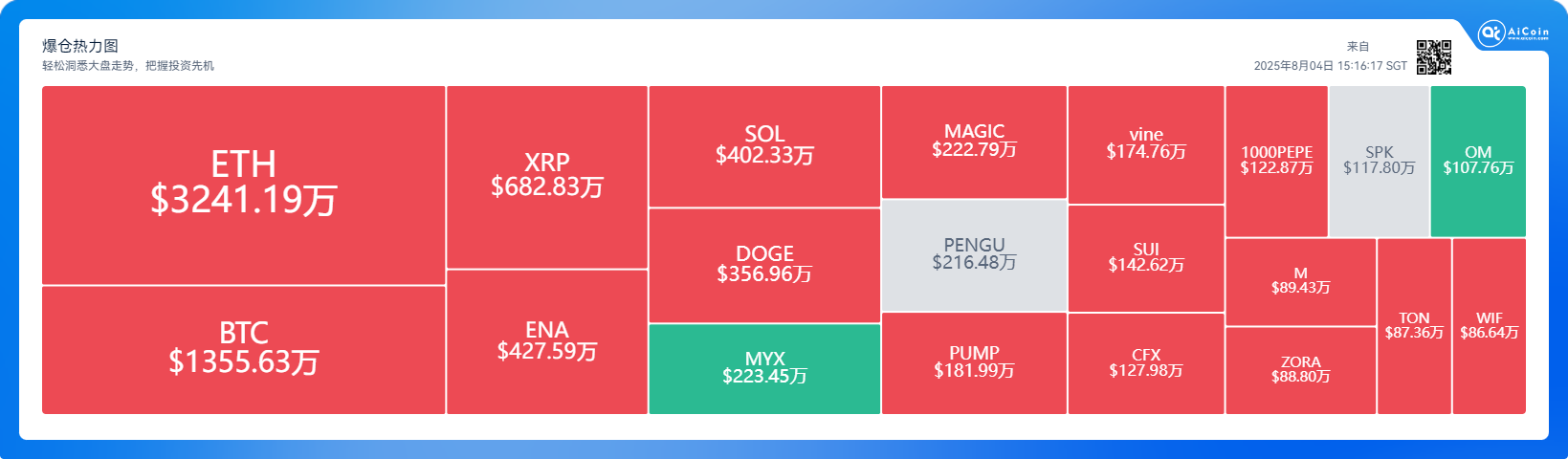

The cryptocurrency market experienced severe fluctuations, with a total liquidation amount of $143 million across the network within 24 hours. Among this, short positions accounted for $106 million, making up 74% of the total, while long positions saw liquidations of $37.0985 million. Ethereum (ETH) and Bitcoin (BTC) topped the liquidation list, recording liquidation amounts of $32.41 million and $13.55 million respectively, highlighting the market's extreme sensitivity to price volatility of major assets.

Short Positions Dominate, Market Sentiment Under Pressure

On August 2, Bitcoin's price briefly fell below $112,000, reaching a two-week low, before rebounding to $119,000, with a fluctuation exceeding 6% within 24 hours. Ethereum's price dropped from $3,634 to $3,517, with this liquidation closely related to recent market volatility. The high ratio of short position liquidations indicates that many investors bet on further price declines, but the rapid market rebound led to the liquidation of high-leverage short positions.

