Author: J.A.E, PANews

Pendle, which innovates on-chain yield trading with the PT/YT mechanism, is expanding its territory into the trillion-dollar derivatives market. On August 6, 2025, its new product Boros was launched, achieving on-chain tokenization and hedging of perpetual contract funding rates for the first time, marking a key strategic transformation for Pendle from a "yield management protocol" to "DeFi interest rate infrastructure."

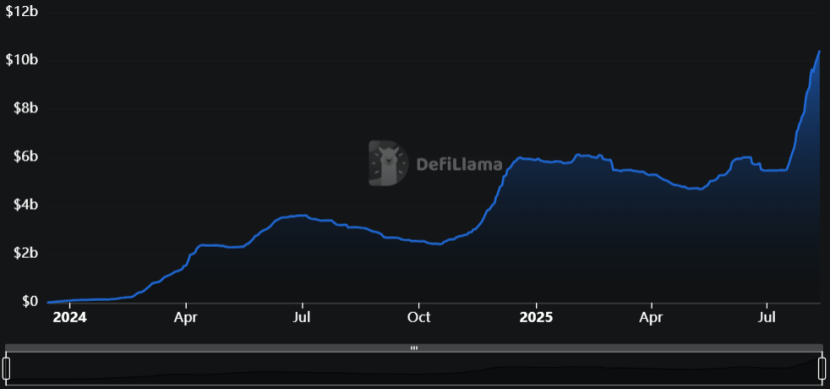

In the past year, Pendle has experienced explosive growth, with TVL surpassing $10 billion, and is no longer limited to splitting existing yields but is committed to building a complete on-chain yield curve.

Nansen has pointed out: "Pendle is becoming the interest rate infrastructure in the DeFi space." The birth of Boros is a core piece in realizing this ambition.

Core Mechanism of Boros: The "Interest Rate Derivatives" Market for Funding Rates

Pendle has built a new platform Boros on Arbitrum, with the core function of converting the highly volatile funding rates of perpetual contracts into tradable tokenized tools—Yield Units (YUs). Each YU represents the yield rights of 1 unit of collateral asset (such as BTC/ETH) over a specific period (e.g., 1 YU-ETH represents the yield of 1 ETH nominal value until maturity). The mechanism of Boros references the YT (Yield Token) representing future yield rights in Pendle V2, and the logic is similar to TradFi's interest rate derivatives.

