Overview

2017 was the year of the initial coin offering (ICO) bubble, 2021 saw the non-fungible token (NFT) and crypto lending bubble, and by 2025, a similar phenomenon in this cycle is becoming clear: the frenzy of "crypto asset companies." If someone wants to take on significant risks and get rich quickly by entering early, these publicly listed asset companies on Nasdaq are the way to go. The structures of the trades are diverse, but simply put, there are two popular methods: reverse mergers and special purpose acquisition company (SPAC) transactions.

A typical reverse merger usually works like this: find a "zombie" small company listed on Nasdaq as a target, ideally with no debt, a failed core business, a market capitalization of less than $40 million, low risk of litigation or contingent liabilities, and a small number of insiders holding most of the equity. Then, private investment in public equity (PIPE) investors are called to participate in the equity issuance, some of whom may be the same group of investors that specialized in ICO issuance eight years ago. The target company then issues new shares, diluting the existing shareholders' stakes to a minimal amount, and these newly issued shares are owned by PIPE investors after the transaction is completed. These PIPE investors become common shareholders and form a new management team focused on asset strategies. The company then uses the raised funds to purchase selected cryptocurrencies. The fundraising is done in dollars, but it is also possible to subscribe in kind with related cryptocurrencies.

The goal is for the company's stock trading price to reach 2 to 5 times the underlying cryptocurrency value after the transaction is completed. The company can then start issuing new shares in the market and use the proceeds to buy more cryptocurrencies, just like MicroStrategy (MSTR). Since the stock is sold at a price above the marked net asset value (mNAV), this increases the amount of cryptocurrency held per share. This, in turn, may further push up cryptocurrency prices, creating a virtuous cycle that boosts stock prices.

PIPE investors participate at a valuation of about 0.8 to 1.0 times, which is approximately 1.0 times the expected value of the cryptocurrency the company plans to purchase at issuance. If the stock trades at a huge premium after the transaction is completed, PIPE investors hope to gain substantial profits in the short term.

Attractiveness of Investment

Many have asked us why people participate in these issuances. After all, the explanation for the mNAV premium relies on circular reasoning, that is, the logic of "premium proves premium." This bears similarities to a Ponzi scheme. However, at the PIPE level, if viewed in a certain way, these transactions can be very attractive. Consider the following reasoning:

You are an early holder of Bitcoin (OG), having stored 1,000 Bitcoins in a cold wallet for over a decade. You face the following decision tree:

Continue holding these 1,000 Bitcoins

Participate in a PIPE transaction of an asset company. This could lead to the following two outcomes:

Transaction succeeds, and the stock trades at a price far above mNAV. You can sell the company stock at a premium and then buy back more Bitcoins.

Transaction somewhat fails, and the stock trades below mNAV. But this is not a problem. You trust the management team and hold a significant proportion of voting rights in the company. The management team assures you that if this happens, they will narrow the discount by selling Bitcoins and repurchasing stock or paying dividends. This is why the management team is crucial; if you hold a large amount of Bitcoin, you are likely to respect and trust at least one of Adam Back, Jack Mallers, Anthony Pompliano, or Michael Saylor. You can choose for yourself.

This is a "win on the upside, no loss on the downside" situation. No matter how institutions like "BitMEX Research" talk about "circular reasoning," the fact is that there are currently dozens of asset companies trading at a premium. Why not give it a try? In reality, this is not entirely a "no loss on the downside" situation. There are some fees and equity dilution involved. These fees can be high, but if you think about these transactions in terms of option value, these fees may be worth it.

Passive Funds

If this asset company strategy succeeds and the stock of the asset company becomes large enough, these stocks will start to enter more indices. Then, passive index funds provided by companies like Vanguard will begin to purchase these stocks. For example, in the case of MSTR, according to Bloomberg data, as of the end of June 2025, Vanguard had become its largest single shareholder, holding 7.0% of the outstanding shares through its 66 fund products.

In our view, MSTR's asset company plan can be said to be successful at this stage. Early buyers have made substantial profits, and now, ironically, Vanguard, a company notorious for being anti-Bitcoin, has become the ultimate "greater fool." Vanguard is so averse to Bitcoin that it has been reported that they do not even allow their U.S. clients to use their pure execution services to purchase BlackRock's Bitcoin ETF.

