In July, the global market welcomed a critical turning point. Trump rarely "pressured" the Federal Reserve, attempting to push for interest rate cuts to alleviate government debt pressure, but Powell maintained independence and kept interest rates unchanged, causing market expectations for a rate cut in September to drop from 60% to 47%. Meanwhile, the tariff war entered a "post-era." Although the game is not completely over, market reactions have become muted. The three new main lines in the post-tariff war era are interest rate cuts, AI, and the institutionalization of crypto assets.

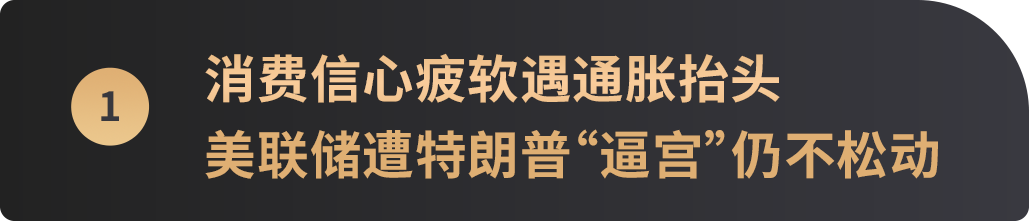

Currently, the U.S. economy resembles a tightrope walker: on one side is consumer confidence, a "soft footstone"—the consumer confidence index in July slightly climbed to 97.2, up from 95.2 in June, but it is indeed below market expectations, reflecting overall consumer caution, especially regarding confidence in the job market; on the other side, there is inflation pressure, with the June CPI rising 2.7% year-on-year and 0.3% month-on-month. Consumers' concerns about tariff policies potentially driving up prices are intensifying, adding significant uncertainty to future inflation trends.

