In every cycle of cryptocurrency, there are always certain engines that ignite the flames of the market. This year, a new capital narrative—Digital Asset Treasury (DAT)—has emerged as a new engine for the crypto market over the past three months, injecting substantial buying power into mainstream altcoins and redefining corporate balance sheets in the Crypto era.

I. The First Half of the Bull Market: The Four Driving Engines of Bitcoin

In all cycles experienced by the crypto market, Bitcoin has always been the flagbearer. In this cycle, Bitcoin's rise is driven by four key factors:

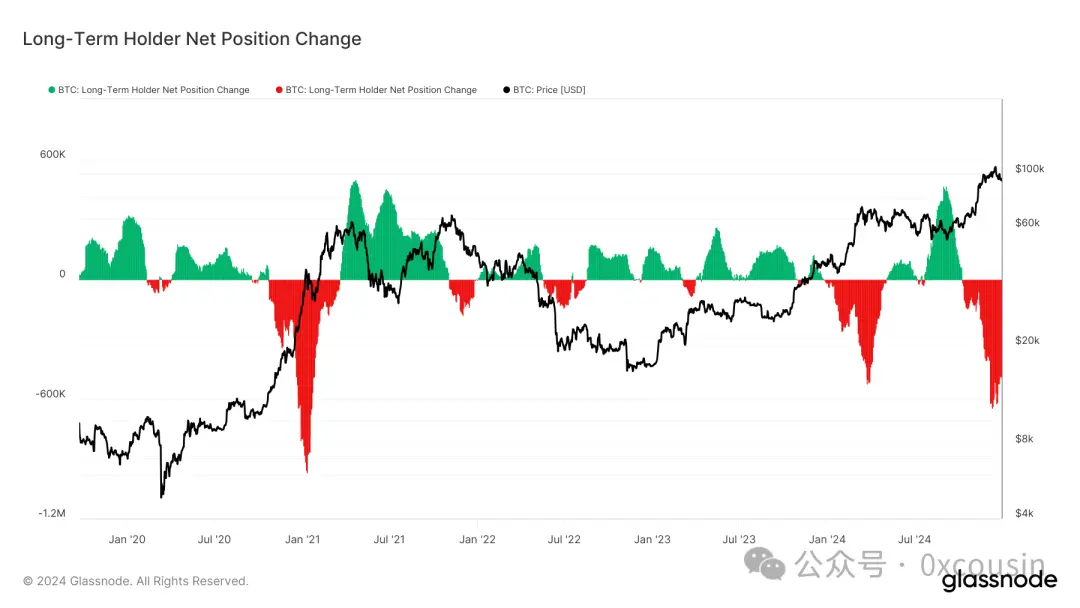

The faith of Long-Term Holders (LTH): Long-Term Holders act as the stabilizing force in the Bitcoin market, forming a strong consensus near the shutdown price of Bitcoin. On-chain data shows that after the previous cycle's winter, the BTC holdings of long-term holders surpassed 14.52 million in Q4 2023, reaching an all-time high. Their "diamond hands" characteristic provides a solid foundation for the market and is the basis for the tightening of circulation.

Data Source: Glassnode

The influx of funds from Bitcoin ETFs: Starting in 2024, traditional giants like BlackRock and Fidelity have launched Bitcoin spot ETFs, which have net bought over $15 billion within three months of listing, accumulating over 596,300 BTC (valued at over $150 billion) to date, fundamentally rewriting the funding structure of the crypto market.

