Leverage, Premium, Reflexivity: A Century Later, the Essence of Finance Remains Unchanged.

Author: Be Water

Translation: Deep Tide TechFlow

Part Three of "Speculative Attack"

In financial markets, fervent emotions are often driven by powerful vested interests, even when such fervor approaches madness—as was the case in 1929. For anyone commenting on or writing about current financial market trends, this is undoubtedly a warning. However, there are indeed some fundamental rules that cannot be ignored, and the cost of neglecting these rules is far from trivial. The most affected are often those who scoff at all current warnings.

—JK Galbraith, “The Parallel Lines of 1929”, The Atlantic, January 1987, before the Great Crash of 1987

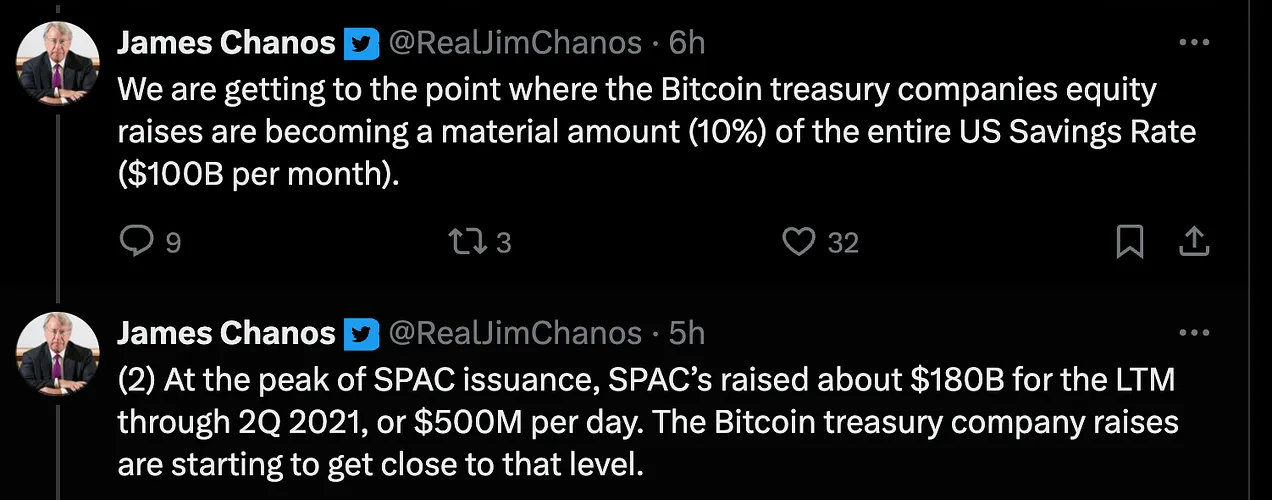

While Bitcoin treasury companies are currently just a small blemish in the vast financial matrix—and, given that Fartcoin has a market cap of $1.5 billion, it seems somewhat absurd to scrutinize them closely—their similarities to the investment trusts of the 1920s reveal a recurring speculative pathology that transcends their current scale. In fact, they provide a universal blueprint for the pervasive reflexive bubbles. Thus, the mechanisms shared between trusts and treasury companies offer a perfect perspective for us to understand financial history more broadly and the dynamics currently unfolding within the financial matrix.

In Part One of "Speculative Attack", we explored how Michael Saylor's MicroStrategy weaponized Wall Street's own financial engineering to combat the traditional financial system through the subversion of risk alchemy; now hundreds of companies are racing to replicate his blueprint.

Part Two of "Speculative Attack" examined the similarities between today's Bitcoin treasury companies and the "investment trusts" of the 1920s. These trusts were initially a transformed version of the highly regarded investment tools in the UK, but became corrupted as American financiers leveraged them. By mid-1929, the trust frenzy reached its peak. Goldman Sachs Trading Corporation became the "MicroStrategy" of the time, with new trusts being launched at a rate of one per day, and investors were eager to pay two or even three times the value of their underlying "scarce" assets.

However, how could a futuristic concept like Bitcoin treasury companies possibly be related to the financial trusts of the 1920s? In that era, computer technology was not yet widespread, let alone blockchain, and the Securities and Exchange Commission (SEC) had not even been established, much less begun to curb Wall Street's flashy abuses of power. At first glance, the structural differences between the trusts of 1929 and today's treasury companies seem both obvious and inevitable.

We believe that these differences are not fundamentally important. Each era in financial history exhibits its unique characteristics within its specific context. Overemphasizing superficial distinctions is a rationalization of humanity's long-standing warnings about emerging financial risks and excesses based on historical lessons. Market participants treat each event as if it were humanity's first encounter with financial alchemy, ignoring the "warnings for posterity" recorded in the “Great Mirror of Folly” (1720). However, this approach is akin to preparing to fight the last war rather than striving to master enduring principles of warfare and applying them to current battles.

In recent decades, this pattern has been particularly evident across multiple domains, from "private credit" to trillions of dollars in negative-yield bonds, to the real estate bubbles that have historically ravaged Australia, Canada, Sweden, and the UK (which now seem to be receding). Taking these real estate bubbles as an example, market participants cite the lack of complex American derivatives (such as CDOs, NINJA loans), rampant fraud, non-recourse loans, and bank failures during the 2008 financial crisis to dismiss concerns. Just as purists demand that champagne must come from specific hills in France, many today believe that a true real estate bubble can only exist with the typical characteristics of the subprime crisis popularized by The Big Short—including CDO cube managers eating sushi in Las Vegas.

Excerpt from the movie "The Big Short"

The result is a literalism of history: structural differences are seen as evidence of safety, when in fact, these differences are often exaggerated, misleading, or entirely irrelevant. For instance, in practice, each of the aforementioned countries has merely developed its unique mechanisms that serve a similar alchemical function.

Supporters of Bitcoin treasury companies also make similar arguments, claiming that comparing Bitcoin treasury companies to the investment trusts of the 1920s is fundamentally flawed: these trusts were built on opaque pyramid structures, hidden leverage, and unregulated market fees, while Bitcoin treasury companies are transparent single-entity companies without layers of management fees, bound by modern SEC disclosure rules, and hold currently the most ideal market value assets. In short, they argue that any apparent similarities obscure profound differences in structure, agency relationships, and information flow.

