Today's homework is not easy to submit. If yesterday's market decline had some justification, today's drop has caused many friends to start surrendering. The reason for the decline is believed to be the "falsification" of employment data or severe downward revisions leading to expectations of an economic downturn. Whether this is the truth is unknown, but whether this marks the beginning of a bear market or the initial phase of continued decline, from my personal perspective, I do not agree. Of course, I may not be right.

The reason is that the current market support still relies on Trump's tariff policy and the Federal Reserve's monetary policy. If the economy weakens, then the support would be the Fed's interest rate cuts. Although there may indeed be risks, we have already warned about economic dangers many times from last year to this year, and even the Fed itself has mentioned being cautious about the risks of economic downturn.

This risk does exist, but the probability of it erupting now is not very high, at least that’s what I think. After all, the U.S. has not yet seen systemic risks, and to think that a slight downturn in the economy is solely due to employment data seems a bit far-fetched, especially for Trump, as experiencing an economic downturn in his first year would be a definite slap in the face.

The big beautiful plan is to abandon long-term strategies and stimulate short-term economic growth. Investment in the AI industry has just begun, and the easing in the cryptocurrency sector is also starting, meaning that forced survival might last for a while.

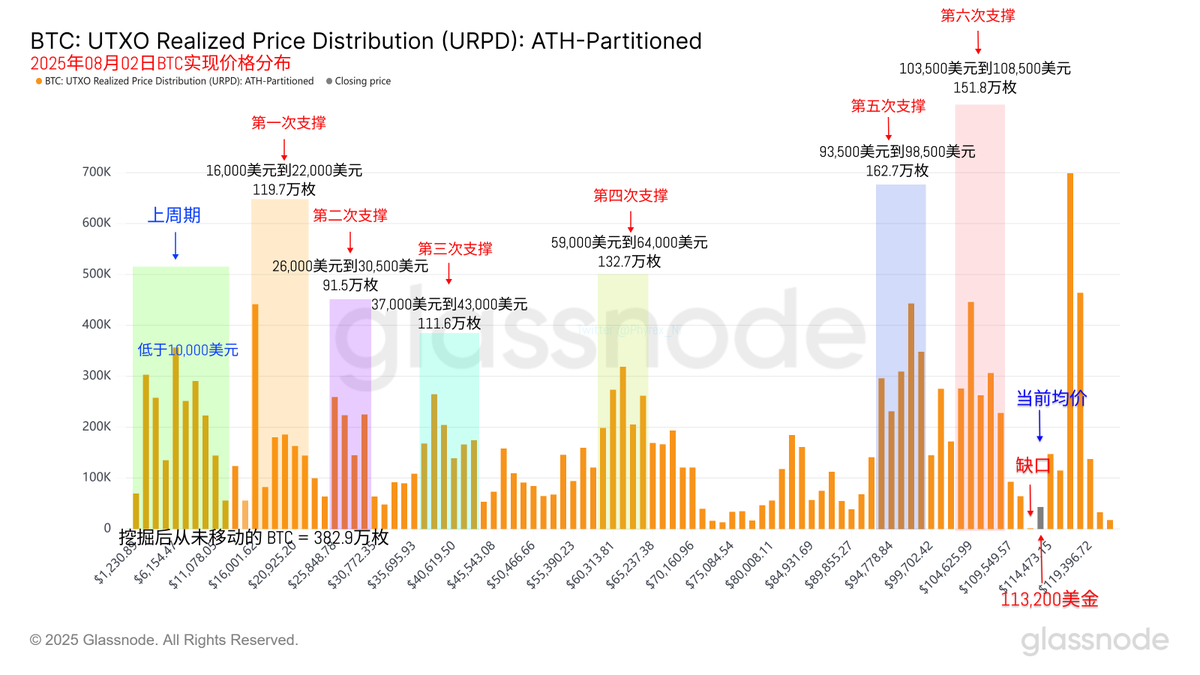

In light of this situation, there are two things we need to do. The first is to determine if this is just a correction, and if so, what level is the bottom? From the data that has been released, the URPD gap is at $112,000. I have mentioned this gap countless times; it will definitely be filled, but the timing of that fill is uncertain, perhaps it could be this time.

Currently, there are two support levels: the first is between $103,500 and $108,500, and the second is between $93,500 and $98,500. The first level, while not very stable due to a significant number of short-term investors, should not break this range unless there is a major negative factor. The second range is much more stable; even if it breaks, it should be able to recover relatively quickly.

Overall, I believe that there is currently no systemic risk. Although the turnover rate has increased significantly, such a degree of decline occurs almost every month. Within two months, there was a drop of this magnitude due to the ancient whale and the argument between Trump and the Fed, and even the initial concerns about monetary policy led to a quick return to the $93,500 support level. Therefore, I still have some confidence.

What I am slightly worried about is the weekend. After the weekend, the focus next week may be on the Federal Reserve's resignation of a board member. Trump should be able to provide a nomination before August 8, which would expand his influence within the Fed to three voting members, a positive signal for the market.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。