Data Source: Coinglass

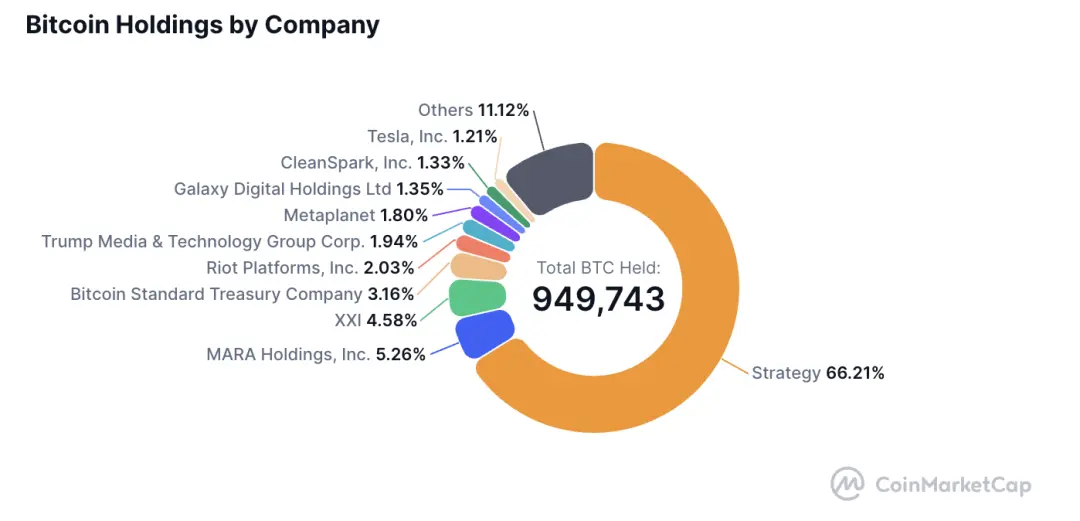

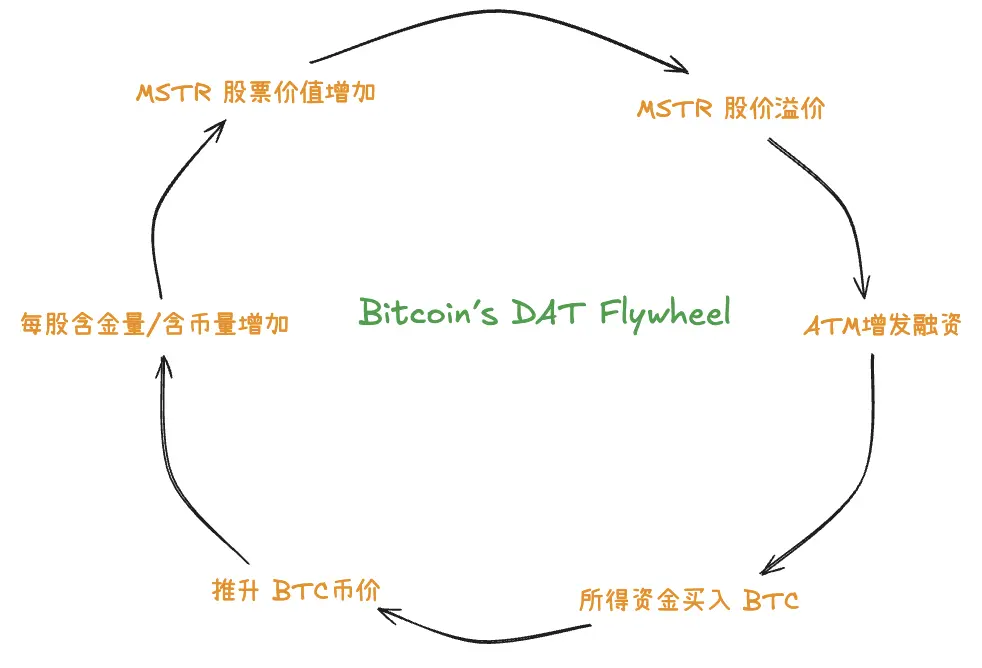

The DAT strategy of listed companies: MicroStrategy has strategically transformed and initiated the Bitcoin Treasury strategy, creating a capital alchemy model driven by stocks, bonds, and cryptocurrencies—raising funds through zero-interest convertible bonds and stock issuance to purchase BTC, which in turn boosts valuation and stock prices, leading to refinancing. The underlying logic of this strategy is: when its market value is at a premium compared to the on-balance-sheet value of crypto assets, it uses financial instruments like private placements, convertible bonds, and preferred stocks to raise funds from the market and purchase more crypto assets, thereby allowing listed companies to accumulate more assets at a lower cost. Through this treasury strategy, MicroStrategy has accumulated over 628,000 BTC, inspiring over 134 listed companies to include BTC in their treasuries, collectively reserving over 949,000 BTC.

