Meme coins are sweeping the crypto world, with a hundredfold wealth creation effect continuously validating their status as the strongest market narrative today. By the end of July 2025, the total market capitalization of the Meme sector surpassed the historical peak of $84 billion, and the growth curve remains steep.

However, the prosperity hides cracks: CoinMarketCap's Q2 2025 data shows that the coverage of Meme coin derivatives is less than 3%, creating a stark contrast with the 92% derivative penetration rate of the top 100 mainstream coins by market capitalization.

How can the high volatility of Meme coins be transformed into an Alpha engine for ordinary retail investors through derivatives? Superp provides the answer.

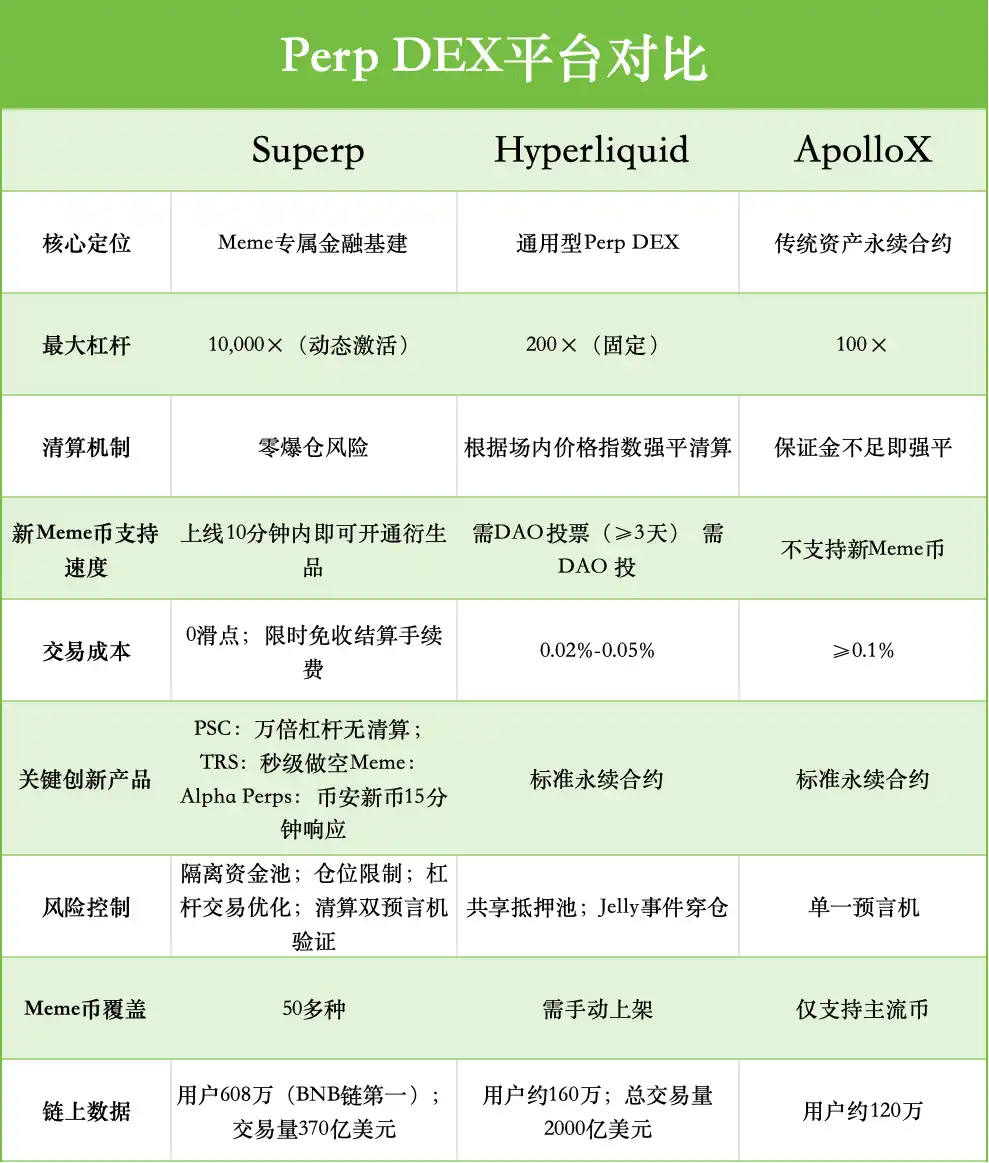

