Author: Luke, Mars Finance

On August 11, 2025, a seemingly ordinary summer day marks a memorable fifth anniversary in the capital markets. Five years ago today, a business intelligence (BI) software company named MicroStrategy, which had seen little turbulence in the tech world and was growing steadily but sluggishly, made an announcement that would write a disruptive new chapter for the company and the entire industry: it purchased 21,454 bitcoins (BTC) for a total price of $250 million.

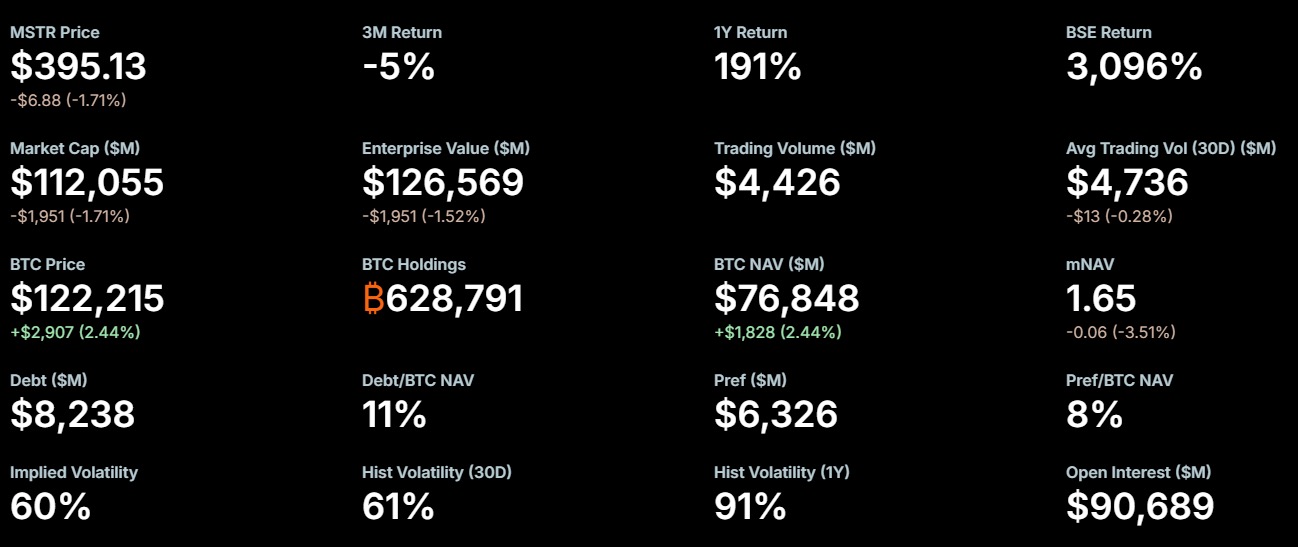

This move sent shockwaves through the capital markets at the time. A company listed on NASDAQ publicly announced for the first time that it would use bitcoin as its "primary reserve asset," which was unprecedented. At that time, MicroStrategy's market capitalization was only about $1.4 billion; five years later, its market cap has soared to over $112 billion, achieving an astonishing growth of more than 78 times, and it has officially rebranded as "Strategy." This leap was not merely a passive ride on the coattails of rising bitcoin prices but stemmed from a well-thought-out, bold, and meticulously designed multi-year strategy.

This fifth-anniversary review will take you back to the beginning, delving into the key decisions, financial alchemy, and risk management that defined this transformation, revealing the entire process of its evolution from a traditional software company to a bitcoin whale.

Chapter 1: Genesis - Responding to "Great Currency Inflation"

Catalyst of Macroeconomics

Let’s return to the macroeconomic backdrop of 2020. At that time, the world was shrouded in the shadow of the COVID-19 pandemic, and central banks around the globe implemented massive quantitative easing policies to combat economic recession. Cash returns continued to decline, and the trend of a weakening dollar became increasingly evident. For companies holding large amounts of cash, this constituted a silent erosion. It was against this backdrop that MicroStrategy's founder and then-CEO Michael Saylor began to seek a safe haven outside traditional assets.

In the official press release on August 11, 2020, the company clearly stated that the decision to invest in bitcoin was partly "driven by macro factors affecting the economy and business landscape, which we believe are creating long-term risks for our corporate financial plans." This clearly indicated that the move was not a spur-of-the-moment speculation but a well-considered defensive financial strategy aimed at hedging against macro uncertainties.

