The memecoin market is in decline, and PumpFun's strategic transformation may become the biggest winner.

Author: miya

Translation: Deep Tide TechFlow

First of all, this is not an attack on LetsBonk; I believe the Bonk team led by Tom has done an excellent job in winning the favor of memecoins, making any counterattack seem pointless. LetsBonk has won the memecoin battle and will continue to maintain its dominance.

PumpFun is achieving victory. Your first reaction might be to laugh at my lack of understanding of the market. But before jumping to conclusions, let’s look at some data that clearly indicates PumpFun has not won.

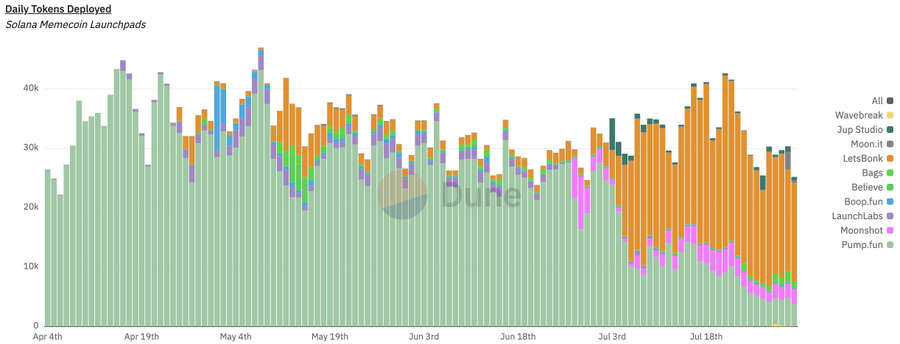

LetsBonk has not only successfully captured market recognition in daily token issuance but has also become the absolute leader in the token issuance field.

Currently, LetsBonk leads in the number of tokens issued by about 3.7 times and has successfully captured 65.1% of the market share in just one month. Additionally, LetsBonk's token distribution events are about 7.8 times that of PumpFun. While PumpFun has a higher token issuance volume in each distribution event, LetsBonk has become a more expected value (+EV) trading launch platform.

So, why is PumpFun considered to be winning right now? All indicators and charts seem to show a gap. Let me explain:

It’s time to take a broader perspective to understand why PumpFun's strategy has been executed so perfectly to date.

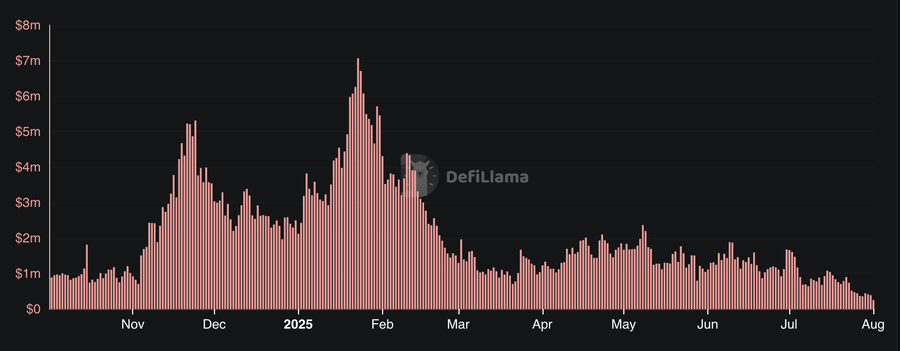

PumpFun's revenue plummeted from $7.07 million to $469,000, a decrease of $6.601 million, with a 93.4% drop in peak revenue over 24 hours.

