What Does BNC Network’s $160M BNB Acquisition Mean for the Market?

BNB Acquisition : A First in Corporate Crypto History

BNB Network Company, the treasury arm of CEA Industries, has acquired $200,000 coins valued at approximately $160 million. This move accelerated BNC to become the first corporate treasury of Binance tokens. This purchase is a part of a landmark $500 million private placement, led by 10X Capital in partnership with YZi Labs, to fund a treasury strategy signifies exclusively on Binance and now holding the company’s primary reserve asset.

Source: Wu Blockchain

BNB acquisition of $160 Million coins to raise up to $1.25B for further growth expansion in Binance’s ecosystem is clearly a step forward in its growth. BNC Network which was earlier known as VAPE is steering its reserve management to focus solely on building significant exposure to Binance.

David Namdar to Lead New Strategic Treasury Vision focusing on BNB Acquisition

David Namdar will be taking the CEO position and reframing boards including executives from 10X Capital. Binance is the fourth largest crypto currency of the world and BNC Network aims to enhance its institutional representation among investors. This accumulation is creating awareness among token holders and increasing its institutional value.

The newly renamed company BNC Network has a wider plan to raise up to $750Million more for future BNB acquisition. It will give exposure to investors without requiring direct ownership of the token.

Price Surges Following BNB Acquisition News

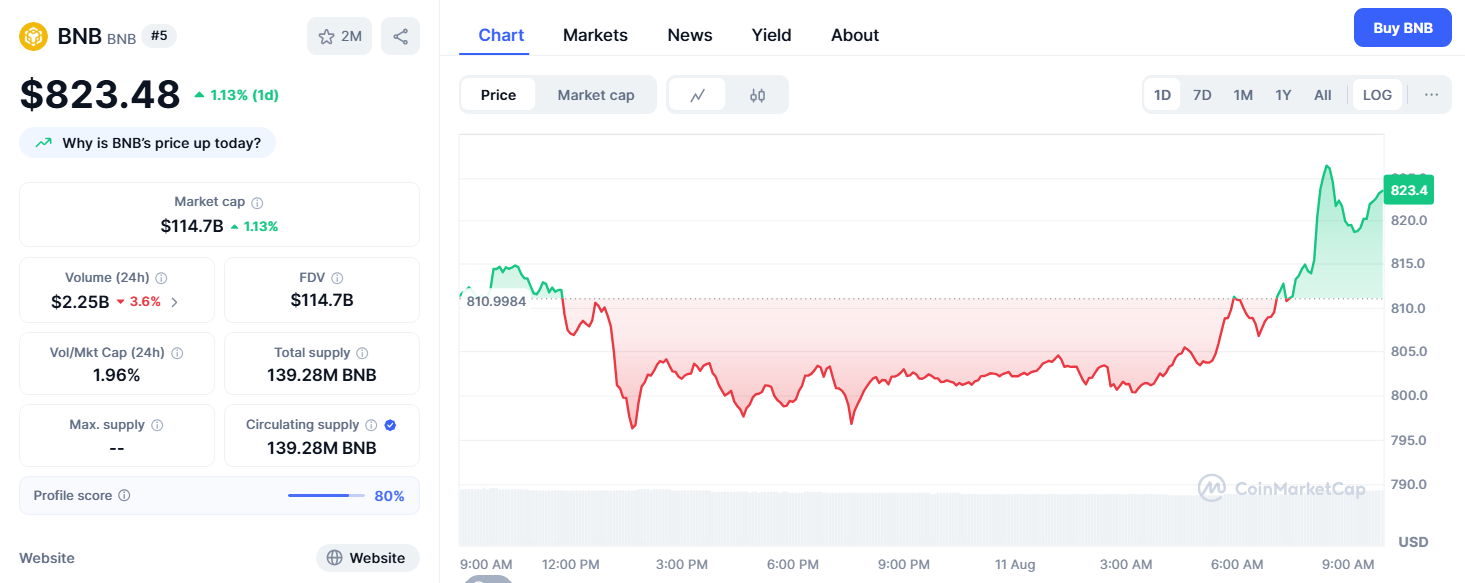

The token is currently trading at $823 and gained 1.13% in 24hrs. The coin surged more than 9% due to the BNC Network company news of accumulation of the coin to form an institutional reserve. The token is swinging between $750 - $820 price with a high of $823.

Source: CoinMarketCap

History shows that this kind of move often creates retail FOMO. Large-scale corporate purchases reduce circulating supply 139M coin in circulation while signaling institutional confidence. Its 24h volume dipped 3.6% to $2.25B, suggesting accumulation phase rather than speculative frenzy.

How BNB Acquisition will impact its Ecosystem

Institutional interest shifting towards altcoins rather than Bitcoin is building trust in investors. The corporate reserve acquisition signals a strong confidence in it’s ecosystem and gains momentum. It also adds a buying pressure, which results in positively influencing BNB’s market price and stability. Altcoin corporate treasury is trending nowadays more. Institutions are becoming more focused towards Altcoin rather than Bitcoin, building reserves and holding more.

Overall major public listed companies are focusing and showing their trust in cryptocurrencies by building their reserves and holding it for their future growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。