While we agree with some of these points—even if not all—we still arrive at a different conclusion. The striking fact is not that there are such significant differences between Bitcoin treasury companies and the trusts of the 1920s, but rather that the same fundamental dynamics repeatedly emerge—making the deeper similarities between them impossible to ignore. Both exhibit massive net asset value premiums, "value-adding magic," and reflexive feedback loops, in which purchases drive up the prices of underlying assets, thereby enhancing their own value and borrowing capacity. Investors in both eras embraced "smart" long-term leverage and the enticing promise of easy profits through financial alchemy to capitalize on "sure bets."

These patterns not only represent historical similarities but also reveal the eternal constancy of human nature and financial reflexivity, which are the roots of credit bubbles, transcending the limits of time and assets. Therefore, the fate of these early trusts provides an objective perspective that allows us to not only examine the emerging phenomenon of Bitcoin treasury companies but also gain insight into the recurring financial alchemy that has defined bubble formation for centuries.

Twitter/X: @bewaterltd. Suggestions? Feedback is welcome.

Not investment advice. For educational/informational purposes only. Please see the disclaimer.

“Investment Trusts Multiply Like Locusts”

The explosive growth of Bitcoin treasury companies mirrors that of the investment trusts of the 1920s, both gold rushes stemming from a perfect storm of greed: the strong demand from investors for scarce assets gave rise to net asset value premiums, while promoters rushed to monetize them. If Goldman Sachs could reap huge profits from its trusts in the 1920s, why couldn't other companies do the same? If MicroStrategy could monetize its net asset value premium, why shouldn't other companies follow suit?

Galbraith recorded the explosive growth of trusts in the 1920s:

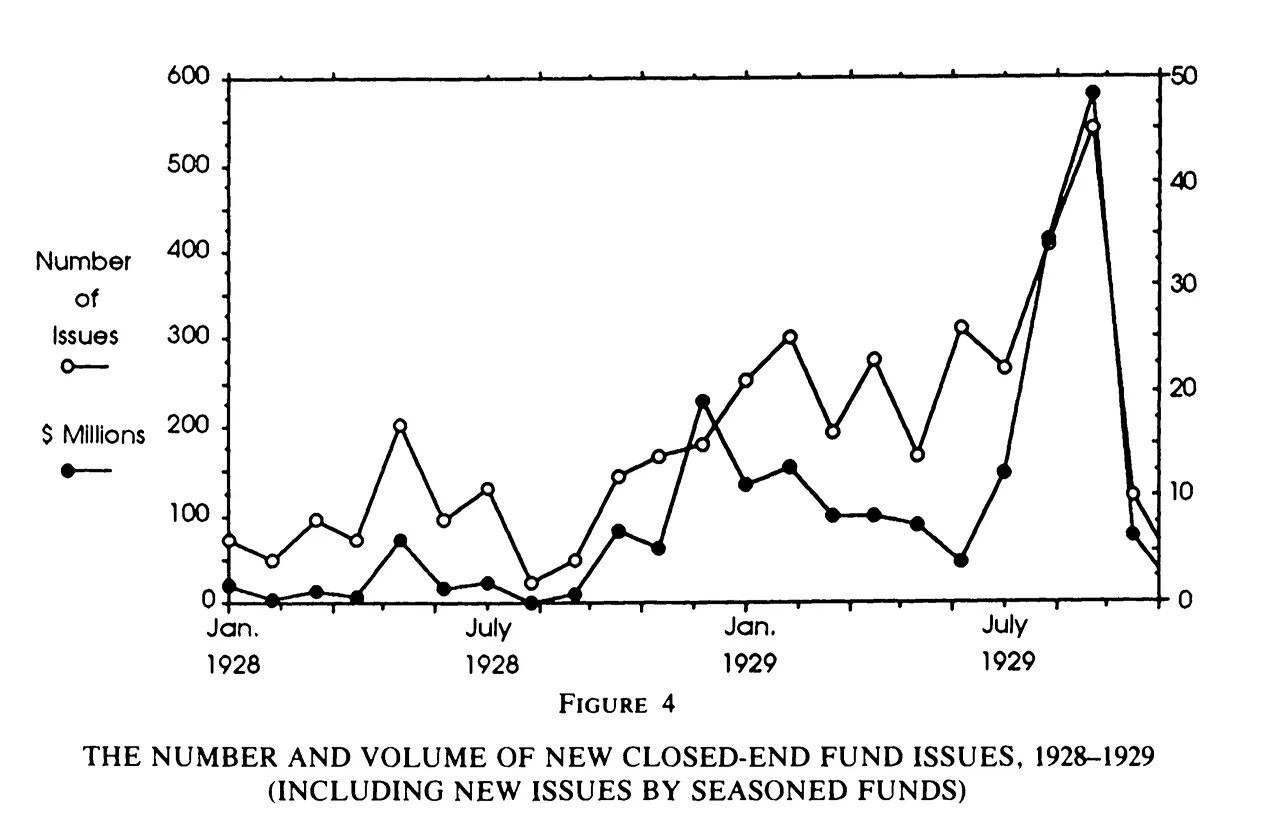

In 1928, it was estimated that 186 investment trusts were established. By early 1929, the rate of establishment of these investment trusts was about one per working day, with a total of 265 trusts established that year.

The scale of funds raised was equally remarkable, accounting for 70% of all funds issued in the 1920s. In just August and September of 1929, new trust issuances reached $1 billion—equivalent to $20 billion in today's purchasing power, or 130 billion dollars of today's economic total:

In 1927, these trusts sold approximately $400 million worth of securities to the public. In 1929, the value of securities they sold was estimated to reach $3 billion. This accounted for at least one-third of all new capital issued that year.

By the fall of 1929, the total assets of investment trusts were estimated to exceed $8 billion, growing about 11 times since early 1927.

