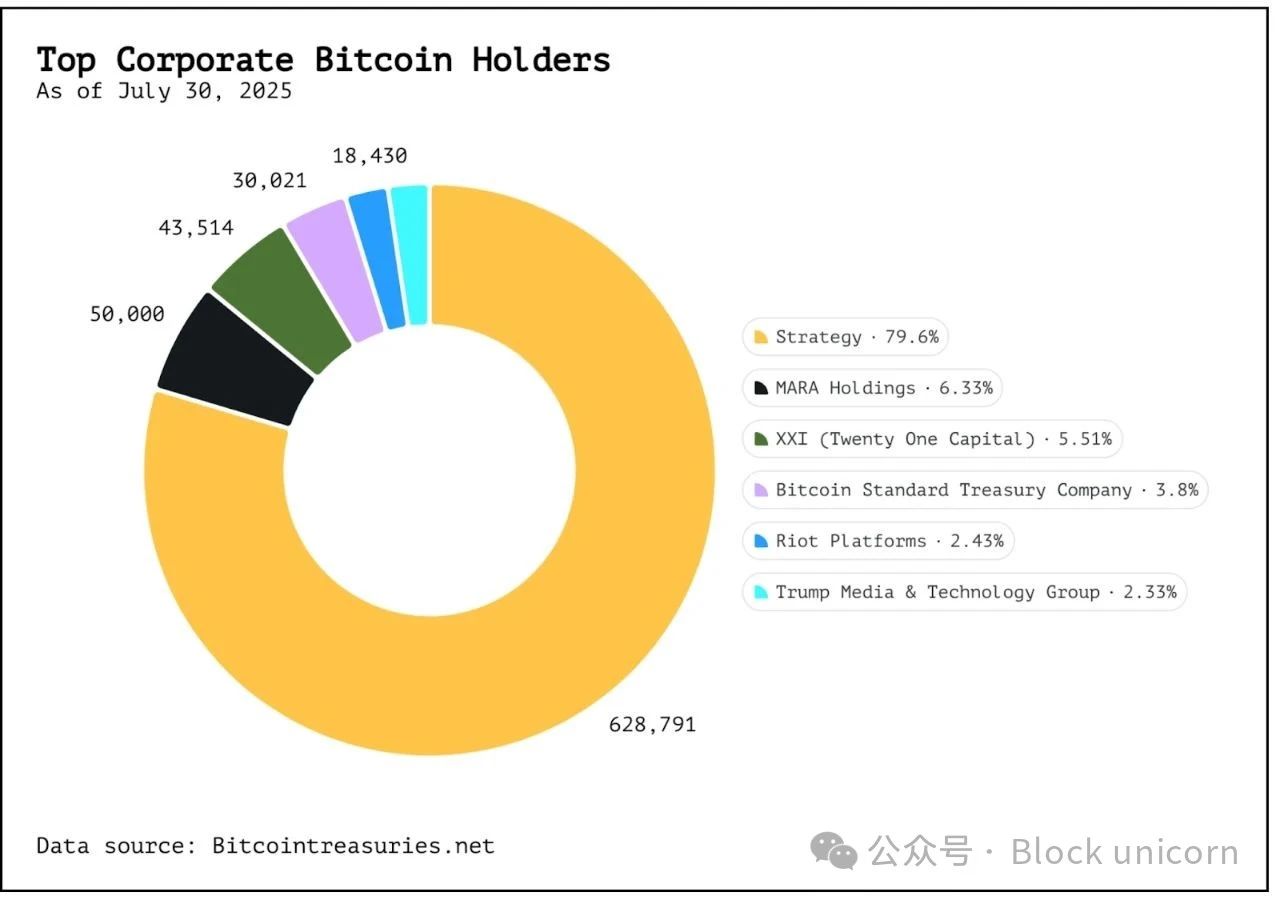

Currently, 160 publicly traded companies collectively hold 923,327 BTC, valued at over $10 billion, accounting for 4.6% of Bitcoin's current supply.