As the leading Perp DEX project on BSC, Superp supports leverage of up to 10,000 times and offers a "never liquidate" experience, completely changing users' perceptions of Meme derivatives trading, earning it the title of "Meme version of Hyperliquid."

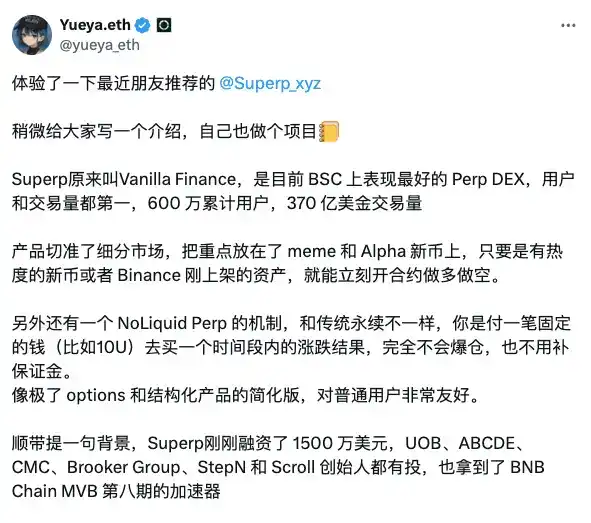

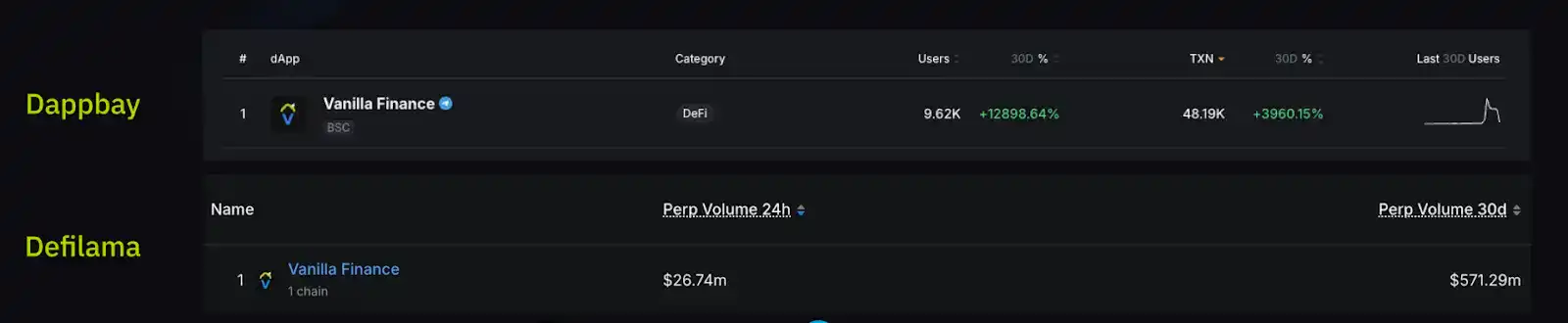

Currently, Superp has accumulated over 6 million real users, with a total trading volume of $37.07 billion. According to platform DappBay and DeFiLlama, Superp ranks first in both active user count and transaction volume on the BSC chain, demonstrating a clear competitive advantage. On August 5, Superp's token SUP will officially launch on Binance Alpha and several top-tier exchanges.

As on-chain derivatives inject Meme frenzy, volatility is tamed into a programmable yield engine, Superp, as a new platform, may be quietly creating a new paradigm.

