Written by: kkk

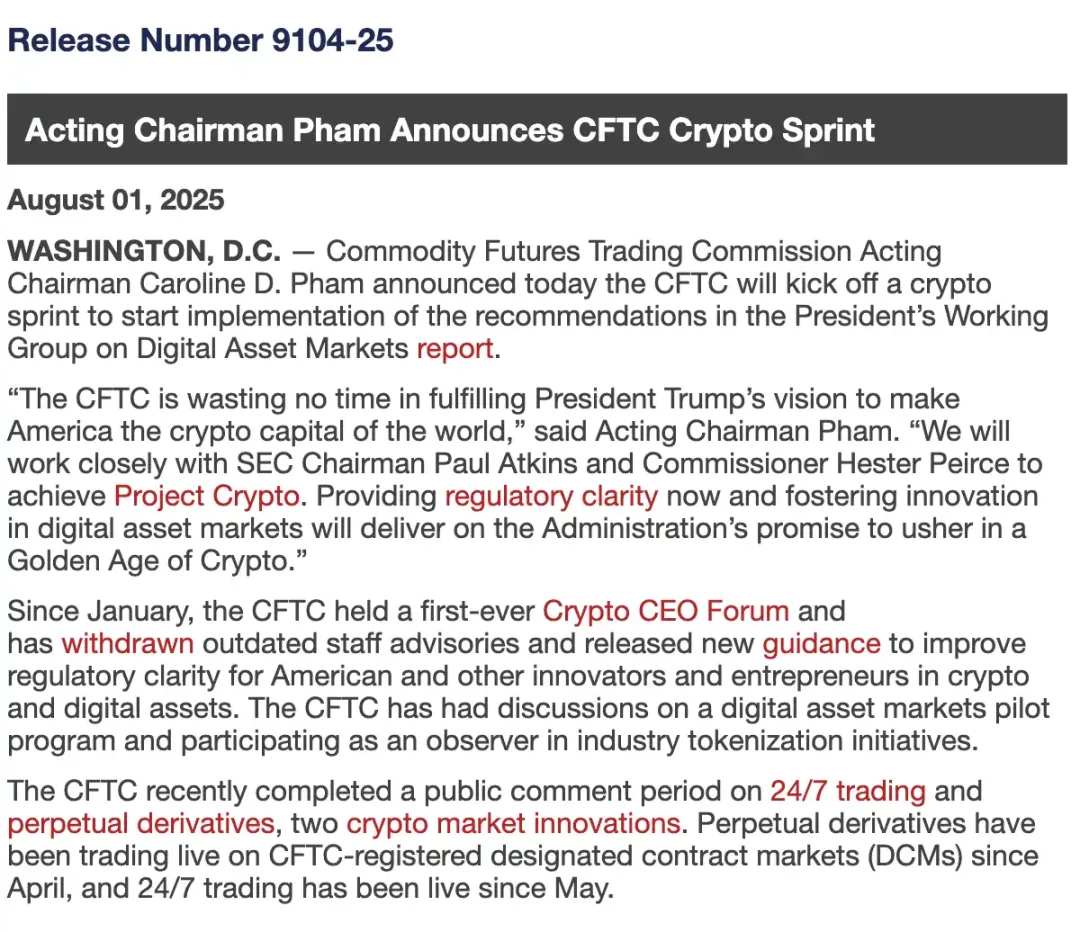

Under the strong push of the Trump administration, the United States is accelerating the integration of crypto assets into the mainstream financial system. On August 1, the Commodity Futures Trading Commission (CFTC) officially launched a regulatory program called "Crypto Sprint," and on August 5, proposed to include spot crypto assets in compliance trading on CFTC-registered Designated Contract Markets (DCM). This move not only breaks the long-standing regulatory gray area of the spot market but also indicates that the Web3 industry will welcome a clear and feasible compliance path.

CFTC Acting Chair Caroline Pham publicly stated: "Under the strong leadership of President Trump, the CFTC is fully advancing federal-level digital asset spot trading and coordinating with the SEC's 'Crypto Plan'." This statement sends a strong signal: U.S. regulation is shifting from "defensive suppression" to "institutional acceptance," providing unprecedented compliance opportunities for Web3 infrastructure such as DeFi, stablecoins, and on-chain derivatives.

Legalization of Spot Contracts: The Institutional Starting Point for the Crypto Market

For a long time, the U.S. regulatory system has lacked unified management of crypto spot trading. Transactions of crypto assets such as BTC and ETH are mostly concentrated on overseas platforms or unlicensed domestic exchanges. The lack of regulation not only makes it difficult to protect investors' rights but also keeps a large amount of institutional capital on the sidelines.

The "Crypto Sprint" launched by the CFTC aims to address this pain point. One of its core contents is to promote the legal listing of non-securities crypto asset spot contracts on CFTC-registered DCMs. By approving these platforms to carry out spot crypto trading, the CFTC provides a compliant alternative path for the market, replacing the long-reliant unlicensed or offshore trading platforms—these platforms have gradually lost institutional trust amid the FTX collapse (2021) and ongoing regulatory issues with Binance. Therefore, this policy means that the entry path for institutional investors into crypto assets is now more legal, transparent, and fair, clearing obstacles for large-scale allocation of digital assets.

