Why Ripple Buys Rail For $200M and How It Fueled RLUSD vs USDC Debate

Something big is happening in the world of digital payments—and it’s not regular Ripple XRP news . While most headlines screamed "Ripple Buys Rail $200M" and moved on, they missed the real story.

This isn't just another acquisition. This is Layer 1 chain setting the stage to reshape how stablecoins power cross-border payments, and possibly challenging the very dominance of Tether and USDC.

So what exactly is Blockchain unlocking with Rail? Let’s dig in.

Inside the $200M Ripple-Rail Deal: More Than Just a Buyout

According to Reuters and Wu Blockchain, Ripple confirmed on August 7 that it would acquire this crypto platform, a Toronto-based stablecoin payment platform, in a $200M deal.

The transaction is expected to close in Q4 2025, pending regulatory approval. At first glance, it looks like another Web3 expansion—but what the chain is really buying is precision-grade settlement power.

Backed by Galaxy Ventures and Accomplice, Rail crypto platform supports virtual accounts and automated payment processing. This makes blockchain’s infrastructure faster, leaner, and more robust.

With this acquisition, the firm can now process cross-border transactions that once took days in just hours.

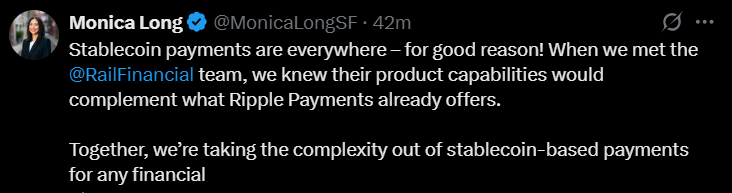

Blockchain's President Monica Long took X handle and said:

This isn’t just growth—it’s about dominance, and this acquisition is the clearest signal yet.

Ripple Rail Acquisition: Hidden Cross-Border Gameplan?

The strategic value of the platform lies in its global reach and automation, something fiat systems still struggle with. The cryptocurrency platform reportedly powers 10% of global stablecoin-based payment activity, a figure most payment firms dream of.

By integrating this backbone into its existing network, Ripple may finally offer a stablecoin solution that combines regulatory clarity, fast settlements, and low-cost remittances. It’s a direct challenge to legacy platforms like SWIFT, and even fintechs like Wise or Revolut.

More importantly, it aligns perfectly with Trump’s recent crypto bill, which introduces a federal regulatory framework for stablecoin regulation.

As a crypto analyst, I see this acquisition as the layer 1's attempt to gain first-mover advantage in compliant global payments. And this move could put it ahead of both Tether and USDC in institutional adoption.

How RLUSD vs USDC Battle Heats Up After This News?

-

They launched its dollar-backed stablecoin RLUSD last year to challenge top players like Tether and USDC.

-

At that time, Tether’s market cap was over $164 billion, and USDC was the top choice for regulated payments.

-

Now that $200M buy is official, RLUSD gets key upgrades—like virtual accounts and automated systems.

-

This means RLUSD can now connect easily with businesses and large financial platforms.

All this gives RLUSD a stronger position in the growing battle of RLUSD vs USDC.

What Rail Never Told You: Is This the Missing Link for XRP Price Surge?

One overlooked aspect of this Ripple buying Rail $200M is how it may affect XRP news today. While blockchain is legally distinct from its native token, market trends have consistently shown a correlation between blockchain's expansion and XRP price movements .

As they are now owning a system that clears stablecoin payments globally, there’s room to speculate whether XRP could once again be integrated into liquidity corridors.

That’s why this news is very important, it's more than just acquisition of stablecoins; it includes bridging regulatory gaps, and the start to a new era of flows of funds, both fiat and crypto.

Also read: Hamster Kombat GameDev Heroes Daily Combo 08 August 2025: Play免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。