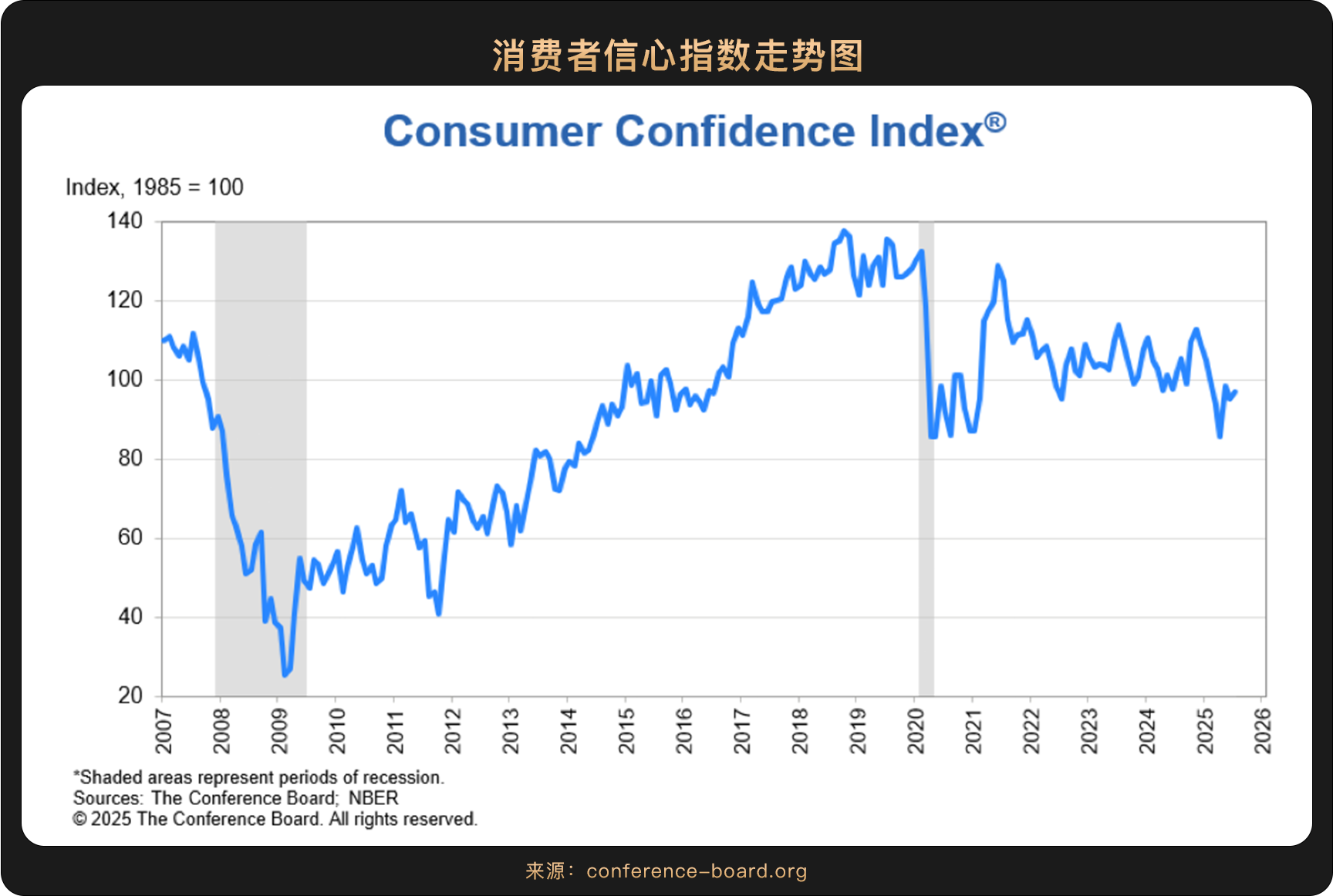

Faced with a complex economic situation, the pressure on the Federal Reserve is naturally increasing. However, at the latest interest rate meeting on July 31, the Federal Reserve still chose to hold steady and maintain interest rates unchanged, marking the fifth consecutive time this year that the benchmark rate has remained in the 4.25%-4.5% range. This decision triggered strong dissatisfaction from President Trump, who rarely personally went to the Federal Reserve headquarters to apply pressure, demanding a significant rate cut to 1% and attempting to use issues like the Federal Reserve building renovation overruns as political leverage. At this meeting, for the first time since 1993, two governors appointed by Trump—Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller—cast dissenting votes in favor of an immediate 25 basis point rate cut, indicating a public division in decision-making within the Federal Reserve.

In the face of pressure, Federal Reserve Chair Powell stood firm, asserting that monetary policy is data-driven and not influenced by "shouting." He stated that the current inflation level is still above the Federal Reserve's target and that a moderately restrictive policy stance needs to be maintained.

This tough stance directly affected market expectations.

Currently, the market is focused on the September interest rate meeting, with the probability of a 25 basis point rate cut rising to between 65% and 90%. Some institutions (such as Goldman Sachs and Citigroup) predict that the Federal Reserve will cut rates consecutively in September, October, and December, totaling 2-3 cuts.

However, Federal Reserve Chair Powell and most officials are cautious about a rate cut in September, emphasizing the need to observe more economic data, especially regarding employment and inflation dynamics, and have not made a clear decision on a rate cut. Powell's remarks once caused expectations for a September rate cut to drop to about 40%.

In fact, the Federal Reserve has been striving to maintain policy independence in this dilemma, but the shadow of political intervention looms large. Recently, Trump, dissatisfied with the latest employment data released by the U.S. Department of Labor, ordered the dismissal of the head of the Bureau of Labor Statistics, a subordinate of the Department of Labor. This series of actions has heightened market concerns about the uncertainty of U.S. economic policy.

