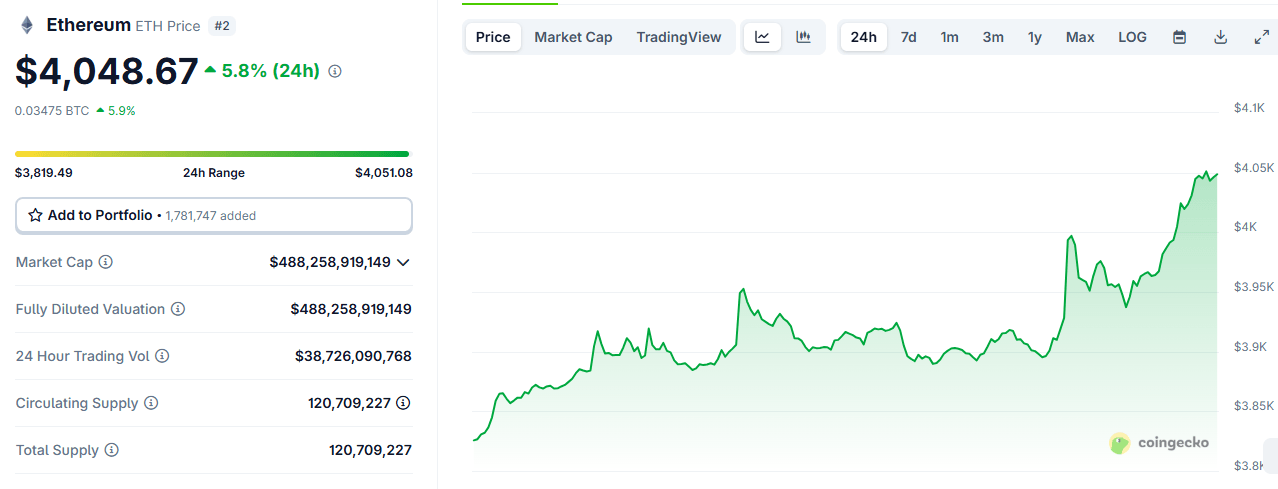

Ethereum (ETH) broke past the $4,000 mark for the first time since Dec. 9 as interest in the digital asset continues an uptrend that began in late June. Data shows that ETH traded at $4,050 at 1:20 p.m. EST on Aug. 8, a gain of approximately 6% in 24 hours and nearly 10% over seven days.

Despite surging more than 50% in the last 30 days, the digital asset was at the time of writing approximately 17% below its all-time high of $4,878.26 set in November 2021. Still, this recent price action is seen positioning the digital asset at a critical juncture, with one technical analyst identifying the current level as an “extremely” important point of resistance.

The market’s ability to either break through this ceiling or be rejected by it will likely determine ETH path for the foreseeable future. One analyst, Satoshi Stacker, noted that ETH had previously been rejected at this level six times, resulting in a 30% to 75% decline each time. However, the only time it surpassed this mark, it went on to set an all-time high, the analyst added.

While Stacker expressed hope that bulls would come on board and help break the resistance, Borovik, a partner at a fintech software platform for alternative assets, voiced optimism and compared ETH to bitcoin ( BTC) before it raced past the $20,000 mark back.

“Once we break past $4k, we’ll see a rapid movement towards $5k (ATH), and then you’ll see $10k before the year ends. Stablecoin regulation will bring TRILLIONS onto ETH, and massive companies will continue to launch L2s. $80k is possible,” Borovik argued.

Before ETH broke past the $4,000, the digital asset’s supporters voiced concern over reports that Binance was selling ether and Solana. One social media user went as far as accusing the top crypto exchange of manipulating ETH and the entire altcoin market.

“Ethereum is strong, pushing to break $4,000 with institutions and whales buying aggressively. Yet… as I pointed out earlier, they’re dumping millions of ETH by moving it to multiple market maker accounts to sell off,” the user claimed.

The user also questioned why the exchange was moving so much ETH to these accounts when it did not have an excess of the digital asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。