The recent employee statement from the U.S. Securities and Exchange Commission (SEC) regarding liquid staking was intended to clarify how federal securities laws apply to this type of crypto mechanism, but it has sparked significant controversy within the industry and among regulators.

From former SEC Chairman Gary Gensler's Chief of Staff Amanda Fischer to current Commissioner Caroline A. Crenshaw, and across the entire crypto industry, the debate over whether "liquid staking is equivalent to the risks seen during the 2008 financial crisis" has evolved into a classic "regulation versus innovation" battle.

The Spark of Controversy

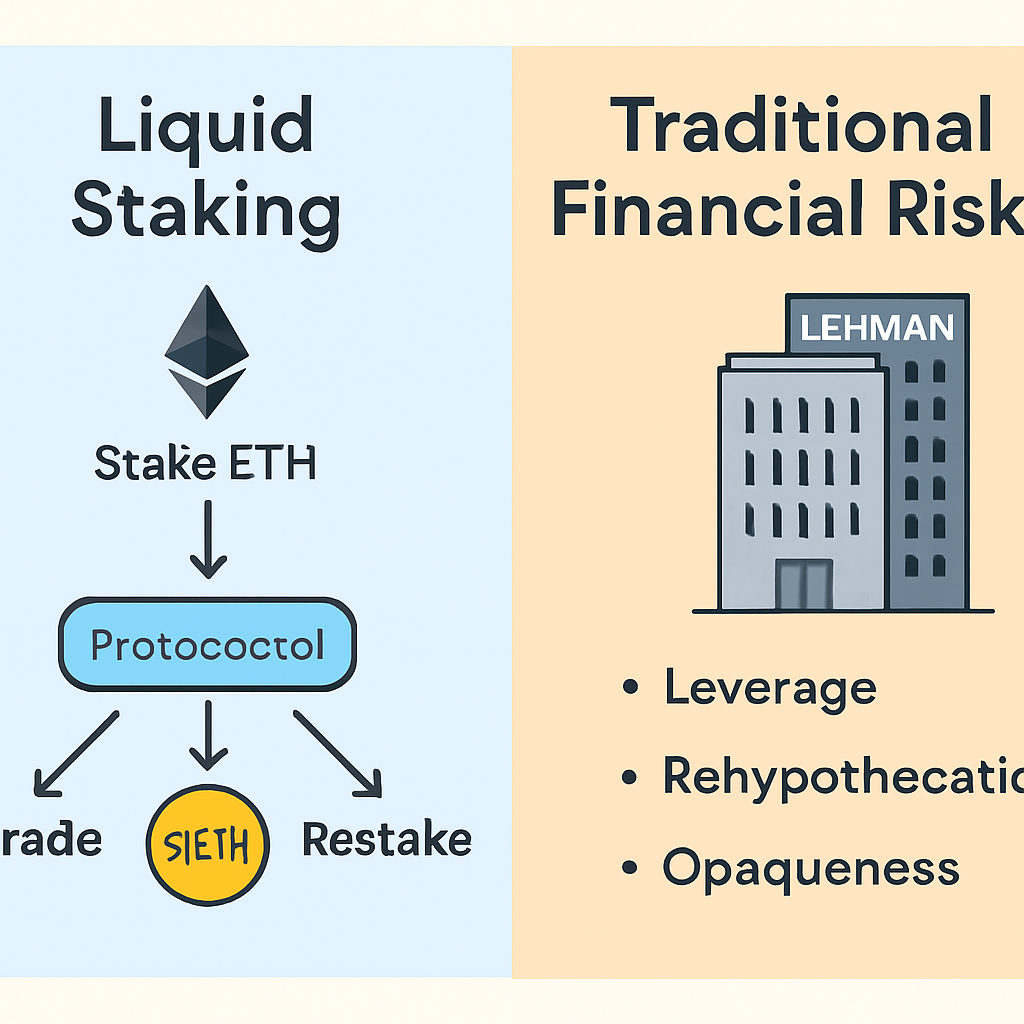

This statement places liquid staking within the framework of federal securities law, raising concerns among traditional finance professionals, including former SEC Chief of Staff Amanda Fischer. Fischer stated on Twitter that liquid staking is highly similar to the "rehypothecation" mechanism seen before the collapse of Lehman Brothers, deeming it a "high-risk" reemergence.

Fischer later outlined the main concerns associated with liquid staking, including:

- Assets may be "re-staked" across multiple protocols, leading to leverage risks;

- Dependence on third-party intermediaries, which could trigger a chain reaction if they fail;

- Delays in the unstaking process (e.g., ETH requires an 11-day wait), complicating withdrawal during a crisis;

- Lack of disclosure, regulation, and inspection mechanisms, unlike traditional securities markets.

She ultimately criticized the SEC's statement as "implicitly endorsing high-risk structures," noting that due to the absence of a central bank or regulatory safety net in the crypto ecosystem, such risks may be even harder to control.

Industry Rebuttal: A "Misunderstanding" or "Deliberate Misleading"?

Fischer's comments quickly drew backlash from the industry. A crypto user responded on X, stating that her remarks were "extremely misleading" and that she may have completely misunderstood the operational logic of liquid staking.

Matthew Sigel from VanEck, Mert Mumtaz from Helius Labs, and Joe Doll from Magic Eden also voiced their opinions, with core points including:

- The transparency of blockchain can effectively control risks;

- Liquid staking is fundamentally different from Lehman-style leverage, especially in non-leveraged "passive staking" mechanisms;

- Fischer's application of traditional financial models to decentralized systems is an inappropriate risk analogy.

This series of rebuttals highlights the industry's deep dissatisfaction with the "dominance of traditional financial discourse in regulatory frameworks."

Reflections from Within the SEC

More critically, there are dissenting voices within the SEC itself regarding the statement. Commissioner Caroline A. Crenshaw issued a statement on the SEC's website on August 5, criticizing the guidance as "misleading," stating that it not only failed to provide clear direction but also created more uncertainty.

Crenshaw pointed out:

- The guidance is based on multiple unverified assumptions (as indicated in footnotes n.11, n.18, n.24);

- The so-called "legal conclusions" only hold under specific hypothetical conditions;

- The statement reflects only employee views and does not represent the official position of the SEC Commission;

- She even cautioned liquid staking participants to "proceed with caution."

This stance differs from Fischer's "high-risk warning," leaning more towards questioning the SEC's internal guidance mechanisms.

Deeper Significance: Regulatory Logic or Risk Reminder?

The regulatory debate surrounding liquid staking essentially reveals the fundamental gap in "understanding frameworks" between policymakers and the industry:

Regulators are concerned about the potential for systemic risks to reemerge; meanwhile, industry participants emphasize that the blockchain mechanism itself has risk mitigation capabilities; within the SEC, there are also doubts about the legal logic and applicability of the existing statement.

While Fischer's Lehman analogy carries a cautionary message, it is viewed by the industry as "overgeneralizing"; Crenshaw's criticism suggests that even within the SEC, there are reservations about the accuracy and applicability of the statement.

Conclusion

Regardless of how this controversy is interpreted, the regulatory issues surrounding liquid staking can no longer be ignored. They pertain not only to technological implementation and asset security but also represent a direct clash between "old financial logic" and "new financial realities" in the U.S. as it formulates crypto asset policies.

The future direction of regulation may depend on whether these divergences can be effectively resolved through cross-disciplinary understanding and communication, rather than remaining stuck in a path dependency of "replicating traditional financial risk control templates."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。