Original Author: Castle Labs

Compiled by|Odaily Planet Daily (@OdailyChina)

Translator|CryptoLeo (@LeoAndCrypto)

Recently, the Pendle team announced a new platform called Boros launched on Arbitrum, where users can arbitrage and hedge funding rates. Boros will initially operate in the BTC and ETH markets across major exchanges, trading using Yield Units (YU), where each YU represents the yield of 1 unit of collateralized asset (for example, 1 YU-ETH = yield equivalent to 1 ETH nominal value). Friends who frequently use Pendle should know that this is similar to its YT mechanism. Currently, the Boros market has only launched contract trading for BTC and ETH on Binance, and users can earn PENDLE rewards by placing limit orders on its platform. Castle Labs has released an introduction and outlook on Boros, which Odaily Planet Daily has compiled as follows:

The original text is as follows

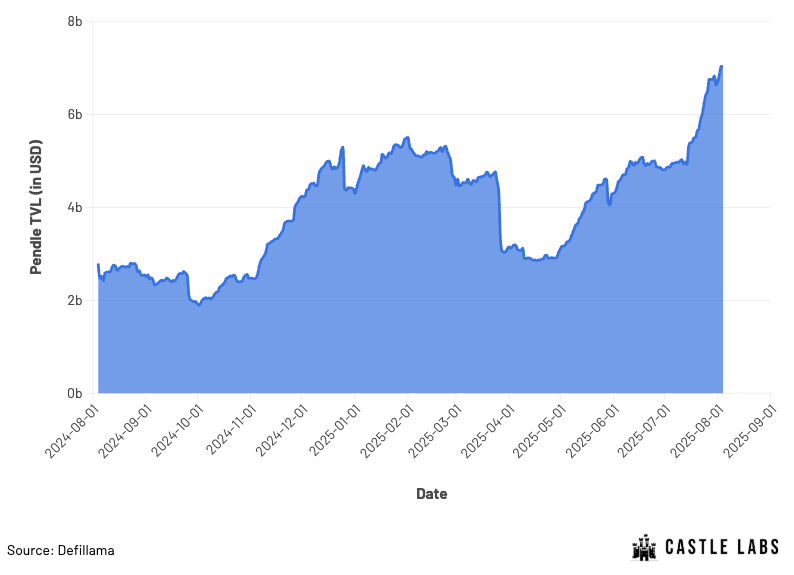

Pendle has been steadily advancing and has now become a hub for on-chain yields. Its total TVL recently surpassed $7 billion, reaching an all-time high.

To get closer to its vision of providing yields for any asset, they launched Boros, whose architecture can support any form of yield, including those from DeFi protocols, TradFi, as well as yields from bonds, stocks, and other RWAs.

In the initial phase, it will focus on funding rate yields, which is an underdeveloped on-chain market, as the daily trading volume in the contract space reaches $150 to $200 billion.

Boros aims to hedge funding rate exposure or leverage trade through short/long Yield Units (YU). YU represents the yield of 1 unit of collateralized asset before maturity. For example, 1 YU ETH equals the yield of 1 ETH nominal value before maturity, similar to how YT (Yield Tokens) operates on Pendle.

Initially, Boros will support contract funding rates for BTC and ETH on the Binance platform, and later will support more assets such as SOL and BNB, and will integrate with Hyperliquid and Bybit. To ensure a smooth launch, Boros will set a contract position limit of $10 million and a maximum leverage of 1.2 times, allowing the team to monitor risks in the early stages.

Products like Delta-neutral stablecoins can benefit from this, as they can hedge negative funding rate exposure. This also opens up new strategies and risk management tools for institutional investors and DeFi-native traders.

