Author: Sankalp Shangari

Translation: Shaw Golden Finance

Abstract

Digital Asset Treasury (DAT) serves as the financial institution for on-chain "enthusiasts." So, what are these companies becoming?

- Not just treasury reserves, but also programmable capital structures;

- Not just balance sheets, but also liquidity engines;

- Not only holders of cryptocurrencies, but also builders of a crypto-native financial ecosystem.

The corporate finance departments of the 2020s will no longer resemble traditional CFO offices, but will instead function like real-time, blockchain-driven hedge funds equipped with APIs, treasuries, and validators.

They will handle cross-border payments through stablecoins. They will invest funds into the ecosystems they help govern. They will issue tokens, set up special purpose vehicles (SPVs), and conduct macro hedging—all on-chain.

Yesterday's DAT held Bitcoin. Today's DAT operates a flywheel. Tomorrow's DAT will control programmable capital machines.

They will issue stocks to buy ETH. They will engage in yield farming with nine-figure balance sheets. They will stake governance tokens to shape ecosystems, all while reporting quarterly to Wall Street. They will blur the lines between treasuries, venture capital funds, and protocol operators until only the self-printed yield curve remains.

Welcome to a new era of capital formation, nurtured by cryptocurrencies, presented in equity form, and jointly managed by spreadsheets and smart contracts.

In this summer of corporate theatrics, spreadsheets have gathered dust, and balance sheets are undergoing digital transformation. Public companies around the world are abandoning mundane capital plans in favor of bold cryptocurrency gambles, a scene reminiscent of opera.

Forget about R&D frenzies or flashy product launches. The blockbuster event of the season is not a new gadget or service—but financing, with proceeds directly funneled into cryptocurrency wallets, allowing the market to take its course. From French chip manufacturers to Texas electric bike startups, the lineup is diverse. This is your front-row ticket to experience the corporate cryptocurrency frenzy.

Phase One - The Accumulation Era

"A fallen cowboy once roamed the wilderness of DeFi; now, Wall Street's suited individuals have entered the same domain."

What has happened:

- Since June, nearly 100 public companies have initiated token purchase activities, raising over $43 billion, double the total amount raised in all U.S. IPOs in 2025.

- MicroStrategy tops the list with a book value of 607,770 Bitcoins (approximately $43 billion); Trump Media has invested $2 billion in Bitcoin and its derivatives.

- Special Purpose Acquisition Companies (SPACs) have evolved into "cryptocurrency treasuries" (like ReserveOne, Bitcoin Standard), providing retail investors with cutting-edge investment opportunities.

Why it matters:

- This is not just about fund management; it is performance art expressed through stock codes.

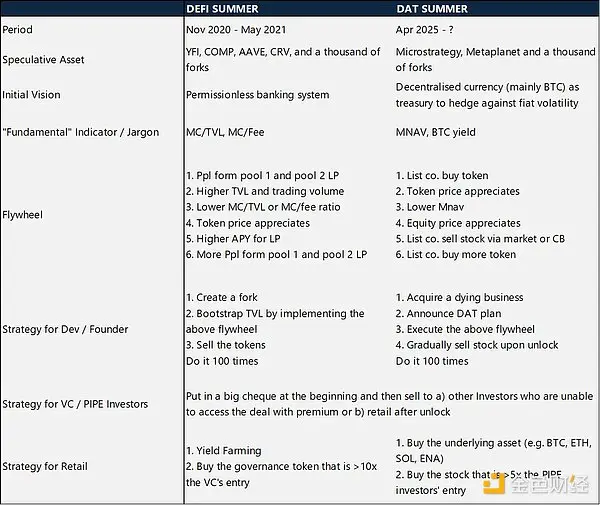

- What began as fringe experiments (like the "DeFi Summer" of 2021) has now transformed into mainstream finance dressed in tuxedos.

