Author: White55, Mars Finance

When Coinbase's stock price plummeted 15% on Friday, the market's attention was drawn to the dismal numbers in its financial report: total revenue fell 26% quarter-over-quarter, trading revenue dropped 39%, and cryptocurrency spot trading volume shrank by over 30% compared to the first quarter. However, amidst the panic selling, Benchmark analyst Mark Palmer's team wrote a starkly different recommendation in a report on Monday: "These operational metrics are just noise; buying on the dip is very wise" — they not only reiterated a "buy" rating but also set a target price as high as $421, implying over 30% upside from the current stock price.

I. Financial Report Storm: The Hidden Deep Crisis

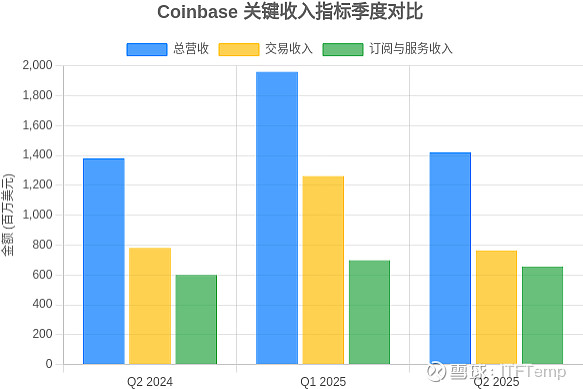

Coinbase Key Financial Metrics Quarterly Comparison (Unit: Million USD) Trading Revenue

Coinbase's Q2 2025 financial report was like a deep-sea bomb, creating huge waves in the cryptocurrency market. Behind the seemingly impressive net profit of $1.43 billion lies a dangerous financial structure — of which $1.5 billion comes from unrealized gains on a strategic investment in Circle, and another $362 million comes from the book value increase of crypto assets. After stripping away this "fluff," the adjusted net profit is only $33 million, a year-on-year decline of 37%. The speed at which the core business is bleeding is far beyond expectations: trading revenue plummeted 39% year-on-year to $764 million, well below market expectations.

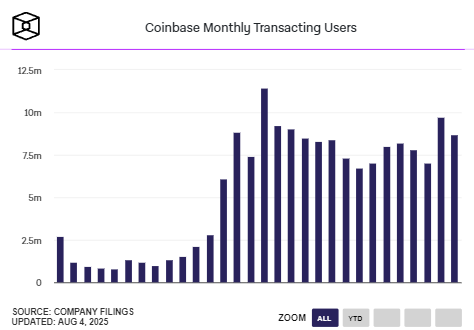

User attrition and shrinking trading volumes have formed a vicious cycle: the number of trading users in Q2 sharply decreased by 1 million, falling back to 8.7 million. More critically, existing users fell into "emotional panic," with the average trading size plummeting by 38%, directly leading to dismal platform trading volumes. The total trading volume of $237 billion, although slightly up year-on-year, saw a dramatic drop of 40% compared to the first quarter, with retail trading volume down 45% and institutional clients also decreasing by 38%. Subscription and service revenue fell 6% to $656 million, with only the stablecoin business (mainly USDC) becoming a slight highlight, with revenue increasing 12% quarter-over-quarter to $333 million.

The market's punishment was swift and brutal: after the financial report was released, the stock price fell over 9% in after-hours trading to $377.7, and then continued to drop to a low of $314 over the following days, evaporating nearly $10 billion in market value. This wave of selling reflects deep concerns among investors about the fragility of Coinbase's business model — when trading revenue still accounts for as much as 52.26%, a reduction in market volatility is enough to breach the profit line.

II. Five Key Signals: Benchmark's Bullish Logic Breakdown

1. The "Policy Dividend" of the Stablecoin Bill

The "GENIUS Act" emphasized by Benchmark is no empty talk. Coinbase has deeply integrated into the USDC ecosystem, with Q2 stablecoin revenue reaching $333 million, a year-on-year increase of 38%, accounting for 22% of total revenue. The average USDC balance on its platform reached $13.8 billion, with external circulation reaching $47.4 billion, creating a vast stablecoin network. If the bill passes, the revenue-sharing agreement between Coinbase and Circle will allow it to enjoy industry dividends and may even open stablecoin channels with traditional financial institutions like JPMorgan and American Express.

2. Compliance Moat under Regulatory Framework

Under the anticipated "CLARITY Act," Coinbase's compliance layout has become a key barrier. In June of this year, it obtained a MiCA license in Luxembourg, allowing it to provide retail and institutional services in 30 European Economic Area countries. Earlier in February, the U.S. SEC dropped its lawsuit against it, clearing significant regulatory clouds. These moves have made its "Crypto-as-a-Service" model attractive to over 240 institutional clients, including giants like BlackRock and PayPal, creating a hard-to-replicate B2B network effect.