According to the CFTC, Section 2(c)(2)(D) of the Commodity Exchange Act has clearly stipulated that any commodity trading involving leverage, margin, or financing must be conducted on a registered DCM. This provision provides a solid legal foundation for the legal listing of crypto spot contracts and brings much-needed regulatory certainty to the market. Under this framework, we may see centralized trading platforms similar to Coinbase or on-chain derivatives protocols like dYdX obtaining compliance operating licenses through registered DCMs.

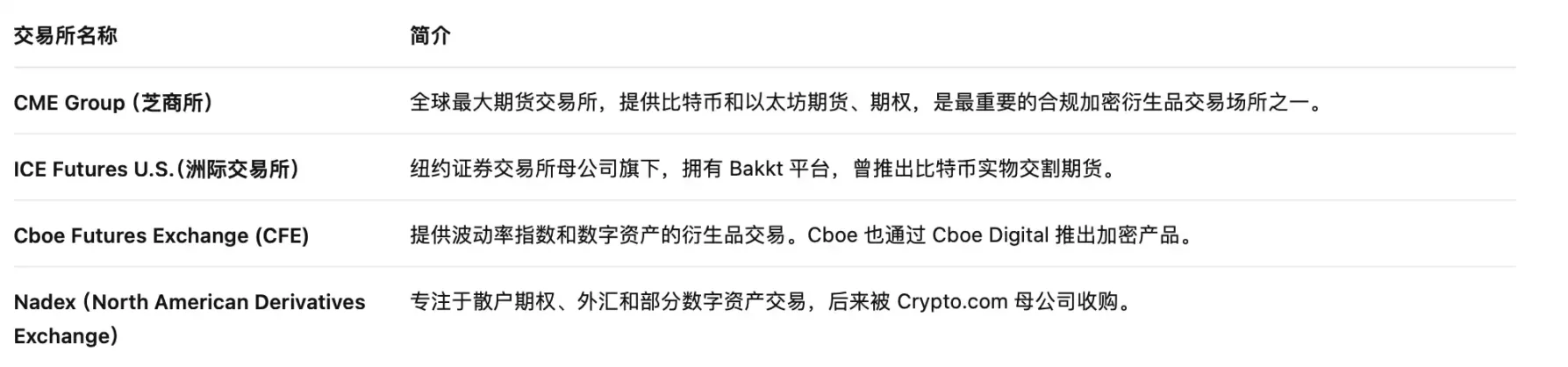

At the same time, this policy also opens a compliant channel for traditional financial institutions to access crypto assets. The Chicago Mercantile Exchange (CME), representing DCMs, already has a complete infrastructure for BTC and ETH futures markets. Once spot contracts are approved for listing, it will provide institutional investors with a one-stop trading entry for crypto assets from futures to spot, accelerating the pace of traditional capital entering the market.

SEC and CFTC Join Forces: Regulatory Coordination Brings Certainty

One of the biggest regulatory challenges in the U.S. crypto market in recent years has been the overlapping and ambiguous delineation of responsibilities between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Project teams often have to deal with compliance pressures from the SEC while also considering CFTC's commodity trading rules, falling into the dilemma of "regulatory squeeze" or "duplicate enforcement," which consumes resources and increases uncertainty.

The "Crypto Sprint" has now clearly released the signal that the CFTC will establish a close cooperation mechanism with the SEC to clarify the legal attributes of crypto assets (securities or commodities), custody standards, and trading compliance requirements, thus providing market participants with a unified and predictable compliance path.