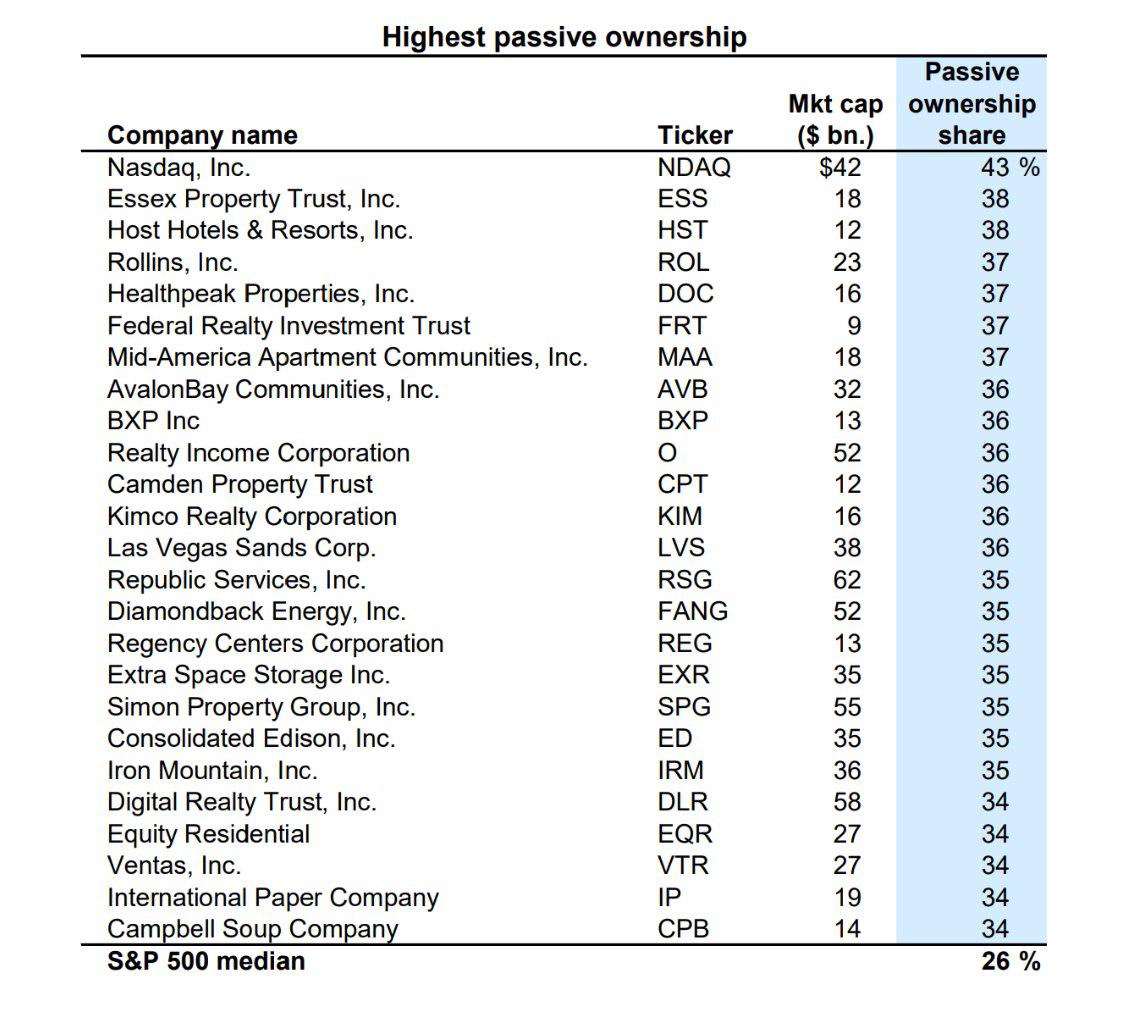

According to a Goldman Sachs report from November 2024, the median ownership percentage of passive funds in S&P 500 constituents is 26%. Another irony is that Nasdaq itself, as a home for crypto asset companies, ranks first on this specific list, with a passive fund ownership percentage as high as 43%.

