I'm about to lose it. My state today is just not good, and I still haven't started writing the weekly report. I originally planned to start writing it after finishing my homework, but I don't know what I was thinking; I ended up replying to other friends' tweets and completely forgot to submit my homework. Then I felt like the browser was too laggy, so I planned to clear the cache before writing the weekly report, but when I restarted the browser, I realized I still hadn't submitted my homework.

Today's homework is still a bit challenging, mainly due to the understanding of U.S. macro data. If I were still stuck on inflation data today, it would be hard to calculate that both the Nasdaq and S&P 500 hit new highs. From the data, inflation indeed looks bad, which may affect the Federal Reserve's decisions. Several Federal Reserve officials' articles after the CPI data was released reflect this as well.

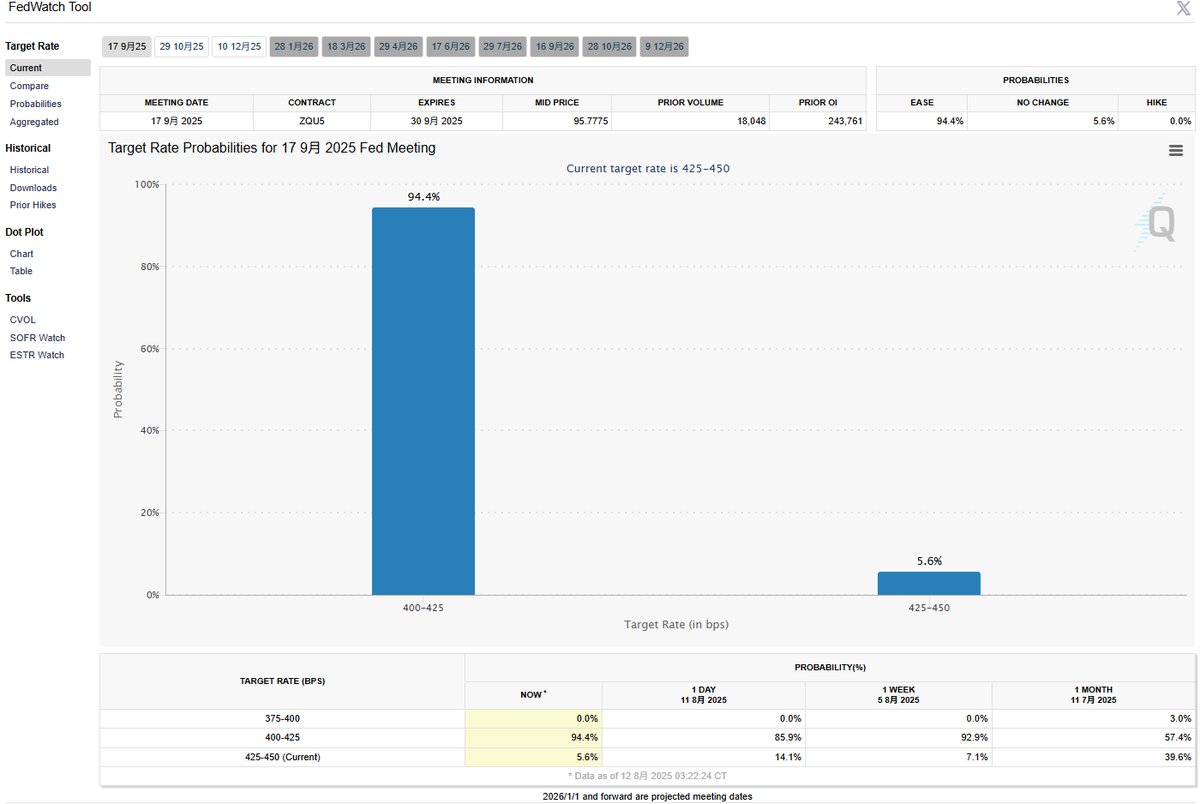

Some Federal Reserve officials still believe that inflation is quite high, and maintaining the current policy is appropriate. A small number of officials hinted that it might be time to cut interest rates. Ultimately, Nick's tweet stated that although the inflation data is not good, it will not affect the Fed's interest rate cut in September, which increases the chances of a rate cut in September.

Interestingly, the Wall Street Journal does lean more towards the Republican side, so whether Nick's comments represent the Federal Reserve or Powell, or if they represent Trump's faction, is still uncertain. However, it can be seen that U.S. macro data is not as important now. If the data is good, everyone is happy, but if the data is bad, Trump will hold Powell accountable, and that is indeed the case.

The market is very eager to know what Powell will think. Before the September meeting, there will be a Jackson Hole meeting where Powell will speak, likely around August 22, Beijing time. So, the main contention in the U.S. market now is still between Trump and the Federal Reserve's monetary policy, while the importance of macro data has diminished.