1. Market Pain Points: Why do Meme Players urgently need Superp?

The demand for derivatives in the Meme market is extremely strong. Some popular projects see intense short-selling sentiment but lack effective short-selling mechanisms.

For example, in the past few months, Binance Alpha has frequently launched various new Meme projects, which generally began to decline after their launch. However, the market lacks derivative trading for new coins, making it nearly impossible for users to establish short positions early on and secure certain market gains. This not only limits the diversity of trading strategies but also affects the overall efficiency of the market.

Why is there a gap in the Meme derivatives market on traditional trading platforms?

From the platform's perspective, the extreme volatility of Meme coins deters most exchanges. Popular Meme projects often experience daily fluctuations exceeding 100%, with hourly price changes frequently surpassing 50%. This volatility also renders traditional derivative risk control models ineffective, leading most mainstream exchanges to either completely refrain from offering contract trading for Meme coins or only provide products with extremely low leverage, a form of "leverage discrimination" that directly deprives users of the right to obtain excess returns.

From the users' perspective, the "point liquidation" curse also limits trading enthusiasm. Under traditional contract risk control mechanisms, users often face liquidation due to abnormal price spikes as soon as the price of a Meme coin begins to move, or they may miss out on major market movements due to forced liquidation when profits are too high. This phenomenon of "premature liquidation" and "forced liquidation" has become the biggest pain point for Meme traders.

These pain points have created a demand for certainty: how to achieve risk control and a leap in capital efficiency without sacrificing the high return potential of Meme coins?

To address the above issues, Superp has built a solution based on three major technological pillars: NoLiquidation Perp (PSC) allows users to enjoy up to 10,000 times leverage without ever facing liquidation, Meme Perps (TRS) enables instant short-selling after the launch of Meme projects, and Alpha Perp provides specialized derivative solutions for high-quality projects listed on Binance.

Of course, to excel in crypto derivatives trading, one must deeply cultivate this field over the long term, accumulating professional knowledge and practical experience while understanding the unique patterns of the crypto market. The core team members of Superp come from top exchanges, including seasoned experts who have worked at platforms like Huobi and HashKey, boasting over 7 years of experience in CEX and DEX operations.

Starting from the second quarter of 2023, Superp has been meticulously developed over three years and has finally been officially launched. During this period, the project was selected for the 8th phase of the BNB Chain MVB Accelerator Program and received incubation support from CoinMarketCap, accumulating over $15 million in top-tier institutional financing, with leading investors including UOB Venture, ABCDE Capital, Paper Ventures, Brooker Group, and angel investors from projects like Scroll, Step'N, and XAI.

Such a background and strength provide a solid foundation for Superp to become the "Meme version of Hyperliquid."

2. Superp's Triangular Barriers Build a Moat

Superp is a decentralized derivatives protocol built on the BNB Chain, implementing the "Meme Hyperliquid" concept through three core modules, expanding the application scenario boundaries of decentralized derivatives.

NoLiquidation Perp (PSC): 10,000 Times Leverage, Never Liquidate

NoLiquidation Perp is an innovative product under Superp, whose timed settlement mechanism completely decouples the proportional relationship between leverage and risk, breaking the traditional notion that "high leverage necessarily means high risk." Users can enjoy trading with leverage up to 10,000 times without worrying about liquidation risks.