Source:

Passive Funds

Over the past few decades, passive funds have become increasingly popular and have further growth potential as they gain market share from active fund managers. It is not hard to see how they are attractive to existing shareholders of crypto asset companies. If an asset company becomes large enough, it can attract holders of passive index funds. Then, when the company issues new shares to buy more cryptocurrencies, passive funds almost become "forced buyers," required to participate in the subscription. If passive funds continue to grow, they may eventually hold more than 50% in a company, possibly even a crypto asset company. Let’s speculate on the mathematical logic behind this. If the passive fund ownership in MicroStrategy (MSTR) reaches the 50% threshold, and its trading price is at a 2x premium to its underlying Bitcoin value, then Saylor's "infinite money printer" could become even more absurd. To some extent, Saylor has indeed "invaded" the traditional financial system.

Strategic Advisors and Asset Managers

Another key element of these emerging asset companies is the sponsors, asset managers, management teams, or "strategic advisors." These individuals are essentially the behind-the-scenes drivers of the transactions. The role of the advisors varies by transaction but typically includes the following:

Appointing a CEO or serving as CEO themselves

Managing asset strategies, i.e., deciding when and whether to buy more cryptocurrencies and possibly executing these trades

Perhaps most importantly, promoting and marketing the company's stock to potential investors

Overall, these advisors are extremely important, and in some cases, the viability of the company may be questioned without them. Note that the role of these strategic advisors is different from that of "sponsors" or "placement agents." Sponsors are typically investment banks responsible for structuring the transaction, such as Cantor Fitzgerald, while advisors are usually entities contracted with sponsors to arrange the deal. Sponsors typically receive substantial setup fees, while advisors or management teams also usually receive decent compensation as an incentive to increase the mNAV premium. As we have seen, setup fees typically range from 1% to 8% of the transaction size. This report does not focus on the fees of sponsors or placement agents, as these fees are not unique to crypto asset companies. Instead, we focus on the advisory service agreements that may last for years.

