The development of cryptocurrency OTC platforms has seen two explosive points: the approval of Bitcoin and Ethereum ETFs in 2024, and the gradual introduction of frameworks (MiCA, VARA) in regions like the EU and Dubai, allowing for large-scale legal operations of over-the-counter trading. Institutions need to quickly acquire underlying assets. In 2025, following former U.S. President Trump's proposal of the concept of a "cryptocurrency capital," the overall trend in traditional finance made a 360-degree turn. After the introduction of various new cryptocurrency policies, Bitcoin reached new highs and Ethereum surged strongly in early 2025, leading to an explosive growth in OTC platform trading driven by institutional asset allocation.

Generally speaking, OTC trading matches buyers and sellers directly. They provide a single quote, so there is no slippage or bidding, and transfers are completed through custodial wallets and institutional accounts. Because orders never touch the public limit book, the market never sees your hand. As a "dark pool" of the cryptocurrency market, OTC institutions do not publicly disclose the specific trading details of their users, but unlike traditional finance, we can usually find clues from on-chain data.

In July 2025, one of the largest Bitcoin OTC trades to date occurred, with 80,000 BTC changing hands for about $9 billion, yet the public market remained almost unaffected. The orchestrator behind this was Galaxy Digital, the most favored "crypto OTC institution" on Wall Street today, which also raised its Q2 revenue forecast by 268 times year-on-year.

What role did OTC platforms play in this wave of compliance? How did Galaxy Digital leverage its resources to maneuver in coin-stock trading? Rhythm BlockBeats conducted a series of studies on this topic.

The Third Major Liquidity Pillar in Crypto

With this wave of institutional enthusiasm, OTC platforms have clearly become the "third major liquidity pillar" in the crypto market, following centralized exchanges (CEX) and decentralized exchanges (DEX). For large funds, CEX/DEX struggle to directly accommodate buy orders in the hundreds of millions without causing severe volatility, so OTC platforms play the role of "white gloves" for institutions, completing their positions or liquidations behind the scenes.

Throughout 2024, no month saw OTC trading volumes fall below the same period last year, indicating that market participants are increasingly inclined to trade through private channels rather than betting openly in the market. The crypto industry has gradually transformed from a fringe speculation to an acceptable asset allocation option in their eyes, with Wall Street shifting from skeptics to participants. This growth further accelerated exponentially in 2025.