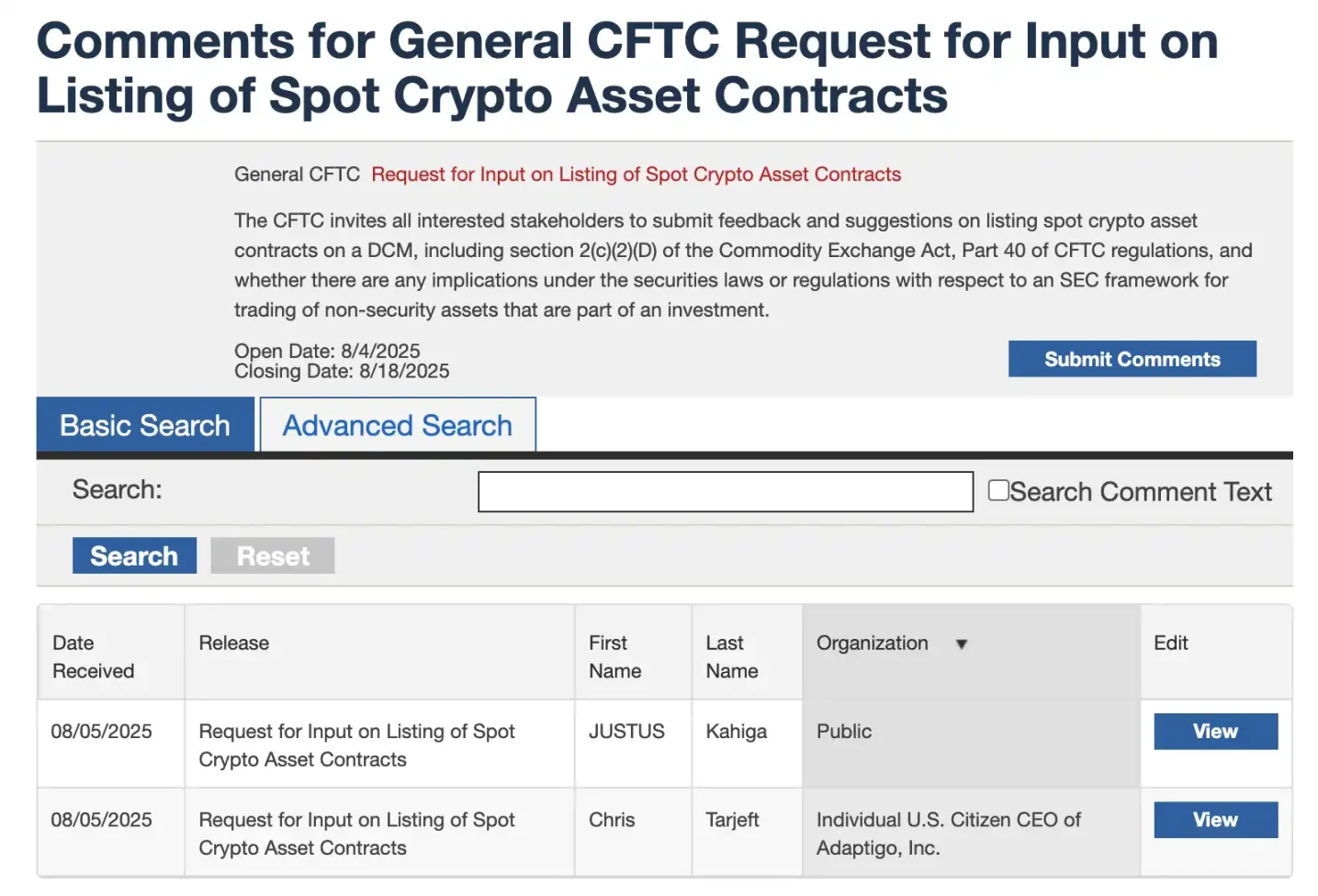

The "sprint" not only symbolizes an acceleration of regulatory pace but also marks a shift in regulatory thinking—from passive defense to active collaboration. For Web3 project teams, this is no longer a simple "regulatory observation period," but an unprecedented window for institutional co-construction. The CFTC has publicly solicited market feedback on the "listing of spot crypto asset contracts on registered exchanges (DCM)," with a deadline of August 18. Participants who can submit opinions in a timely manner not only hope to avoid future regulatory blind spots but may also influence the specific direction of the rules.

At the same time, the SEC's "Crypto Plan" is highly coordinated with the "Crypto Sprint," attempting to create a unified federal regulatory framework that clarifies the boundaries between securities-type and commodity-type crypto assets and promotes the construction of a "Super App" structure that can trade multiple asset types simultaneously. If this concept is realized, future trading platforms will be able to legally provide "one-stop" crypto financial services such as stocks, Bitcoin, stablecoins, and staking services under a single license.

SEC Chair Paul Atkins and Commissioner Hester Peirce have also publicly expressed support, calling it a "historic turning point in promoting the on-chain transformation of the financial system," and stated that they will accelerate the formulation of specific rules in key areas such as stablecoin regulation, crypto asset custody, and compliant token issuance.

This dual-track regulatory approach is expected to end years of confusion in the U.S. regarding whether crypto assets are "securities or commodities," setting a clear and replicable compliance model for the world.

More importantly, this means that Web3 projects can finally stop "violating regulations by stepping on landmines" and instead truly integrate into the mainstream financial system through clear registration processes, compliant custody, and auditing systems, achieving a connection between on-chain assets and real-world finance.

Conclusion

In the past week, the U.S. government has released unprecedented strong signals in the field of crypto assets: the White House officially issued the "Digital Asset Strategic Report," the SEC launched the "Crypto Plan," the CFTC initiated the "Crypto Sprint," and publicly solicited opinions to promote the compliant listing of spot contracts; at the same time, the White House made a rare statement prohibiting banks from discriminating against crypto companies—this is not just a "softening" but a complete policy shift.

Once upon a time, the SEC was the biggest regulatory shadow over crypto projects, but now we see it joining forces with the CFTC to establish a unified regulatory framework for Web3. What is visibly happening is a historic structural transformation: moving from ambiguity to clarity, from suppression to support, from gray areas to federal legislation.

This time, the sprint is not just for regulatory agencies—but for every Crypto Builder.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。