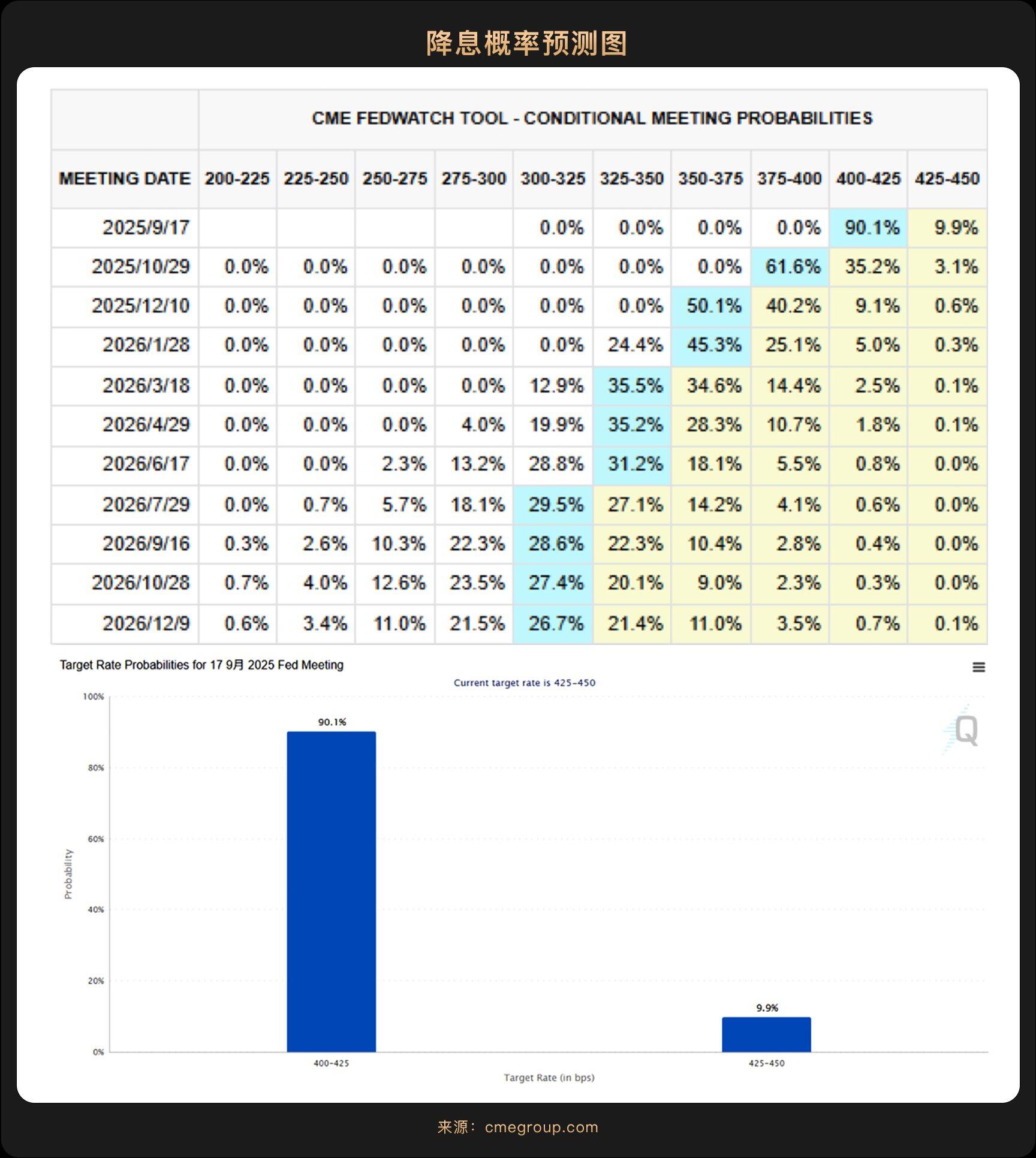

The U.S.-led tariff policy, once a "market bomb," is now taking a back seat. In July, the U.S. signaled tariff easing with major economies such as China, Europe, and Japan. Notably, at the end of the month, the U.S. and Europe announced a new trade agreement. Although the U.S. still imposes a 15% tariff on most EU goods, this is lower than the originally threatened rate, reducing short-term uncertainty and pushing the S&P 500 and Nasdaq to new historical highs. Looking ahead, although localized tariff frictions may still occasionally "increase," the market generally believes that the overall tariff level will be controlled within a "safe zone that does not push the economy into recession," much like installing safety rails on a roller coaster.