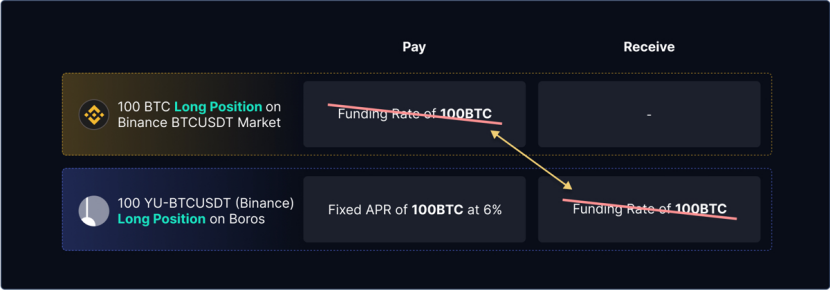

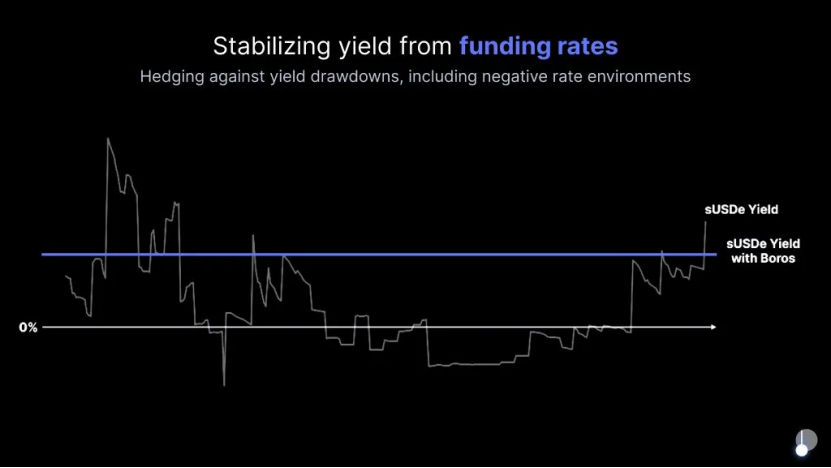

Boros has created a floating-fixed funding rate swap market, allowing users to hedge risks or bet on the rise and fall of funding rates according to their needs. Boros provides effective on-chain tools for users with risk hedging needs, allowing users facing funding rate risks due to spot-perpetual contract basis arbitrage or Delta-Neutral strategies in the perpetual contract market to offset their funding rate exposure on exchanges by paying a fixed rate and receiving a floating rate, thus earning yields or locking in maximum holding costs.

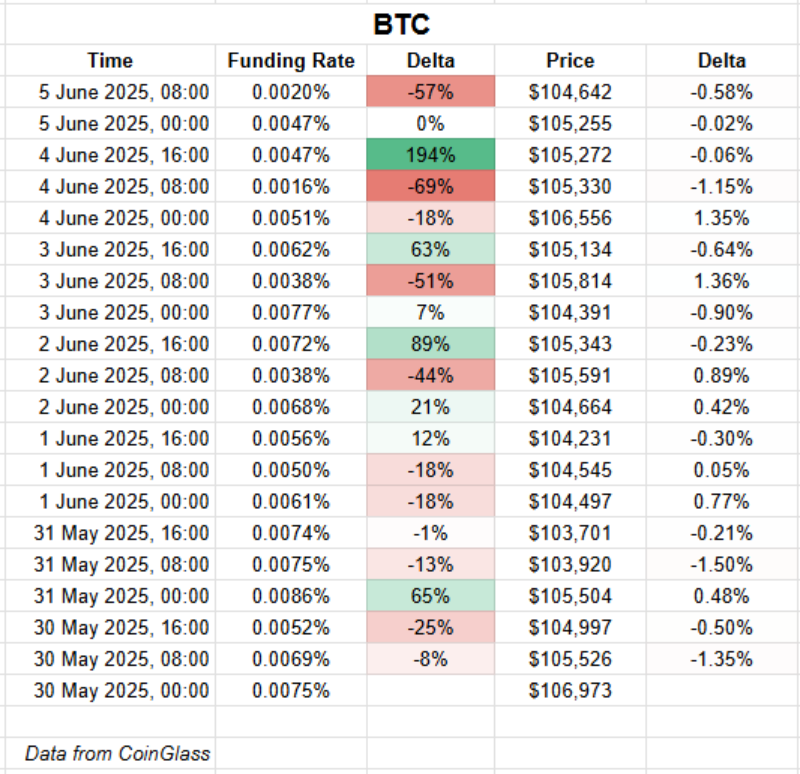

Similarly, Boros has created a new trading variety for users with trading needs, allowing users to judge the future trend of funding rates, going long on YUs to bet on their rise or going short on YUs to bet on their fall, thus profiting from the volatility of funding rates. It is worth noting that, over the same period, the volatility of perpetual contract funding rates is much higher than that of their prices.

The Pendle team believes that risk management is the primary focus in the early stages, so Boros adopts a cautious risk control strategy, with an open interest (OI) limit of $20 million nominal value and a leverage ratio controlled at 1.4 times.