The "Melting Ice Cube" Theory

Michael Saylor vividly articulated his core argument with a compelling metaphor. He described the hundreds of millions of dollars in cash held by the company as a "melting ice cube," whose purchasing power was continuously eroding in an inflationary environment. In his view, converting this cash into an asset that could withstand inflation and preserve value was a fiduciary duty owed by the management to the shareholders.

Bitcoin became his ultimate choice. Saylor believed that, compared to holding cash, bitcoin as a "reliable store of value and attractive investment asset has greater long-term appreciation potential." This assertion placed the company's aggressive actions within a prudent financial management framework. It was no longer merely about pursuing high returns but actively protecting shareholder value from the erosion of fiat currency depreciation. This narrative was crucial for garnering understanding and support from early investors.

Viewing Bitcoin as "Digital Gold"

Saylor's theory went beyond this. He constructed a complete and persuasive value system for bitcoin, defining it as "digital gold." In the initial announcement, he detailed several outstanding attributes of bitcoin, including "global acceptance, brand recognition, ecosystem vitality, network dominance, architectural resilience, technological utility, and community spirit." He asserted: "Bitcoin is digital gold—more robust, stronger, faster, and smarter than any currency that preceded it."

This profound, almost faith-like recognition laid a solid ideological foundation for the entire bitcoin strategy. It explained why the company could maintain astonishing composure during subsequent market volatility. Because when the foundation of decision-making is a philosophical and ideological affirmation—namely, a denial of the existing macroeconomic consensus and an embrace of a new paradigm of corporate financial management—short-term market price fluctuations no longer pose a threat but instead become opportunities to increase holdings. This ideological steadfastness is the core driving force behind its ability to navigate bull and bear markets while continuously executing its strategy.

Chapter 2: Accumulation Engine - Financial Alchemy in Capital Markets

Strategy's bitcoin treasury was not built in a day. The evolution of its funding sources clearly outlines a path from utilizing its own cash to skillfully navigating the capital markets. This chapter will dissect the "financial alchemy" behind it.

From Own Cash to Capital Markets

In 2020, the company's initial bitcoin accumulation primarily relied on cash on its balance sheet. However, as ambitions grew, internal funds quickly became insufficient. A decisive turning point occurred at the end of 2020 when the company announced it would raise funds by issuing $650 million in convertible notes and use the proceeds to purchase more bitcoin. By December 21, 2020, the company had accumulated 70,470 bitcoins at a total cost of approximately $1.125 billion. This marked the official beginning of Strategy's financial engineering, transforming the company from a bitcoin holder into a "hunter" utilizing capital market tools to acquire bitcoin.

Convertible Bond Script

Convertible Notes became Strategy's most essential financing weapon in its early days. The brilliance of this financial instrument lies in its provision of a "go forward, retreat safe" option for investors.

- Mechanism Analysis: The company issued bonds at very low or even zero coupon rates. In return, bondholders received a call option: if the company's stock price rises above the agreed conversion price in the future, they can convert the bonds into company stock and share in the gains from the stock price increase; if the stock performs poorly, they can still recover their principal as creditors at maturity.

- Classic Cases: Over the following years, Strategy successfully employed this tool multiple times. For example, the convertible bonds issued in February 2021 maturing in 2027, and the convertible bonds issued in November 2024 maturing in 2029, the latter raised nearly $3 billion at a 0% interest rate.

- Volatility Arbitrage: This strategy was a perfect match for Strategy. MSTR stock, due to its high correlation with bitcoin, exhibited extremely high implied volatility. In financial pricing models, high volatility means the embedded call option is worth a fortune. It was this option value that allowed the company to attract investors at very low financing costs, effectively using market volatility to provide cheap leverage for its bitcoin acquisition plan. Interestingly, Michael Saylor's high-profile media image and bold statements also inadvertently fueled this volatility, creating a self-reinforcing cycle.