This trend of "easing worst expectations" has become an important psychological foundation for the new highs in U.S. stocks and crypto, indicating that global capital will reassess risks and opportunities in a new round.

In this new opportunity, the commercialization breakthrough of AI has taken up the banner of new market narratives. In the latest earnings season, tech giants generally exceeded expectations, with Meta (Nasdaq: META) and Microsoft (Nasdaq: MSFT) standing out. Meta benefited from AI technology's deep empowerment of its advertising business, with its stock price soaring significantly after the earnings report, bringing its market value close to $2 trillion, soon to join the "trillion-dollar club" alongside Google (Nasdaq: GOOGL) and Amazon (Nasdaq: AMZN); Microsoft (Nasdaq: MSFT), driven by strong growth in Azure cloud services, became the second company after Apple (Nasdaq: AAPL) to officially enter the "four trillion-dollar club." The once-dominant tariff issue is retreating, indicating that investors' sensitivity to such policy risks is decreasing, and the profit expectations brought by AI innovation are becoming the core driving force of the market, especially in the tech sector.

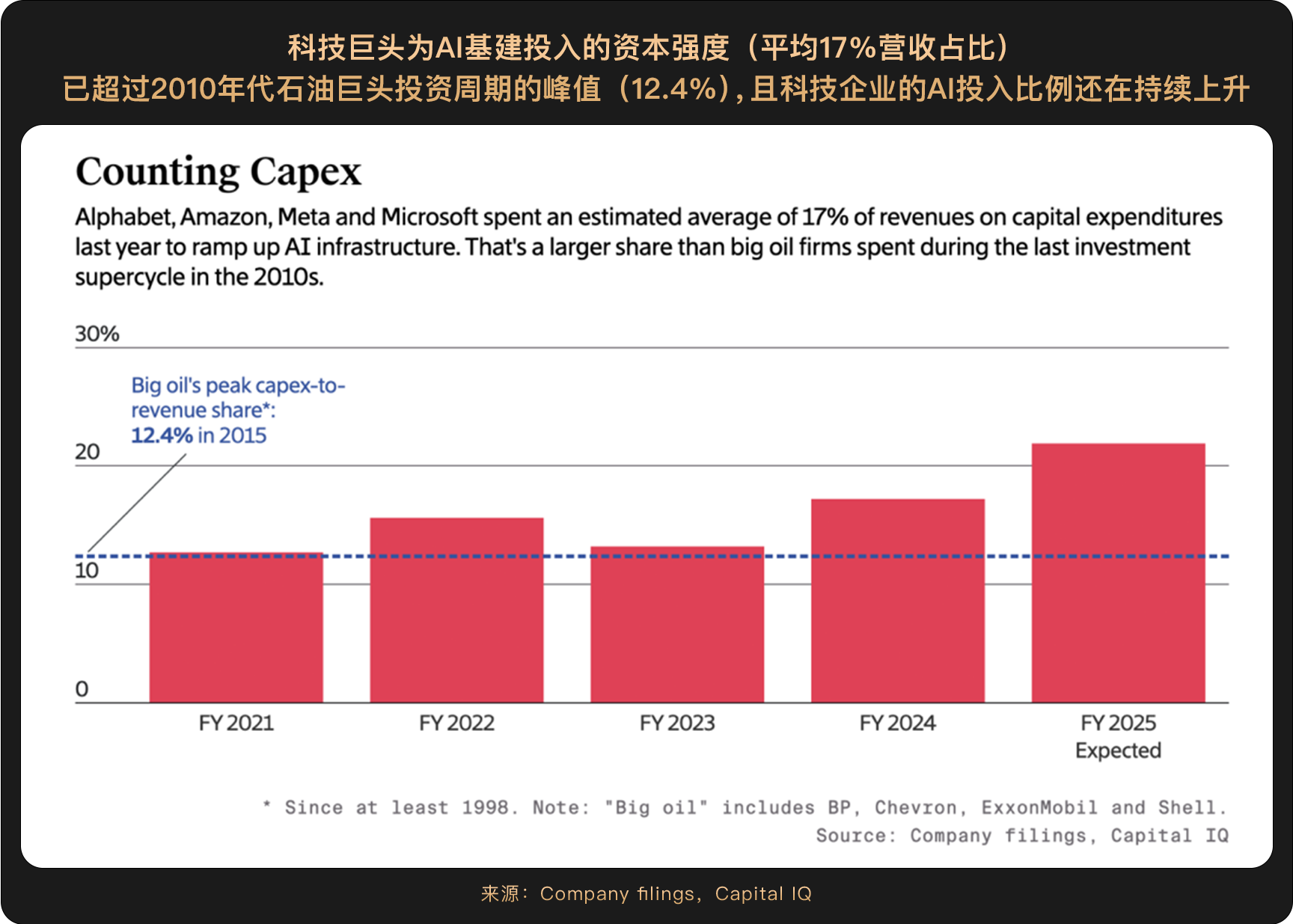

More importantly, these leading tech companies are ramping up AI investments with unprecedented intensity. Meta announced an increase in its capital expenditure plan for 2025 to $72 billion, while Microsoft plans to invest $120 billion in AI infrastructure by 2026. Such a massive investment scale not only demonstrates the companies' firm confidence in the future of AI but also suggests that the commercialization process of AI may be more rapid than the market expects.

The current market is shifting gears: the dominant pattern of trade frictions over the past few years is gradually receding, and new technology tracks represented by AI are beginning to attract more attention, further changing the market's capital allocation pattern.