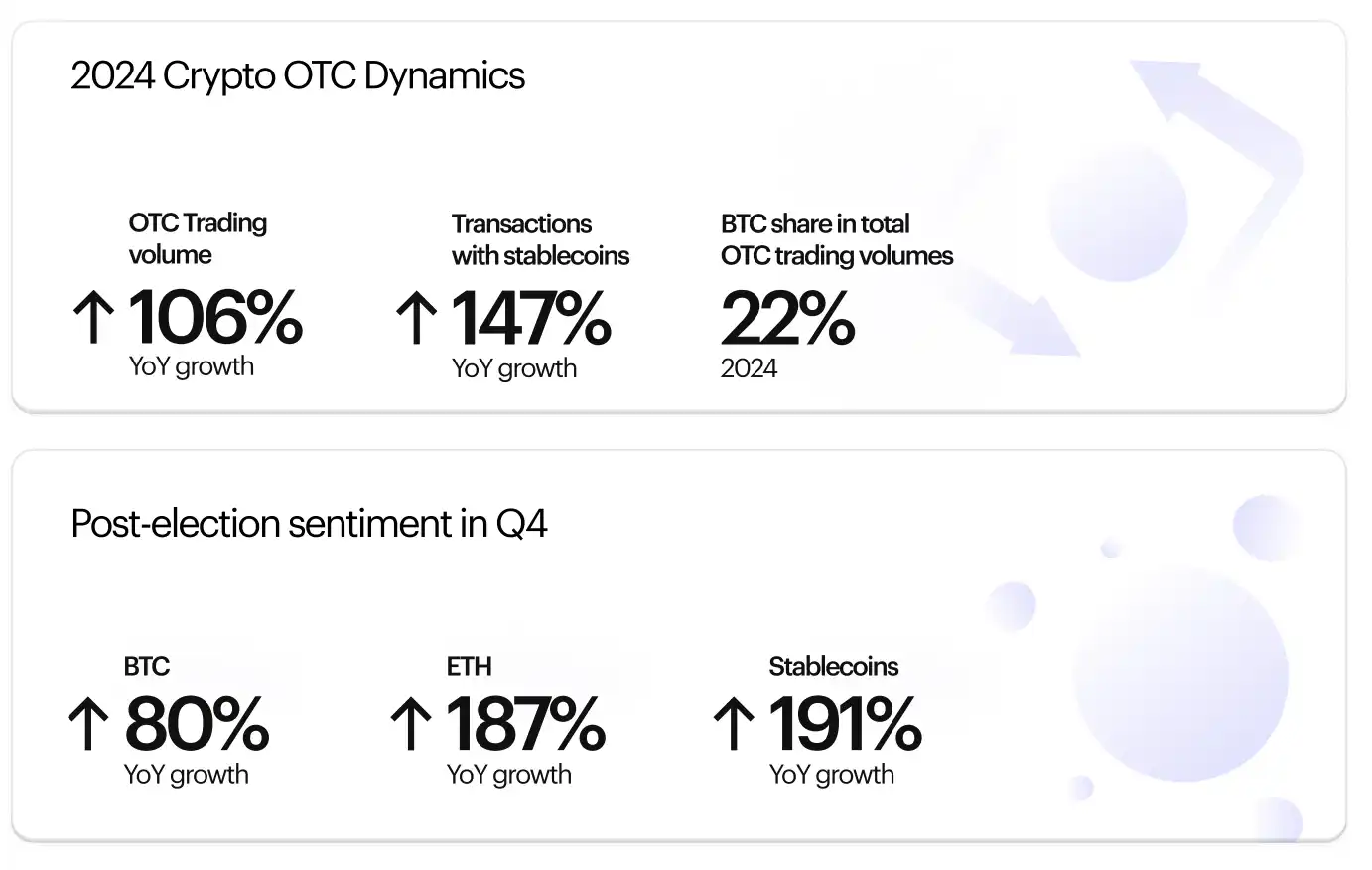

Finery Markets pointed out that an increasing number of traditional financial leaders have shifted from "watching" to "neutral or acceptance," which is a significant reason for the surge in OTC trading volume. When more trades occur in dark pools, the apparent market volatility may be significantly smoothed. According to Finery Markets' report for Q4 2024, the overall trading volume on OTC platforms increased by 106% compared to the previous year, and in the first half of 2025, OTC spot volume grew by 112.6% year-on-year compared to the first half of 2024.

Notably, as the compliance environment improves in Europe and the U.S., the Asian OTC market is also on the rise. Licensed OTC platforms in Hong Kong, as well as emerging platforms in the UAE and Southeast Asia, are attracting global large order liquidity. Meanwhile, some traditional block trading market makers like Flow Traders are also active, using high-frequency and quantitative strategies to provide bilateral quotes for institutional clients in large crypto trades, improving execution efficiency and reducing impact costs. These factors collectively reinforce OTC's position as an invisible pool in the crypto market.

The Rising Star Galaxy Digital

Among the many OTC players, Galaxy Digital, founded by Mike Novogratz, is undoubtedly a star in this wave of institutional buying frenzy. Galaxy is a well-known crypto investment bank that also operates a high-reach OTC trading business, covering trading, investment, asset management, consulting, and mining. Its clients include top players such as publicly listed companies and hedge funds. However, the main pillar of its profitability is OTC spot trading and investment. Backed by the founder's 20 years of Wall Street experience and the company's compliance shaping through its public listing, more and more institutional funds are flowing in, leading to astonishing large trades on Galaxy's platform, covering mainstream assets like ETH and BTC, as well as popular coins like SOL and BNB.

Epic 80,000 BTC Trade Smoothly Executed

As mentioned earlier, the OTC trade of 80,000 Bitcoins within four days, valued at $9 billion, set a record as one of the largest single trades in crypto history, with Galaxy Digital acting as the intermediary.

On July 25, Galaxy Digital announced that it was commissioned to complete this massive BTC sale for an early investor from the "Satoshi era." It was reported that this was part of the investor's estate planning, and Galaxy did not disclose the client's identity, only stating that the trade was a step in a broad wealth management strategy. Surprisingly, the clearing of these 80,000 BTC had almost no impact on the market. Starting from July 17, ancient addresses on-chain began to show activity, transferring Bitcoin to Galaxy Digital's OTC address within a few days, and the clearing of these 80,000 Bitcoins did not reflect in the Bitcoin price. Although a few days later, after Galaxy's announcement, the price briefly dropped nearly 4% and fell below the $115,000 mark, it quickly rebounded to about $117,300 within hours.

Analyst Jason Williams pointed out that this massive sell-off has been "fully absorbed" by the market, while another analyst, Joe Consorti, remarked, "80,000 Bitcoins (over $9 billion) sold at market price, and the BTC price barely budged." On one hand, this tested the current market's OTC depth, as there were counterparties able to absorb such a large sell order shortly after exchange matching; on the other hand, it highlighted the importance of "dark pool trading" in today's cryptocurrency space. In fact, according to the already public OTC address (bc1q0), the total value of Bitcoin handled by Galaxy OTC Deck weekly reaches hundreds of millions to billions of dollars, and the actual situation may be even more than this figure.