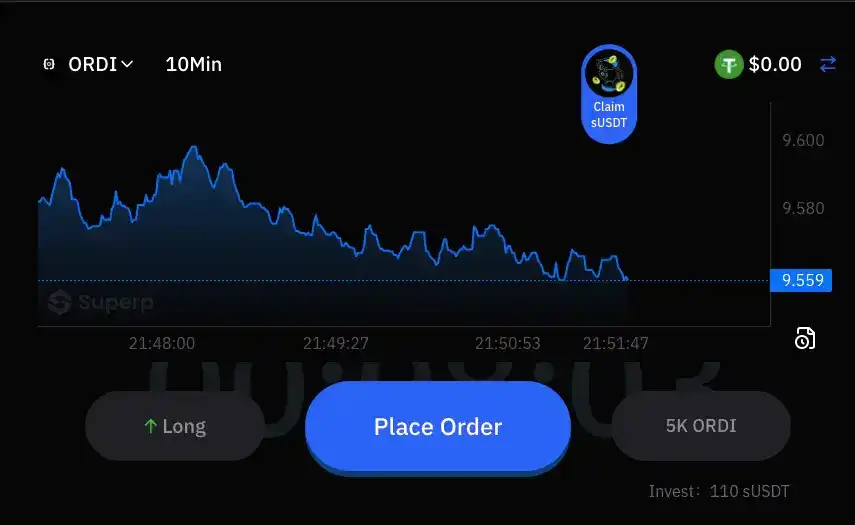

Specifically, users can freely choose the expiration time of the contract, including options like 10 minutes, 1 hour, 24 hours, and 48 hours. It should be noted that the current version only offers a 10-minute expiration option to optimize user experience, allowing users to quickly seize market opportunities, but this is sufficient for users to experience the core advantages of the product.

Let’s understand this mechanism through a specific example: Suppose user Justin Sun is optimistic about ORDI's short-term trend and decides to open a long position when the price is $9.559, with a position size of 5,000 and an investment of 110 USDT, resulting in an actual leverage of 434 times. Within 10 minutes, ORDI rises by 10% to $10.5, yielding a net profit of (10.505-9.559)*5000-110 = $4,620, with a return rate of 42 times. Even if ORDI's price drops by 5% within the 10-minute period, Justin Sun will not face forced liquidation; however, in traditional perpetual contracts, if ORDI's price drops by more than 0.2%, he would be liquidated, regardless of any subsequent price increase. Of course, within this 10-minute validity period, he can also close his position early to lock in profits.

Through the above example, the core advantages of the NoLiquidation Perp mechanism are:

- No liquidation risk: Users will never be forcibly liquidated due to price fluctuations.

- High capital efficiency: Up to 10,000 times leverage makes it possible for small capital to leverage large returns.

- No slippage impact: The timed settlement mechanism avoids the slippage issues of traditional AMMs, improving pricing transparency and ensuring users can execute trades at precise predetermined prices without being affected by market liquidity fluctuations.

- No trading fees: The platform does not charge any additional fees, ensuring users only pay the fixed costs of the product without any hidden or extra fees, simplifying the trading process and reducing costs.

Currently, NoLiquidation Perp supports trading for 40 mainstream coins, covering major coins like ETC, LTC, BCH, as well as popular blue-chip Meme coins like BONK, SATS, PEOPLE, and RATS. The platform's settlement fee is set at 10% of profits, but at this stage, Superp is waiving settlement fees for a limited time, with future fee standards to be dynamically adjusted based on market conditions.

Meme Perp (TRS): Extreme Short-Selling, Capturing Every Alpha Opportunity

Meme Perps (TRS) has achieved an industry-first function: supporting short-selling transactions within 10 minutes after the launch of Meme coin projects, providing users with great strategic flexibility.

In the traditional Meme coin ecosystem, users often can only buy in the spot market after a project is launched, and even if they suspect issues with the project or that the price is overvalued, they cannot establish short positions in time for hedging. The emergence of Meme Perp fills this gap, allowing professional traders to implement complete trading strategies right at the launch of the project.