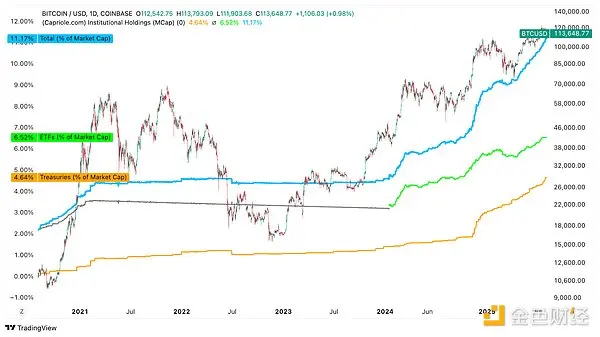

This chart vividly illustrates the institutional transformation occurring in the Bitcoin market, which is the core argument of the DAT summer. Currently, over 11.17% of Bitcoin's market capitalization is held by institutions, with exchange-traded funds (ETFs) accounting for 6.52% and corporate treasuries for 4.64%. From the initial phase of a few bold companies accumulating sporadically, this trend has evolved into a fully operational flywheel, especially after 2023, with a surge in ETF inflows and rising Bitcoin prices making this trend increasingly evident. This shift reflects the "activation" of the second phase, where structured funds raised by Wall Street through ETFs and financing are driving the development of liquidity, momentum, and narrative. The significant growth in ETF and corporate treasury holdings is not merely financial activity; it signifies the institutionalization of Bitcoin as a balance sheet asset and capital market tool. In short, this chart is the clearest evidence to date: Bitcoin has become a corporate asset class.

Phase Two - Generating Engineering Returns from Dormant Reserves

"Buying Bitcoin is the first phase. The real show begins when you make it work." — Steve Kurz, Galaxy Digital

Yield generation strategies:

- Staking and DeFi liquidity: Various companies are putting ETH and other tokens into DeFi protocols.

- Structured products and options: Capital market professionals are layering options coverage and basis trading on cryptocurrency holdings.

- Governance manuals: Voting in decentralized autonomous organizations (DAOs) and staking governance tokens to influence protocol roadmaps.

- On-chain ecosystems: Creating products that integrate corporate fund management into real-world applications.

New flywheel:

- Public companies purchase tokens.

- Token prices rise.

- Stock prices soar due to increased net asset value.

- New shares or convertible bonds are issued.

- Returns are redistributed into more tokens.

- This process repeats continuously.

Why it’s different:

- This is a combination of traditional capital markets and crypto innovation, fully regulated and highly liquid.

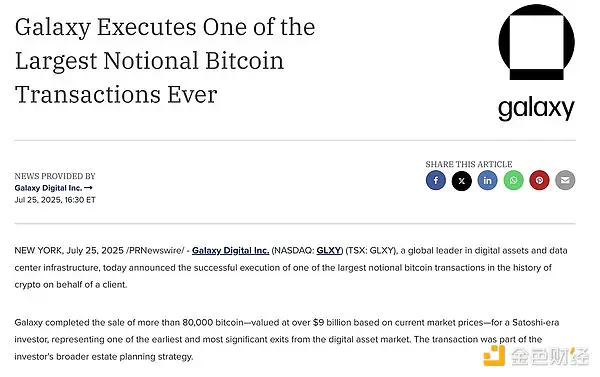

- Companies like Galaxy Digital have already helped raise $4 billion for cryptocurrency acquisitions, including custody, risk management, and yield infrastructure.

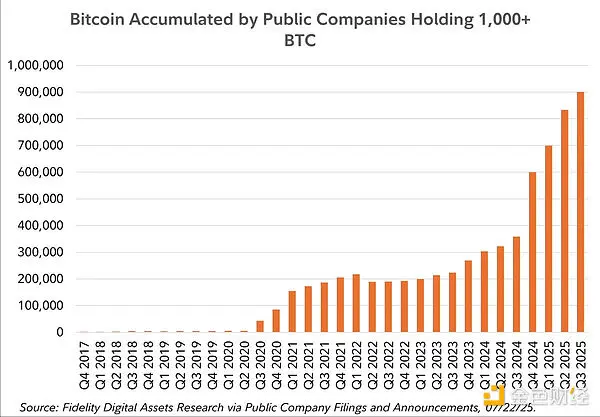

Public companies currently hold nearly 900,000 Bitcoins, with a 35% increase in just one quarter.

