Today's homework should be submitted early, as it's not difficult to write. Although the PCE data has been released, it is just as expected; even if the data isn't good, the pressure on the market is very short-term. This is because the current macro data is not very useful for the market. It's not that macro data isn't important, but rather that any data right now may not stop Trump from his firm intention to cut interest rates.

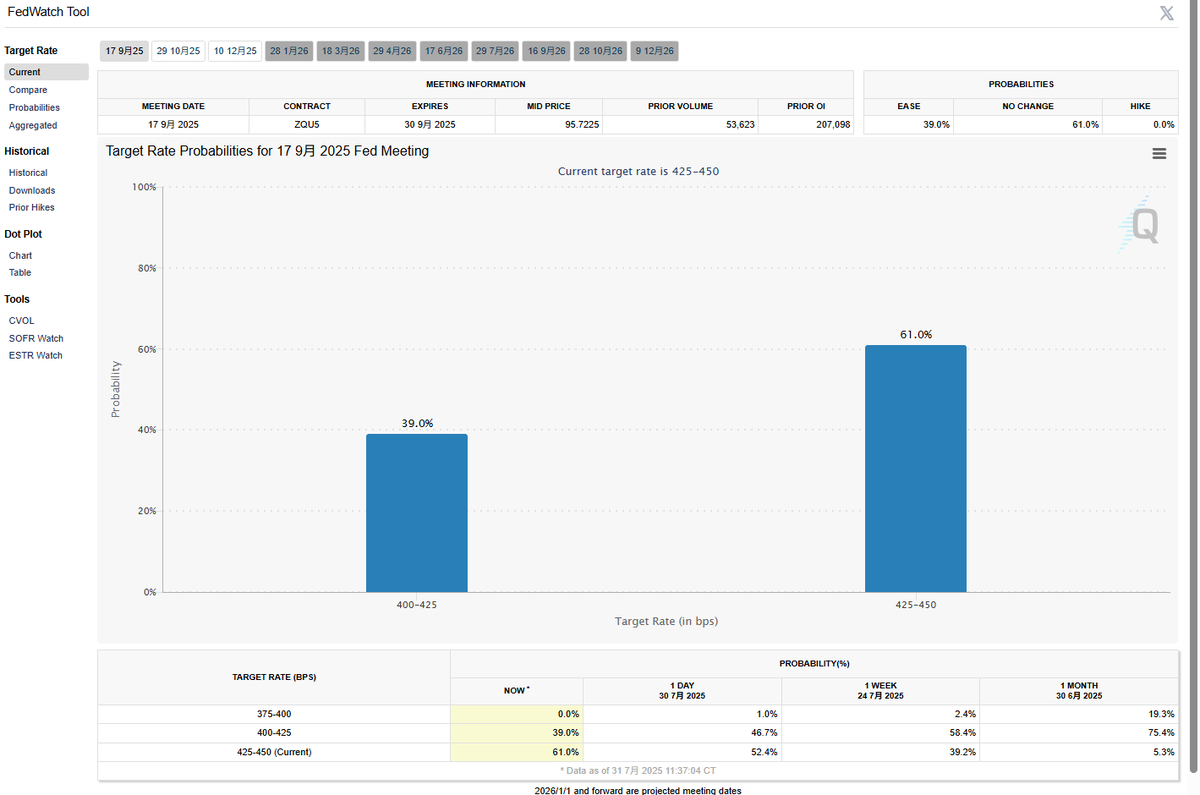

The more dissatisfaction Trump expresses towards Powell in the media, the higher the market's desensitization to macro data becomes. Good data that could support a rate cut is considered good data, and data that cannot support a rate cut is also good data. The more Powell resists, the stronger the backlash from Trump becomes. This is why, after the PCE data, the probability of the Federal Reserve not cutting rates in September has risen to 61%, yet the market remains upbeat.

For example, tomorrow's unemployment rate data: if this data rises, it will increase market expectations for a Federal Reserve rate cut, which is good data. Conversely, if this data falls and reduces the Federal Reserve's determination to cut rates, the market won't be overly concerned, as the greater worry is Trump. We will know tomorrow.