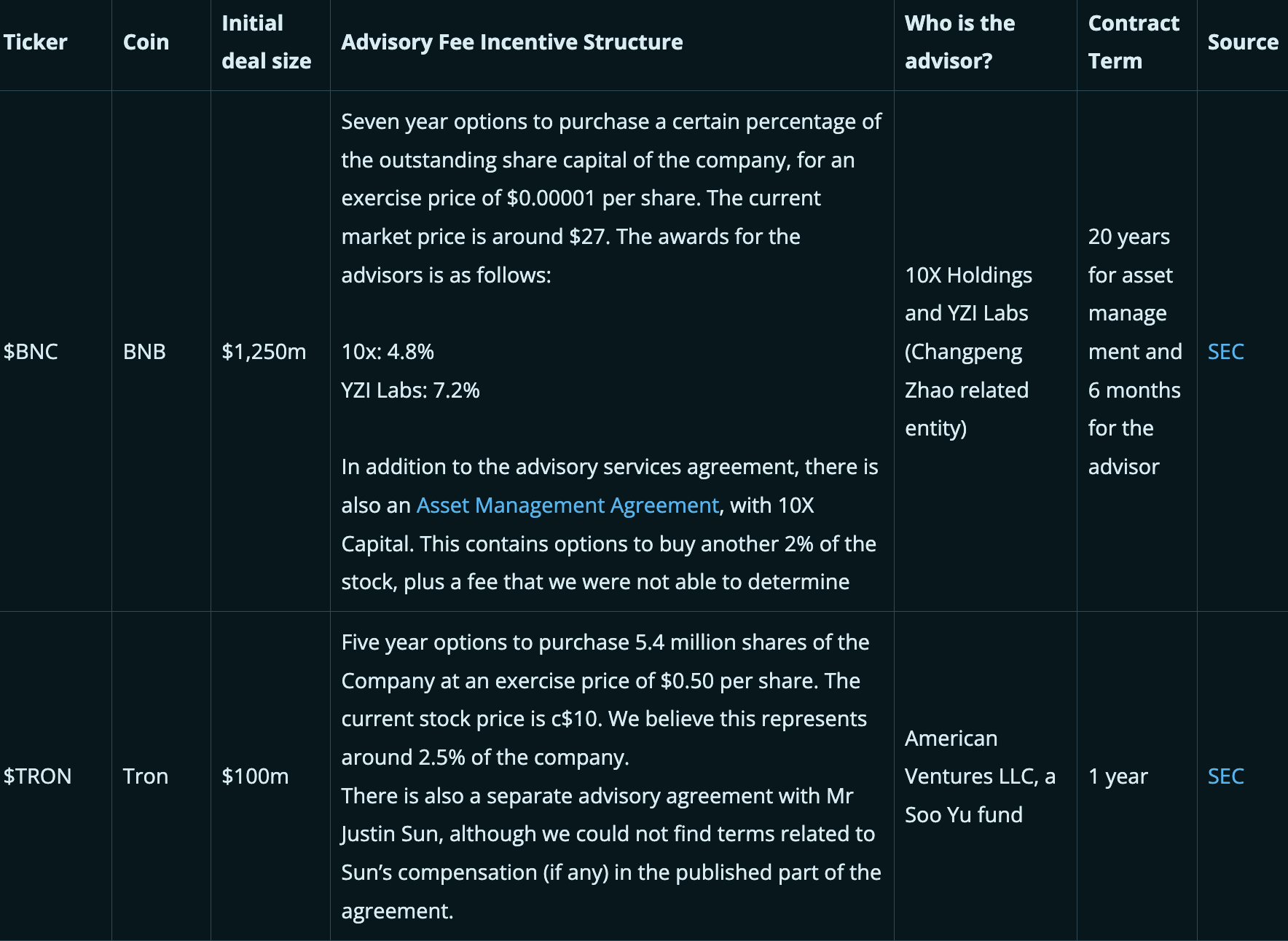

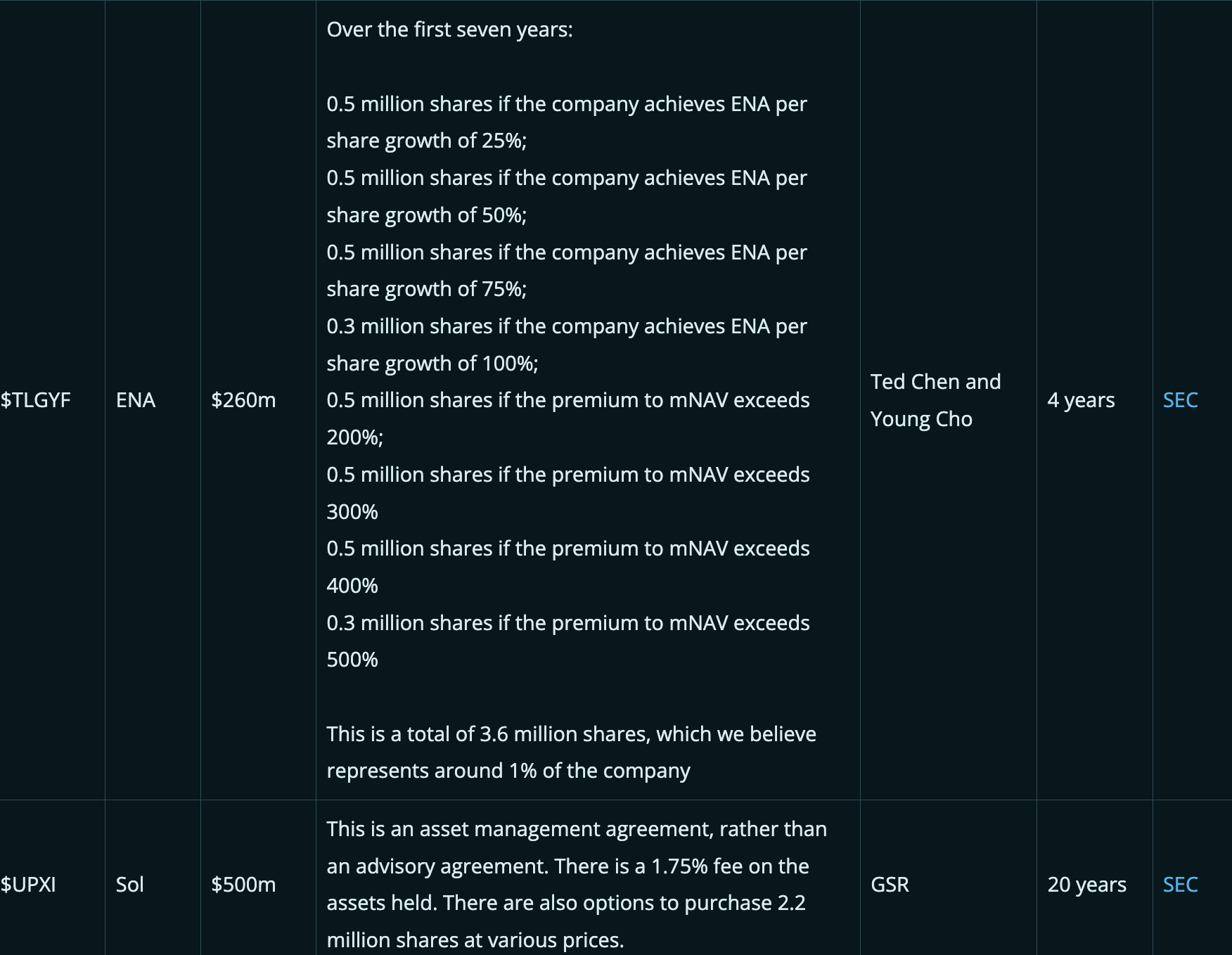

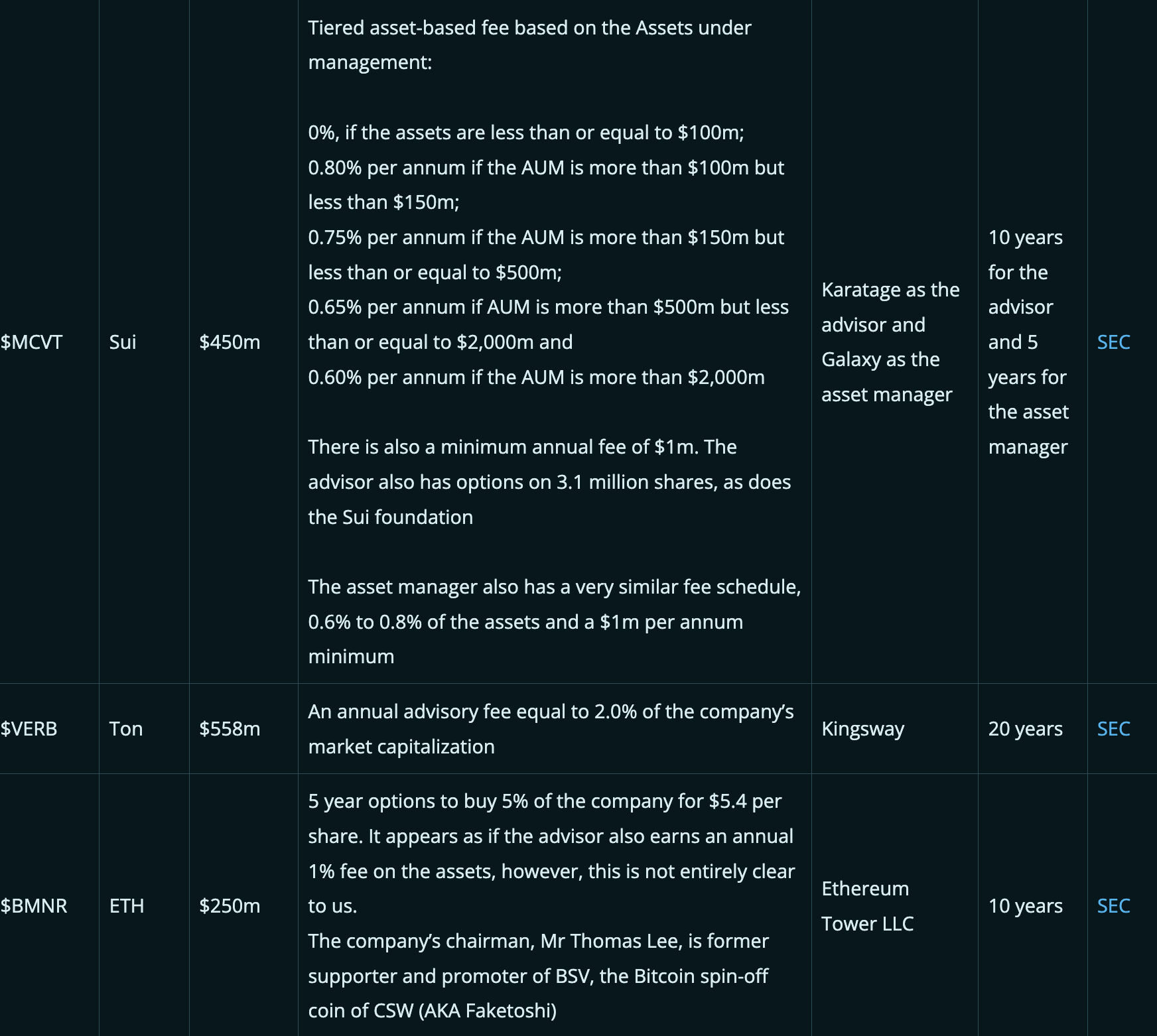

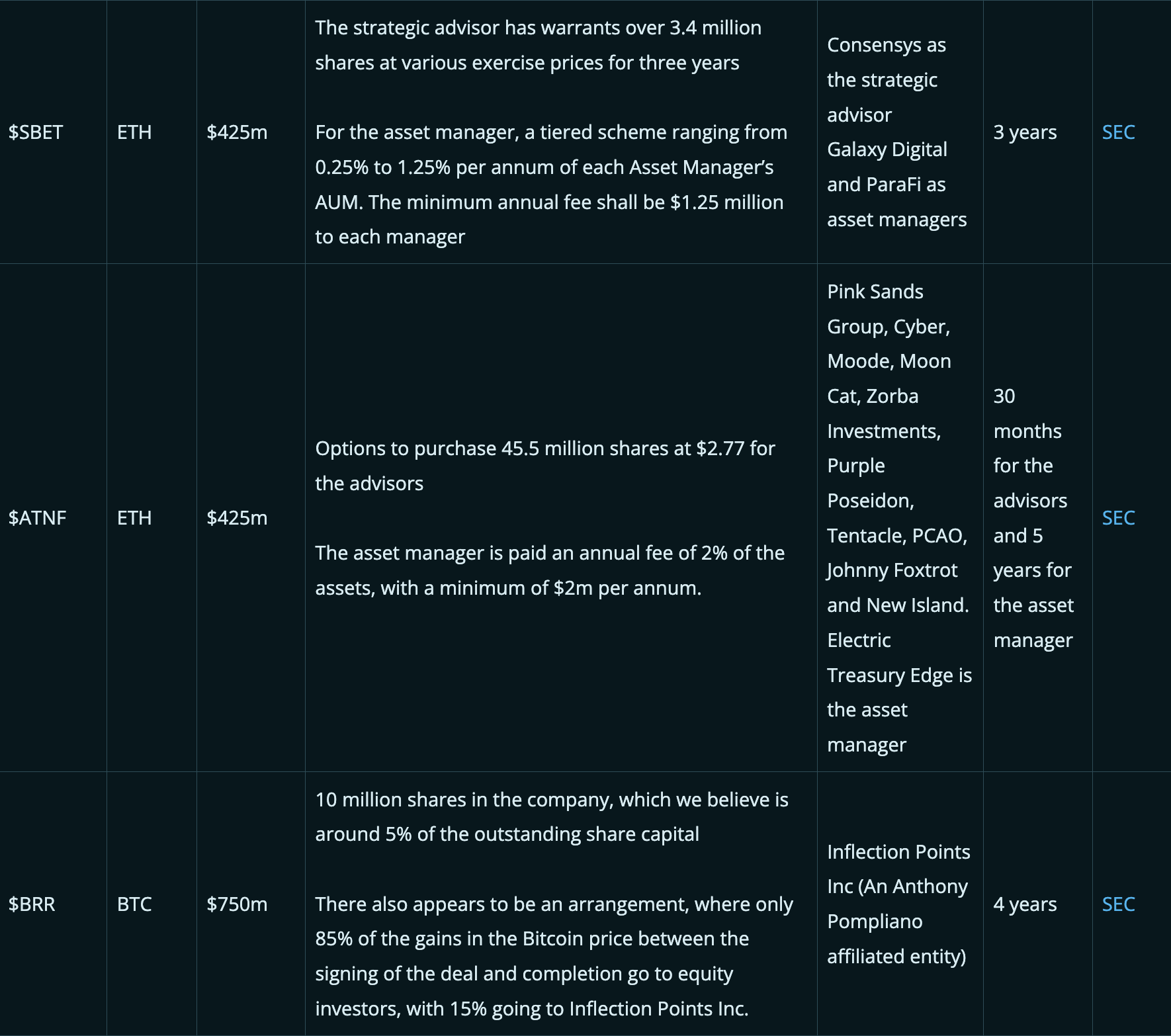

The table below summarizes some key incentives and compensations paid to "strategic advisors" in various transactions, aimed at encouraging management or advisors to enhance the company's market value or mNAV premium. Please note that each transaction is different, and the comparisons we make in the table may not be entirely appropriate. Sometimes, the role of "asset managers" may also exist, usually as a complement to strategic advisors. Additionally, companies are only included in the table when we can find relevant details from SEC filings, so the data in the table is somewhat subject to selection bias. For certain cases, we believe that details regarding advisory agreements may surface later as the transactions are completed.