Fed's Hawkish Stance and Non-Farm Data Trigger Market Turbulence

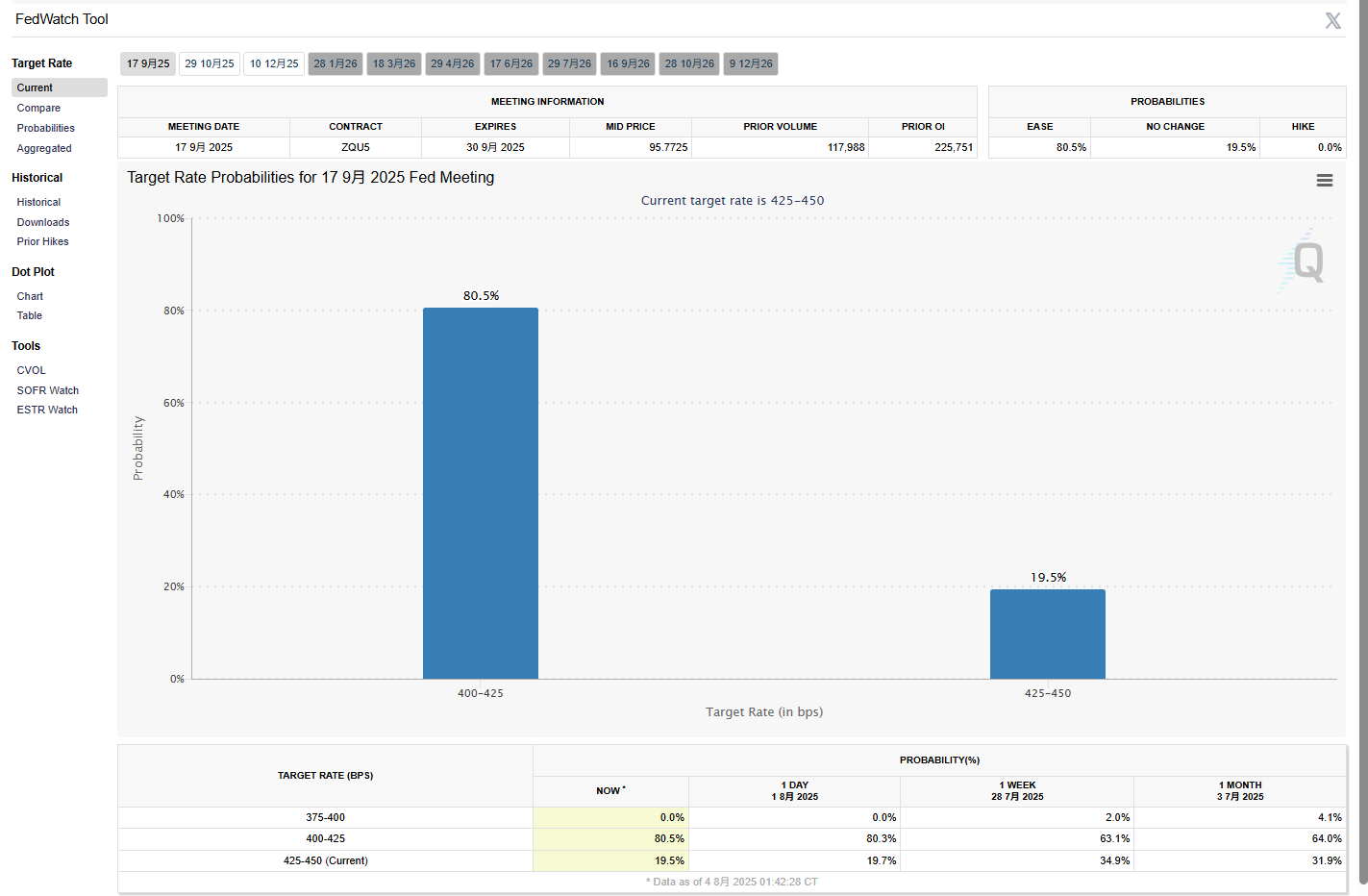

The Federal Reserve's decision on July 31 served as a macro catalyst for this liquidation. The Federal Open Market Committee (FOMC) voted 10-2 to maintain interest rates at 4.25%-4.50%, with Vice Chair Bowman and Governor Waller casting dissenting votes advocating for a 25 basis point cut. Chair Powell displayed a hawkish stance at the press conference, emphasizing the resilience of the job market and inflation risks, stating that the decision on a rate cut in September would depend on data from August and September. This statement pushed the Dollar Index (DXY) up to 100, putting pressure on risk assets.

The non-farm employment data released on August 1 further exacerbated market volatility. The actual increase in jobs was 73,000, below the market expectation of 110,000; the unemployment rate rose to 4.2%, in line with expectations. Although the data did not significantly deviate from expectations, concerns about a slowdown in the labor market still heightened rate cut expectations, with the probability of a 25 basis point cut in September rising to 80.5% as of the time of writing.

Asset Dynamics Behind the Liquidations

ETH: The $32.26 million liquidation amount for Ethereum reflects its high volatility and active high-leverage trading. On August 2, Ethereum's price fluctuated between $3,500 and $3,600, with a 24-hour trading volume of $18 billion. On-chain data shows that Ethereum whale addresses accumulated about 12,000 ETH (approximately $4.5 million) during the decline, indicating institutional investors were buying the dip. However, high-leverage derivatives trading (with perpetual contract leverage reaching up to 50 times) led to concentrated liquidations of short positions, especially on Binance and Bybit. Ethereum has recently been supported by the RWA (Real World Asset Tokenization) sector, which rose by 3.69% on August 3, but macro pressures limited its upward potential.

BTC: Bitcoin saw a liquidation of $13.53 million, which, while lower than Ethereum, is still significant. After the price fell below $112,000, it quickly rebounded, triggering short position liquidations. On-chain analysis shows a decrease in Bitcoin OTC balances and active whale buying, indicating institutional confidence in long-term value. However, the Fed's hawkish decision and a stronger dollar weakened short-term upward momentum. The market predicts that if Bitcoin falls below the $110,000 support, it may further test the $105,000 level.

Interwoven Macro and On-Chain Signals

This liquidation event was driven by multiple factors:

Fed's Hawkish Stance: Powell's "data-driven" remarks and uncertainty regarding a September rate cut heightened market volatility. High-leverage traders failed to adjust their positions in time during the rapid price rebound, leading to large-scale liquidations.

Non-Farm Data Expectations: The mild performance of July's non-farm data (110,000 new jobs, 4.2% unemployment rate) did not trigger recession fears, but concerns about labor market slowdown still elevated volatility.

Trump's Tariff Policy: Powell mentioned that tariffs could lead to a "one-time price shock," exacerbating market speculation due to diverging inflation expectations.

On-Chain Dynamics: High-leverage derivatives trading was the main cause of the liquidations. Data shows that on August 2, the total open contracts in the crypto market reached $60 billion, with an average leverage of 20 times, and some perpetual contracts reaching up to 50 times. The rapid price rebound triggered forced liquidations, with short positions suffering particularly severe losses.

Market Outlook and Investment Strategies

Short-Term Risks:

Sustained High Volatility: Inflation and employment data for August and September will determine the Fed's direction in September. If the data shows a rebound in inflation or strong employment, Bitcoin and Ethereum may face further pressure, testing the $110,000 and $3,500 support levels.

Liquidity Risk: The depth of liquidity for Ethereum and Bitcoin is $120 million and $200 million respectively, lower than that of the stock market, which may amplify price fluctuations.

Regulatory Pressure: The U.S. SEC's tightening regulation of the crypto derivatives market may limit high-leverage trading, affecting market activity.

Investment Opportunities:

RWA Sector Potential: Ethereum stands to benefit from the RWA boom, with projects like Maker (MKR) likely to continue leading, making them suitable for long-term investment.

Data-Driven Strategy: If the CPI released on the evening of August 12 shows a decline in inflation, the probability of a rate cut in September may continue to rise, benefiting crypto assets.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram Community: t.me/aicoincn

Chat Room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。