Doubt, Disbelief, and a Sense of Déjà Vu

Some of the smartest people in the room are rolling their eyes:

- "This is a bubble."

- "Ethereum (ETH) has no real demand—why choose SBET?"

- "If the flywheel stops turning, these crypto treasury companies are done."

Makes sense. But remember: prices change perceptions, and time will prove everything.

The same situation has occurred with DeFi tokens, NFTs, and even Bitcoin itself. If irrational exuberance creates real infrastructure, it will not perish—it will continue to evolve.

Phase Three - Quality Traps and Quality Rewards

"Not everyone can achieve the same premium. Act early, don’t repeat." — Galaxy Digital

Quality phenomena:

- Companies with substantial crypto reserve assets trade at an average of 73% higher than their on-chain assets.

- But saturated risks can cut into profits—if you are the tenth to enter the market, it will be indifferent.

Regulatory and market changes:

GENIUS & CLARITY Acts: Stimulating stablecoin competition; affecting Circle's valuation before its Q2 earnings report on August 12.

Ethereum as a corporate strategy: SharpLink Gaming's 360,807 ETH reserves rose 110% this month, signaling a new on-chain treasury model.

While Circle Declines, Galaxy Rises

Analysts refer to it as the "comprehensive supplier" for institutions, surpassing single-service companies like FalconX and NYDIG.

The GENIUS and CLARITY Acts support Galaxy's stablecoin custody, issuance, and AI data center business.

Currently, over two-thirds of Galaxy's value comes from its infrastructure, such as the Helios facility (formerly Argo Blockchain), which now hosts CoreWeave's AI and high-performance computing business.

DAT meets computation, creating a vertically integrated architecture.

A key driver behind this corporate cryptocurrency flywheel is the concept of mNAV, or market-based net asset value, which measures the real-time value of the cryptocurrency held by a company relative to its stock market value. When a public company accumulates a large amount of cryptocurrency assets and the price of those assets rises, its mNAV increases significantly. The difference between the actual token value and the stock value becomes a tradable narrative. The market begins to price not only from an operational perspective but also from the potential future appreciation of tokens, often at a premium. This leads to soaring stock valuations, allowing companies to issue more shares or convertible bonds on favorable terms, and then reinvest those funds to purchase more cryptocurrencies. It is a self-reinforcing cycle: cryptocurrency reserves → higher mNAV → higher stock prices → more funds → larger reserves. In this cycle, mNAV is not just a valuation tool but also the fuel driving the next phase of growth.

Survival manual:

- Be strategic: Don’t just buy tokens—customize financial products.

- Stay flexible: Adjust incentives as regulations and earnings seasons change.

- Build infrastructure: Go beyond hoarding; launch APIs, treasuries, and validators.

DAT Summer or Corporate Casino?

What started as a trickle—a few daring companies testing the waters in cryptocurrency—has now evolved into a surging wave filled with various filings, financial disclosures, and capital flows. Welcome to "DAT Summer," where public companies are not only hoarding digital gold but weaponizing it.

Yesterday's DAT held Bitcoin.

Today's DAT operates a self-reinforcing flywheel.

Tomorrow's DAT will be a programmable capital machine: issuing stocks to purchase ETH, yield farming with nine-figure balance sheets, and shaping ecosystems through governance.

We have entered an era where the question is no longer whether companies will hold cryptocurrencies, but how much, what other areas they will venture into, and what new tricks they will come up with next. Whether this will evolve into a new financial architecture or merely the fanciest corporate roulette game in history remains to be seen. But one thing is certain: the casino doors are open, and the chips are digital.

This is either a new financial architecture built on digital gold or the fanciest corporate roulette in history. Either way, this summer on Wall Street feels less like strategic meetings and more like a casino filled with laser eyes and "FOMO" market sentiment.

Welcome to DAT Summer, where public companies are not only purchasing digital assets but also weaponizing them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。