Data Source: CoinMarketCap

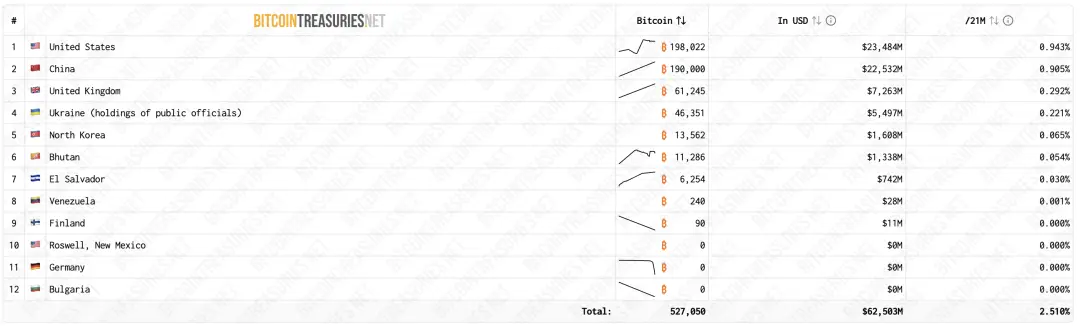

National strategic Bitcoin reserves: In early 2025, after Trump returns to the White House, an executive order will be issued to establish a national-level strategic Bitcoin reserve, promoting the Treasury and state governments to explore a strategic reserve model for BTC, endowing Bitcoin with a new geopolitical dimension of reserve value and injecting unprecedented national narrative imagination into Bitcoin.

Data Source: BitcoinTreasuries

Thus, Bitcoin surged to $120,000, and in the short term, no engines have been seen that could propel Bitcoin to leap again. However, MicroStrategy's treasury strategy has inspired many institutions to apply the DAT strategy to mainstream altcoins, thereby finding new engines for some mainstream altcoins.

II. The Second Half of the Bull Market: The DAT Strategy Becomes a New Engine for Mainstream Altcoins

ETH Rises Due to the DAT Paradigm: The "Treasury Duo" Quietly Emerges

Although the Ethereum ETF was approved in 2024, it did not trigger the expected rise in the ETH/BTC exchange rate, which continued to weaken. It wasn't until April 2025, when the DAT strategy was replicated on ETH, that the ETH market was truly ignited. The leaders in this movement are two treasury companies whose ETH holdings have surpassed those of the Ethereum Foundation: BitMine (BMNR) and Sharplink Gaming (SBET).

Sharplink Gaming (SBET)

On May 27, 2025, SharpLink Gaming announced a $425 million financing round to purchase ETH as the company's primary treasury reserve asset, making SBET the first Ethereum reserve company. Consensys led the investment, with participation from crypto institutions like Pantera Capital, ParaFi Capital, and Galaxy Digital. They also appointed Joseph Lubin as the chairman of the board and as a strategic advisor to assist in the development of the company's core business.

Joseph Rubin joined the Ethereum development team at the end of 2013 when Vitalik released the Ethereum white paper, and he is widely regarded as one of the eight co-founders of Ethereum. In 2015, to promote the application of Ethereum on-chain, Joseph Rubin founded Consensys, which has incubated dozens of well-known sub-projects, including MetaMask and Linea.

Since the start of SharpLink Gaming's ETH treasury strategy, they have continuously increased their ETH holdings, which have now reached 428,200 ETH, making them the first institution to surpass the Ethereum Foundation in terms of holdings.

BitMine (BMNR)

On June 30, 2025, BitMine announced a $250 million fundraising effort to initiate its ETH treasury strategy, with participation from several crypto institutions, including Pantera Capital, Founders Fund, Galaxy Digital, and Kraken. They later received investments from Silicon Valley venture capitalists like Peter Thiel and "Cathie Wood" of Ark Investment.

On the day BitMine launched its ETH treasury strategy, they appointed Tomas Jong Lee as chairman. He is a former chief equity strategist at JPMorgan, who began focusing on the cryptocurrency space in 2017 and frequently makes public predictions about the market, making him a "die-hard bull"… clearly well-suited to lead this strategy. Since taking on the role, Tomas Jong Lee has frequently appeared in mainstream media to interpret investment opportunities in Ethereum.

