Recently, several Alpha projects on Binance have skyrocketed, and I suddenly realized that this might be a very good opportunity to buy coins. So, I delved deeper into the research.

For a while, blindly shorting new projects after their launch seemed to be a highly probable correct choice. However, the situation has clearly changed recently. For example, the recently launched Dark and MM experienced a brief decline before rising steadily.

I compiled the data for Alpha in July, and Binance's Alpha launched a total of 46 projects in July, with 8 directly launched and 38 through IDO or Airdrop. It is evident that Alpha has shifted from direct launches to IDO or Airdrop methods.

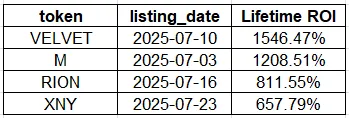

Among the 38 projects, 4 had an increase of over 5 times, accounting for 10.8%, with the highest increase being VELVET, which yielded 15 times the return. If calculated from the lowest point, 7 projects had an increase of over 5 times, making up 20%.

- Finding Potential Quality Projects in Alpha

The purpose of user investment is to make money, and this is true in both the cryptocurrency and stock markets. One of the fundamental methods of making money is discovering potential quality projects.

Starting from 2024, the entire market has lost confidence in project tokens. The FDV of projects launched on Binance's main board is too high, exhausting future growth potential, and completely lacking the characteristics of potential targets. Therefore, many people, including myself, have not paid much attention to project tokens in the past six months, focusing entirely on pure chains.

There are often big players in the chain, but they are also accompanied by a lot of conspiracy schemes. This has created many myths of sudden wealth while attracting various characters. Here, one needs to react quickly, have a discerning eye, and also be prepared for the worst-case scenario of being harvested. From the results, purely meme-based projects on the chain have a greater probability of succeeding.

Now, I suddenly realize that Binance's Alpha has become a second holy land for discovering potential projects, much like Binance's main board in its early years. Most of the projects in Alpha are from the project parties, and the FDV at TGE is not high. Unlike pure chains, Alpha has an average frequency of one project per day, and the number of projects researched is far lower than on the chain.

It should be noted that Binance Alpha is also on-chain trading, which is open and transparent. The reason I use the term "pure chain" is that there is currently no universally recognized term for the on-chain projects, meme coins, and project parties that are commonly played.

- Three Major Advantages of Alpha Projects

1) The projects in Alpha have undergone some research by Binance, ensuring a certain level of quality and are supervised by Binance. In fact, most users still recognize "Binance's selection." So far, the proportion of projects that have run away after launch is extremely low. Therefore, the amount of investment is also larger, and the overall returns are not small.

In the general mindset of current users, the ranking of launches is approximately as follows: Binance Main Board > Upbit/Coinbase > Binance Alpha > OKX.

Thus, users tend to think that projects launched on Alpha are better than those on OKX.

2) Projects launched on Alpha receive just the right amount of exposure. The key word here is "just right," because if the notoriety is too high before launch, it can easily lead to a peak at launch, resulting in immediate harvesting. However, insufficient publicity is also not good, as even excellent projects can fail due to lack of awareness. Currently, Binance officially provides a certain level of exposure and attention to Alpha, but it is not excessive. Although project parties may not like this, it is very nice for us retail investors.

3) Potential for future contract and spot listings. Alpha projects are more likely to be listed for contracts and even spot trading, which is well known. Listing for contracts and spot trading means there is a higher market cap potential, which everyone understands. This is something that projects in other places cannot compare to. In actual data, among the projects launched in July, 14 were listed for Binance contracts, accounting for 37%. Among them, 3 were listed on the Binance Main Board. In July, the Binance Main Board launched a total of 4 spot trading projects, with 1 being from June's Alpha.

As I write this article, I find myself experiencing FOMO. In short, I need to pay more attention to Binance Alpha in the future, as there should be many wealth codes emerging from it. I will also keep an eye on it and write some reports in a timely manner.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。