Addressing Market Pain Points: Injecting Stability and Efficiency into DeFi

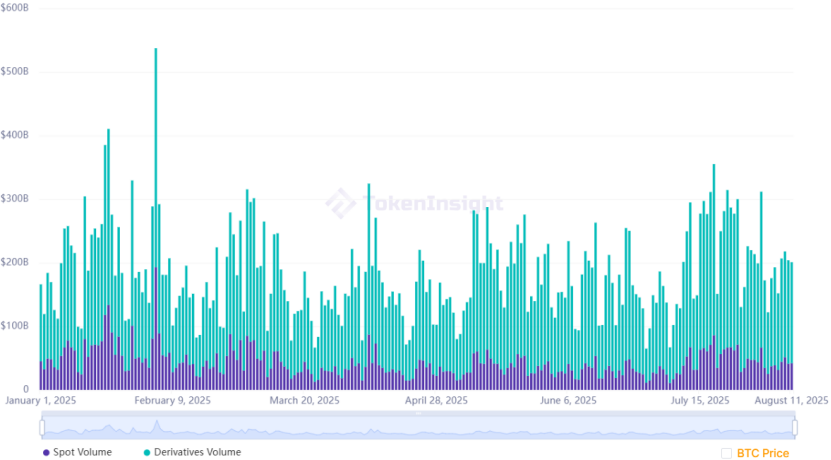

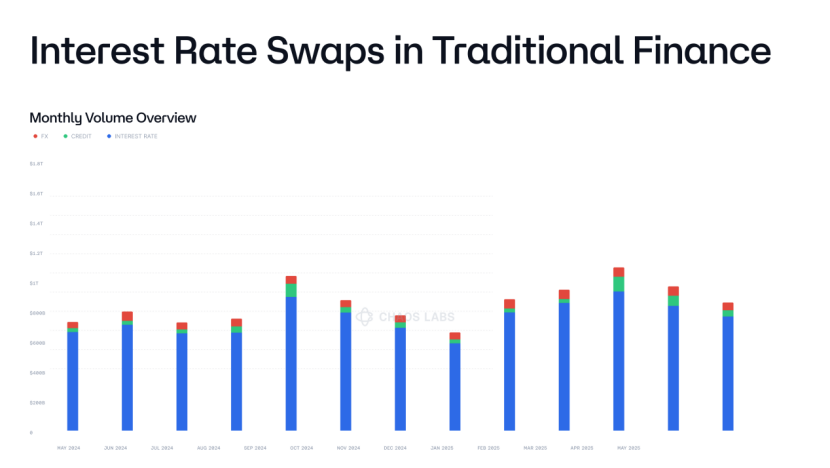

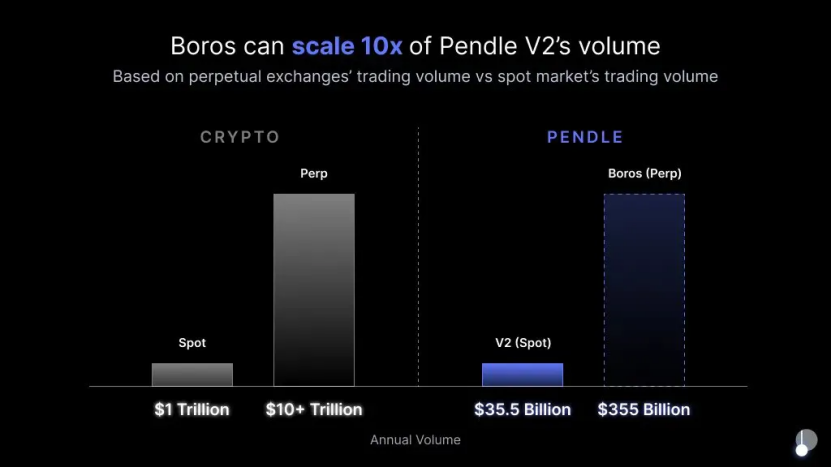

In the crypto market, the trading volume of derivatives far exceeds that of spot trading.

Perpetual contracts are the main trading variety, with an average daily trading scale of about $1 trillion.

Referring to the structure of TradFi's derivatives market, the interest rate swap market accounts for the vast majority of trading volume. Perpetual contracts are equivalent to the cornerstone of crypto asset derivatives, and the closely related funding rate derivatives market may become one of the largest emerging markets in the entire DeFi ecosystem.

However, the high volatility of funding rates and the lack of effective on-chain hedging tools are long-standing "pain points" in the DeFi derivatives market, which not only increases users' risk exposure but also limits the influx of incremental funds and the stability of DeFi strategies.