Please note: We sincerely apologize for any inaccuracies related to data on advisor service compensation and do not assume any liability for errors. If you believe we have made any mistakes, please contact us immediately, and we will correct them as soon as possible.

The compensation terms for advisors vary by transaction. In some cases, there is typically an incentive or compensation linked to market value or mNAV premium. Therefore, from the investor's perspective, this again leverages the option value of the transaction, creating a "win or not lose" situation:

If the stock trades at a price far above mNAV, the company may pay substantial fees to the strategic advisor, and investors profit.

If the stock fails to trade at a high premium, the fees paid to the strategic advisor are lower, and investors do not incur losses.

To some extent, these fees can sometimes be justified, as the key individuals involved in these transactions need to be well compensated, and their compensation is often linked to the mNAV premium, aligning their incentives with those of the shareholders. However, these fees are often high enough to refute the argument made by some that "asset companies are better than cryptocurrency ETFs because their fees are lower."

Conclusion

In some cases, the fees paid to advisors may seem high, but these fees may be necessary to complete the transaction, and the advisors themselves are often major investors in the company. In many instances, advisors are absolutely essential for attracting investors, which is a key part of this strategy. When the market is hot, investors may be less concerned about the fees paid to strategic advisors or management teams. However, there may be similarities here with the Grayscale Bitcoin Trust ([$GBTC$]) and its 2.5% underlying asset management fee. Over the years, this fee has been acceptable to investors, but with the approval of Bitcoin ETFs in January 2024, market competition has intensified, and fees have dropped to around 25 basis points. GBTC subsequently faced massive redemptions, but the fund remains a huge "fee-collecting machine" today. In a few years, when investors may become more patient and discerning, the fees of asset companies may decrease to some extent.

In our view, the ultimate outcome is that many of these companies will end up trading at prices well below mNAV and become "zombies" again, potentially still paying high fees, just like [$GBTC$]. However, a few companies may succeed. Here, "success" may mean that these companies have reached a sufficient scale such that passive funds like Vanguard and State Street become the largest shareholders, after which the mNAV premium may eventually decline to close to 1.0 times or lower.

Another simpler takeaway from this report is: directly purchase ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。