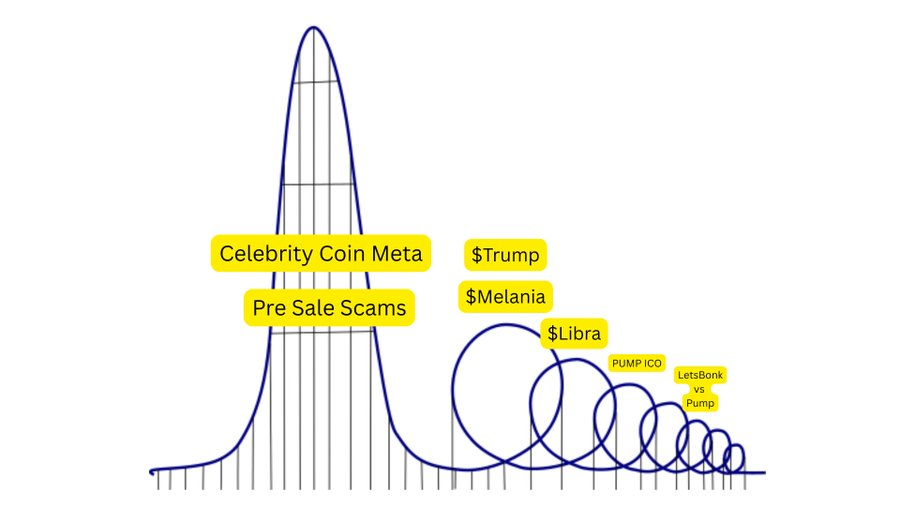

Memecoins are dying. Since February 2025, the entire market has been in continuous decline. This is reflected not only in PumpFun's 93.4% drop in 24-hour revenue but also affects LetsBonk, as the entire market size is shrinking.

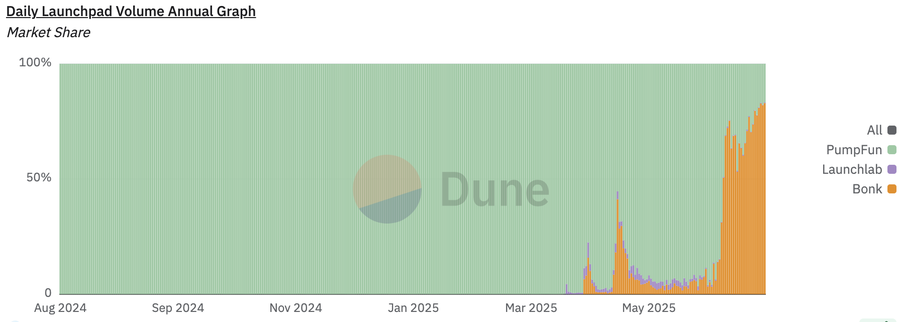

The trading volume share may look like this:

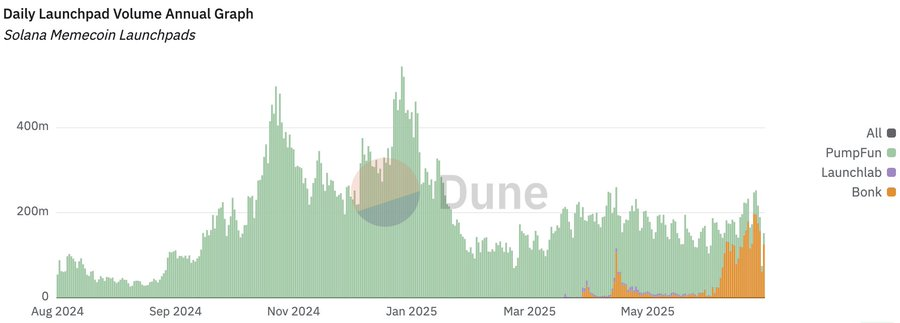

The actual market size that both are competing for is shown below:

This chart does not yet account for the significant increase in bot activity, and the actual trading volume from real users has decreased even more severely.

Since the release of the celebrity coin meta data, the risk appetite for Solana memecoins has been continuously declining. Major mining events like MELANIA and LIBRA have accelerated this downward trend.

Retail investors' risk appetite.

It can be fairly said that memecoins are no longer in their former glory. To understand why the reality is worse than what is seen from the outside, please refer to the detailed analysis in my previous three-part series.

