Written by: angelilu, Foresight News

On August 1, the global financial markets experienced a round of severe turbulence, and the cryptocurrency market was no exception. BTC plummeted to 112,751 USDT in the early morning, erasing nearly three weeks of gains and hitting a new low since July 10. As of the time of writing, the BTC price is 113,639 USDT. ETH also fell to a recent low of 3,431 USDT in the early morning.

According to Coinglass data, the total liquidation across the network in the past 24 hours reached 726 million USD, with long positions liquidated at 640 million USD and short positions at 86.85 million USD. Additionally, ETH saw liquidations of 270 million USD in the last 24 hours, surpassing BTC's 165 million USD.

Cryptocurrency-related stocks in the U.S. stock market performed poorly, with Coinbase dropping 16.7%, Riot Platforms falling 17.75%, and Circle down 8.4% at yesterday's close. This indicates that investors' risk appetite for crypto assets is decreasing.

The weak employment data in the U.S., Trump's intense political response, and rising geopolitical risks collectively triggered significant market volatility.

Macroeconomic Environment: U.S. Employment Data Collapse Triggers Market Shock

On the evening of August 1, Beijing time, the U.S. Bureau of Labor Statistics released the non-farm payroll report for July, showing that the U.S. non-farm employment increased by only 73,000 jobs, significantly below the expected 104,000, marking the smallest increase since October of last year. Even more shocking to the market, the Bureau also significantly revised down previous data, lowering the employment figures for the previous two months by a total of 258,000 jobs.

Trump's Strong Response: Immediate Dismissal of the Labor Statistics Bureau Director

U.S. President Trump reacted strongly to the weak employment data, posting on social media to accuse the Labor Statistics Bureau Director Erika McEntarfer, appointed by Biden, of falsifying employment data before the election, stating, "The non-farm employment data has been manipulated to embarrass me." Just hours after the non-farm employment report was released, he ordered the immediate dismissal of Erika McEntarfer. William Wiatrowski will take over as the acting director of the U.S. Labor Bureau.

Trump stated, "We need accurate employment data. Such important data must be fair and accurate, and cannot be manipulated for political purposes." He also criticized the Federal Reserve for "playing tricks" by significantly cutting interest rates twice before the presidential election, implying that Powell should also "retire."

Additionally, Federal Reserve Governor Kugler announced he would resign early next week, providing Trump with the opportunity to appoint a favored candidate, which could have a significant impact on the Fed's future monetary policy.

Rising Geopolitical Risks

Aside from economic data, geopolitical risks are also heating up. Trump announced on social media that, based on "provocative remarks" from former Russian President Medvedev, he has ordered the deployment of two nuclear submarines to areas near Russia.

This series of events directly triggered a sharp decline in all three major U.S. stock indices. On August 1, Eastern Time, the U.S. stock market saw a single-day market value evaporation of over 1 trillion USD. Meanwhile, risk aversion sentiment surged, with gold prices skyrocketing, breaking through the 3,350 USD/ounce mark, and as of the time of writing, it stands at 3,362 USD/ounce.

August BTC Enters "Downward Devil Month"

Historically, the cryptocurrency market has performed poorly in August. According to statistics from Lookonchain, August and September are historically the worst months for Bitcoin (BTC). Data shows that in the past 12 years, Bitcoin's price has fallen in 8 of those years during August and September, with a decline probability of 67%.

Market Faces a Critical Turning Point: Short-term Correction or Long-term Consolidation?

Currently, the market faces a critical question: Is this pullback a healthy short-term correction, or are we about to enter another long-term consolidation phase?

Following this data event, market expectations for a Federal Reserve rate cut in September have continued to rise. CME's "FedWatch" data shows that the probability of a 25 basis point rate cut in September has risen to 89.8%, while the probability of maintaining the current rate has dropped to 10.2%. The probability of a cumulative 50 basis point cut in October has reached 51.8%. From a macro perspective, the weak U.S. employment data may accelerate the Fed's rate-cutting pace, which theoretically should be beneficial for risk assets, including cryptocurrencies.

ARK Invest Goes Against the Trend

Notably, against the backdrop of increasing downward pressure in the market, investment firm ARK Invest increased its holdings on August 1, with multiple ARK funds simultaneously buying Coinbase (COIN) stock. The ARKK, ARKW, and ARKF funds collectively purchased 94,678 shares of Coinbase stock, totaling approximately 33 million USD. Additionally, Ark Invest bought about 18.7 million USD worth of BMNR stock (a publicly traded company using ETH as a financial strategy).

Whale Game: Liquidation vs. Bottom Fishing

In terms of whale movements, some are quickly selling while others are bottom fishing: Arthur Hayes sold 2,373 ETH (worth about 8.32 million USD), 7.76 million ENA (worth about 462,000 USD), and 38.86 billion PEPE (worth about 414,700 USD) in the past 6 hours. Meanwhile, according to @ai_9684xtpa's monitoring, an address suspected to belong to Anchorage Digital seems to be buying 14,933 ETH through Galaxy Digital OTC, worth about 52.07 million USD. This address received these tokens 4 hours ago (almost at the rebound point for ETH) at an average price of 3,487 USD.

