Bitcoin Market Analysis on August 10

Price Trend

- K-Line Pattern

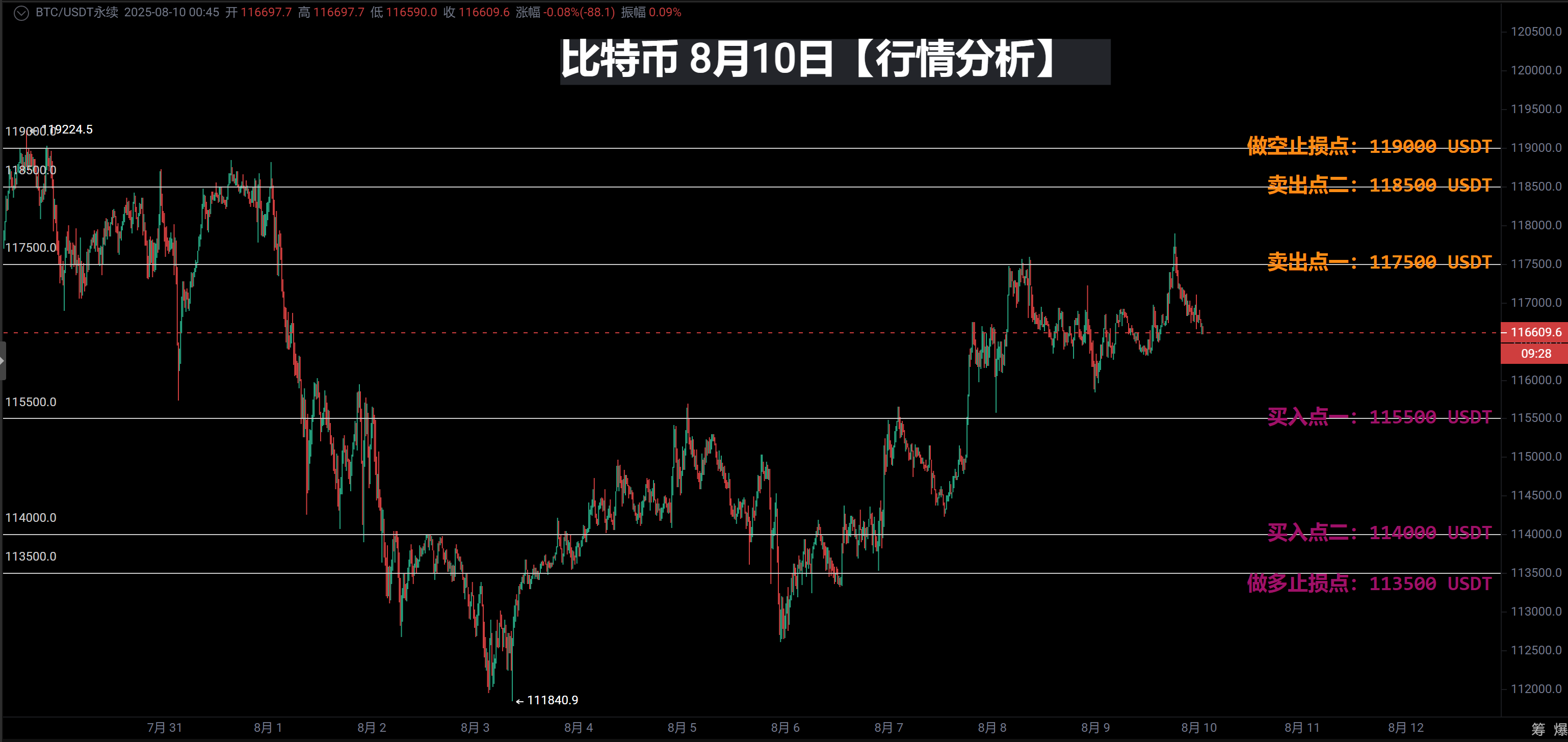

Recently maintained a range of 116,000–118,000 USDT, with multiple attempts to break the 117,500 resistance level being blocked.

The long lower shadow low on August 7 at 114,259 saw strong buying support, but the rebound faced selling pressure.

- Technical Indicators

MACD: DIF and DEA are diverging downwards, with the histogram's negative value expanding, indicating a continuation of the bearish trend but with weakening momentum.

RSI: RSI14 = 54.05, in the neutral zone, with unclear short-term direction.

EMA: EMA7 (116,064.69) and EMA30 (115,380.06) are both below the current price, indicating a flat short-term trend; EMA120 (107,125.17) is far away, suggesting a bullish long-term trend.

- Trading Volume

Volume has decreased from the peak of 24,487 on August 1 to 6,845 on August 9, indicating reduced activity.

Volume spikes are concentrated during significant fluctuations (e.g., the crash on August 1), with capital flowing in and out.

📌 Strategy and Levels

Long Position Area

115,500 USDT — Support at previous low (low on August 5 + integer level buying)

114,000 USDT — Low of the long lower shadow (August 6)

Stop Loss: 113,500 USDT (breaking below 114,000 may lead to further declines)

Short Position Area

117,500 USDT — Upper range resistance level, tested multiple times without breaking

118,500 USDT — High points on August 3–4, strong selling pressure

Stop Loss: 119,000 USDT (breaking above may push towards 120,000)

**—— Crypto Master Community, a community focused on technical analysis. Anyone with questions about operations or trends can communicate and learn together with me! Share and profit together! Remember to follow Crypto Master, available 24/7, and you won't get lost!

**[The above analysis and strategies are for reference only. Risks are to be borne by the reader. The article's review and publication may have delays, and the strategies may not be timely. Specific operations should refer to the real-time strategies of Crypto Master.]

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。