Source: DeLong/Shleifer

Frederick Lewis Allen's account confirms JK Galbraith's assertion; in “Only Yesterday: An Informal History of the 1920s”, Allen vividly describes how “investment trusts multiplied like locusts”:

It is said that there are now nearly five hundred such trusts, with a total paid-in capital of about three billion dollars, holding stocks worth about two billion dollars—many of which were purchased at the current high prices. Among these trusts, there are both honest and shrewd management companies, as well as wildly speculative enterprises founded by ignorant or greedy promoters.

The Cambrian Explosion of Bitcoin Treasury Companies

Today, Bitcoin treasury companies exhibit a strikingly similar pattern; as companies around the world rush to replicate MicroStrategy's success, new entities are launched every week. The “Cambrian explosion” of Bitcoin treasury companies can be tracked in real-time through web data dashboards:

Source: BitcoinTreasuries.net

The Golden Age of Fraud

The beginning of innovation quickly evolved into exploitation. Galbraith and Allen emphasize that this was not an era of isolated bad actors, but rather a time of systemic opportunism driven by soaring prices and a lack of ethics.

The most profitable role in the trust boom was not that of the investors, but of the promoters. Galbraith explicitly points out that insiders could preemptively capture value by charging fees and continue to extract value, while the public buyers bore the ultimate risk:

The public's enthusiastic pursuit of investment trust securities brought the greatest returns. Almost without exception, people were willing to pay far above the issue price as a premium. The sponsoring company (or its promoters) typically received a certain allocation of shares or warrants, giving them the right to purchase shares at the issue price. They would then immediately sell at a higher market price for profit.

Newly issued shares were often sold to insiders or favored clients at slightly above net asset value, but many newly issued shares quickly rose to substantial premiums. For example, Lehman Brothers Corporation received a significant oversubscription at $104 per share, equivalent to purchasing $100 worth of assets (but note that its management contract stipulated that 12.5% of profits would be paid as a management fee to Lehman Brothers; its true net asset value might only be $88). After going public, the fund immediately rose to $126 per share. The organizers profited not only from the $4 per share spread and future high management fees but also became significant initial investors on better terms than the public. Additionally, they retained a right—worthless when the fund traded at a discount but extremely valuable when the fund traded at a premium—to charge management fees in the form of purchasing new shares at current net asset value.

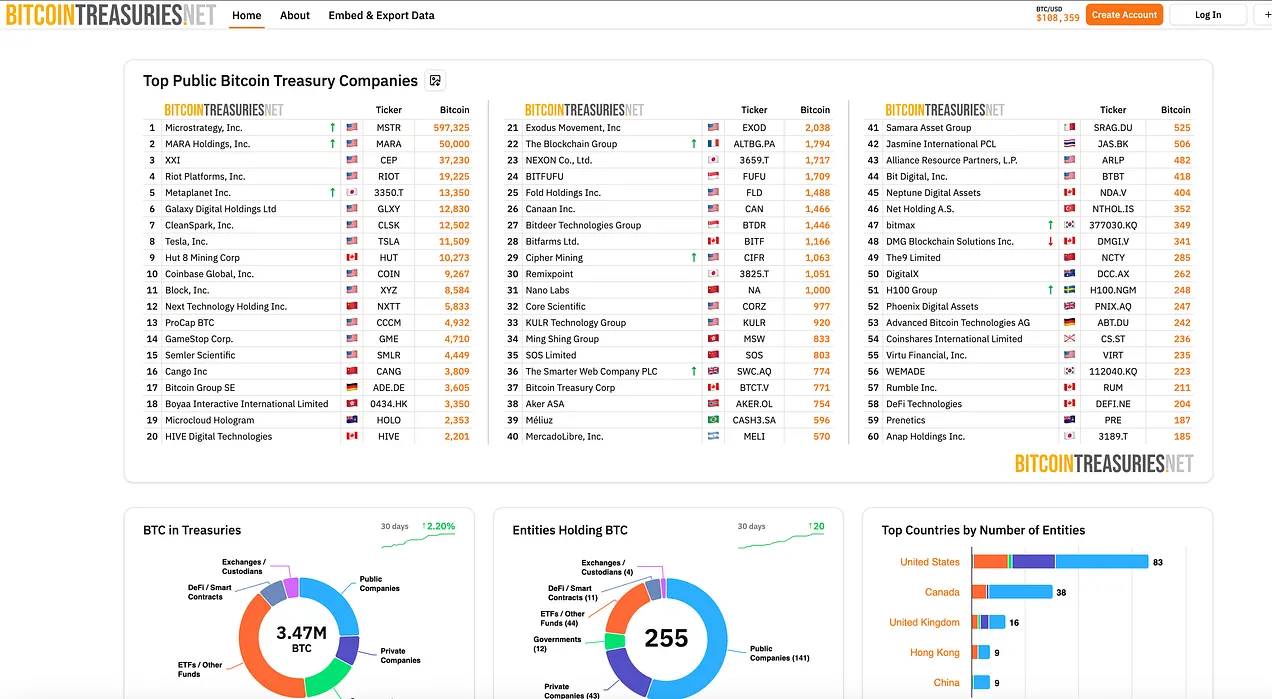

Similar to the trusts of the 1920s, today's Bitcoin treasury companies often adopt similar arrangements—founder stock allocations, internal stock options, and incentive schemes for promoters and podcasters. However, this time, these mechanisms are publicly disclosed under SEC rules designed to address the abuses of the 1920s. But transparency does not eliminate risk or dissolve incentive distortions:

In the 1920s, the speculative frenzy and rapid establishment of trust companies provided excellent cover for the abuses of unscrupulous promoters. The proliferation of improper investment trust and holding company structures exemplified what Galbraith considered typical manifestations of financial excess in the 1920s. He noted that American businesses “embraced an extraordinary number of promoters, corruptors, swindlers, impostors, and fraudsters,” describing this phenomenon as “a tidal wave of corporate theft.” Frederick Lewis Allen concurred:

As long as prices rise, people can comfortably indulge in various dubious financial behaviors. The great bull market obscured countless evils. For promoters, it was a golden age, and “his” name was legion.