Original article link: Solanas 'Crime Gap'

The memecoin supercycle has entered a complete end.

For a company aiming to operate for more than two years, memecoins are not an ideal future investment. Memecoin trading has evolved into not just an ordinary casino but a place for capital betting with extremely low expected value (-EV).

“Oh, but they are already addicted; just extract more capital from the traders.”

Let me give you a simple analogy: it’s like going to a restaurant that has charming decor, low prices, and excellent service, making you feel like you’re in paradise. However, every time you leave, you feel miserable. Would you frequently choose such a dining service?

Look, even the most addicted gamblers are leaving the memecoin market because they know they will ultimately be “tortured.” Those savvy market participants have developed extremely advanced tools and have an information advantage (like FNF and insider coins), leaving ordinary traders further behind in the future. This is an irreversible path: insider advantages are gradually increasing, while the capital available to ordinary traders is gradually decreasing.

So let’s return to the title: Why will PumpFun win?

Let me ask the following question: if you were Alon (CEO of PumpFun), what different choices would you make?

Option 1: Use your substantial funds to buy back $PUMP.

Well, let’s assume he now establishes a $200 million fund to buy back $PUMP over the next 31 days using TWAP (time-weighted average price), and the generated fees are used for 100% income buybacks. Would that solve all problems? No, not at all. The memecoin market is still in continuous decline, and PumpFun still bears the heavy brand image of a “memecoin launchpad.” Buying back $PUMP will not bring market risk appetite back to past highs, nor will it restore the liquidity needed to support organic “hit coins.” Can it boost market sentiment in the short term? Maybe. But can it revive the memecoin market? No. This would be a capital-intensive commitment made in a declining market, which is detrimental to long-term sustainability.

Option 2: Airdrop $PUMP to users and create new liquidity.

Again, the only result of this approach would be injecting capital into a declining market with shrinking market share. PumpFun would risk distributing free funds that not only cannot be recouped but, worse, may flow into the hands of competitors.

Alon has executed this hypothetical strategy almost perfectly to date.

PumpFun must evolve. Continuing to compete in this already lifeless memecoin gambling field is pointless.

Now, let’s look at what is currently happening.

LetsBonk has invested most of its fees into BONK and GP, but does not have a massive capital reserve. Insiders hold large allocations in projects like BONK and USELESS, which is essentially their way of cashing out and making money through the Launchpad. Regardless of what happens next, they may attract market attention but lack financial support.

They may be losing the memecoin war, but due to the market's extremely low expectations for the future of this field, winning this war may actually be worse than losing it.

@rasmr_eth has made some suggestions for PumpFun's future, one key point being to create a $200 million “hit project” on PF (like ChillHouse). But I believe this is a completely unnecessary investment and further indicates that PumpFun is still competing for a declining market. I think PumpFun has given up on the idea of reviving memecoins; otherwise, they wouldn’t have stopped tweeting for a week straight or given up competing with LetsBonk.

While I do not know the specific actions currently taking place within PumpFun, I do know that Solana Labs is preparing for ICM: bringing back utility to its chain in the upcoming bear market cycle.

Regardless of what narrative unfolds next, PumpFun is financially well-prepared to stay ahead of any other participants.

I also find it ridiculous that Alon would give up on PumpFun.

PumpFun has a mature brand, extensive connections within the Solana ecosystem, and a clear company structure. No one would abandon a well-functioning company just because they cashed out a certain amount; this view is unfounded in the business development (BD) field and is merely propagated by those accustomed to “cashing out events.” While I do not believe Alon will reinvest all income back into the business, I am confident that in the upcoming bear market cycle, PumpFun will successfully attempt to conquer the next market in Solana.

I believe $PUMP is one of the long-term holds worth considering in the upcoming bear market, and if you think this cycle will last another year, the current price is a reasonable investment point.

I hold $PUMP in the spot market as a hedge against my potential misjudgment that the cycle is about to end. I believe there are almost no other highly liquid altcoins more suitable for this bet than $PUMP.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。