Utilizing Premium: At-The-Market (ATM) Offerings

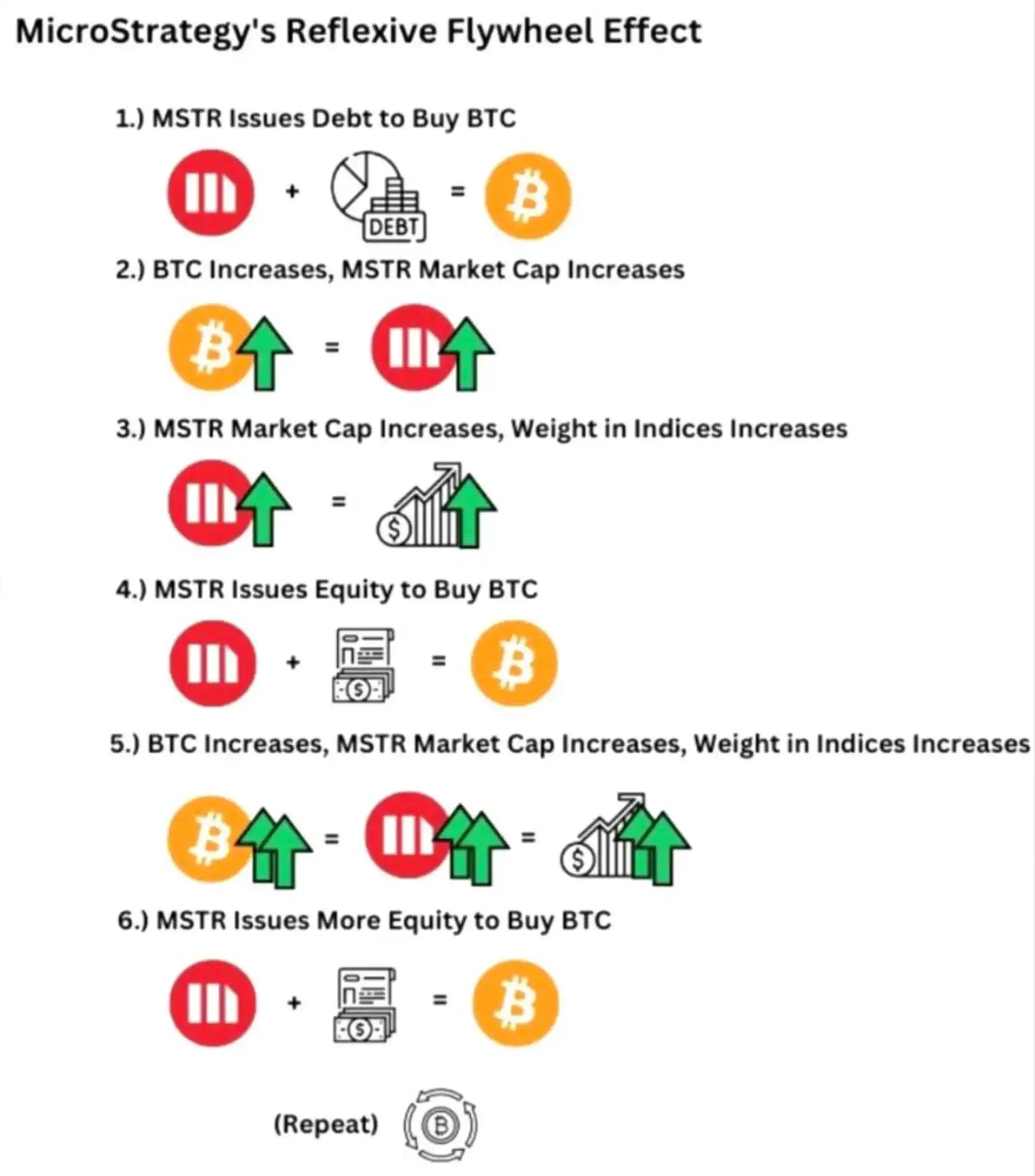

As the strategy progressed, the market gradually began to view MSTR's stock as a leveraged proxy for bitcoin. This led to a significant premium of its stock price relative to the net asset value (NAV) of the bitcoin it held. In other words, the market was willing to pay a higher price for bitcoin held indirectly through MSTR stock than for directly purchasing bitcoin, with this premium stemming from the compliance accessibility for institutional investors, the liquidity of the stock, and its inherent leverage effect.

Strategy keenly captured and "weaponized" this premium.

- "Crypto Reactor": The company launched a large-scale "At-The-Market" (ATM) program, continuously selling newly issued stock at a premium in the secondary market. It then used the cash obtained to purchase more bitcoin at market fair prices. This process was accretive for existing shareholders in terms of the "Bitcoin per Share" (BPS) metric. The company tirelessly promoted this metric to the market, successfully building a recursive loop: premium financing to purchase bitcoin attracted more investors, thereby maintaining or even pushing up the premium. This clever mechanism was vividly termed "Crypto Reactor" by analysts.