These observations resonate with other periods of financial speculation and fraud, including today’s “Golden Age of Grift” and historical events like John Law's Mississippi Bubble—we discussed this in the “Risk Alchemy” series and satirically recorded it in “The Great Mirror of Folly” (1720). But behind the outright fraud lies another risk—perhaps less obvious but equally dangerous: the inherent structural risk alchemy in the design of trust capital structures.

Financial Alchemy

Some call it alchemy, and I call it valuation.

—MicroStrategy CEO Phong Le

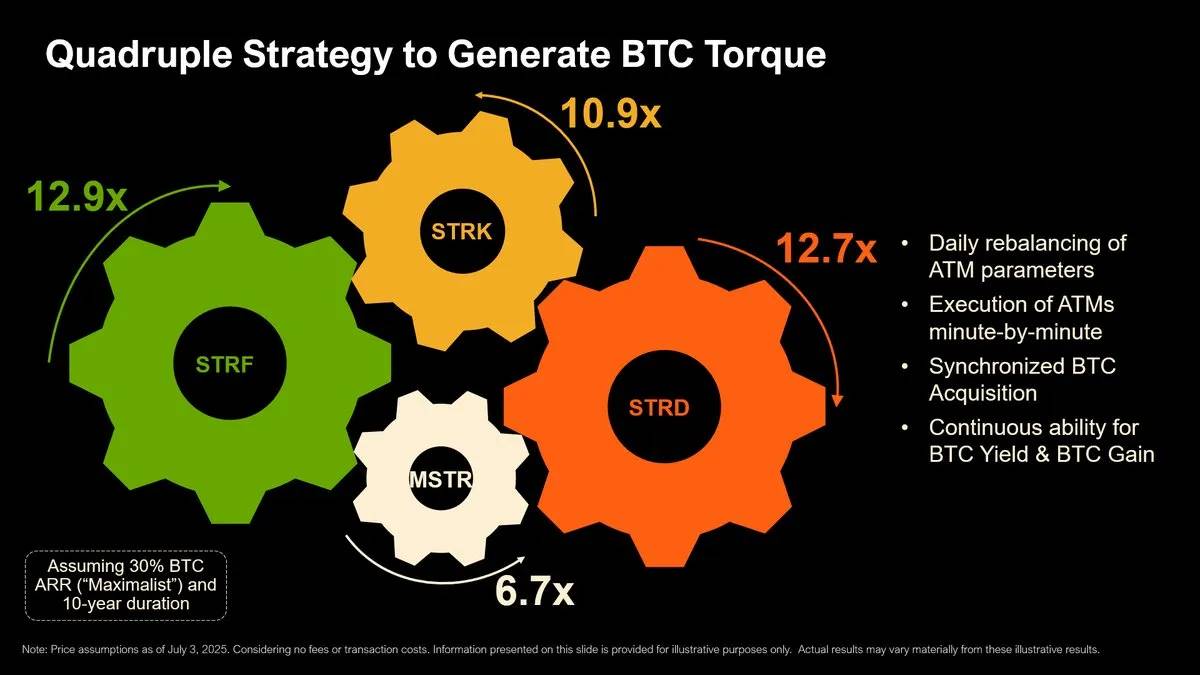

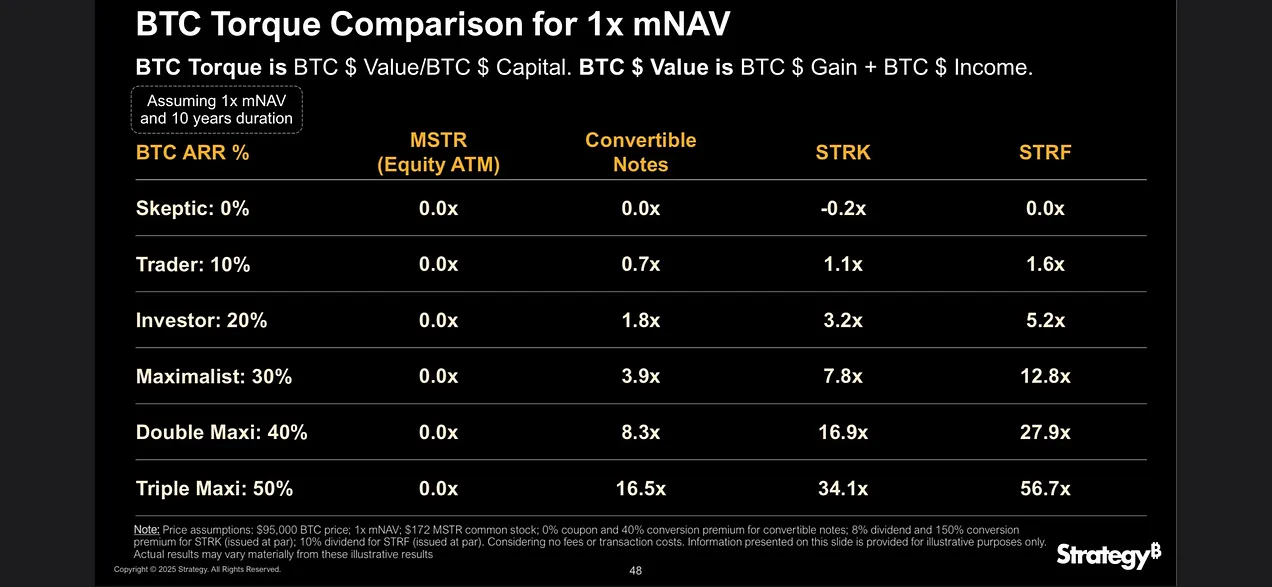

Source: MicroStrategy

MicroStrategy provides a video and chart demonstrating the “leverage effect” of its capital structure's different tiers (stocks, convertible bonds, preferred shares, etc.)—essentially amplifying exposure to Bitcoin price movements:

Michael Saylor rebuffed comparisons with closed-end funds like GBTC (see Part Two), pointing out that MicroStrategy, as an operating company, has greater flexibility:

Sometimes I see… a Twitter analyst saying, oh, this is just like when the P/E ratio of GBTC and Grayscale fell below mNAV. They overlook one thing, Grayscale (GBTC) is a closed-end fund. And we are an operating company.