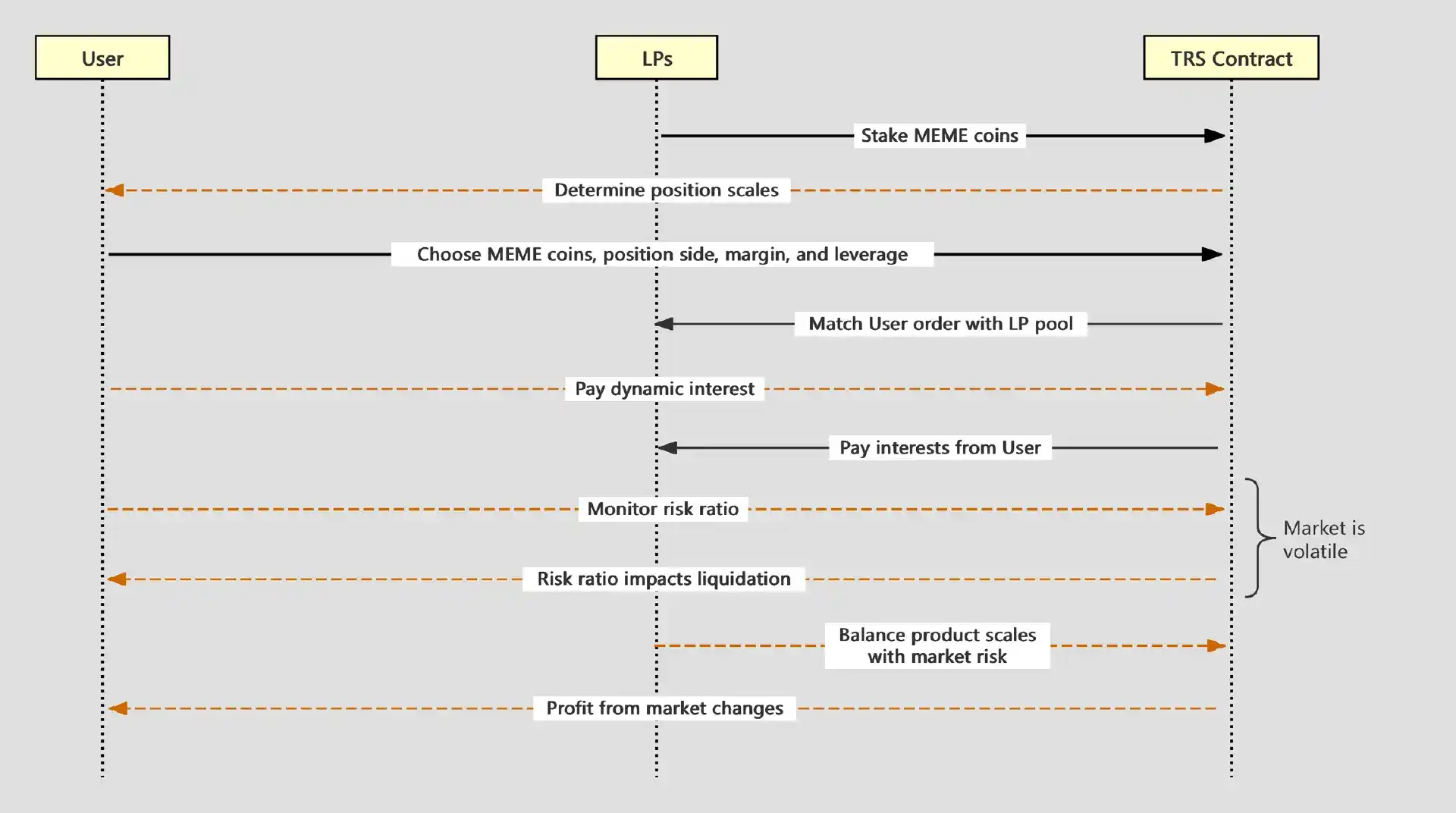

In terms of specific implementation, similar to Hyperliquid, Superp's Meme Perp also requires users to stake Meme tokens to provide liquidity (i.e., become LPs). Users stake their assets into the TRS liquidity pool and earn returns from the fees generated by leveraged traders—if leveraged users are liquidated and still have remaining funds, those will be transferred to the staking pool as earnings for stakers. Once users provide liquidity by staking, other traders only need to pay a dynamic interest rate to borrow assets from the TRS liquidity pool to open long or short positions.

In March of this year, a whale exploited a liquidity loophole to manipulate the price of the JELLY token through self-trading, causing the Hyperliquid platform's market-making treasury HLP to near zero, ultimately forcing a manual price freeze and user compensation. This centralized intervention saved a decentralized failure, exposing structural flaws in the industry.

