The writing team includes Lincoln Murr (Coinbase), Stefano Bury (Virtuals), Rishin Sharma (Solana), Pilar Rodriguez (The Graph), David Mehi (Google Cloud), and Cambrian members Ariel, Brian, Doug, Jason, Ricky, and Tumay.

Agentic Finance is reaching a critical tipping point, holding immense economic potential for those who leverage smart agents to enhance their financial behaviors. AI agents are a class of autonomous tools equipped with data analysis, decision-making, and trade execution capabilities, operating with varying degrees of human involvement. Currently, these agent tools are being made available to the public, gradually disrupting a financial system long dominated by Wall Street and its high-frequency algorithms.

This article focuses on the retail applications of agentic finance in "Decentralized Finance (DeFi)", comprehensively reviewing automated agent projects that are already live and focused on serving individual users. To this end, the project team conducted extensive research and interviews with dozens of teams in the industry, ultimately compiling a rigorously selected list of active projects, categorized by product type, with annotations for each representative product.

Agentic finance is driving the maturation of the crypto industry, providing real-time information, professional-level advice, and optimizing user experience, making participation in DeFi more efficient and reliable for ordinary users. Below is a structured overview of the current ecosystem:

What is Agentic Finance (AgentFi)?

Agentic Finance refers to an emerging category of financial products centered on the active management of user funds using AI or machine learning, or providing personalized financial advice. Some products utilize large language models (LLMs) for interaction and analysis, while others rely on rule engines or traditional machine learning algorithms. Despite differing underlying technological paths, they commonly refer to themselves as "agentic" products.

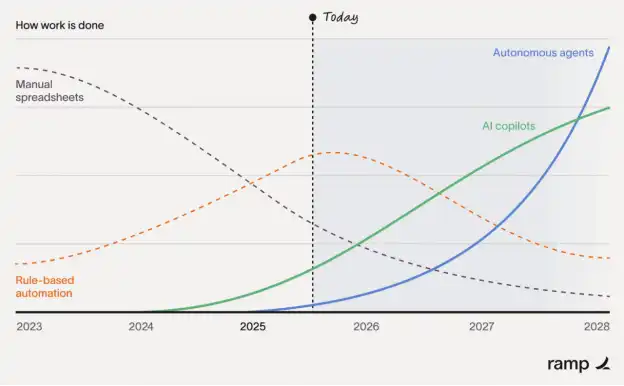

Currently, Agentic Finance is in the innovator stage, still at the starting point of the early adoption curve. Soon, various agents and AI assistants will dominate financial activities. Source: Ramp

However, it is foreseeable that in the near future, traders, asset managers, financial analysts, and other professionals will enhance their efficiency using dedicated smart agent tools, while automated agent versions aimed at ordinary users will also be launched simultaneously. This trend is already beginning to manifest: for example, on the Solana network, automated trading bots now account for over half of the trading volume¹.

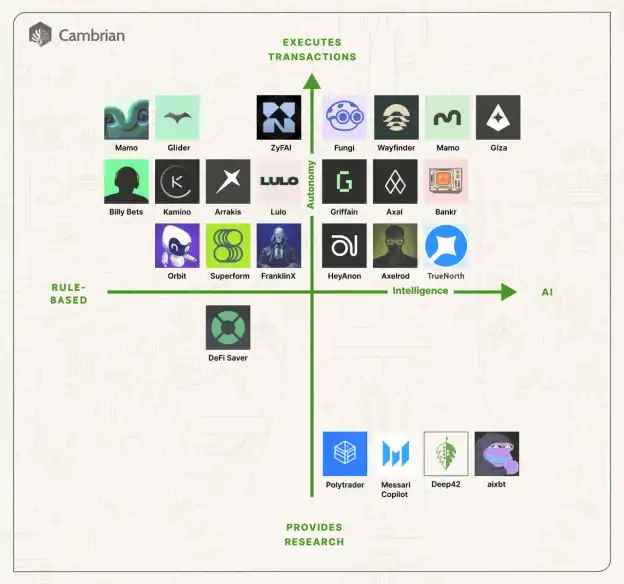

Autonomy vs Intelligence: The Capability Coordinate System of AgentFi

Different agentic projects are distributed within the "autonomy - intelligence" coordinate system based on their service scenarios and technical capabilities.

The horizontal axis represents the level of intelligence: on the left are tools based on rules and statistical models, in the middle are traditional machine learning models, and on the right are advanced agents based on large language models (LLM) or subsequent technologies;

The vertical axis represents the level of autonomy: at the bottom are "advisory agents" that only provide suggestions and analysis, at the top are "fully automated agents" with complete decision-making and execution authority, and in the middle are "human-in-the-loop" hybrid architectures.

