$3.7B Bet: Metaplanet Buys Bitcoin, Eyes Long-Term Rally

Metaplanet Files $3.7B Shelf to Accelerate Bitcoin Buys

The Japanese digital assets treasury firm Meta Planet Announced that it has filed a shelf registration to issue up to 555B yen which is approx $3.7 billion of shares to fund its Bitcoin accumulation strategy

Source: X

New Filing Aims to Reach 210K BTC Goal by 2027

This shelf registration will go effective from August 9,2025 to August 8. Metaplanet plans to issue these securities in portions across the two years when the market conditions align. The latest filing gives a broader prospectus to its previously announced target of raising 210,000 coins by 2027. The plan also depends on the company's request to increase the number of authorized shares from 1.61 billion to 2.723 billion, which was disclosed in the same filing. At the Extraordinary General Meeting (EGM) on September 1, the proposals will be put to a vote. If the proposal is approved the firm will issue two new classes of perpetual preferred shares of Class A and Class B with each having a potential issue value of 277.5 billion yen. These shares would pay out dividends up to 6% more frequently than common stockholders, with the money raised going toward buying digital gold. Metaplanet also stated that there is no specific plan for issuance of Preferred Shares, it is in progress and It is unclear if such an issuance will occur.

Metaplanet Has Bought 17,132 BTC Since April 2024

Metaplanet started to acquire BTC from last April 2024 since then in 13 months it has accumulated 17,132 BTC which is worth $1.95B. Recently on July 28 the company acquired 780BTC . The proposed raise is 75% of companies total market capitalization 714B and could reshape its future plans.

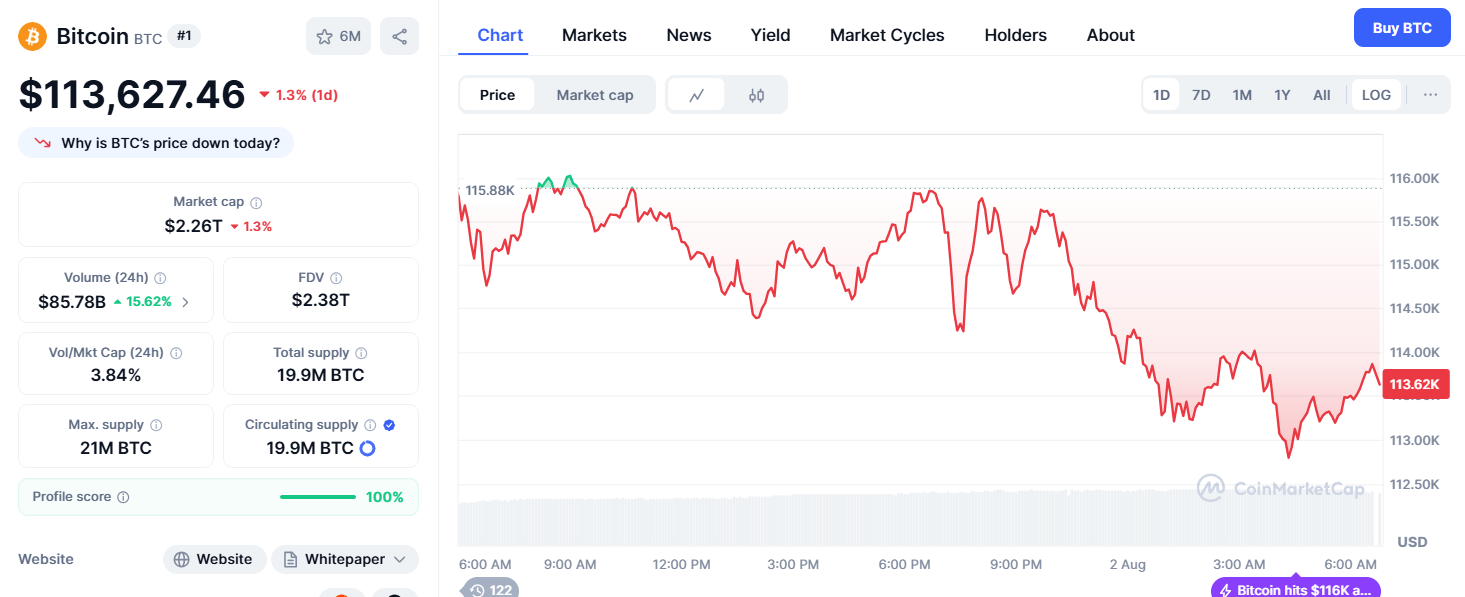

Bitcoin Dominance at 61.2% Despite Recent Price Dip

Source: coinmarketcap

Bitcoin has dominated the total crypto market with 61.2%. The dominance shows how this digital gold can play a crucial role in the volatility of the global crypto market. In past months, the token has seen its all time high and trading at $113,627 with a downfall of 1.3% in the last 24hrs, at the time of writing. Many technical and political factors affect the price of coins. Recent announcement of US job data , technical breakdowns and liquidation could be the reason behind the coin’s Dip.

Is Metaplanet and Corporate Treasury Accumulation is the Main Reason Behind Bitcoin Price Volatility

The Bitcoin treasury trend is setting a major goal towards all giant financial institutions. Despite the dip, all of them want to buy and hold BTC, however many of them are turning towards Altcoins like Ethereum, XRP, Dogecoin and SOL nowadays. As per analyst when the token is facing downfall it's a great time to buy more and hold. The downfall shows the historic pattern of correction after hitting its all time high. That's why market sentiments are bullish. Metaplanet buys are signaling strong towards the rise of token again.

Can Bitcoin Hit $150k Target by Q3 2025

It may be approaching the end of its current bull market cycle. As per analyst reports it is anticipated that the token can reach between $130k- $150k target by the end of 2025. Many sleeping whales are awake and aggressively buying the digital gold. Strong institutional absorption is one factor contributing to this continuous balance. Businesses and exchange-traded funds (ETFs) keep accumulating Bitcoin steadily, which helps reaching the target.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。