Superp has learned from the risks that Hyperliquid LP faced due to past incidents leading to losses and has made several key improvements:

First is the position limit mechanism. Superp has strictly limited the maximum position size for individual users to prevent extreme operations by whale users from causing systemic risks to the entire pool. Additionally, the platform has implemented a dynamic position adjustment mechanism that adjusts the maximum allowable position size in real-time based on market volatility.

Next is the optimization of leveraged trading. Unlike the high-risk characteristics of pure index derivatives, Superp adopts a more conservative and stable leveraged trading model, offering a maximum leverage of 10 times, with specific multiples dynamically adjusted based on the volatility of the underlying asset. Through precise risk control algorithms, it ensures system stability while providing high leverage.

In simple terms, the biggest advantage of leveraged trading is that each position is a real buy or sell, rather than purely relying on index derivatives. This also makes the price more reflective of actual spot performance, avoiding situations where contract trading sometimes sees inverted prices between spot and derivatives.

Additionally, there is a more comprehensive liquidation design, utilizing an automatic liquidation system to protect lenders and maintain protocol stability. Furthermore, it combines smart contracts to verify liquidation conditions in real-time; if conditions are not met (for example, due to abnormal market fluctuations or oracle delays), liquidation will automatically stop to prevent unfair liquidations. This mechanism ensures that traders do not suffer from unfair or excessive liquidations during market volatility. In simple terms, if a whale attempts to manipulate prices, causing a significant deviation between the platform price and the spot price in other markets, it will not lead to user positions being liquidated, thus also ensuring the safety of LP assets on the Superp platform and avoiding a repeat of the Hyperliquid tragedy.

According to the official plan, the initial token selection for Superp Meme Perp is primarily based on the market popularity and liquidity of the projects; in the future, users will be allowed to spontaneously create liquidity pools for any project and launch trading pairs.

Alpha Perp: Specialized Derivative Solutions for Quality Projects

Alpha Perp is designed specifically for Alpha tokens listed on Binance, and only the most promising assets can be selected. These tokens typically have better fundamentals and more stable liquidity, providing professional investors with a relatively low-risk, high-efficiency trading environment.

Compared to Meme Perp, the core logic of Alpha Perp is roughly the same, but the latter introduces stricter risk controls, more precise asset selection, and a more comprehensive incentive mechanism. Each listed Meme token has different LTV ratios, interest caps, and liquidation tolerances. Specific comparisons can be referenced in the table below:

"Our goal is to provide a safer and more robust environment for Meme coin speculation while maintaining the fun and viral nature of the Meme coin ecosystem," the official documentation states.

Through the organic combination of three major products, Superp has built a complete trading ecosystem for Meme coin derivatives. Whether retail investors seeking extreme leverage experiences or professional traders requiring precise risk control, they can find suitable products and strategies on the Superp platform. This is precisely the concept that Superp aims to convey: not only to provide an extreme trading experience but also to ensure that this experience is safe and sustainable.

3. Ecological Explosion Engine: Token Economics and Growth Flywheel

The quality of token economics design often determines a project's long-term development potential. Superp demonstrates deep strategic thinking in the design of the SUP token, particularly in the innovative design of airdrop distribution and liquidity management, building a sustainable growth flywheel for the project.

Carefully Designed Token Distribution Mechanism

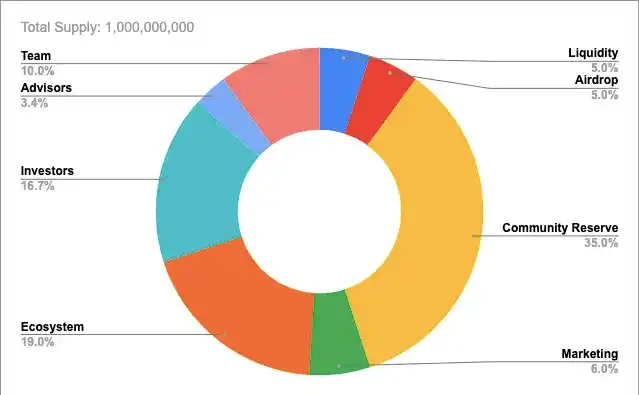

The total supply of SUP tokens is set at 1 billion, and the distribution plan reflects the team's emphasis on community building and long-term development. The specific distribution ratio is: team 10%, advisors 3.4%, liquidity 5%, airdrop 5%, investors 16.7%, community treasury 35%, market 6%, ecosystem 19%.