Innovation in Capital Structure: "Bitcoin Bank"

Entering 2025, Strategy's financial innovation reached new heights. It was no longer satisfied with a single financing tool but began to build a diversified capital structure aimed at becoming a "bitcoin bank."

- Securities Menu: The company successively issued various preferred stocks with different yields and risk levels, such as STRK, STRF, STRD, and STRC. These securities provided channels for investors with different risk appetites to participate in its bitcoin strategy, from equity investors seeking leveraged returns to credit investors pursuing stable high yields. Notably, the IPO of STRC in July 2025 became the largest IPO project in the U.S. that year, raising as much as $2.52 billion.

- Market Segmentation: Michael Saylor's ultimate goal was very clear: to transform Strategy into a leading bitcoin bank, creating a series of capital market tools around this "most valuable asset in the world." He publicly stated that his competitors were not other cryptocurrency companies but the traditional bond and preferred stock markets worth trillions of dollars.

This series of complex financial maneuvers indicates that Strategy's bitcoin strategy is far from a simple "buy and hold." It has evolved into a highly integrated financial ecosystem, a sophisticated machine capable of systematically capturing market sentiment (premium) and market volatility (low-cost debt) and converting it into sustained accumulation of core assets (bitcoin).

Table 1: Capital Formation for Strategy's Bitcoin Acquisition (2020-2025) The table below outlines the key capital raising activities undertaken by Strategy to fund its bitcoin acquisitions, showcasing the evolution of its financing strategy from reliance on internal cash to skillfully utilizing diversified capital market tools.

Chapter 3: Trial by Fire - Surviving the Crypto Winter of 2022

Any bold strategy must be tested by adversity. For Strategy, the crypto bear market of 2022 was that "trial by fire" determining its survival.

The Storm Approaches

In 2022, with the collapse of the Terra/Luna ecosystem and the bankruptcy of several crypto lending platforms, the entire crypto market plunged into a deep bear market. Bitcoin prices plummeted from their historic highs in 2021, and market panic spread. At this moment, all eyes were on Strategy, the company that had bet its life on bitcoin—could it survive this storm?

Panic of Margin Calls

Market concerns centered around a $205 million bitcoin collateral loan that Strategy obtained from Silvergate Bank in March 2022. In May 2022, the company's Chief Financial Officer, Phong Le, revealed during an earnings call that if the price of bitcoin fell to around $21,000, the company would face a margin call. This meant that the company would need to provide additional collateral, or else the bitcoin it had pledged as collateral would be at risk of forced liquidation.

This news immediately ignited market sentiment. As the price of bitcoin continued to approach this critical threshold, rumors of Strategy facing a liquidation became rampant. This was not only a test of the company's financial stability but also a judgment on the credibility of its entire bitcoin strategy.

Decisive Response

In June 2022, when the price of bitcoin indeed fell below $21,000, the market held its breath. However, the anticipated collapse did not occur. Michael Saylor's response was swift and decisive; he communicated a clear message to the market through social media and public statements: the company had anticipated such volatility and had constructed an appropriate balance sheet structure. He emphasized that the company held a significant amount of unencumbered bitcoin, sufficient to serve as additional collateral at any time. Shortly thereafter, the company officially confirmed that it had not received any margin call notifications and had enough capital to withstand further market fluctuations.

The resolution of this crisis revealed the deeper logic of Strategy's risk management strategy. Although the company employed high-risk leverage tools, it maintained a substantial strategic bitcoin reserve that was not tied to any single loan. This reserve acted like a firewall, ensuring that in extreme market conditions, the company had enough buffer space without being forced to sell assets at market lows. Saylor's confident and transparent communication during the crisis successfully stabilized investor sentiment and firmly controlled the market narrative.

Buying in a Bear Market

More importantly, Strategy not only weathered the crisis but also demonstrated the steadfastness of its strategy through action. Throughout the bear market of 2022, the company did not halt its progress; instead, it continued its strategy of "steady accumulation," adding over 8,109 bitcoins throughout the year. This move sent a powerful signal: the company's belief did not rely on a bull market; price declines were merely opportunities to acquire more quality assets at lower costs. In August 2022, Saylor stepped down as CEO to become Executive Chairman, allowing him to focus entirely on the bitcoin strategy.