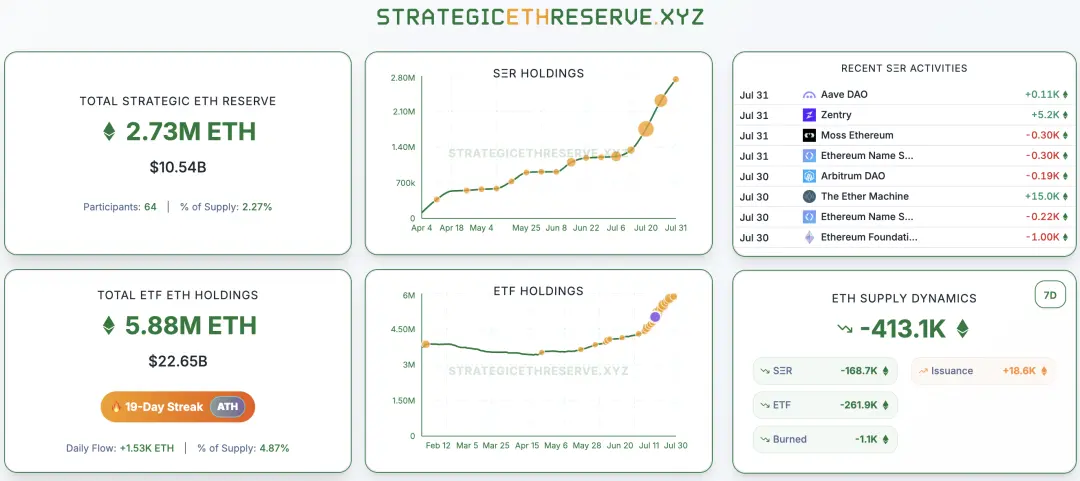

In just one month, BitMine's ETH holdings rapidly expanded to 625,000 ETH, surpassing Sharplink Gaming and the Ethereum Foundation to become the company with the largest ETH holdings.

Data Source: Strategicethreserve

The ETH treasury "duo" not only brings in clear capital inflows but also attracts more companies like The Ether Machine, Bit Digital, BTCS Inc., GameSquare Holdings, and Intchains Group to initiate ETH treasury strategies, simultaneously reversing the downward trend of ETH prices and shaking the Ethereum Foundation's monopoly in terms of community faith, pricing power, and discourse power. It is no exaggeration to say that Tomas Jong Lee and Joseph Rubin are the true decision-makers behind the current ETH price trend.

Projects like SOL, BNB, ENA, and HYPE Follow Suit

The DAT strategy for Ethereum has reversed the downward trend of ETH prices, prompting more institutions to lay out DAT strategies. Projects like SOL, BNB, ENA, and HYPE have successively launched treasury strategies, making the DAT strategy a rising engine for mainstream altcoins.

To date, eight companies have initiated a Strategic SOL Reserve, collectively reserving over 3 million SOL, with Upexi and DeFi Development holding the largest reserves.

DeFi Development Corps (DFDV): In April 2025, Pantera Capital invested in DeFi Development Corps, the first publicly traded company in the U.S. to use SOL as a reserve asset. Most members of DFDV come from senior positions at Kraken, and the CFO has operated Solana validation nodes, giving the team a deep understanding of Solana. To date, DFDV's SOL reserves have reached 999,900 SOL, and its stock price has increased over 20 times in the past six months.

Upexi: Between April and July 2025, Upexi increased its SOL holdings from 73,500 to 1.8 million SOL. Almost all of Upexi's SOL holdings are used for staking, and based on an 8% annualized yield, Upexi expects to generate approximately $26 million in staking rewards annually through its SOL treasury strategy. Upexi primarily increases its SOL reserves through token discount purchases, staking strategies, and issuing equity along with convertible notes.

SOL Strategies Inc. (HODL): This is also one of the first publicly traded companies to announce a phased acquisition of SOL to initiate a strategic reserve plan. In early 2025, they issued $500 million in convertible bonds to establish an SOL treasury and participate in the operation of validation nodes. To date, SOL Strategies holds approximately 260,000 SOL, most of which are used for institutional validation node staking, with a mixed yield between 6% and 8%.

Additionally, projects like BNB, ENA, and HYPE have also seen institutions launch corresponding DAT strategies for their tokens. For example, BNB has CEA Industries Inc (VAPE) with investment from YZi Labs; Hyperliquid has Sonnet Bio Therapeutics (SONN) funded by Paradigm; and Ethena has StablecoinX established under the leadership of the Ethena Foundation.

III. Analysis of the Two Paradigm Models of DAT

Bitcoin Paradigm: "Digital Gold" as an Inflation Hedge + Premium Leverage

MicroStrategy utilizes a "triple flywheel" (stock-coin resonance flywheel, stock-bond synergy flywheel, coin-bond arbitrage flywheel) to execute its Bitcoin reserve strategy, capturing three types of capital through a tiered sales strategy (preferred stock locking in fixed-income investors, convertible bonds attracting arbitrage funds, and stocks bearing risk speculation).

Illustration: IOBC Capital

MicroStrategy is currently the only company that has operated a DAT strategy for over one cycle (4 years) and achieved a spiral rise in stock and coin value.

