Paul Atkins Leads SEC Project Crypto to Overhaul U.S. Crypto Laws

The U.S. Securities and Exchange Commission is taking a bold new step with the launch of SEC Project Crypto. It is an initiative aimed at updating outdated financial rules that no longer fit today’s digital markets.

Announced by SEC Chair Paul Atkins at the America First Policy Institute in Washington D.C. on July 31, the project is expected to change how cryptocurrencies and tokenized assets are regulated in the U.S.

Source: X (Previously Twitter)

Source: X (Previously Twitter)

Atkins explained that many current financial rules were created decades ago for old-school industries like manufacturing.

These rules, he said, don’t work well for digital currency platforms or blockchain-based products.

With SEC Project Crypto, there is a hope that the commission may rewrite or eliminate old policies and create space in favour of new innovations of tokenized real world assets (RWAs) and decentralized finance (DeFi).

Making Rules That Fit Today’s Technology

SEC Project Crypto is not just a small update, it's a full reset.

For the first time, the SEC is designing legal frameworks that speak directly to blockchain-based finance.

This includes:

-

Giving clear definitions for digital assets.

-

Allowing super-apps to operate under one federal license

-

Building safe zones for projects in DeFi, staking, and airdrops.

This SEC Project Crypto is a fresh set of rules could finally give legal clarity to many digital currency projects that have been stuck in limbo.

That kind of certainty could attract more institutional investors, boost liquidity, and give new energy to the U.S.-based crypto innovation.

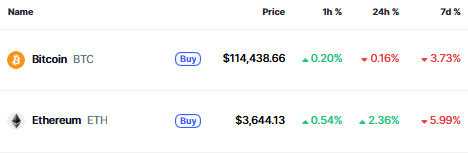

The cryptocurrency market cap stands at $3.74 Trillion with an increase of 0.40%. Currently Bitcoin price is at $114,438 with a decrease of 0.16%, while Ethereum is trading at $3644 with an increase of 2.36% within the last 24 hours.

Source: CoinMarketCap

Helping Super-Apps and Tokenized Assets Grow

One of the big winners from SEC Project Crypto could be:

The rise of “super-apps” platforms that offer trading, lending, payments, and cryptocurrency services all in one place.

-

Instead of applying for different licenses in different states, these apps could soon run legally under one national framework.

-

That’s a game-changer for companies looking to grow fast and serve customers across the country.

-

The same goes for tokenized real-world assets. From real estate to the US Treasury bonds, these blockchain-backed assets can finally gain clear approval and protection under U.S. law.

Experts are of the opinion that this will push more institutions to enter the digital assets industry and assist in getting more money and trust into the ecosystem.

A New, Open Attitude from the SEC

Paul Atkins stressed that the SEC needs to stay flexible and open-minded about the future of finance.

“We don’t know yet what the final shape of finance will look like,” he said. “So our job is to avoid becoming a roadblock.”

That means:

-

Inviting ideas from the public, working closely with the cryptocurrrency industry.

-

Being willing to adjust the rules as needed.

-

A new team of the task force within the commission will gather feedback and conduct open forums

-

Study global practices which are the best to redefine the future rulebook.

Could the U.S. Lead the Global Crypto Race?

With SEC Project Crypto , America is aiming high. If the reforms go through, we could see 24/7 trading markets, stronger investor protections, and a flood of global capital flowing into U.S.-based projects.

This could make the U.S. the top destination for digital currency innovation, something the country has been at risk of losing.

For now, the industry is watching closely. Many believe that with the right support, the U.S. can turn blockchain dreams into reality and SEC Project Crypto might be the roadmap to get there.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。