The highlight of this distribution plan is its tilt towards the community. The community treasury occupies the largest share at 35%, and these tokens will be used to incentivize community building, ecological development, and user growth; combined with the 5% direct airdrop distribution, the proportion of community-related tokens reaches 40%, which is quite generous among current DeFi projects.

Particularly noteworthy is the 5% airdrop distribution. Although this percentage may seem low, considering Superp's positioning as "Meme Hyperliquid" and its enormous market potential, this 5% airdrop could generate significant wealth effects. Referring to Hyperliquid's airdrop performance, early users received an average airdrop value exceeding $30,000, and Superp's advantages in product innovation and market positioning are expected to bring even greater airdrop value.

Strategic Considerations for TGE Design

During the Token Generation Event (TGE), Superp chose a relatively conservative liquidity release strategy. The initial circulating supply accounts for only 17.5% of the total supply, specifically including: 5% liquidity, 2% airdrop, 2% marketing, and 8.5% ecosystem development. This means that over 80% of the tokens are locked during the TGE, and this design has multiple strategic values.

First, a low initial circulating supply helps reduce selling pressure at the opening, providing better support for the token price. In the current market environment, many projects have faced severe price declines after launch due to excessive initial circulating supply, and Superp's design effectively avoids this risk.

Second, the lock-up design for most tokens reflects the team's confidence in the project's long-term development. The lock-up period for team and investor tokens typically lasts several years, and this "shared fate with the project" design enhances market confidence in the project's long-term value.

Finally, a gradual token release strategy helps maintain the token's scarcity, creating better value protection for long-term holders.

Pre-TGE Activities: Innovative Practice of Zero-Risk Trading Competition

To allow more users to experience Superp's innovative products and gain airdrop opportunities, the platform launched the Pre-TGE zero-risk trading competition. This event is expected to officially start at 10:00 UTC on July 30, serving as an important preheating before the TGE.

The core highlight of the event is that each user can receive 1,000 USDT in test funds—after connecting their wallet, they can link to Twitter to claim test tokens for experiencing the NoLiquidation Perp product. It is important to emphasize that users' trading during the event will not incur real financial losses, eliminating the psychological barriers for new users trying high-leverage products. New users can deeply experience Superp's product features in a zero-risk environment.

The reward mechanism for the event is based on users' profit rankings, with outstanding performers receiving more airdrop rewards during the TGE. This design not only effectively filters the platform's core users but also provides substantial incentives for these users, allowing experienced traders to showcase their trading skills for more airdrop allocations.

From community feedback, this zero-risk trading competition model has been widely welcomed, with many leading crypto KOLs actively sharing and interacting.

4. Future Development Prospects of Superp: Competitive Edge and Data Endorsement

As the leading Perp DEX on the BNB chain, Superp has demonstrated remarkable development momentum in a short period. By comparing and analyzing the development trajectories and valuation levels of similar projects, we can gain a clearer understanding of Superp's market position and future potential.

Data Performance: Strong Growth Momentum

Although Superp is still in the early stages of development, the existing data performance shows that the project exhibits strong growth momentum.

In the third quarter of 2023, Superp's predecessor, Vanilla Finance, officially launched in South Korea, with trading volume quickly exceeding $3 billion; in the second quarter of 2024, within 30 days of launching on Scroll and Bitlayer, trading volume reached $1 billion, and on-chain users reached 70,000; in the fourth quarter of 2024, within 30 days of launching on Telegram, trading volume reached $10 billion, and the user count reached 3 million.