In this wave of tech investment frenzy, WealthBee has observed that digital assets are becoming a new option for corporate balance sheets, with more and more listed companies starting to include cryptocurrencies like Bitcoin in their corporate reserve assets. These pioneering "early adopters" typically share two characteristics: first, they generally pay attention to the turning point of global monetary policy and potential inflation pressures, viewing the scarcity and decentralization of cryptocurrencies, especially Bitcoin, as effective tools for hedging against inflation and systemic risks; second, the tech industry they belong to has a natural affinity for new asset classes. Against the backdrop of a turning point in global monetary policy, the scarcity characteristics of cryptocurrencies make them a natural potential tool for these companies to hedge against inflation.

Unlike the market trends of the past few years, which relied on retail FOMO sentiment to "push the wave," the approval of Bitcoin spot ETFs at the beginning of 2024, including 11 institutions like BlackRock and Fidelity obtaining SEC entry permits, has fundamentally reshaped the capital structure and operational logic of the crypto market. By July 2025, this transformation has become even more profound.

Throughout July, Bitcoin's price began a sharp upward trend from the beginning of the month, breaking through key resistance levels in the first half of the month. Compared to the beginning of the year, it has shown a fluctuating upward trend, with a cumulative increase of over 20%. The influx of funds has also shown explosive growth, with institutional investors building large positions through ETFs. As of July 2025, the total scale of Bitcoin ETFs in the U.S. is approximately $110 billion, and the market size continues to grow rapidly. Among them, the iShares Bitcoin Trust ETF under asset management giant BlackRock accounts for nearly 48% of the market share, holding over 540,000 Bitcoins, with a market value of about $51.5 billion.

