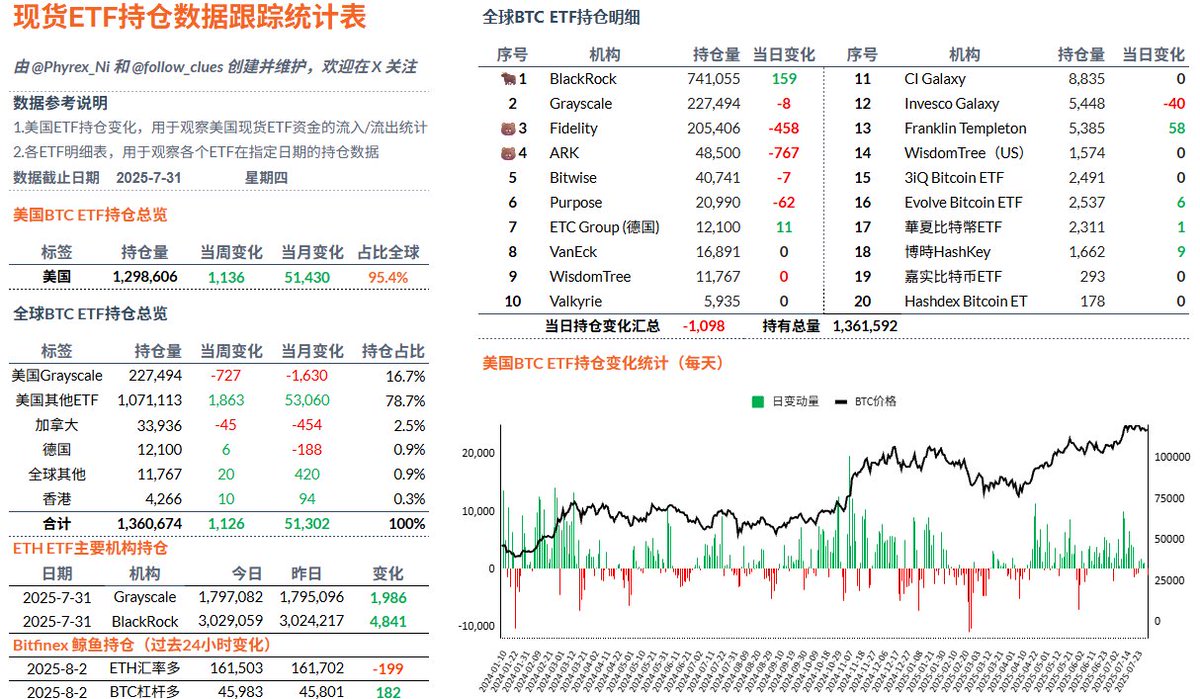

In the past week, the data for spot ETFs has been quite weak, whether for $BTC or $ETH. As we've mentioned several times, this indicates a retreat of traditional users. Yesterday, nearly 1,100 Bitcoins were net withdrawn, with Fidelity and ARK being the main sellers. The users of these two funds tend to chase highs and cut losses. BlackRock's investors saw a net inflow of less than 200 BTC, which is insufficient to support the situation.

We've said many times that the data for spot ETFs does not represent price fluctuations, but it can serve as a barometer for traditional investors, reflecting their sentiment. The data over the past two weeks has gradually shifted from FOMO to indifference, with purchasing power steadily declining until sell-offs occurred, indicating that the market is waiting for new opportunities. Next, we will see what Trump has to say.

Data link: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。