Trader Perspective: Divergent Technical Analysis Opinions

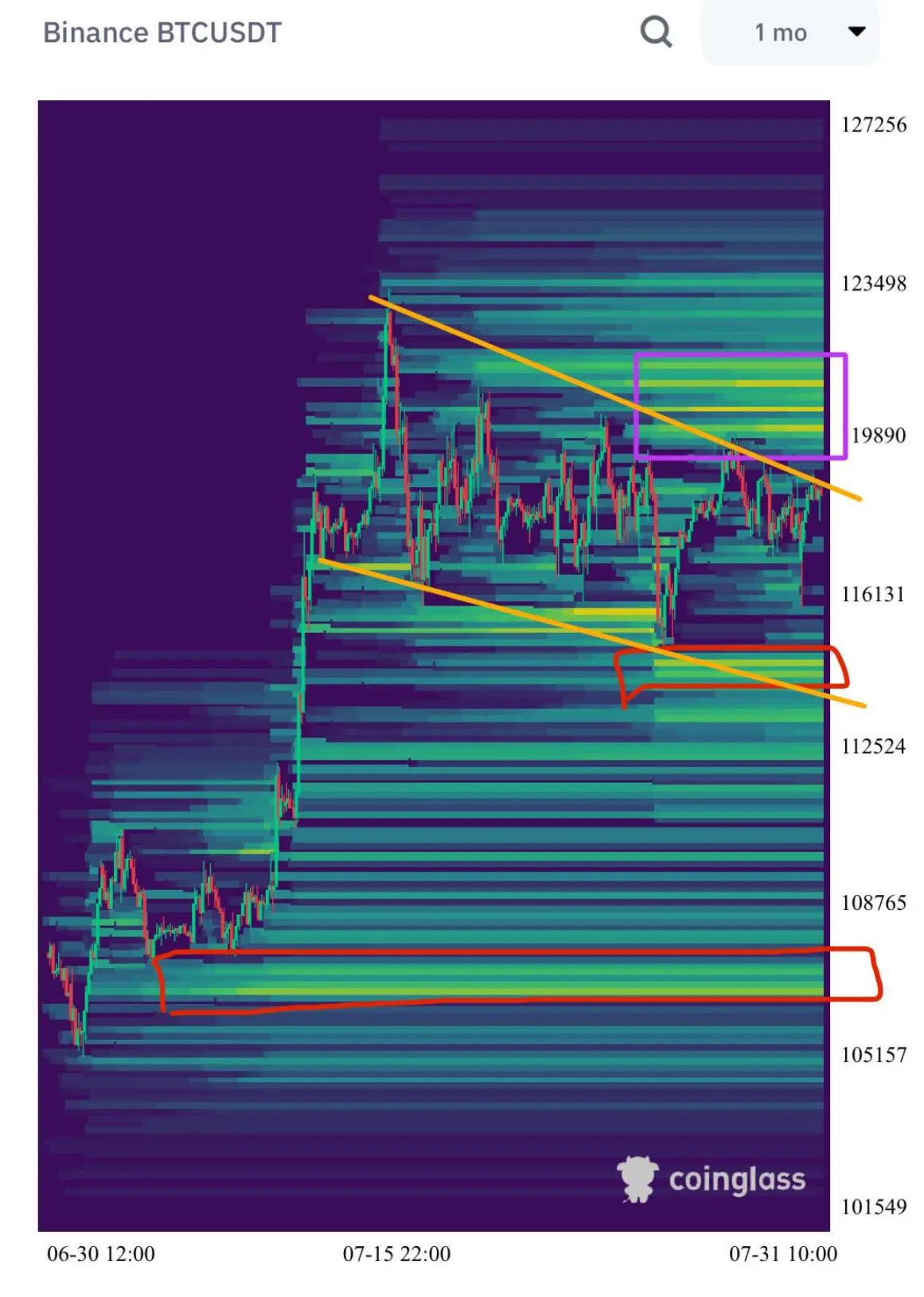

Investment firm DragonFly has analyzed and marked the key accumulation liquidation zones for Bitcoin, suggesting that the market may first test the upper liquidity before exploring the lower liquidity zones. Notably, due to Bitcoin forming a flag pattern, there is a possibility of moving upward without touching the bottom liquidity. Although the current trend is unclear, they emphasize that closely monitoring the BTC liquidity distribution map is crucial for grasping future market movements.

Bitcoin trader Crypto Bully pointed out that BTC ultimately broke below the lower range and fell below the volume-weighted average price (VWAP bands). He stated that he would maintain a short-term trading mode until the Bitcoin price rises to 115,000 USD or falls to 110,000 USD, attempting to seize short-term bullish opportunities before the Asian trading session.

Another analyst, Crypto Fella, offered a more cautious view, stating, "If Bitcoin breaks below the support level of 114,700 USD, it may further test the support area of about 112,000 USD on the 4-hour chart."

Data analyst and quantitative trader Crypto Painter indicated that BTC's descending wedge has broken, and the price can only be treated as a descending channel as it stands back within the wedge.

Meanwhile, crypto investor Sensei holds an optimistic view, stating that the Bear Trap has ended, and preparations for an upward movement can begin. Foresight News notes that a Bear Trap is an important stage in the market psychology cycle, referring to a situation where the market briefly declines and then quickly reverses upward, causing short sellers (bearish investors) to incur losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。