Preference for ETH Coin-Stock Companies

In Q2 2025, multiple unusually large buy orders appeared on the Ethereum chain, drawing close attention from the community. Since July 9, 14 new wallet addresses have cumulatively purchased an astonishing 856,554 ETH through OTC platforms like Galaxy Digital and FalconX, valued at about $3.16 billion. These wallets had no history on-chain before suddenly accumulating large amounts of coins through OTC channels, indicating that "big players are quietly increasing their ETH holdings."

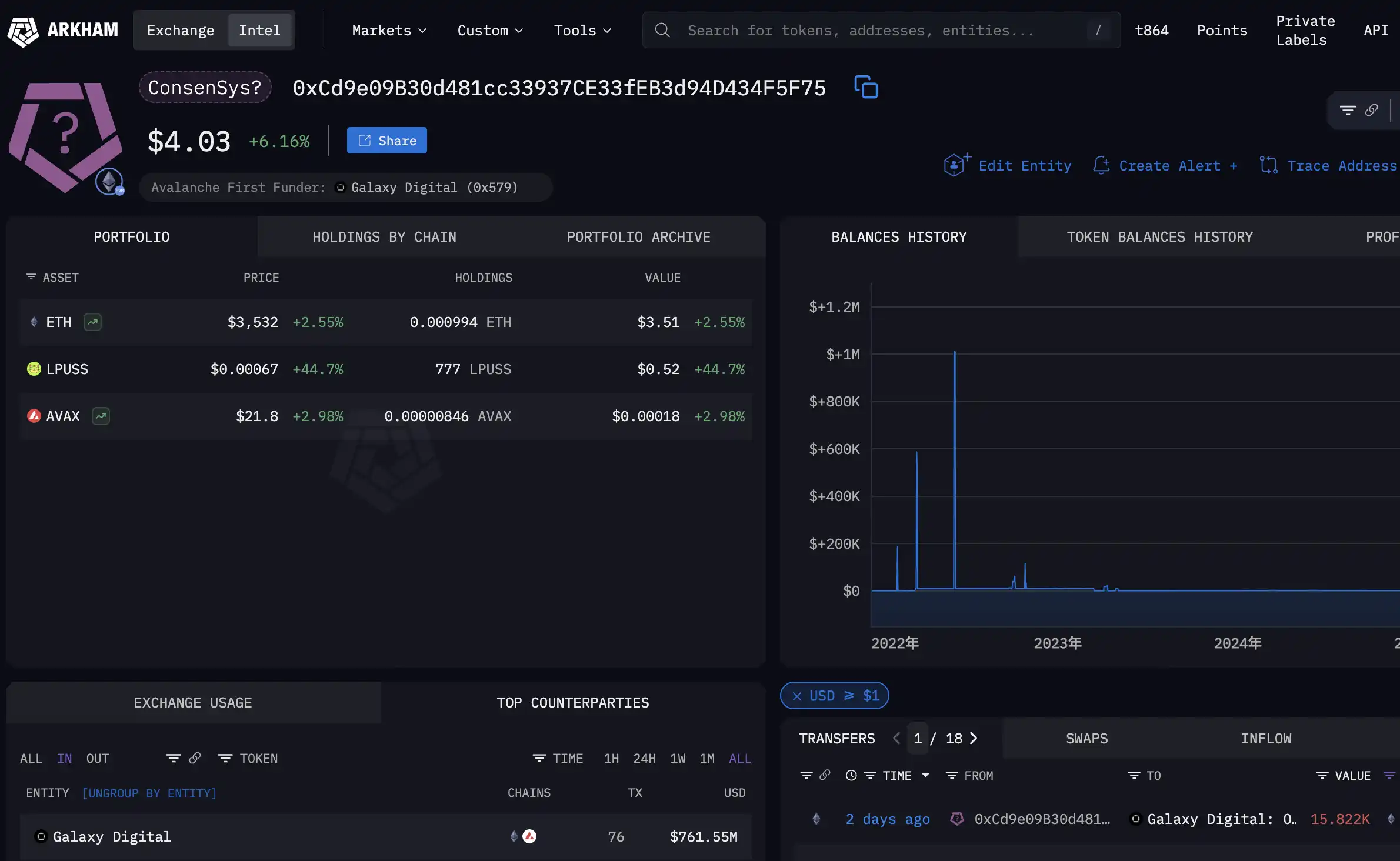

On-chain analysis company Arkham Intelligence pointed out that starting from late July, a newly created wallet address (0xdf0A…2EF3) accumulated about $300 million worth of ETH through Galaxy Digital's OTC trading desk in just three days. This address once held 79,461 ETH, costing about $300 million, while at the time, the market value was around $282.5 million, indicating a paper loss of about $26 million (approximately an 8.7% drawdown). This suggests that the whale's average purchase price was relatively high, yet they continued to firmly increase their holdings.

