The long-silent DeSci has welcomed a collective rebound, analyzing its reasons and KOL tracking list.

Written by: hoeem

Translated by: Tim, PANews

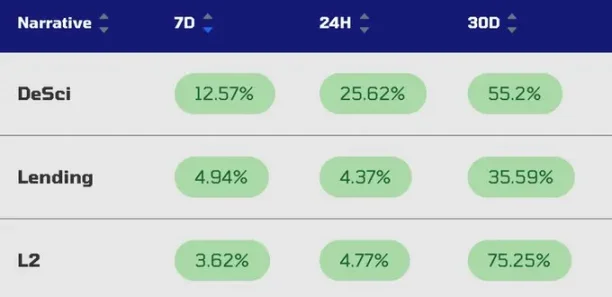

You are reading this article because you want to obtain a venture capital-level research report on the DeSci track, which has recently been one of the best-performing narratives in the crypto market, especially on August 7.

A bold idea, so keep reading. It only takes 5 minutes to finish, covering:

What are the currently hottest DeSci tokens?

Value discovery vs. mind share

Funding rates

Comparison of new and old tokens

Mind distribution in the DeSci track

Smart followers vs. ordinary followers

KOL accounts worth following in the DeSci track

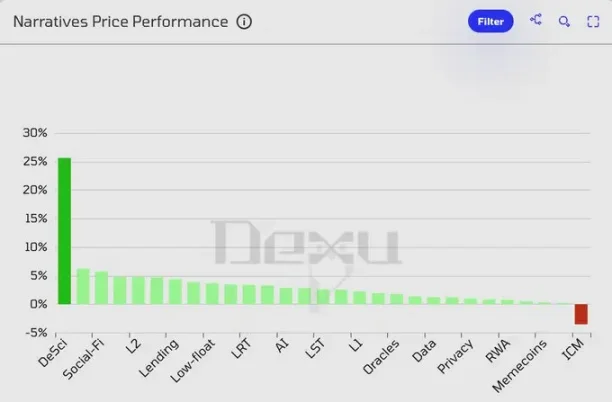

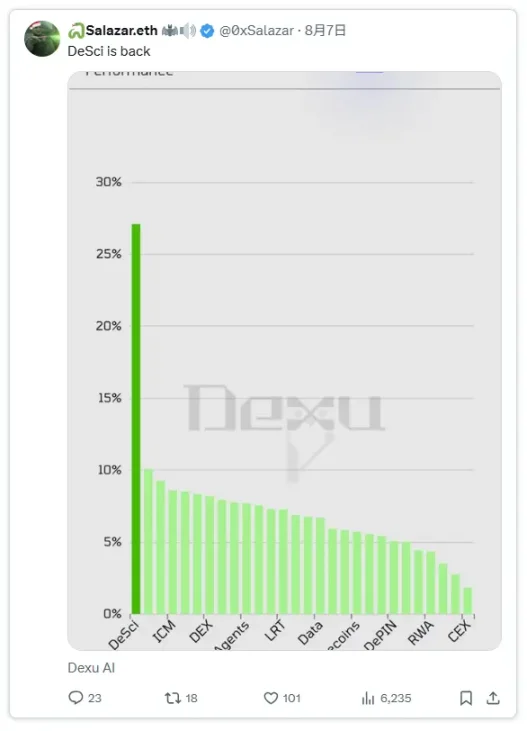

DeSci is the best-performing narrative sector today.

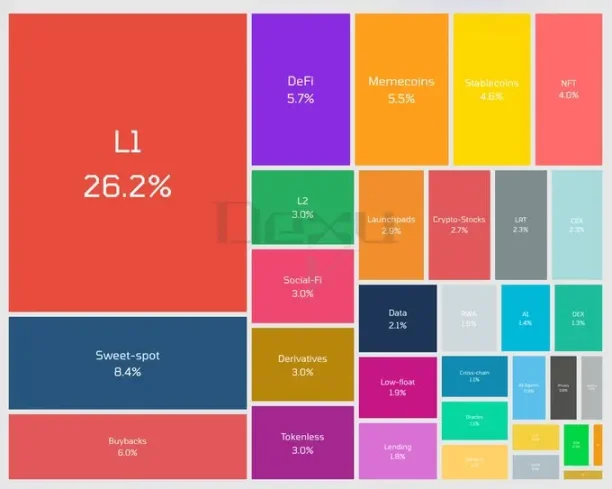

DeSci occupies only 0.2% of the mind share in the entire crypto field, yes, just that, the small orange box in the lower right corner.