[Funds like GBTC]… do not have the operational flexibility to manage their capital structure… they have no choice but to refinance or take on leverage or sell securities, buy securities, restructure capital, or repurchase their own stock.

Operating companies like MicroStrategy have greater flexibility. We can buy stock, sell stock, restructure capital, and also fill or resolve funding gaps through borrowing.

However, this distinction overlooks a certain historical irony: the investment trusts of the 1920s pioneered capital structure innovations that make today’s Bitcoin treasury companies so attractive to investors and created the same reflexive dynamics we observe today.

As Galbraith recorded, investment trusts evolved into something far more complex than simple pooled investment vehicles like GBTC—they became a flexible corporate structure, precisely the kind that Saylor boasts about today:

Investment trusts effectively turned into investment companies. They sold their securities to the public—sometimes just common stock, more often common stock, preferred stock, bonds, and other types of debt instruments—and then management invested the proceeds at their discretion. By selling non-voting shares to common stockholders or transferring their voting rights to voting trusts controlled by management, they could prevent common stockholders from interfering with any possible actions by management.

The Investment Company Act of 1940 explicitly restricted these practices because they had proven to be very effective and very dangerous in the market speculation leading up to the 1929 crash. When Greyscale and its lawyers constructed GBTC, they likely chose this form (at least in part) to avoid registration under the 40 Act (Investment Company Act of 1940). Funds like GBTC cannot deploy the full suite of tools available to MicroStrategy not because of their inherent limitations, but as a result of deliberately crafted policies by the SEC to prevent a repeat of the excesses and consequences of the investment trusts of the 1920s.

The capital structure of investment trusts in the 1920s is nearly indistinguishable from that of today's MicroStrategy: both issue securities—stocks, bonds, convertible bonds, and preferred shares issued at a premium to mNAV—to attract investors with different risk ("leverage effect") preferences and return demands. For example, convertible bonds, which are central to MicroStrategy's financing strategy, were also a hallmark of the trusts recorded by Allen (Frederick Lewis Allen) in his studies:

Converting newly issued bonds of the trust into stock or attaching warrants to purchase stock at some future date gave them an acceptable speculative flavor, and this practice became fashionable.

During the economic boom of 1929, the business model of many investment trusts was rooted less in asset management and more in financial alchemy. The complex capital structures and layers of leverage were not merely passive financing tools to enhance returns but were at the core of the enterprise. Their goal was to create a continuous supply of speculative securities to satisfy the insatiable public demand. This demand was driven by a belief—captured by Galbraith (JK Galbraith)—that the stocks purchased by the trusts had acquired some form of "scarcity value," and that the most sought-after stocks were about to disappear entirely from the market.

However, what the public was purchasing was not merely a diversified portfolio of scarce stocks, but a bet on the performance of the trust's own financial alchemy: the true "product" was the securities and net asset value of the trust itself. They functioned like alchemical laboratories, transforming the public's desire for speculative gains into newly conjured securities.

Wise Long-Term Debt

This strategy, similar to MicroStrategy's, allowed trust managers in the 1920s to obtain high-quality leverage: long-term corporate bonds (sometimes up to 30 years), rather than margin loans or "call" loans that required immediate liquidation. Theoretically, these extended maturities allowed trusts to maintain leverage throughout the business cycle without facing immediate refinancing pressures, while their relatively low yields reflected investors' general complacency and systemic mispricing of risk.

Lyn Alden has made similar observations about contemporary Bitcoin treasury companies:

Compared to hedge funds and most other types of capital, publicly traded companies can obtain better leverage. Specifically, they have the ability to issue corporate bonds… typically with maturities of several years. If they hold Bitcoin and the price drops, they do not need to sell prematurely. This makes them more capable of withstanding market volatility than entities reliant on margin loans. While there are still some bearish scenarios that could force companies to liquidate, these scenarios would lead to a prolonged bear market, making them less likely.

Long-Term Debt and Reflexivity

Lyn's analysis—though accurate for any company—overlooks the systemic risks that may arise when these "safer" leverage structures proliferate. Just as 30-year fixed-rate mortgages did not prevent the 2008 financial crisis, any long-term debt cannot inherently eliminate systemic risk and may even exacerbate it.

During the boom period of the late 1920s, financial alchemy amplified returns through the same self-fulfilling prophecies that benefit today's Bitcoin treasury companies: rising asset prices and mNAV premiums led to higher leverage and "leverage effects," further driving up asset prices. But this reflexive cycle rendered the system inherently unstable. As we have seen, these complex capital structures were far more than passive financing tools—they played an indispensable role in fueling the astonishing inflation of bubbles and their subsequent collapses.

Just as cheap hurricane insurance stimulated a building boom after several calm storm seasons, the seemingly safe debt maturing regularly in a bull market may encourage people to increase leverage, creating larger positions and asset inflation, ultimately amplifying rather than dampening downward volatility. The newly discovered "affordable" forced liquidation protections triggered a stunning expansion of risk-taking in coastal areas—until the inevitable hurricane arrived, causing the insurance market itself to collapse. When hundreds of companies adopt the same capital structure and business model, engaging in "one-way bet" speculation, what may seem like prudent practices in individual cases can easily become collective instability. In financial "progress," the dose determines the outcome.

Path Dependence and Ponzi Schemes

Just as some extreme mortgages designed in 2005-2006 were almost destined to default at the first payment, many investment trusts at the tail end of the 1920s bubble were effectively variants of Ponzi schemes from the outset—relying on new inflows of capital or rising prices to meet obligations—despite holding diversified portfolios of dividend-paying stocks and interest-bearing bonds:

Some of these companies… were so overcapitalized that they could not even pay preferred stock dividends from the income of the securities they held, relying almost entirely on the hope of profits.

This created an unstable dependency: to pay the returns to bondholders and preferred stockholders, the trusts either issued new shares (relying on their mNAV premium) or hoped for future appreciation of their portfolios. These two mechanisms intertwined: portfolio returns drove up the mNAV premium, which in turn encouraged the issuance of more shares, funding further expansion of the portfolio.