The margin call incident of 2022 was a decisive moment in the legend of Strategy's bitcoin journey. It proved that the company's model could operate not only in favorable market conditions but also as an all-weather battle creed. This successful stress test not only solidified its position in the hearts of its followers but also laid a solid foundation of credibility for its subsequent larger-scale capital operations.

Chapter 4: Saylorism - Preaching, Identity, and the Endgame

To understand Strategy's success, one cannot overlook its soul figure—Michael Saylor. His role has transcended that of a traditional corporate executive; he is more like a preacher, a philosopher, and the core promoter of its bitcoin strategy.

The "High Priest" of Corporate Bitcoin

Saylor's public image is an indispensable part of his strategy. He frequently appears in various interviews and keynote speeches, using highly provocative language to paint a grand vision for bitcoin. Bold predictions such as "Bitcoin will rise to $1 million" and "The bear market will not return," while seen as almost arrogant in traditional finance, precisely capture the sentiment of the crypto community and inject continuous topicality and volatility into MSTR stock. This volatility, as previously mentioned, in turn fuels its low-cost financing strategy.

Educating the Market, Creating Consensus

Saylor understands that to have such an aggressive strategy accepted by the market, he must win the narrative war. To this end, the company began hosting the annual "Bitcoin for Corporations" summit in 2021. These summits are not merely marketing events but a carefully orchestrated industry education initiative. The company invites experts from institutions like Deloitte to explain in detail the legal, financial, and operational considerations of adopting a bitcoin strategy for corporations, providing a complete "action manual" for other companies. In this way, Strategy positions itself as an industry thought leader and pioneer, attempting to create a consensus that "adopting bitcoin is a wise move for corporations," thereby validating the correctness of its strategy.

Evolution of Identity

As the bitcoin holdings continued to increase, the company's identity underwent profound evolution.

- From BI Company to Bitcoin Proxy: Initially, the market and analysts gradually viewed MSTR's stock as a leveraged tool for investing in bitcoin, with its traditional software business's weight in valuation diminishing.

- Renaming to "Strategy": In February 2025, the company officially changed its name from "MicroStrategy" to "Strategy" and adopted a new logo featuring the bitcoin "B" symbol. This marked a complete transformation of the company's identity, with bitcoin no longer merely an asset on its balance sheet but becoming the "core" of its existence.

- Vision of a "Bitcoin Development Company": Recently, the company further positioned itself as a "bitcoin development company." Although details regarding specific software development investments and products remain vague, this signals the company's future ambition: to transform from a passive asset holder into an active builder of the bitcoin ecosystem, thereby binding the company's fate more closely to the future of bitcoin.

Paving the Way for Others

Strategy's success undoubtedly provides a blueprint for other publicly traded companies to follow. Under its leadership, tech giants like Tesla and Block (formerly Square) have also added bitcoin to their balance sheets. Recently, Trump Media and Technology Group announced a significant bitcoin purchase, hoping to replicate MSTR's stock price myth. The emergence of these followers further reinforces Strategy's position as an industry pioneer.

Fundamentally, Saylor's "preaching" is closely intertwined with the company's financial operations, mutually supporting each other. Continuous public promotion and industry education have established a loyal investor base, supporting the long-term premium of MSTR stock; the existence of this premium, in turn, is key to the operation of its financial accumulation engine. Each rebranding of the company is a carefully designed narrative upgrade aimed at ensuring the market values it according to the framework it has set. In this grand strategy, the narrative itself is a form of productivity.

Chapter 5: Leverage Masterpiece or House of Cards?

After five years of rapid advancement, Strategy's bitcoin strategy has achieved astonishing financial returns. However, the market's evaluation of it has shown a polarized view. Is this a financial masterpiece that creates value through leverage, or a house of cards built on risk?

Bullish Arguments: An Exceptional Investment Tool

Supporters argue that MSTR stock offers investors a unique investment tool superior to directly holding bitcoin.

- Leveraged Excess Returns: The data speaks for itself. Over the past five years, MSTR's stock price has risen approximately 7,700% (about 78 times), while bitcoin's increase during the same period was around 878%. This astonishing excess return stems from its highly leveraged balance sheet structure, which causes its stock price to exhibit a "high beta response" to bitcoin prices. In bull markets, its gains far exceed those of bitcoin itself.