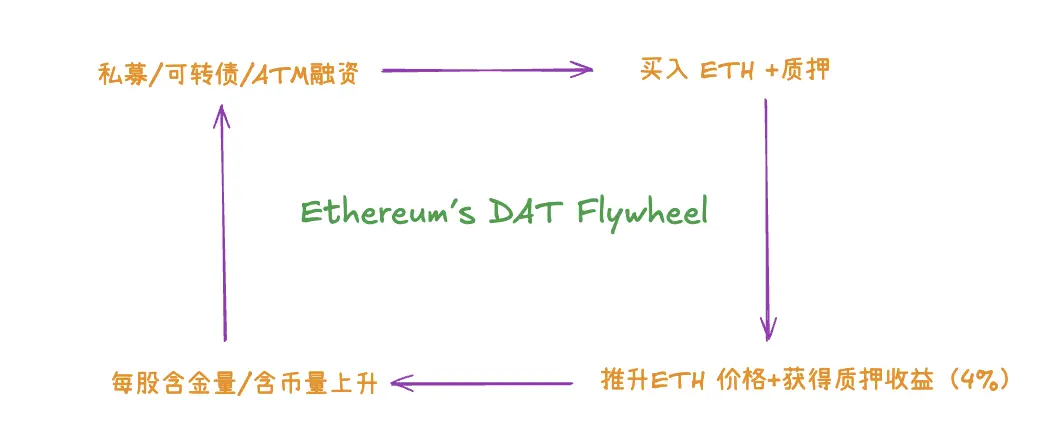

Ethereum Paradigm: "Digital Treasury Bonds" as a Yield Anchor

Unlike MicroStrategy, the ETH treasury duo has only recently transitioned to the "ETH treasury strategy," and they are supported by investment institutions heavily invested in Ethereum.

Illustration: IOBC Capital

Unlike Bitcoin, Ethereum operates on a PoS mechanism, allowing ETH to be staked and generate stable on-chain yields. Therefore, ETH is positioned similarly to "digital treasury bonds," with an annual yield of about 4%. This is also an advantage for listed companies reserving ETH—they can obtain relatively stable staking income, which allows them to enjoy asset appreciation from rising ETH prices while also securing stable cash flow from staking.

Solana's DAT strategy is similar to Ethereum's, as it can also generate staking income, and its annual yield of 6%-8% is higher than that of ETH. Coupled with the expectation of SOL spot ETFs being approved and launched in the second half of the year, SOL's market performance is also worth looking forward to.

IV. Strategic Significance and Reflexivity Risks of DAT

The reason DAT has become a new engine for mainstream altcoins is primarily due to its successful deep integration of corporate financial strategies with on-chain assets for listed companies, effectively adding new assets to their balance sheets. For crypto asset projects, it not only provides a solid buying power foundation for the crypto market but also attracts more traditional capital and long-term investors' attention. When MicroStrategy's financial reports start discussing "per share crypto content," when BitMine's ETH staking yields become the focus of quarterly calls, and when SOL Strategies Inc.'s earnings call sees investors focusing on institutional validation node staking yields… the crypto industry will enter a new era.

Caution is needed regarding the "castle in the air" type of DAT strategy. We have observed that, apart from MicroStrategy's "triple flywheel" financing path, most mainstream altcoin DAT strategies initially derive their funds from the project foundation itself, major token investors, or core ecological nodes. For example, the 10 million HYPE tokens of SONN are directly injected by Paradigm's holdings of HYPE tokens, and StablecoinX's ENA can be directly injected by PIPE round investors using their own ENA tokens… these are essentially not new real buying power. The projects listed in this article still have more or less real buying power cases of DAT strategies, while some projects not mentioned in the article have DAT strategies that essentially belong to "stepping on the left foot with the right foot."

Caution is also needed regarding the reflexivity of DAT strategies during a Minsky moment. DAT strategies are highly dependent on the feedback mechanism of capital markets, forming a tight feedback loop between coin prices, stock market capitalization, and refinancing capabilities. When this loop operates positively, both coin prices and stock market capitalization grow, and the company's refinancing capability is strong; however, if this loop operates negatively, it may trigger a chain reaction: falling coin prices → shrinking per-share value → contraction of stock market capitalization premium → declining refinancing capability → forced sell-offs → further price declines → other DAT strategy companies also forced to sell off → leading to a stampede.

V. Conclusion

The emergence of digital asset reserve strategies may signify that the outcome of this bull market no longer solely depends on who has the most technological innovation or application innovation; financial configurability is also very important. Market funds may cluster around a few cryptocurrencies suitable for inclusion in balance sheets, exhibiting a "the strong get stronger" phenomenon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。