Essentially, they used the funds of new investors or future price appreciation to pay off existing debts—this is a typical Ponzi scheme structure—making them vulnerable to market downturns when new capital dried up and portfolio returns evaporated, leading to their mNAV premiums collapsing in a self-reinforcing spiral.

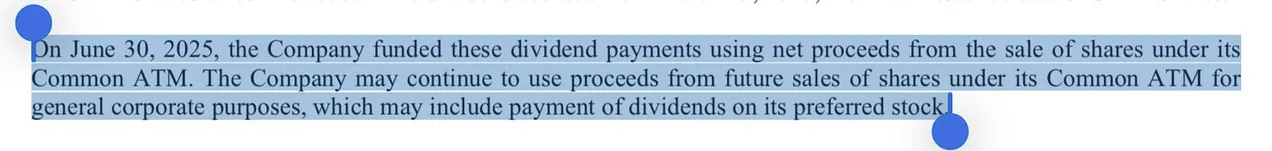

Since Bitcoin treasury companies (currently) have no cash flow, they tend to follow a similar strategy of raising funds from investors to pay off debts:

Like the trusts of the 1920s, this pyramid-like strategy operates effectively when Bitcoin appreciates, the company maintains its net asset value (mNAV), and capital markets remain open to it. However, if all these conditions deteriorate simultaneously over an extended period—potentially due to the over-leveraged Bitcoin treasury companies themselves—these companies will face the same structural vulnerabilities that devastated the trusts of the 1920s.

In fact, one major difference between the investment trusts of the 1920s and today's Bitcoin treasury companies lies in the actual assets they hold. These trusts held (seemingly) diversified portfolios, including dividend-paying stocks and interest-bearing bonds, which generated cash flows to fund their preferred stock and bond payments—at least during the Great Depression, when there was a widespread credit bubble, there was a correlation between them.

While "hyperbitcoinization" and "Bitcoin banks" may have opportunities to change this landscape in the future, Bitcoin currently generates neither cash flow nor dividends, nor does it accrue interest. This creates a structural vulnerability that the trusts of the 1920s, despite their many flaws, never faced. Bitcoin treasury companies lack even the income sources of the 1920s trusts, making them more susceptible to the effects of this pyramid dynamic, not less. Even in the context of a long-term bull market where Bitcoin appreciates tenfold, their viability entirely depends on the path, on continued appreciation, credit channels, and investor enthusiasm. Breaking this chain—potentially due to the over-saturation of leveraged Bitcoin treasury companies themselves—ultimately leads to structural collapse, which we will discuss in the upcoming fourth part of this series.

The Collapse of Trusts and the 1929 Financial Crash

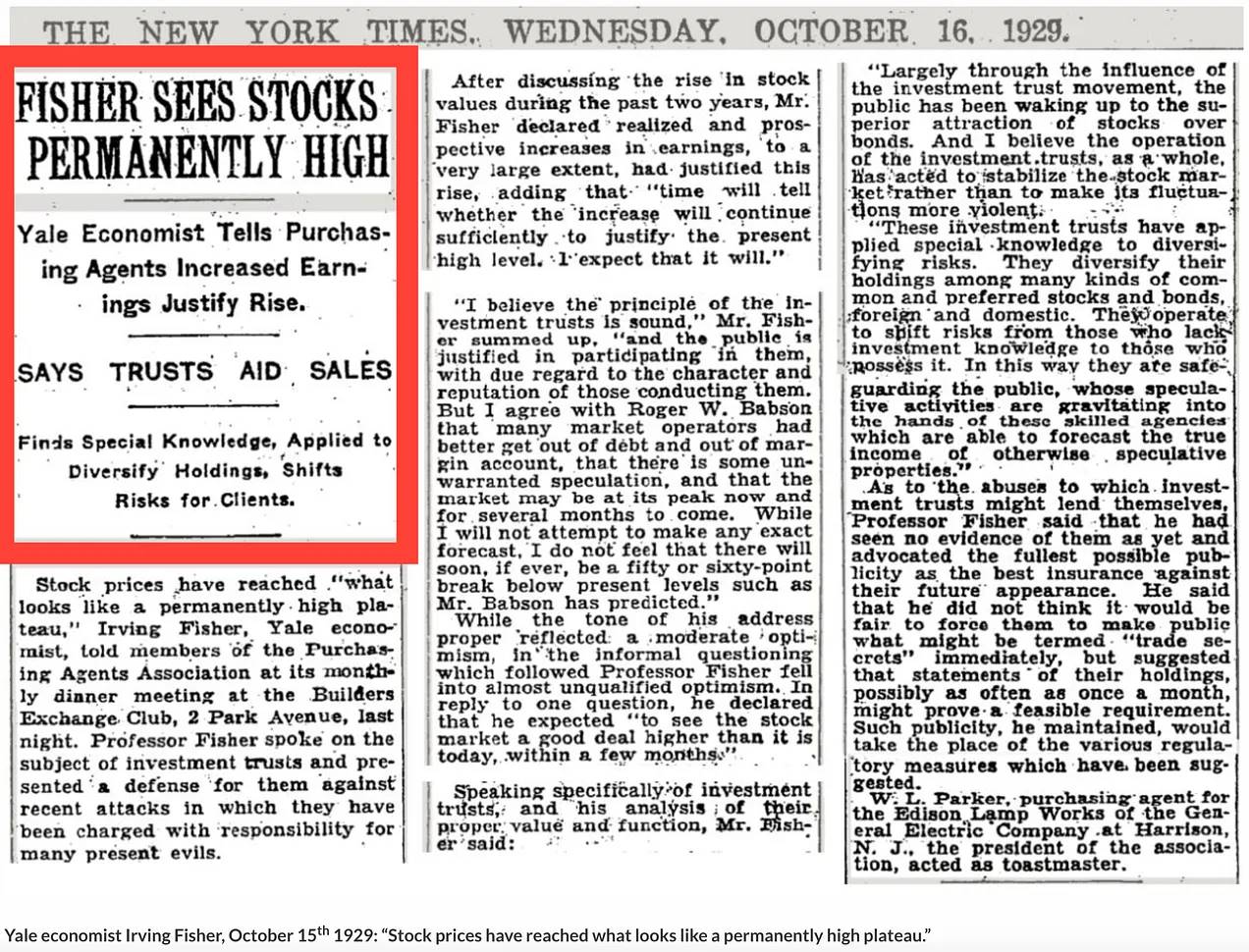

The famous Yale economist Irving Fisher once said that just before the 1929 stock market crash, stock prices had reached a point of "permanently high plateau." Fisher's statement reflects the euphoric confidence typically characteristic of markets at their peaks. Even the most fervent Bitcoin bulls should be wary of similar sweeping generalizations, at least in the short term:

Fisher's famous quote about the market being at a "high level" is now widely known, but the lesser-known context reveals a deeper story. He was actually defending investment trusts, arguing that they were an important support for stock valuations, much like today's Bitcoin supporters mention the built-in demand within Bitcoin treasury companies. The New York Times reported at the time:

Professor Fisher delivered a lecture on the subject of investment trusts and defended them against recent attacks that blamed investment trusts for many of the current ills.

Fisher defended the trusts on the grounds that these tools were awakening public awareness of the advantages of stocks over bonds and providing investors with a superior structure for gaining exposure to stocks—just as Bitcoin funding advocates today claim that MicroStrategy offers greater "leverage" than direct ownership of Bitcoin, and that Bitcoin itself is superior to traditional financial assets such as fiat currency, stocks, bonds, and real estate:

I believe the principles of investment trusts are sound, and public participation in them is reasonable, but it is essential to consider the character and reputation of the managers. To a large extent, it is due to the influence of the investment trust movement that the public has gradually come to realize that stocks are more attractive than bonds. And I believe that, overall, the operation of investment trusts helps stabilize the stock market rather than exacerbate its volatility.

Reflexivity is Bidirectional!

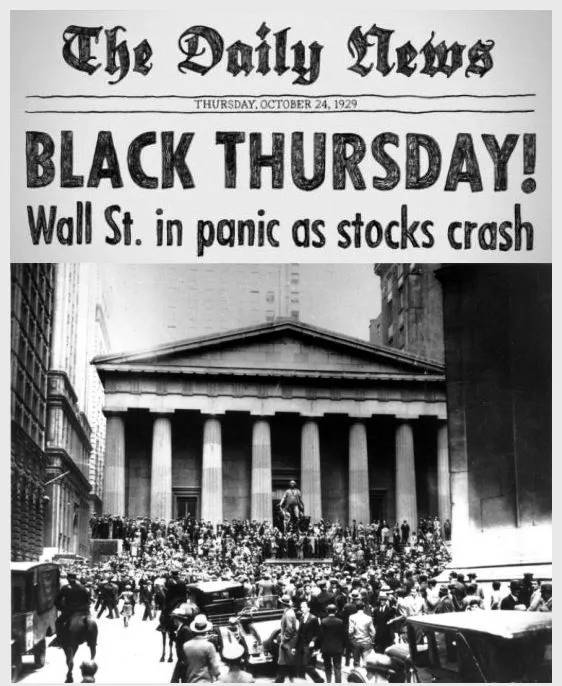

The stock market crash was not merely a price event— as the reflexive cycle reversed, the forces that had driven the stock market boom amplified the decline in asset markets and the real economy. The investment trusts that Irving Fisher had vigorously advocated just a week earlier, claiming they could guarantee stock values to "permanently remain high," became the main drivers of this crash:

By now, it is evident that investment trusts, once considered pillars supporting high economic levels and intrinsic defenses against collapse, have now become profound weaknesses. Just two weeks ago, people were still extolling the virtues of leverage with enthusiasm, but now the situation has completely reversed.

It has astonishingly wiped out the entire value of a trust company's common stock. As before, the situation of a typical small trust company is worth contemplating. Assume the public securities held by the company had a market value of $10 million at the beginning of October. Half of this is common stock, and half is bonds and preferred stock. These securities are fully covered by the current market value of the securities they hold. In other words, the market value of the securities included in the trust company's portfolio is also $10 million.

The representative securities portfolio held by such trusts may have shrunk by half by early November. (By later standards, many of these securities still have considerable value; on November 4, the lowest stock price for Tel and Tel was still $233, General Electric was $234, and Steel was $183.) *The new portfolio value is $5 million, barely enough to cover the asset losses of the previous bonds* and preferred stock. The common stock will be worthless. Apart from those not-so-optimistic expectations, it is now worth nothing. This geometric cruelty is not an isolated case. On the contrary, it has a massive impact on the stocks of leverage trusts. *By early November, most of these trusts' stocks were nearly unsellable. Worse still, many of these trusts' stocks were traded in over-the-counter markets or outside exchanges, where buyers were scarce and market activity was thin.*

Frederick Lewis Allen's account again confirms Galbraith's assertion:

However, the fear did not linger long. As the price structure collapsed, people suddenly rushed to escape. By 11 a.m., traders on the stock exchange were frantically scrambling to "sell off." Even before the lagging ticker could predict the situation, news of the market nearing its bottom had already come through phones and telegraphs, and the number of sell orders had doubled. Leading stocks fell by 2 points, 3 points, or even 5 points between two sell-offs. Down, down, down… Where were the bargain hunters who should have stepped in to save the day? Where were the investment trusts that should have provided a buffer by buying new stocks at low prices? Where were the large speculators who claimed to remain bullish? Where were the powerful bankers believed to be able to support prices at any moment? It seemed there was no support. Down, down, down. The noise in the exchange hall had turned into a panicked roar.