And they continue to increase their holdings.

Next came Solana, which attracted enterprises with low fees, high speed, and staking rewards. Companies like Sol Strategies, DeFi Development Corp, and Upexi hold approximately 3.3 million SOL, valued at around $600 million.

Ethereum followed closely, offering similar staking rewards and decentralized finance (DeFi) use cases. As the second-largest cryptocurrency, it is more than just a store of value. SharpLink and BitMine now collectively hold over 920,000 ETH (valued at about $3.5 billion), surpassing the amount held by the Ethereum Foundation.

Ethereum and Solana compensate for the lack of asset appreciation through their yield generation capabilities. Staking not only generates returns but also supports the network security and throughput of PoS chains.

All of this reflects institutional adoption of altcoins that may not see rapid price increases like Bitcoin. Institutions are now trying to explore whether these models can extend beyond Bitcoin, Ethereum, and Solana.

Are altcoins like BNB, SUI, and XRP worth entering corporate reserves? Are they the next phase of institutional adoption, or are they risky ventures under misguided hype?

BNB is the core driver of the Binance ecosystem, used for everything from discounts on transaction fees to supporting DeFi applications. Its on-chain activity, user base, and staking rewards create a feedback loop similar to Ethereum or Solana, despite greater centralization risks.

The total locked value (TVL) of all DeFi protocols on the Binance Smart Chain (BSC) is $6.96 billion. Meanwhile, BNB's market capitalization is $111 billion, ranking fifth among all cryptocurrencies. This gives it a market cap to DeFi TVL ratio of 16.15, far exceeding Ethereum's 5.48 or Solana's 9.89, second only to Bitcoin among the top 20 chains.

Relative to the actual capital locked in its DeFi ecosystem, BNB's market cap appears inflated. But this is only part of the story. Unlike Ethereum, BNB's value is also influenced by centralized activities of the Binance exchange, including fee discounts, token issuance platforms, and buybacks. Corporate control and quarterly buybacks (loosely tied to Binance's revenue rather than DeFi activity) also play a role. Additionally, a large number of retail users utilize BNB for low-cost trading.

BNB boasts nearly 2 million daily active addresses, with daily decentralized exchange (DEX) trading volume exceeding $7.5 billion, the highest among all chains, surpassing Ethereum and Solana. Binance also holds $158 billion in assets on its centralized exchange (excluding its issued tokens).

For institutions, this presents a dilemma.

BNB's daily active users and DEX trading volume indicate its growing dominance among chains. However, at the same time, the relatively small scale of its DeFi ecosystem shows a lack of depth. Clearly, BNB's value derives from both Binance's corporate engine and centralized activities, as well as its open on-chain ecosystem. This complicates modeling it, perhaps making it difficult for institutions to support BNB in a theoretically driven manner as they do with Ethereum and Solana.

Perhaps institutions need a new metric to assess the value they see in ecosystems like Binance.