Currently, Superp has accumulated over 6 million real users, with a total trading volume of $37.07 billion. According to platform DappBay and DeFiLlama, Superp ranks first in both active user count and transaction volume on the BSC chain, demonstrating a clear competitive advantage. Notably, after the launch of the Pre-TGE trading competition, user registrations have also seen significant growth, with daily new user numbers hitting record highs.

In terms of security, Superp's smart contracts have been audited by several well-known security audit firms, and the code security and system stability have been fully verified. The platform's response speed and transaction execution efficiency have also reached industry-leading levels, providing users with a smooth trading experience.

In terms of partnerships, Superp has established strategic collaborations with several leading projects, including mainstream DeFi protocols, data service providers, and wallet service providers. These partnerships provide important support for Superp's ecological construction and user growth.

Competitive Comparison: Clear Differentiated Advantages

In the field of on-chain derivatives trading, Hyperliquid is undoubtedly the current benchmark project. Since its launch in 2023, Hyperliquid has accumulated a trading volume exceeding $200 billion, and its token HYPE reached a market cap peak of nearly $20 billion. However, Superp has multiple dimensions of differentiated advantages compared to Hyperliquid.

First is product innovation. Hyperliquid primarily focuses on traditional perpetual contract trading, while Superp's NoLiquidation Perp achieves true "never liquidation," which is a groundbreaking innovation in both technical implementation and user experience. In particular, the combination of ten-thousand-fold leverage with zero liquidation risk provides an unprecedented trading experience for high-risk tolerant traders.

Next is the difference in market positioning. Hyperliquid focuses more on professional traders and institutional users, while Superp, through its differentiated positioning as "Meme Hyperliquid," better aligns with the current market's enormous demand for Meme coin trading. Considering the explosive growth of the Meme sector over the past two years, this differentiated positioning is expected to bring Superp a larger user base and market space.

From a valuation perspective, referencing the market performance of similar projects, Superp has significant upside potential. Taking Hyperliquid as an example, it achieved a valuation of billions of dollars without a formal token, and after the token release, it created a market cap peak of nearly $20 billion.

Given Superp's advantages in product innovation, market positioning, and ecological construction, as well as the rapid development trend of the BNB chain ecosystem, the project's theoretical valuation ceiling is quite considerable. Especially with the continued prosperity of the Meme coin market and the growing demand for on-chain derivatives trading, the "Meme Hyperliquid" positioning is expected to bring Superp excess market premiums.

Future Roadmap: Ecological Expansion and Function Improvement

According to the development roadmap released by Superp, the project will achieve several important milestones in the coming quarters.

In the short term, the platform will complete support for more mainstream cryptocurrencies, adding more trading pairs for NoLiquidation Perp, Meme Perp, and Alpha Perp, covering more popular Meme coins, RWA assets, and AI tokens. Additionally, Superp will integrate Solana and upgrade its recommendation system to provide a smoother experience and more generous referral commissions.

In the medium term, Superp plans to launch more innovative trading products, including the first leveraged crypto stock product, supporting long and short positions on RWA assets like xStocks and Robinhood; and launching standard perpetual products to create the most comprehensive perpetual contract platform across the chain. The launch of these products will further consolidate Superp's leadership position in the on-chain derivatives trading field.

In the future, Superp will also initiate liquidity mining activities, where market makers and liquidity providers will receive SUP rewards based on their contributions to trading depth and volume; implement DAO governance, and release token burn or buyback plans.

Conclusion: Restructuring the Meme Trading Paradigm

Superp, as the "Meme version of Hyperliquid," completely reshapes the on-chain Meme derivatives trading paradigm through three major innovative products. With its unique risk control model and on-chain infrastructure, Superp not only addresses the derivatives gap caused by the extreme volatility of Meme coins in traditional exchanges but also transforms risk into an Alpha engine. As the leading Perp DEX on the BNB chain, Superp is expected to establish a dominant position in the $84 billion Meme sector, ushering in a new era of on-chain derivatives.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。