The emergence of Boros is particularly important for Delta-Neutral protocols. Such protocols typically rely on funding rates to maintain returns and have a strong demand for stable yields and risk hedging. Taking Ethena as an example, it has a TVL exceeding $10 billion, and the stablecoin USDe it issues is backed by volatile assets such as BTC, ETH, and LST. To achieve Delta-Neutral conditions, Ethena will use collateral as a spot position and open a short perpetual contract position on exchanges to hedge price fluctuations.

Although Ethena maintains a Delta-Neutral position, it still has to bear the funding rates charged by exchanges, which is also one of Ethena's revenue sources. When the funding rate is positive (long OI > short OI), Ethena will profit because the long side pays the funding rate to the short side; however, when the funding rate is negative (short OI > long OI), Ethena will incur losses. At this time, Boros can act as a key "shock absorber," helping to mitigate the risks brought by negative funding rates and smooth the yield curve.

Pendle co-founder and CEO TN Lee emphasized: "With daily trading volumes in the hundreds of billions for the perpetual contract market, there has never been a scalable, permissionless on-chain way to hedge or trade funding rates. Boros will change that." Infrastructure-level enhancements may also attract more incremental funds.

Value Proposition: Empowering Ecological Win-Win

Upon its release on August 6, Boros saw $PENDLE rise over 40% within the week, with prices nearing $6. The strong upward momentum also validates the market's recognition of its potential.

Boros will enhance the value capture capability of $PENDLE, with 80% of the fees generated by the protocol being allocated to vePENDLE holders, thereby solidifying vePENDLE's position as the core value capture module of the ecosystem. The accumulation of fees from Boros to vePENDLE will create a powerful positive feedback loop. Increased usage of Boros can bring more fees to vePENDLE, feeding back into more $PENDLE locked, further strengthening the incentive effect.

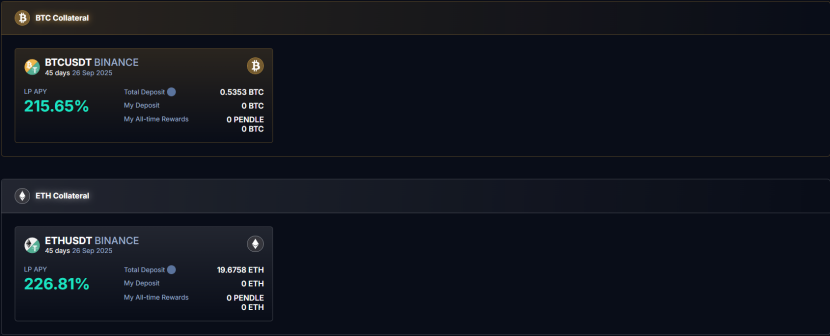

Boros has opened a dedicated Vault for LPs, allowing them to earn returns by providing liquidity to the funding rate swap market. Revenue sources include $PENDLE emission incentives, trading fees, and favorable changes in implied annualized yields.

Future Vision: A Yield Layer Throughout On-Chain Finance

Initially, Boros has only opened the funding rate market for BTC and ETH perpetual contracts on Binance, with plans to gradually expand to more mainstream perpetual contract platforms (such as Bybit, Hyperliquid, Bybit) and high liquidity assets (such as SOL, BNB). The well-known market maker Caladan has stated that it is providing liquidity for Boros.

In principle, Boros can be integrated into the entire DeFi ecosystem, becoming a core interest rate module, meaning it is not only an independent DApp but also a highly composable "Lego block" that can be seamlessly called by other protocols.

At the same time, the underlying architecture of Boros is designed with high scalability, which may unlock more types of variable yield sources. In addition to the yields within DeFi protocols, it can also integrate: 1) CeFi yield products, such as structured products from CEX; 2) TradFi yield tools: such as stocks, government bonds, money market rates, and mortgage rates; 3) RWA: including tokenized credit and private debt.

Boros enables the feasibility of most forms of yield streams becoming tradable financial instruments and collateral, pushing DeFi towards a more complete on-chain interest rate market, improving capital efficiency, and paving the way for risk-controlled leveraged strategies. In the long run, Boros can not only develop into the yield layer of DeFi but may also evolve into the yield layer of a broader tokenized financial ecosystem. When DeFi is capable of replicating the core interest rate markets of traditional finance, a true paradigm shift is about to occur.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。