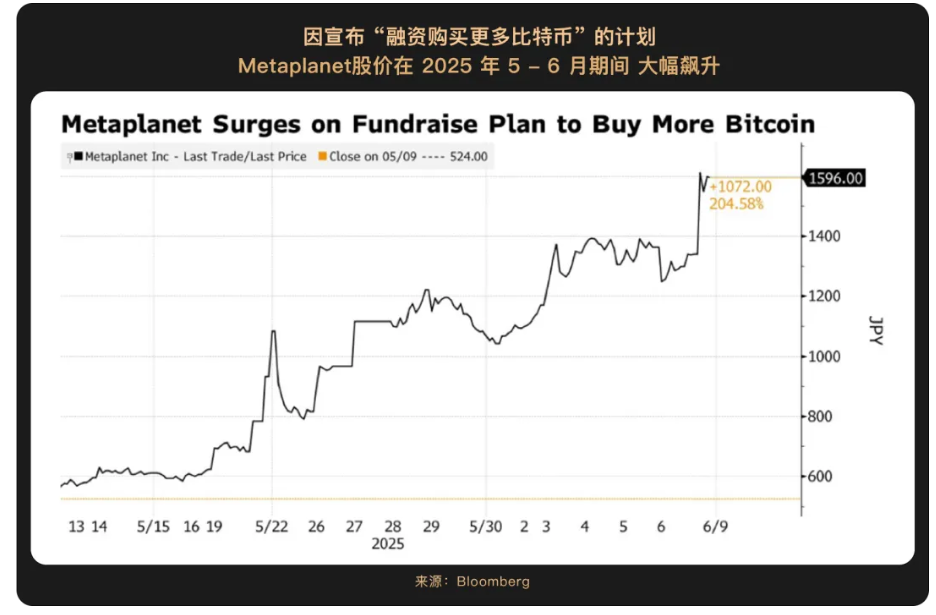

Institutional investors no longer view Bitcoin merely as a high-risk speculative asset but have incorporated it into their long-term asset allocation framework, initiating a competition for corporate-level holdings and driving the market to form a more complex "coin-stock linkage" mechanism: the absolute leader in corporate Bitcoin holdings, Strategy (Nasdaq: MSTR), continued to add spot Bitcoin positions in July despite high prices, stating in the latest disclosed 8-K form that the company purchased $2.46 billion worth of Bitcoin in the last week of July; Japanese listed company Metaplanet also followed Strategy's example, acquiring Bitcoin as a core strategic asset through a series of acquisitions, increasing its Bitcoin reserves to 4,206 coins, ranking among the top ten listed companies globally in Bitcoin holdings. The company also plans to accumulate 21,000 Bitcoins by the end of 2026.

Notably, companies are no longer simply "buy and hold" Bitcoin but are developing a reserve structure that combines equity/debt/derivatives. For example, Metaplanet achieves zero-cost financing for hoarding Bitcoin by issuing zero-coupon bonds → granting stock appreciation rights (SARs) → redeeming bonds with exercise funds upon maturity. The market is also beginning to assign a premium to the financial engineering capabilities of such companies.

Looking at the regulatory aspect, the U.S. SEC has released general listing standards for cryptocurrency ETPs, allowing assets with more than six months of futures trading history to apply for ETFs. The first batch of Altcoin ETFs is expected to be approved in September-October 2025; the Stablecoin Genius Act is just one step away from presidential signature, and the "U.S. Digital Asset Market Clarity Act" has also begun its process in the Senate, clearing legal ambiguities for institutional participation. In Hong Kong, the "Stablecoin Regulation" came into effect on August 1, requiring 1:1 reserves, a capital threshold of 25 million HKD, and transparent audits, accelerating the layout of Chinese-funded enterprises (such as JD.com). It is evident that the focus of this round of regulatory coordination is to clear rule barriers for traditional capital entry and enhance the efficiency of traditional capital entry.

The crypto market in Q3 2025 is no longer solely driven by one-way ETF funds; it has firmly established a new starting point of "institutional dominance + financial engineering + regulatory compliance." The era of price speculation driven by emotions is quietly fading away, and a more mature and resilient market ecosystem is unfolding in the resonance of rules and innovation.

Overall, although changes in expectations regarding the pace of interest rate cuts and the commercialization process of AI may still trigger periodic market fluctuations in the future, systemic risks have significantly decreased, and a new digital economic cycle is accelerating its formation. The deep integration of crypto assets with the traditional financial system is now irreversible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。