Author: Godot

In one sentence, Boros transforms the "changes" in CEX and DEX perpetual contract rates into tradable assets.

It is important to note that it is the trading of "changes" rather than simply tokenizing the rates themselves. Boros is essentially a perpetual contract rate prediction market.

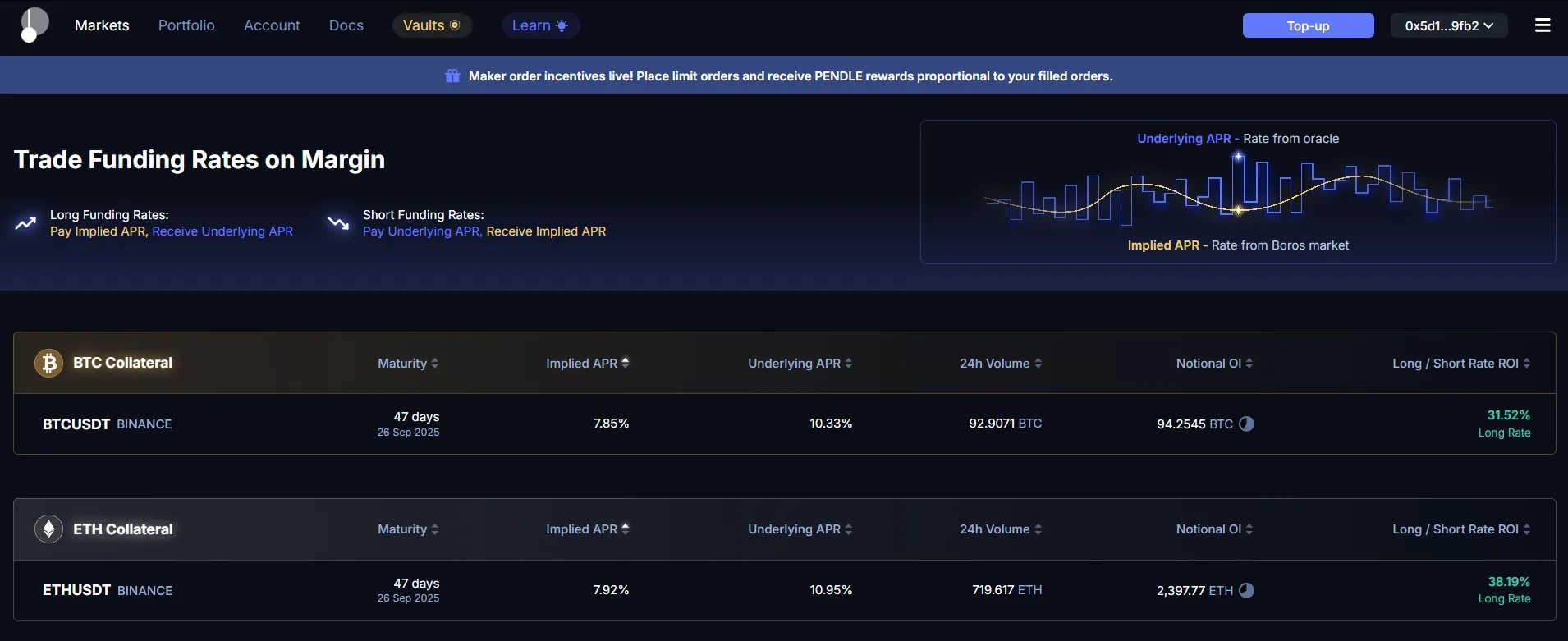

So how is this "change" reflected? Boros uses a comparison of two values to illustrate:

1) Implied APR: The current rate of the asset on Boros (which actually reflects the rate predicted by Boros traders);

The price of Implied APR is the result of user trading within Boros, as shown in the order book below.

2) Underlying APR: The actual rate of the asset on Binance's perpetual contract.

This is essentially displaying the current rate of Binance's perpetual contract in APR, or annualized form. For example, the current Binance BTCUSDT perpetual contract rate is 0.01%, settled every 8 hours. Therefore, the annualized, or Underlying APR is,

0.01% * 3 * 365 = 10.95%.

In summary, trading on Boros is essentially about whether the Underlying APR is higher or lower than the Implied APR, meaning whether the actual rate of Binance's perpetual contract in the near future will be higher than the current pricing on Boros.

If it is higher, the long position profits; if lower, the short position profits.