- Unparalleled Access Channel: For many institutional investors constrained by compliance requirements that prevent them from directly purchasing cryptocurrencies, MSTR provides a perfect solution. It is a regulated, liquid stock traded on NASDAQ, opening the door for these institutions to invest in bitcoin indirectly, efficiently, and with leverage.

- Analyst Endorsements: Several Wall Street investment banks have given MSTR a "strong buy" rating. Analysts from firms like Cantor Fitzgerald and BTIG believe that the company's massive bitcoin reserves are a unique asset unmatched by any other entity and have set extremely high target prices.

Bearish Arguments: Concentrated Risks and "Ponzi" Structure

Critics are equally sharp, pointing out the significant risks lurking behind the model.

- Extreme Volatility and Correlation: The company's fate is entirely tied to the price of bitcoin. This singular risk exposure causes its stock price to be extremely volatile. If bitcoin enters a prolonged deep bear market, the consequences could be catastrophic.

- "Ponzi Elements" Allegations: The most profound criticism targets the core of its business model. Some analysts argue that the "bitcoin yield" heavily promoted by the company, which refers to the increase in bitcoin per share, does not come from real business operations but rather from a wealth transfer from new investors to old ones. The logic is that new investors buy the company's newly issued stock at a high premium, and the company uses this premium-inclusive capital to purchase bitcoin at market prices, thereby increasing the company's total holdings, which increases the bitcoin quantity represented by each share held by old shareholders. In this model, the premium paid by new investors is the "yield" received by old shareholders. Therefore, critics argue that "new investors themselves are the yield."

- Stagnation of Core Business: Financial reports show that the revenue from its traditional software business has been stagnant or even declining for years. This means that if the bitcoin strategy fails, the company lacks a strong core business capable of generating stable cash flow as a backup.

- Governance Risks: The company's strategy and decision-making are highly centralized in the hands of Michael Saylor, raising concerns about key person risk. Additionally, the company has not provided publicly verifiable on-chain reserve data, raising questions about transparency.

At its core, the bullish and bearish arguments are two sides of the same coin. The mechanisms that have created astonishing returns—leverage, stock premiums, and extreme bets on a single asset—are also the sources of risk. Therefore, investing in MSTR is not only a bet on the long-term price trajectory of bitcoin but also a wager that the market will continue to grant MSTR this unique premium. It is a double gamble.

Table 2: Comparative Performance Analysis (August 2020 - August 2025) The table below visually demonstrates the high-risk, high-return characteristics of Strategy (MSTR) by comparing its five-year performance with its underlying asset (bitcoin), mainstream tech indices (NASDAQ 100), and traditional safe-haven assets (gold).

Note: Some final values are estimates based on existing data trends, intended to illustrate relative performance. MSTR's total return rate is derived from user-provided data and other sources.

Conclusion: Five-Year Legend and Future Path

Looking back at Strategy's journey over the past five years, its success can be attributed to four interlinked key decisions:

- Shift in Thinking: In the midst of macro changes, a decisive philosophical shift was made from embracing cash to viewing it as a liability, establishing bitcoin as the new value anchor.

- Building the Capital Engine: A creatively designed and executed diversified capital accumulation engine was systematically developed to transform market volatility and investor sentiment into fuel for purchasing bitcoin.

- Perseverance in the Bear Market: During the industry winter of 2022, the company successfully withstood the margin call crisis through a clever financial structure and steadfast belief, increasing its holdings against the trend, proving the resilience of its strategy.

- Control of the Narrative: Through Michael Saylor's personal charisma and the company's strategic communication, the market perception was successfully shaped, deeply binding the company's identity to its bitcoin strategy and providing public support for its financial operations.

Replicable Blueprint or Unique Phenomenon?

Although other companies have begun to emulate Strategy by incorporating bitcoin into their balance sheets, the complete script of "Saylorism"—the combination of financial engineering, leader cult of personality, and a thorough transformation of corporate identity—may very well be a unique phenomenon created by a specific individual in a specific historical period, difficult to fully replicate.

A Long Road Ahead

The first five years have written a magnificent chapter, but the road ahead remains full of challenges. The core question is: with the proliferation of compliant products like bitcoin spot ETFs, can MSTR's high premium be sustained? What regulatory risks will the company face? Will its transformation into a "bitcoin development company" be successful, and can it create real operational value from the ecosystem?

The first act of Strategy has been successfully performed, but the grand play is far from over. The world will watch closely to see how its second act will continue the legend or lead to an ending.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。