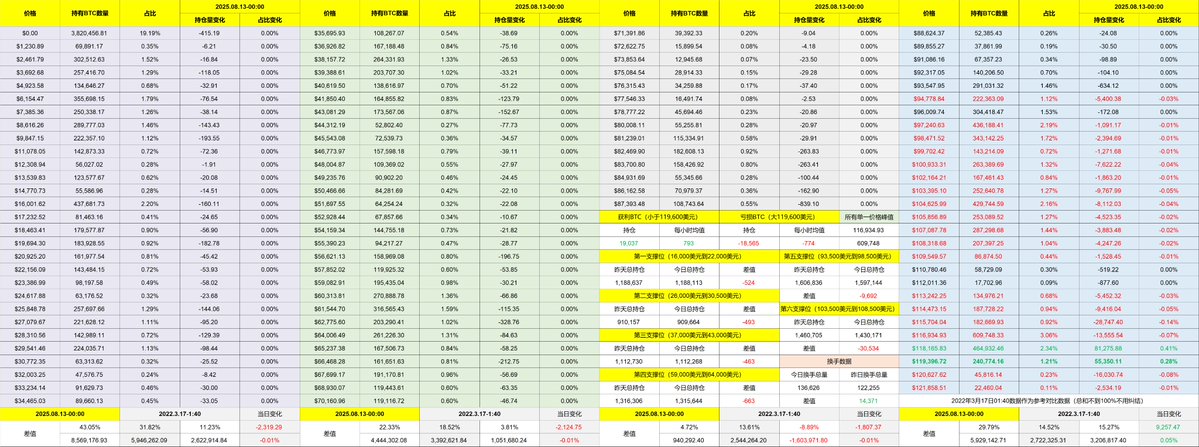

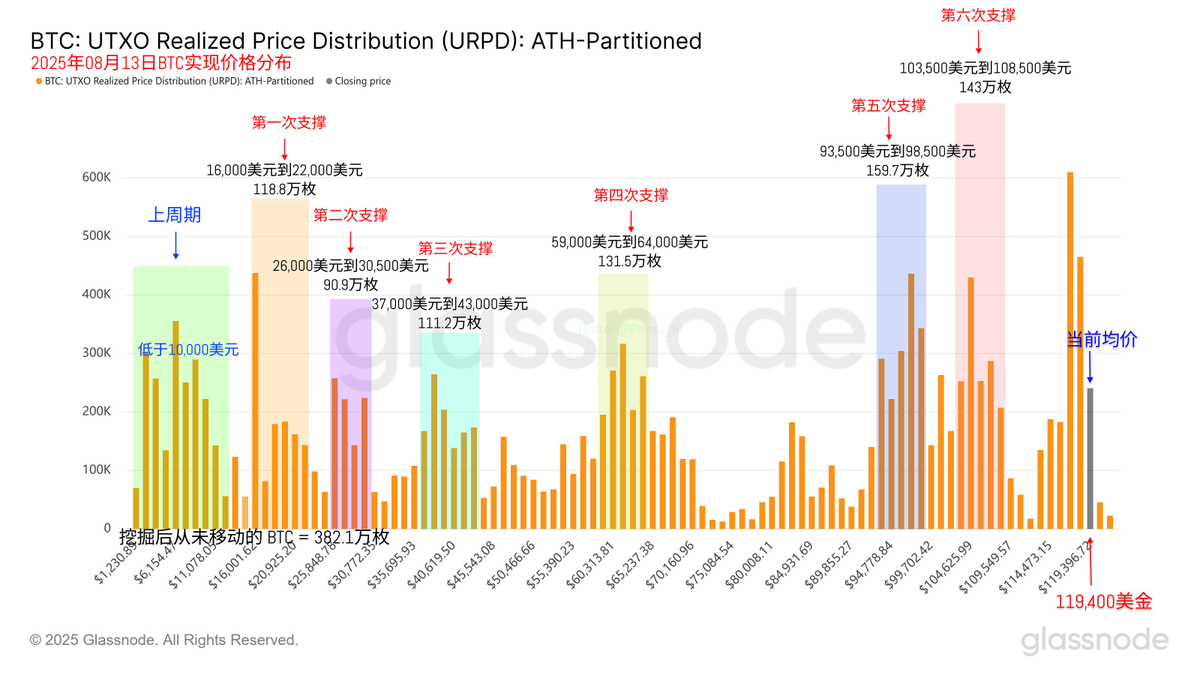

Looking back at Bitcoin's data, due to some risk-averse sentiment regarding CPI, the turnover of $BTC has slightly increased, but mainly investors with a holding cost above $100,000 are the main force behind the turnover. However, as the impact of CPI data decreases, investors' emotions will gradually stabilize, and turnover will also decline.

Recently, BTC's price has been quite stable, maintaining a strong correlation with the performance of U.S. stocks. Although purchasing power is not very strong, $ETH investors have shown obvious FOMO sentiment, which has even helped stabilize BTC's price. Today, the S&P and Nasdaq rose by 1.3%, while BTC rose by 1.1%. No signs of ETH draining liquidity have been observed, as ETH's greater purchasing power still lies in the ETF and coin-stock markets.

This week, there is also retail data, and so far, expectations are not very good. Let's wait and see.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。