Author: Tuo Luo Finance

Trump's support for the cryptocurrency industry can be described as dedicated.

Just last week, Trump unleashed a major move by signing an executive order that allows 401(k) retirement savings plans to invest in a more diversified range of assets, including private equity, real estate, and the newly introduced cryptocurrency assets. This means that up to $8.7 trillion in retirement funds could potentially reach cryptocurrency assets. This event holds significant implications for both the cryptocurrency sector and the pension system itself.

Interestingly, this kind of major positive news, which would have previously caused a surge in the market, has not manifested much in today's cryptocurrency market. On the day the information was released, BTC remained very stable, while conversely, ETH experienced a rare and rapid rise.

To discuss the impact of the executive order on the cryptocurrency market, we must first look at the U.S. pension system. The U.S. pension system is primarily composed of three parts: first, a government-managed universal plan funded through social security taxes; second, individual retirement plans that individuals voluntarily participate in, similar to the current personal pension plans in our country; and third, the focus of this article, the 401(k) plan managed by employers. Under the coverage of these three main components, the U.S. has essentially formed a multi-tiered pension system based on social security taxes, with 401(k) plans as the focus and personal pensions as a supplement.

Specifically, the 401(k) refers to a private enterprise retirement benefit plan established under Section 401(k) of the Internal Revenue Code of 1978, where both employers and employees contribute. Employees can choose their investment portfolios and enjoy tax-deferred benefits, with flexible withdrawals from their accounts upon retirement.

From the terms themselves, the 401(k) is similar to our country's enterprise annuity system, where both the enterprise and employees contribute. However, it is worth mentioning that, unlike our usual model of unified management, enterprises typically have fixed partnerships with fund companies, while employees can control their personal accounts and choose to invest their pensions in various products within designated funds, but they bear the risk of profit and loss.

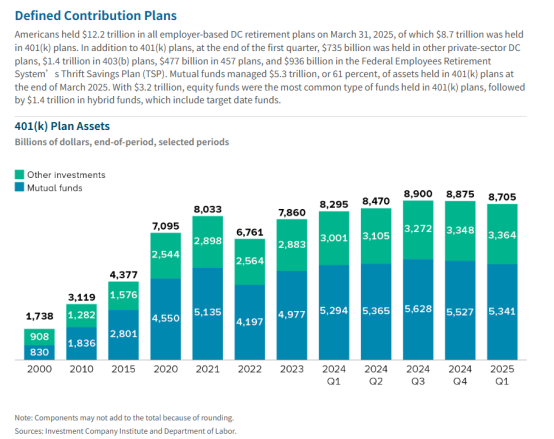

Although the 401(k) is not a universal policy and clearly cannot cover the complete retirement funding needs, considering that nearly 60% of American households have a 401(k), this plan has become the core of the U.S. pension system. The amount of funds involved is also quite substantial. As of March 31, 2025, publicly available data shows that the total assets of all employer-led defined contribution (DC) retirement plans have reached $12.2 trillion, with the 401(k) plan holding $8.7 trillion.

The question arises: where will the $8.7 trillion flow?

Currently, looking at the flow of funds, stock funds are the most common type of fund in 401(k) plans, with a total of $5.3 trillion managed by mutual funds, of which stock funds account for $3.2 trillion and mixed funds hold $1.4 trillion. Given that stocks are included, it can be seen that the investment scope of these funds is not limited to traditional conservative targets.

In fact, due to the special nature of pensions, the investment targets of the pension system have undergone multiple changes from absolute conservatism to yield-oriented approaches. Before the Great Depression, pensions were limited to investing in low-risk assets such as government bonds, high-quality corporate bonds, and municipal bonds. After the devastating impact of the Great Depression, the pension system suffered a catastrophic blow, and returns continued to decline. Some private trusts proposed the "prudent man rule," allowing diversification into assets to pursue higher returns, which began to influence various states. Stock investments began to rise, ultimately leading to the application of the prudent investor standard to public pensions with the Employee Retirement Income Security Act of 1974, officially lifting restrictions on pension investments in the equity market.

By 2025, this restriction was further broken. On August 7, local time, Trump signed an executive order allowing Americans' 401(k) plans to invest in private equity funds, Bitcoin, and other cryptocurrencies, as well as other so-called alternative assets. Trump also instructed Labor Secretary Lori Chavez-DeRemer to collaborate with officials from the Treasury Department, the Securities and Exchange Commission (SEC), and other federal regulatory agencies to determine whether rules should be modified to assist this effort, and directed the SEC to facilitate the inclusion of alternative assets in pension plans for participants to invest independently.

From a policy perspective, this directive will have far-reaching implications for both pensions and the cryptocurrency market. From the pension perspective, this move incorporates cryptocurrencies, private equity, and other alternative assets into the investment scope, broadening the investment channels for pensions while also introducing greater risks and volatility. This signifies a further transition of the pension investment system from relative conservatism to high openness, with illiquid and complex products also being included, marking a radical reform in the pension system.