Boros Beyond Retail

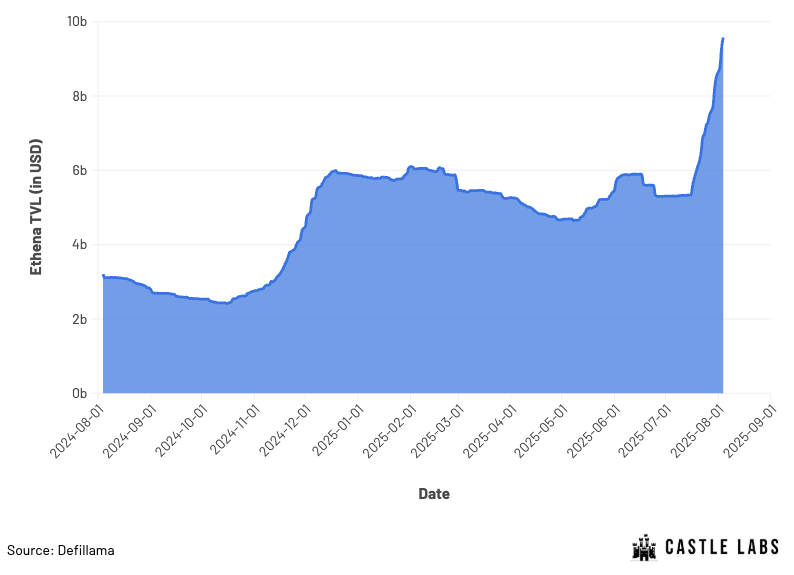

While Boros is a complement to the series of yield puzzles offered by Pendle, its greatest value addition lies in the value it provides to protocols that utilize funding rate exposure in their products. Protocols like Ethena currently have a TVL of $9.71 billion, benefiting significantly as their Delta-neutral strategies have funding rate exposure, which helps enhance their stablecoin yields.

The Ethena stablecoin USDe is backed by volatile assets such as BTC, ETH, and LST. To operate in a Delta-neutral environment, Ethena hedges these volatile assets as spot positions and uses them as collateral by subsequently opening short contract positions.

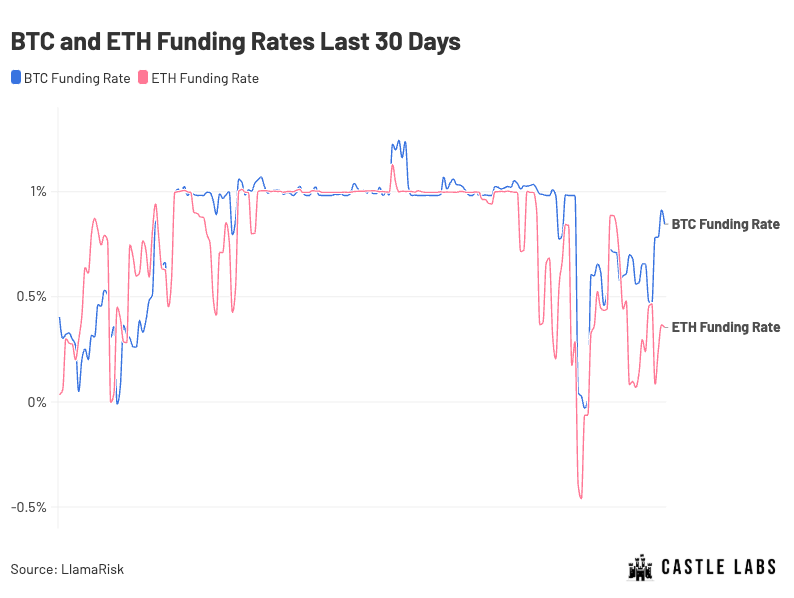

While the Delta value of Ethena's positions remains neutral, it still has to bear the funding rates charged by exchanges, which is also one of Ethena's sources of income. When the funding rate is positive (long positions > short positions), Ethena profits as longs pay funding rates to shorts.

However, when the funding rate is negative (short positions > long positions), Ethena incurs losses and can benefit from additional hedging of these funding rates to ensure stable returns during market downturns, which is precisely what Boros can provide.

For example, Ethena allocates 50% of its collateral to different CEXs, including BTC and ETH (the assets initially supported by Boros), with total collateral deposits exceeding $4 billion, and its funding rates may be hedged through Boros.

Boros can bring to protocols:

Protocols can take directional views on funding rates;

Protocols can effectively hedge their funding rate risk exposure;

Protocols can ensure higher predictability, consistency, and lower output risk.

Conclusion

The emergence of Boros represents a shift in on-chain yield opportunities, providing more avenues for retail and institutional investors to gain exposure to different assets and tools in DeFi and TradFi. This is also the next step in Pendle's vision to provide access to a variety of on-chain yield mediums, if not all.

Pendle has launched tokenized fixed-income products in the DeFi space, while Boros expands the service scope through hedging/leverage operations based on funding rates and yields. Together, they will broaden the range of yields and drive the development of DeFi, where anyone can trade and hedge any yield on-chain or off-chain.

Boros has begun to unlock more funding rate yield strategies by providing a platform for long, short, or hedging operations using YU against funding rate exposure.

In the future, Boros will grow and provide yields that are currently unattainable on-chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。