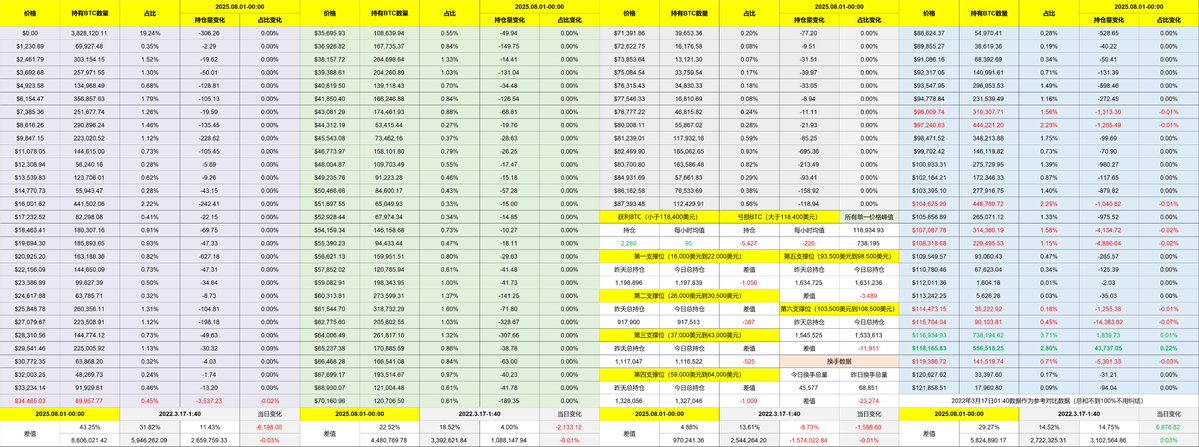

Today, around $118,500, I took profits on 80% of my long positions from the 29th and 30th, leaving 20% to see how it goes. Once this position is fully closed, I will review it.

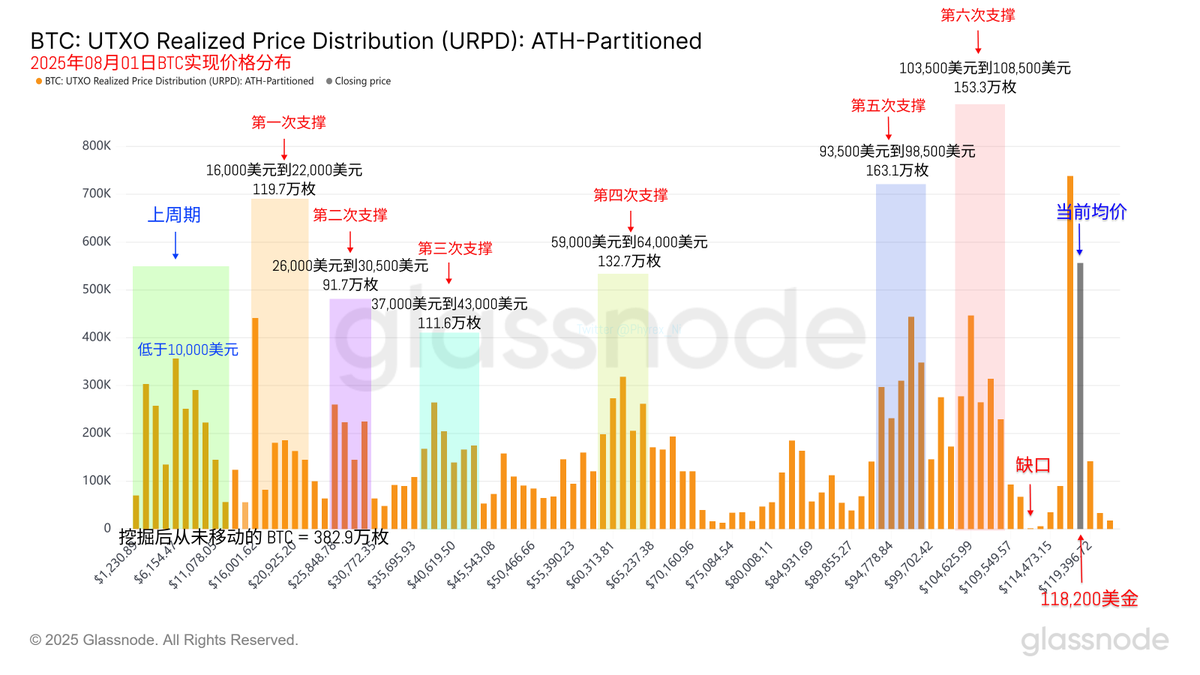

Looking back at Bitcoin's data, the turnover rate is further decreasing. Although there has been a lot of macro data in the past two days and the market has seen significant fluctuations, the decrease in turnover indicates that the current data has less and less impact on investors. Although the FOMO sentiment has almost disappeared, selling is not the main choice for current investors.

Compared to tomorrow's unemployment rate, the earnings reports of $MSTR and $Coin after today's market close will have a more immediate impact on the market. In the second quarter, both the price of $BTC and the market's activity level were higher than in the first quarter, so the earnings reports for MSTR and Coin should look better than in the first quarter, potentially providing positive feedback to the market.

Support remains very strong. Currently, around $117,000 and $118,000, nearly 1.3 million Bitcoins have accumulated, which is quite a significant amount. Continuing to accumulate could likely force investors to choose a direction; the more a single price accumulates, the greater the probability of a directional choice.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。