For the cryptocurrency market, the significance is even greater, representing a leap in the mainstream acceptance of crypto assets. With pensions now accepting them, crypto assets undoubtedly gain a higher level of "national-level" endorsement. From a product perspective, a surge in crypto asset products packaged as ETFs can be anticipated, and more importantly, there will be a structural change in the composition of crypto asset holders. Given that pensions typically have low turnover rates and long holding periods, a Vanguard report indicates that the average trading frequency for 401(k) plans in 2024 is 0.5 times per month. This means that once these funds enter the cryptocurrency market, the price support at the bottom of the assets will be further solidified. In other words, if a large amount of such funds flows into ETFs primarily composed of BTC and ETH, the volatility of mainstream coins will significantly decrease, and the nature of these assets will shift from risk assets to safe-haven assets. In the medium to long term, this executive order will boost market size; after all, with up to $9 trillion in funds, even just 5% would amount to a staggering $4.5 trillion.

However, the greater the impact, the louder the voices in the market. Traditional financial participants have expressed that alternative assets come with high fees and low liquidity, which indeed presents a huge opportunity for asset management companies, motivating them to include these in their portfolios. However, these assets also come with lower information disclosure requirements, making it difficult for individual investors, who are far removed from the market, to thoroughly understand the asset attributes and risks before investing their funds. This information asymmetry could significantly harm investors' interests and increase a series of legal risks. Additionally, it is worth noting that although the executive order has been issued, its implementation will still take some time. For asset management companies responsible for product development, the popularization of new products typically requires several years.

Perhaps due to the reasons mentioned above, after the release of this significant executive order, the market did not react as expected; instead, there was a certain lag effect. BTC only rose 2% within 24 hours, but in terms of fund inflows, there was no significant increase in either spot trading volume or BTC ETFs within that 24-hour period. However, by August 11, BTC had instead surged past $12,200.

Interestingly, Ethereum exhibited a completely opposite trend. Within 24 hours of the pension information being released, ETH's spot trading volume significantly increased, and its price rapidly rose from $3,600 to surpass $4,000 on August 8. As of now, ETH has reached $4,299, with this round of gains exceeding those of BTC. There has also been an increase in ETH ETF holdings, with a net inflow of $680 million over two days.

It can be seen that although both have experienced simultaneous increases, ETH's rise is more sensitive and rapid. The market has suggested that funds seem to be flowing from Bitcoin into Ethereum. A similar trend is observed in the derivatives market. The annualized premium of Ethereum futures on the Chicago Mercantile Exchange (CME) relative to spot has exceeded 10%, higher than that of Bitcoin, prompting some traders to shift their positions from Bitcoin to Ethereum.

Looking solely at the ETH/BTC trading pair, although there has been some recent improvement, the volume has not significantly exceeded the average level, making the argument for a "bloodsucking" theory difficult to substantiate. As for why ETH is more sensitive, there may be multiple reasons.

First, there is the contribution from the growing trend of institutional accumulation. Crypto treasury companies centered around ETH have already accumulated approximately $13 billion worth of Ethereum, and with ETH being relatively lower in price, the growth from fund inflows is more pronounced. Second, there is support from large ETF institutions, with ETH ETFs attracting over $6.7 billion in net inflows this year, backed by asset management giant BlackRock. The core of this strong backing lies in the SEC's blueprint for "bringing all financial markets on-chain," under which Ethereum, as a leading public chain, is a direct beneficiary. Third, there are voices from the over-the-counter market, such as the passionate call from Tom Lee, chairman of Bitmine's board, who discussed Ethereum's future development in a podcast and believes ETH could reach $15,000. This video, which has garnered 180,000 views, seems to have attracted significant retail interest.

In contrast to the thriving BTC and ETH, the altcoin market still does not appear optimistic. In terms of market capitalization, with ETH breaking the long-awaited $4,000 mark, altcoins have shown a trend of rising, with market capitalization increasing over 15% compared to last week. However, upon closer examination, aside from a few blue-chip altcoins rising, over 70% or even 80% of altcoins remain very sluggish.

The reasons are evident: ETH's rise is driven by institutional real money rather than self-funding from the crypto market. In the current context of limited liquidity, institutional investment targets are also more conservative, preferring coins with controllable risks. This results in funds being unable to spill over into the altcoin market. In other words, the upward momentum driven by Ethereum is difficult to transmit to altcoins. In fact, there is already a sentiment in the market that "the current ETH is last year's BTC," which holds some truth. Of course, a comprehensive altcoin boom may be hard to replicate, but there are still opportunities for a structural altcoin bull market, which will depend on investors' own instincts.

Fortunately, another event worth looking forward to is approaching. The U.S. Department of Labor reported that the growth in non-farm payrolls in July was significantly below expectations, and the unemployment rate rose slightly, greatly increasing the likelihood of interest rate cuts. On August 9, local time, Michelle Bowman, Vice Chair of the Federal Reserve, released two key messages in her latest speech, supporting three interest rate cuts this year and announcing that she would host a community bank meeting on October 9.

Moreover, CME's "FedWatch" data reveals that the probability of the Federal Reserve maintaining interest rates in September is 11.6%, while the probability of a 25 basis point rate cut is 88.4%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。