Therefore, we should never forget that reflexivity is bidirectional; it affects not only the market prices of underlying assets but also the fundamentals of those assets:

The most significant weakness of enterprises lies in the new structure of their large holding companies and investment trusts. Holding companies control vast sectors of utilities, railroads, and entertainment. Like investment trusts, these sectors are constantly exposed to the devastating risks brought by reverse leverage. In particular, the dividends from operating companies are used to pay the interest on upstream holding company bonds. A disruption in dividends means bond defaults, bankruptcies, and structural collapses. In this case, the temptation to cut investments in operating plants to continue dividends is evidently very strong. This exacerbates the pressure of deflation. And deflation, in turn, suppresses profits and leads to the collapse of the corporate pyramid. When this happens, further layoffs become inevitable. Income is specifically used to repay debts. Borrowing for new investments becomes impossible. It is hard to imagine any corporate system more suited to perpetuate and exacerbate the spiral of deflation…

The stock market crash is also an extremely effective way to exploit the structural weaknesses of companies. Operating companies at the end of the holding company chain are forced to cut expenses due to the stock market crash. Subsequently, the collapse of these systems and investment trusts effectively destroyed borrowing capacity and the willingness to invest. The seemingly pure trust effect for a long time quickly transformed into declining orders and rising unemployment.

This crisis not only destroyed paper wealth but also exposed the bad investments in the real economy that were masked by debt-driven asset price inflation, forcing unsustainable business models and debt structures into painful liquidation.

Even in the context of a structurally long-term bull market, Bitcoin treasury companies face the same risks. If Bitcoin were to drop significantly (potentially due to the treasury companies' own excessive leverage and speculative behavior), and asset trading prices remained below net asset value for an extended period, then common stock could be completely wiped out like the trust shares of 1929, even though their leverage ratios are "safe." Moreover, as we will discuss in the fourth part, the surge and subsequent collapse of Bitcoin treasury companies could even negatively impact the adoption of Bitcoin itself for a time.

Born of mNAV, Died of mNAV

If we are an operating company and our trading price is below net asset value, then we can monetize it—this is good for me.

Saylor's confidence in monetizing the discount to net asset value (which may be reasonable for MicroStrategy) reflects the same logic that trust managers in the 1920s used to justify share buybacks, only to find later that this supporting strategy was ineffective when liquidity in the entire ecosystem disappeared and selling pressure dominated.

These trusts found that buying back stock in the face of investor sell-offs and credit tightening was entirely different from issuing stock when investors were buying. To support stock prices, these trusts began buying back shares at prices below net asset value—Bitcoin treasury companies are likely to adopt this strategy, but the outcomes for most companies are similarly disappointing:

The stabilizing effect of the investment trusts' massive cash resources also proved to be an illusion. In early autumn, investment trusts had abundant cash and liquid resources… but now, as the effects of reverse leverage gradually emerged, the management of investment trusts was more concerned about the plummeting value of their own stocks than the adverse fluctuations in the overall stock market…

In this situation, many trust companies desperately tried to support their stock prices with their available cash. However, there is a significant difference between buying stocks when the public wants to sell and buying stocks when the public wanted to buy last spring (like Goldman Sachs did)—at that time, the public wanted to buy, and the resulting competition drove up stock prices. Now, cash is flowing out, stocks are flowing in, and stock prices are either not significantly affected or the impact is short-lived. Financial strategies that seemed clever six months ago have now become fiscal self-immolation. Ultimately, buying back one's own stock is the complete opposite of selling stock. Companies typically grow by selling stock.

As the crisis deepened, mNAV continued to trade at a discount, and trust companies exhausted their remaining cash reserves, desperately (and ultimately counterproductively) trying to support the plummeting stock prices:

However, these efforts were not immediate. If a person is a financial genius, trust in that genius does not disappear immediately. For the battered but unyielding genius, supporting the stock of their own company still seems like a bold, imaginative, and effective way. In fact, it seems to be the only option to avoid a slow but inevitable death. Therefore, within the limits of available funds, the management of trust companies chose a faster but equally inevitable death. They bought stocks that were worthless to themselves. It is not uncommon for people to be deceived by others. In the autumn of 1929, perhaps for the first time, people engaged in large-scale self-deception.

Conclusion

The investment trust frenzy of the 1920s provides a comprehensive blueprint for understanding financial bubbles built on leverage, reflexivity, and the magic of premium/net asset value growth. Initial financial innovations quickly evolved into speculative tools, promising easy wealth through financial alchemy. When the music stopped, the reflexive mechanisms that had pushed prices to euphoric heights accelerated their catastrophic decline.

This bears a striking resemblance to today's Bitcoin treasury companies—from the surge of new entity companies to reliance on net asset value premiums, to using long-term debt to amplify returns. As we explored in Tower Of Babel, the primary root of the 2008 financial crisis was not the subprime mortgage crisis, collateralized debt obligations (CDOs), or mortgage fraud—just as the primary reasons for the collapse of investment trusts in the 1920s were not fraud, erroneous bets, lack of transparency and regulatory oversight, or their sometimes interwoven or pyramid-like holdings. They collapsed because their success—built on the "Alchemy Of Risk"—contained the seeds of future failure; Bitcoin treasury companies may be on the same path, heading toward the same cliff.

However, more concerning is that just as the trusts of the 1920s marked an era of speculative excess, Bitcoin treasury companies are symptomatic of today's "multiple inflation"—a deeper malaise distorting the current economic order. The emergence of a recently registered gold treasury company indicates that Saylor and Bitcoin treasury companies' speculative attacks on fiat currency are expanding beyond Bitcoin:

This broader assault on the orthodoxy of currency may herald the emergence of a "flight to real value" (Flucht in die Sachwerte)—a wave that could escalate into a full-scale war against financial institutions. In fact, the actual business model of gold treasury companies—tokenizing commodity markets—could accelerate this trend by bringing more funds and credit into the real economy. This not only fails to safely contain inflationary pressures within the virtual casino of the financial matrix but could further exacerbate the inflation supercycle.

Next: Can Bitcoin Break the Reflexivity Spell?

In the fourth part, we will explore whether Bitcoin's unique monetary attributes—conflicting with the unprecedented large-scale money printing by central banks—might enable leveraged funding companies to completely reverse historical patterns through financial gymnastics: triggering reflexive speculative attacks on fiat currency and creating a self-fulfilling prophecy akin to a "bank run." Or will they, like the investment trusts of the 1920s, embed the seeds of systemic vulnerability of the Bitcoin ecosystem within their structures?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。