Just today, August 5, three new addresses acquired a total of 63,837 ETH through Galaxy and FalconX, valued at about $23.6 million. EyeOnChain disclosed some of these buyer addresses, including 0x55CF…679, 0x8C6b…60, and 0x86F9…446. It is estimated that the cumulative buying intensity of these addresses reached tens of millions to hundreds of millions of dollars, with one wallet holding over 110,000 ETH (valued at over $40 million) at one point.

Who exactly is behind this buying spree? There are indications pointing to SharpLink Gaming, which has publicly claimed since June 2025 to emulate MicroStrategy's strategy by continuously increasing its Ethereum holdings as a primary treasury asset. According to its announcements and on-chain data, SharpLink has aggressively purchased nearly 500,000 ETH through ATM financing and OTC trading from June to the end of July. As of July 27, the company held 438,190 ETH, a 21% increase from a week prior, with over 77,000 ETH purchased in a single week at an average price of about $3,756.

By the end of July, SharpLink had cumulatively purchased about 449,000 ETH. Entering August, the company continued to buy on dips, spending $43.09 million to acquire 11,259 ETH on July 31, and again purchasing 18,680 ETH from Galaxy on August 4. Analysts estimate that SharpLink's total holdings have surpassed 499,000 ETH, with an average cost of about $3,064, currently valued at around $1.8 billion, yielding a paper profit of about $275 million. Such a large-scale Ethereum buying spree has been almost entirely completed through OTC desks like Galaxy and FalconX, with even the founder of Wintermute joking that "it's almost impossible to buy ETH at our OTC desk now because the whales have already swept the supply clean." Besides SharpLink, which currently holds the second-largest amount of ETH, Bitmine, which holds the most ETH, is also a deep partner of Galaxy.

The associated address 0xCd9 has currently transferred over $800 million in ETH to SharpLink. $153 million in ETH from 0xdf0 and approximately $300 million from 0x286, among other addresses, are linked to both.

While we cannot clarify the origins of such dense large-scale OTC positions one by one, this undercurrent is becoming a key force influencing ETH supply and demand. Rhythm BlockBeats estimates that based on several major on-chain OTC addresses from Galaxy, OTC trading in ETH has reached $5.444 billion over the past 90 days, averaging about $1.8 billion in ETH processed monthly.

According to Arkham's public data from four OTC wallets: 0x335, 0x15, 0x46f, and 0xb9c.

Acting as both referee and player, MicroStrategy's drama unfolds on the BNB Chain

If BTC and ETH were the protagonists in 2024, then BNB has also stepped onto the stage of institutional layout starting in the second half of 2025. In July, an unexpected piece of news emerged: CEA Industries, a company listed on the U.S. Nasdaq (stock code VAPE, originally focused on agricultural temperature control and e-cigarettes), announced a complete transformation into a "BNB treasury company," planning to raise up to $1.25 billion through private financing and options exercise to purchase BNB. This plan caused VAPE's stock price to soar by 550% in a single day.

Even more noteworthy is that the mastermind behind VAPE's pivot to crypto is David Namdar, co-founder of Galaxy Digital. He will serve as the new CEO of VAPE, while Russell Read, a partner from 10X Capital and former Chief Investment Officer of the California Public Employees' Retirement System (CalPERS), will take on the role of CIO. Namdar stated that they will actively build BNB positions over the next 24 months using this fund, which could reach up to $500 million (with a maximum expansion to $1.25 billion), including open market purchases, strategic trades, and earning yields through staking and decentralized finance.

This means that BNB will welcome its first large-scale public market institutional buyer, and OTC channels will undoubtedly play a key role in this. Due to the highly concentrated issuance and circulation of BNB, Binance and its founder Changpeng Zhao (CZ) reportedly control 71% of the circulating BNB. To absorb hundreds of millions of BNB without causing severe market volatility, they can only rely on OTC block trades or protocol transfers. Galaxy Digital's rich OTC network and liquidity resources will provide strong support for this "BNB version of the MicroStrategy initiative" led by Namdar. As the third-largest cryptocurrency by market capitalization globally, this move marks BNB's formal entry into the realm of institutional asset allocation.

Whether it is Coinbase's integrated trading platform focusing on custody, trading, and on-chain ecosystems, or the matchmaking of consulting and OTC trading like Galaxy Digital, or the rapid integration of traditional brokerages and trading platforms, various sectors in the cryptocurrency field are beginning to move towards compliance and the aggregation of resources towards the top. The recent launch of Crypto Project may be a public indication of this significant trend, as the era of regulatory hegemony approaches, and the "transparent dark pool" of cryptocurrency OTC platforms may occupy a more important ecological position in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。