3. Ecological Ambition of a Super App

The "Western version of WeChat" strategy is accelerating. The Base App launched by Coinbase has entered public testing, integrating wallet, payment, social, DApp, and other full functionalities, with active addresses far exceeding Layer 2 solutions like Optimism and Arbitrum. CEO Brian Armstrong stated that the goal is to make Coinbase the "top financial services app of the next decade," achieving a qualitative transformation from a trading platform to a financial ecosystem by aggregating trading, DeFi, NFT, and other scenarios.

4. Integration Revolution of Decentralized Exchanges

The acquisition of Deribit is just the first step for Coinbase to complete its derivatives puzzle. This $2.9 billion acquisition (including $700 million in cash and 11 million shares of COIN stock) brings the world's largest crypto options platform under its wing, giving it control over more than $30 billion in open contracts and a trading ecosystem exceeding $1 trillion annually. More critically, its "Everything Exchange" strategic plan aims to integrate liquidity from decentralized exchanges, allowing users to trade thousands of on-chain assets directly within the Coinbase App. Bernstein analysts liken this to "Amazon in the crypto financial services sector."

5. Early Signs of Trading Recovery

Despite the dismal Q2 trading, Benchmark points to a key turning point: expected trading revenue in July is projected to reach $360 million, a quarter-over-quarter increase of 44%. This rebound aligns with market recovery signals such as Bitcoin prices breaking $65,000 and record inflows into Ethereum ETFs. During the same period, Coinbase quietly increased its holdings by 2,509 BTC, bringing its total holdings to 11,776 BTC (currently valued at $1.26 billion), indicating its bet on future market direction.

III. Path to Breakthrough: The Ambition to Tokenize Trillions

Faced with the core business dilemma, Coinbase has unveiled a disruptive strategy: tokenizing traditional financial assets. Product VP Max Branzburg revealed that the platform is about to launch tokenized stock trading, targeting the trillion-dollar traditional stock market. By leveraging blockchain technology for global coverage, 24/7 trading, and instant settlement, this move will directly challenge competitors like Robinhood, which has already provided similar services in international markets.

"We are building a 'one-stop exchange for everything,' where all assets will be traded on-chain," Branzburg's declaration reflects Coinbase's ambition to leap into the comprehensive financial market. The prediction market is becoming another important battleground; despite facing competition from specialized platforms like Kalshi and Polymarket, its compliance advantages and user base constitute a differentiated weapon.

To support this grand vision, Coinbase's technological investments are fully shifting to on-chain. The Base chain privacy protection team has recently expanded to address the core pain points of institutional clients. At the same time, its cross-border payment strategy targets the $40 trillion B2B payment market, using USDC to open corporate payment channels and has already partnered with e-commerce platforms like Shopify. The transformation from a trading platform to financial infrastructure is gradually reducing its excessive reliance on retail trading fees.

IV. Market Divergence: The Tug of War Between Noise and Value

The dramatic fluctuations in Coinbase's stock price reflect a deep division in the market's value judgment. Bears see: trading revenue still accounts for over half, user growth stagnation, and a quarterly decline of $590 million (6%) in cash reserves, which now stand at $9.3 billion. However, from the bulls' perspective, these are merely the growing pains of a transformation:

"Investors should focus less on short-term operational performance and more on the actions the company is taking to build a 'universal exchange,'" Benchmark's call directly addresses the core divergence. While traditional brokerages still value Coinbase based on PE ratios, its real bet is whether tokenized assets can pry open the corners of the traditional financial world, whether stablecoins can reshape the global payment network, and whether decentralized exchanges can disrupt existing trading paradigms.

Wall Street's valuation models have yet to fully digest these variables. But every move Coinbase makes — the $2.9 billion acquisition of Deribit, the expansion of the Base chain ecosystem, the acquisition of regulatory licenses in Europe and the U.S. — is laying the foundation for its "on-chain financial empire." As Armstrong said, "All assets will eventually be on-chain," and Coinbase aims to be that indispensable track.

Conclusion: The Crypto Giant at a Crossroads

As the market anxiously watches Coinbase's quarterly fluctuations, the real players are looking at the financial landscape five years down the line. Behind Benchmark's $421 target price is a reassessment of the ultimate value of "on-chain universal trading." Although short-term profit pains will continue, Coinbase's strategic transformation is rewriting the rules of the game — evolving from a trading platform reliant on market sentiment to a financial infrastructure supporting a tokenized world.

The risks of this gamble are evident: regulatory volatility, technological implementation challenges, and traditional finance counterattacks could all become stumbling blocks. But as Friday's panic selling subsides, calm investors need to answer a core question: Are we witnessing the early pains of an Amazon-like transformation? The answer will determine whether Coinbase plunges into the abyss or navigates the storm toward a trillion-dollar blue ocean.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。