When mentioning Agentic Finance, many people think of "invisible robots" or advanced LLM systems that can automatically trade and independently manage portfolios. However, in reality, such systems have not yet been deployed on a large scale due to the ongoing stability issues with LLMs. For instance, LLMs can still "hallucinate" false information and only recently gained basic counting abilities (such as counting how many letter 'r's are in "strawberry"). Currently, most agents only use LLMs for human-computer interaction interfaces or data analysis layers, while the fund management part still primarily relies on mature statistical models or machine learning algorithms, which have been used in traditional finance (TradFi) for decades.

From the development path of LLMs, their weaknesses in handling numbers and logical reasoning have historical reasons—they were originally designed for language prediction. However, this situation is changing rapidly. For example, Anthropic has launched financial products adopted by institutions, and OpenAI has trained models that are competitive in the International Mathematical Olympiad.

2025 Landscape of Agentic Finance Projects

Below is a list of currently live agentic projects with fund management capabilities open to users. Projects in development or internal testing phases are not included, and products that only use LLMs as interfaces but require manual decision-making by users are also excluded, so many projects are not included in this round-up.

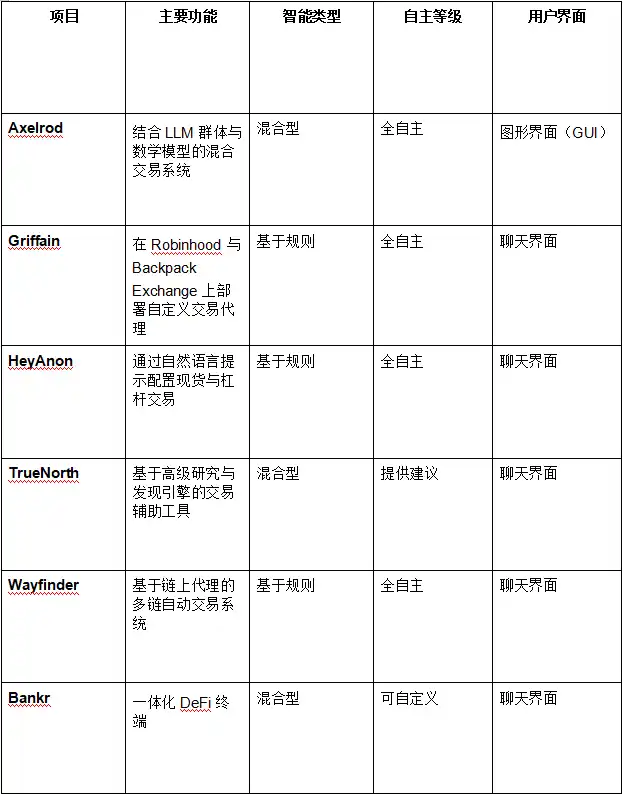

Trading and Asset Allocation Agents

Trading agents are the most commonly thought-of agentic finance products by the public. These agents manage user funds by automatically rebalancing or selecting buy/sell assets. To achieve automated trading, agent systems typically need components such as trading permissions, asset access, budget management, preset strategies, and high-quality data. Below is a list of current projects supporting one or more of these functions:

According to a recent poll initiated by Cambrian on the X platform, most users show a high interest in high-risk trading agents.

Liquidity Providing (LP) Agents

Decentralized exchanges (DEX) rely on third-party liquidity providers (LP) to supply tradable assets, with transaction fees paid by traders going to LPs. LP earnings depend on various factors, including impermanent loss, trading volume, DEX protocol incentives, etc. The following agent tools can help LPs identify optimal liquidity allocation paths:

Lending Agents

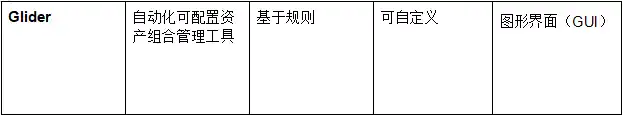

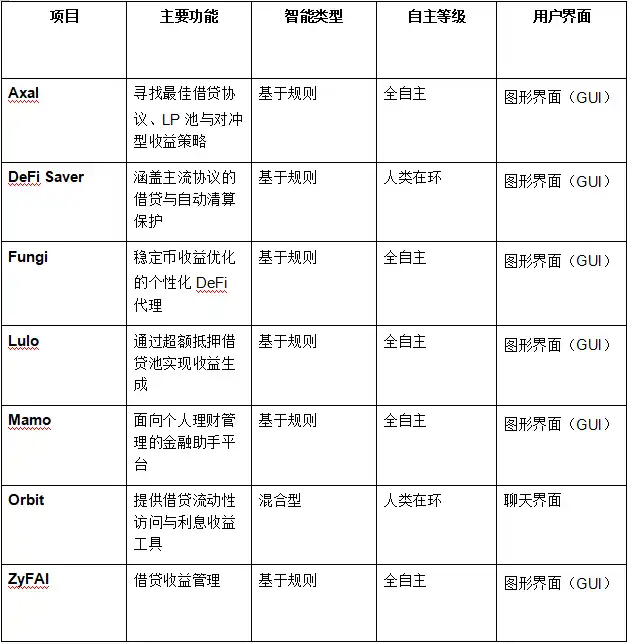

In the crypto market, users can earn interest by providing assets to borrowers. Lending agents typically need to assess factors such as yield, risk exposure, and opportunity cost when deciding whether to participate in lending protocols. Below are some of the live lending agent projects:

Prediction and Betting Agents

Prediction markets allow users to bet on the outcomes of future events, such as elections or sports events. These markets typically rely on real-time tracking of news or real-world information, which can change at any time. Prediction markets naturally align with agentic participation mechanisms, as emphasized by Vitalik Buterin in his proposed concept of information finance (InfoFi) here.

Sentiment, Fundamental, News, and Technical Analysis Agents

Investors typically rely on market analysis to determine "what to buy" and use sentiment analysis to judge "when to buy or sell." LLMs demonstrate transformative value in such analyses: not only do they significantly expand the scale and speed of analyzable data, but they also enhance contextual understanding, providing more comprehensive insights by identifying relationships between data sources.

Unlike the aforementioned executable trading agents, analytical agents only provide informational support and do not execute operations directly. Below are some representative projects among them:

It is worth noting that the Agentic Finance ecosystem is rapidly evolving, and existing projects are continuously expanding their business boundaries. For example, products currently classified as lending agents may expand into liquidity management and other areas in the future.

Future Trends of Agentic Finance

On-chain assets continue to grow, with on-chain stablecoin trading volumes reaching new highs, and traditional fintech companies are also connecting to on-chain infrastructure. For instance, Robinhood recently launched tokenized services for U.S. stocks, enabling 24/7 on-chain trading accessible to global investors.

The crypto industry is gradually moving beyond the narrative of "speculative trading" towards a broader application scenario that encompasses investment functions.

However, for many users, successfully participating in DeFi still presents significant barriers. This is precisely where agentic products come into play: they are expected to significantly enhance usability and profitability, becoming key drivers for the popularization of DeFi.

Agentic Finance is a brand new market segment, and the tools mentioned above represent the first attempts in both TradFi and DeFi. We anticipate that some of the early projects may not achieve their visions, but the overall ecosystem will continue to mature. Ultimately, using agents will become the mainstream way of financial participation, and those users who take the first step into "Agentic Finance" early on will be more likely to reap long-term rewards.

Furthermore, as developers continue to deliver stable returns, users' attention to the details of agent strategies will decrease. In the future, agents may further integrate multiple capabilities (such as managing both trading and LP positions simultaneously) to enhance complexity and efficiency.

Future Focus Areas

Future discussions may delve into the following related topics:

Agent-to-Agent (A2A) communication and payment mechanisms

Agent infrastructure and development frameworks

Data infrastructure and on-chain indexers

On-chain identity management

Agent issuance platforms and markets

Privacy and verifiability

Financial modeling and simulation systems

About the Author

Sam Green, founder of Cambrian Network, focuses on building a financial intelligence layer for agent systems. Previously, he was the co-founder and CTO of Semiotic Labs, leading AI and verifiability research for The Graph; he also participated in the development of the trading platform Odos (which has achieved a cumulative trading volume of $100 billion and served over 3 million users). He worked as an AI and cryptography researcher at Sandia National Laboratories, holds a master's degree in applied mathematics, and earned a Ph.D. in computer science from the University of California, Santa Barbara.

About Cambrian

Cambrian is an on-chain financial intelligence layer for agents, providing APIs for real-time and historical blockchain data to serve Agentic DeFi applications. The data covers yields, liquidity positions, risk exposure, whale dynamics, market sentiment, and standard DeFi metrics, aiming to provide verifiable financial insights.

For more information, please visit: https://www.cambrian.ai

This article is contributed content and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。