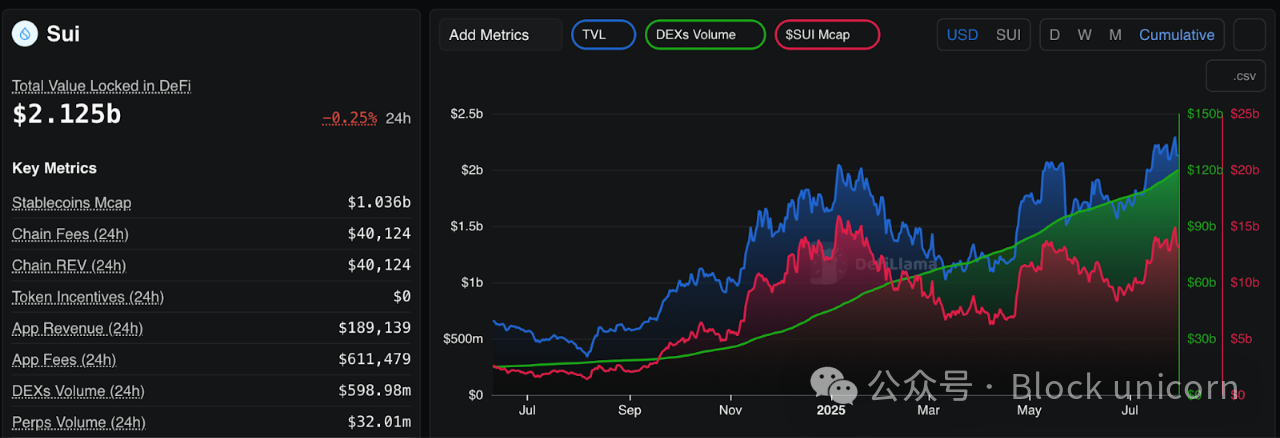

As for SUI, the chain is newer, has strong backers, and is clearly focused on gaming and developer tools. Over the past year, its DEX trading volume and TVL have grown exponentially, in sync with its market cap.

SUI's market cap to DeFi TVL ratio is only 6.21, far below Solana and slightly above Ethereum. For a chain launched in 2023, its current level of DeFi activity has already surpassed Solana's performance at a similar stage, with better consistency.

XRP is not designed for DeFi but for payment scenarios. Its appeal to institutions is primarily based on regulatory clarity and real-world applications. Ripple's recent court victory has opened the door for XRP ETF filings and considerations for corporate reserves.

Despite the network processing over 1 million transactions daily, its fee revenue is negligible (only 0.00001 XRP per transaction), and it lacks staking opportunities due to not adopting a proof-of-stake consensus mechanism. Its market cap has now exceeded $180 billion, far surpassing its actual economic activity. With the rise of stablecoins in cross-border payments, the mismatch between XRP's valuation and actual usage brings uncertainty to its real-world utility.

Despite stagnation in active address numbers and transaction fees, XRP's market cap and price have recently risen. This raises alarms for institutions looking to make significant bets on this cryptocurrency.

Institutional investors' interest stems not only from trust in the technology but also from their desire to find new risk-adjusted return avenues. The cases of ETH and SOL demonstrate that staking can serve as a yield strategy, providing ongoing returns. This makes the comparison between the two clearer. The staking yield for ETH is about 4%, while SOL's hovers around 6-7%. Corporations holding these tokens can stake them and view the resulting income as predictable compound revenue, although they must continuously worry that drawdowns will offset returns. Several companies have already adopted this approach. Upexi earns millions annually from its holdings of SOL.

BNB and SUI also want to join this game. Their staking yields, usage metrics, and developer growth indicate they are approaching institutional-grade levels, or may have already reached them. However, unlike Ethereum and Solana, they lack the same depth of third-party tools, staking service providers, and liquid staking infrastructure, which are key to seamless institutional participation.

Nevertheless, the market is still preparing.

Fund issuers are also waiting for the U.S. approval of ETFs for altcoins like BNB, XRP, and SUI this year. The assumption is that regulated packaged products will attract more retail investors, just as Bitcoin and Ethereum ETFs have done. But they must be wary of the lessons learned from the Ethereum ETF, which struggled early on to find buyers.

If staking rewards can be passed on to ETF holders, their appeal will be further enhanced.

Retail investors should recognize the nature of this moment: it is a filtering phase. Tokens with staking, real activity, and developer commitment may gain legitimacy through corporate reserves. Other tokens may simply ride the wave until they crash. The key insight is to understand the true implications of institutional interest. It is not always a recognition of quality. Sometimes, it is merely an experiment in liquidity.

Nevertheless, the core question is whether institutional interest in altcoin ETFs and reserves is justified. In some cases, yes, especially when yield is combined with usage; in others, it is not yet mature; and for some tokens, it may never be. But if Solana has taught the world anything, it is that the landscape of cryptocurrency reserves is no longer limited to Bitcoin and Ethereum. The next batch of players has arrived, busy staking, expanding, and vying for institutional seats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。