As the expiration date approaches, the Implied APR will converge towards the Underlying APR.

Thus, users trade the price of Implied APR on Boros, allowing for both long and short positions, currently supporting up to 1.4x leverage.

1/ Going Long

This is equivalent to going long on the rate, believing that the actual rate on Binance (Underlying APR) will be higher than the current rate on Boros (Implied APR).

At the end of the countdown to the Next Settlement time, the difference between Underlying APR and Implied APR is received, currently 9.77% - 7.84% = 1.93%.

Since the Binance perpetual contract rate settles every 8 hours, Boros does the same, so at the end of the countdown, one will receive,

1.93% / 365 / 3 = 0.001762%

which will be directly rebased into the account balance.

2/ Going Short

This is equivalent to going short on the rate, believing that the actual rate on Binance (Underlying APR) will be lower than the current rate on Boros (Implied APR).

At the end of the countdown to the Next Settlement time, the difference between Implied APR and Underlying APR is received, currently 7.84% - 9.77% = 1.93%.

Similarly, the profit will be,

-1.93% / 365 / 3 = -0.001762%

which will be directly rebased into the account balance.

The next question is: How does the Implied APR converge towards the Underlying APR as the expiration date approaches?

First, the existence of the Rebase mechanism for rate settlement every 8 hours will cause the Implied APR to converge towards the "actual cumulative average rate."

As the expiration date approaches, the uncertainty of rate fluctuations decreases, making arbitrage possible.

Assuming a scenario,

- BTC's current Implied APR on Boros = 6.50%

- The current actual rate on Binance, or Underlying APR = 8%

- The actual average rate over the past 47 days and 22 hours = 7.85%

- There are 2 hours left until the final expiration date

Actual Operation:

Going long on the BTCUSDT rate on Boros, supporting an Implied APR of 6.5%, will yield 8% at expiration, resulting in a net profit of 1.5% over 2 hours.

Calculation Process:

Over 48 days, there are a total of 48 * 24 = 1152 hours.

Even in the extreme case where the rate drops to 0, then,

(7.85% * 1150 + 0% * 2) / 1152 = 7.836%

In the worst-case scenario, at expiration, one would still receive 7.836%, resulting in a profit of 7.836% - 6.5% = 1.33% over 2 hours.

Summary:

Thus, the trading of rate changes on Boros and the actual rates on Binance's perpetual contracts are essentially two parallel pricing systems.

Trading on Boros reflects the market's expectations for future changes in market rates.

On the other hand, the rate settlement system every 8 hours (the 8-hour period is based on Binance's perpetual contract rate settlement rules; if Hyperliquid rate products are launched later, the settlement time for that series will be set to 1 hour according to Hyperliquid rules), along with arbitrage, ensures that the rates traded on Boros, i.e., the Implied APR price, will gradually converge towards the Underlying APR, which is the actual rate on Binance.

Since the pricing systems are relatively independent, where do the opposing positions for longs and shorts come from? What are the respective demands for going long and going short?

Using Boros to go long or short on rate changes is essentially the use case for Boros.

1/ Going Long

1) Pure directional speculation

For example, if the current perpetual contract rate is low, expecting the market to rise and drive the contract rate up.

2) Periodic trading

During weekends or institutional performance calculation times, when market trading is inactive and contract rates are low, one can choose to go long.

3) Mean reversion arbitrage

Expecting the current rate to be too low and at least revert to the historical average.

4) Cross-asset arbitrage

Two assets with a correlation approaching 1, such as BTC and ETH. However, if there is a significant difference in their current rates, one can choose to short the one with a higher Implied APR and go long on the one with a lower rate.

5) Event trading

Before anticipated positive events, such as tariff resolutions, go long on the rate.

6) Rate hedging

For example, staking in DeFi to obtain fixed income in the base currency while hedging short on perpetual contracts. If concerned about rates turning negative or fluctuating, going long on rates in Boros can make costs more fixed.

7) Advanced strategies

Such as combining with options trading to create advanced strategies.

2/ Going Short

1) Major client: Ethena Labs

Ethena's core revenue comes from shorting ETH to earn funding rates, rewarding USDE stakers.

Ethena can short ETH rates to provide fixed APY returns for USDE stakers. In this case, Ethena can actually launch tiered yield products, offering stakers both fixed and non-fixed APY options.

2) Miners/stakers hedging

Shorting ETH perpetual contracts to lock in ETH staking returns while shorting funding rates to lock in rates.