It is a fact that attention is low, but that’s not all, because if we take a closer look at the biggest winners in mind share increase over the past week, we will find DeSci at the top.

So, let’s delve into this narrative. I hope you can go from knowing nothing about DeSci to deeply understanding the core relevant KOLs in this narrative and the sources of their influence. Now, let’s begin.

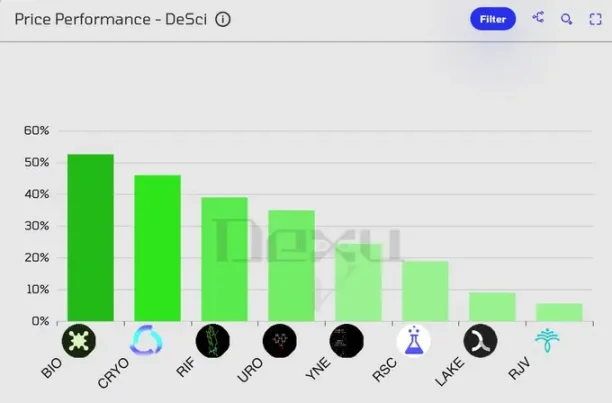

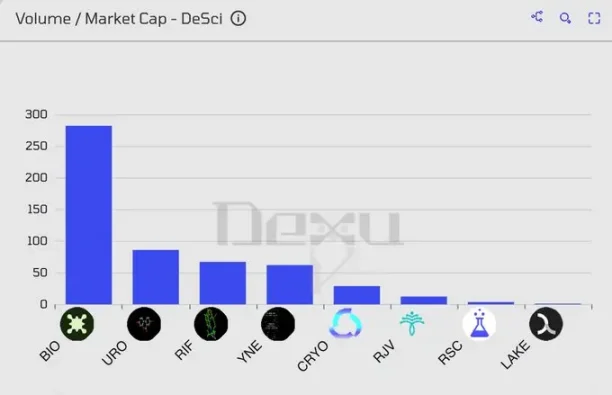

1. What are the currently hottest DeSci tokens?

$BIO

$CRYO

$RIF

$URO

$YNE

$RSC

In the past 24 hours, BIO has maintained its leading position in the sector with over $400 million in trading volume, while other competitors have trading volumes ranging from $1 million to $4 million. If you notice BIO starting to surge, you might explore other tokens in the same category for potential catch-up, but the risk is high!

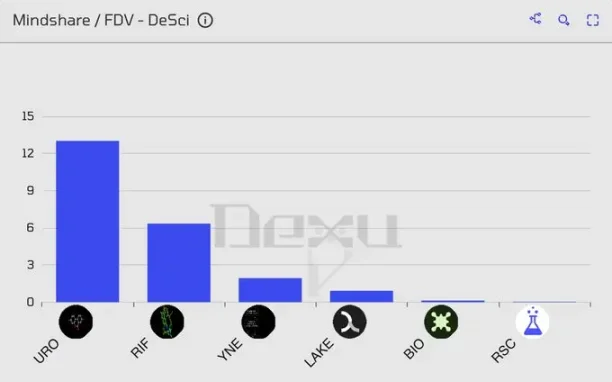

2. Value discovery vs. mind share

Let’s take a look at mind share / FDV, which may help us discover some tokens that have a significant deviation in mind share compared to their FDV.

The following small-cap projects have great potential compared to their FDV:

3. Funding rates

Not all tokens on this list have funding rates, but it is evident that despite BIO experiencing a surge, some are still shorting it. This may indicate that the token still has room for growth, and the price could rise further.

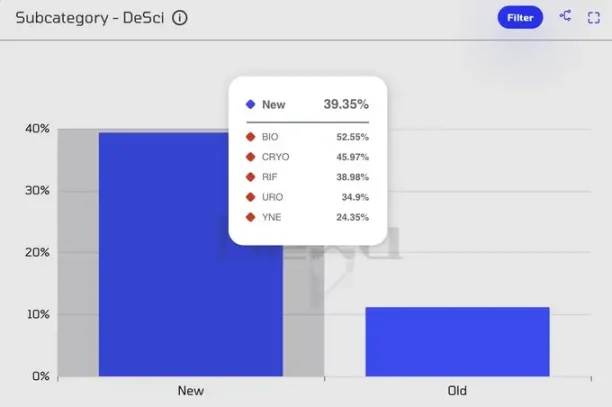

4. Comparison of new and old tokens

Whenever a new narrative emerges in the market, newly launched tokens usually see larger gains, and the current market is no exception. Therefore, it is recommended to closely monitor these new tokens + other potential listings:

5. Mind distribution in the DeSci track

$BIO-50%

$CRYO-21.43%

$LAKE-21.43%

$URO-7.14%

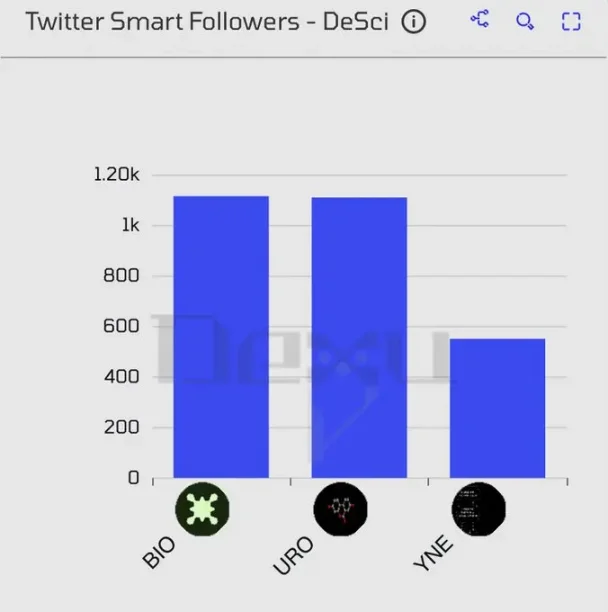

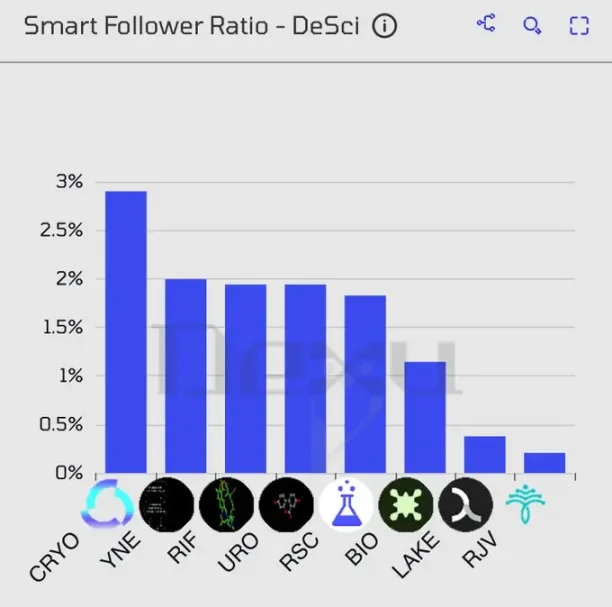

6. Smart followers vs. ordinary followers

Let’s see which tokens have the smartest followers.

Now we can see the ratio of smart followers to ordinary followers and determine if they were ahead of others in noticing a particular protocol:

7. KOL accounts worth following in the DeSci track

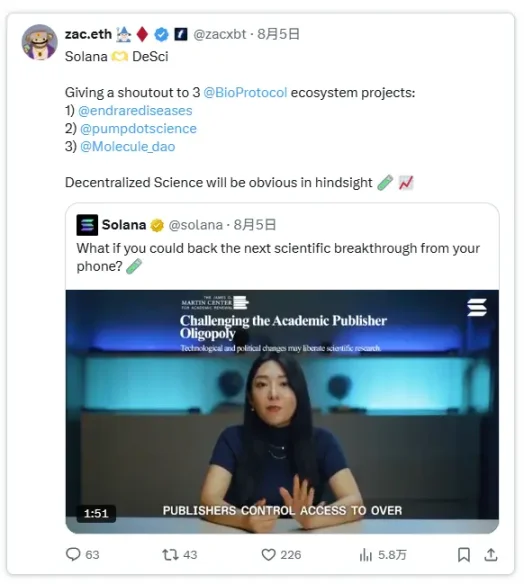

Let’s see who is actively participating in reviving the DeSci topic + who are the early participants in this trend, so you can follow them for the latest updates on DeSci and stay ahead in the narrative of the track.

@zacxbt

@sjdedic

@paulkhls

@langeriuseth

@ViktorDefi

@0xSalazar

@this_investor

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。