3) DeFi staking, hedging short position rates

Additionally, this includes purely speculative trading, periodic trading, and various arbitrage scenarios, etc.

Long and short demands serve as opposing positions.

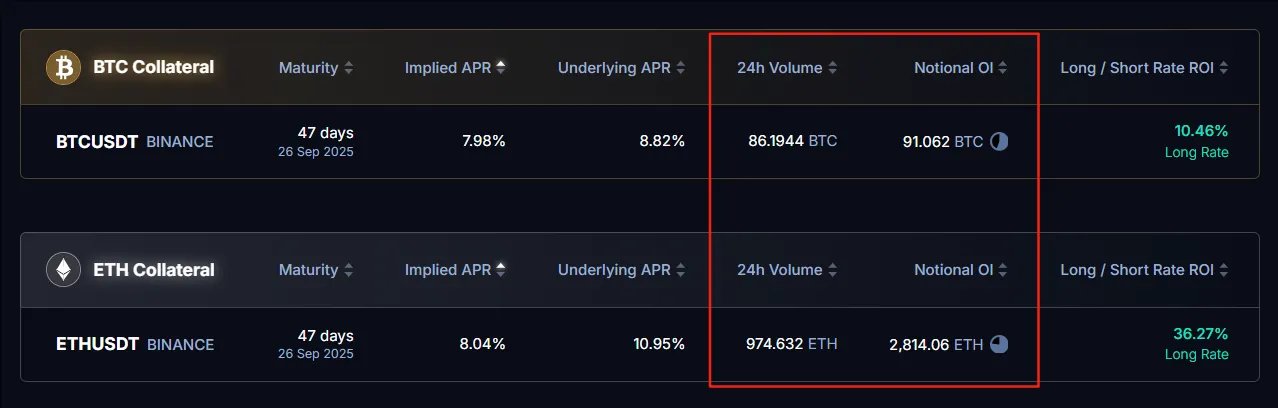

The following chart shows the 24-hour trading volume and positions on Boros one day after launch.

In summary, the design of the Boros product is extremely clever.

The independent pricing system allows users to trade rate changes on Boros, enabling market participants to speculate and reflect on future market changes.

If the current rate is forcibly anchored, the meaning of expected trading is lost.

There is potential for greater innovation in the future, such as creating various term products, 1 month, 3 months, 6 months, etc., and creating composite products, such as the average rates of multiple exchanges. As long as there is sufficient opposing demand for longs and shorts.

In fact, Pendle's PT and YT are also independently priced, not just mechanically anchoring the expected value of the underlying asset, especially YT, which allows market speculation to reflect future value, thus giving rise to airdrop scenarios.

That is, users holding YT, even holding it until it reaches zero, can receive airdrops from ETH Staking and Restaking projects.

Boros continues this concept, allowing the market to determine the reasonable price of rates, maintaining relative reasonableness through rate settlement and arbitrage mechanisms, but without forcibly anchoring.

Currently, Boros is an excellent tool for arbitrage and risk hedging, and in the future, it may become an indicator of market expectation changes and may give rise to more DeFi products.

Supplement:

Enter the product at https://boros.pendle.finance/markets, connect your wallet, and use the Top-up feature in the upper right corner to recharge, supporting the Arbitrum chain. Accounts are divided into Cross Margin and Isolated Account modes.

Currently, it supports Binance perpetual contracts for U-based BTC and ETH products. According to the official Docs, Boros will also support Hyperliquid.

Glossary:

1) YU (Yield Unit) - Yield unit. For example, 1 YU-BTCUSDT-Binance represents a 1 BTC position on Binance, generating all funding rate income from now until the expiration date; (YU is not mentioned in the original text to avoid increasing understanding difficulty)

2) Maturity: The expiration time of the YU contract, after which all income settlements are completed.

3) Implied APR: The market's expectation of the average funding rate before expiration, also the trading price of YU;

4) Underlying APR: The real-time funding rate of the asset on Binance's perpetual contract, obtained through an oracle, used for every 8-hour settlement;

5) 24h Volume: The total trading volume of YU in this market over the past 24 hours;

6) Notional OI: The total scale of all open contracts, measured in underlying assets (BTC/ETH);

7) Long/Short Rate ROI: The potential return rate calculated based on the difference between the current Implied APR and Underlying APR, indicating the relative advantage of going long or short.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。