River aims to establish a stablecoin system based on chain abstraction, allowing users to store assets on Chain A and mint satUSD stablecoins on Chain B; it creates a stablecoin system that does not require cross-chain or wrapped operations, enabling users to safely access yield opportunities across chains without selling their assets.

Capital Dilemma in the Multi-Chain Era

In the past two years, DeFi has accelerated its development, and the ecosystem has entered a multi-chain era:

· 300+ Layer 2s

· 30+ stablecoins

· 20+ LSD/LST based on BTC and ETH

It seems prosperous, but capital and liquidity are locked in isolated islands on their respective chains.

For example, if you collateralize ETH on Arbitrum while holding BNB on the BNB Chain, participating in the same strategy often requires 2-3 cross-chain transactions and asset exchanges through DEXs, which not only incurs high fees but also increases cross-chain risks.

The multi-chain environment brings choices but does not promote the efficient use of assets, and the value between ecosystems cannot flow naturally.

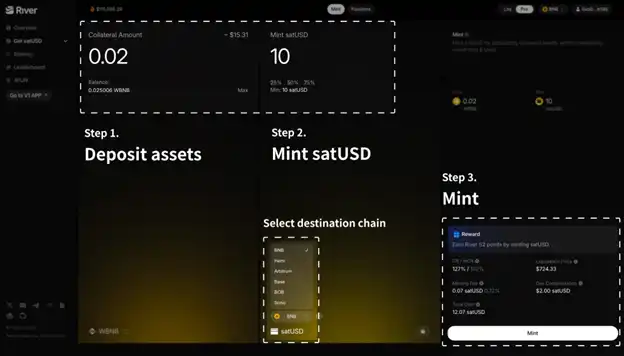

River Chain Abstraction Stablecoin System

Traditional stablecoins operate on a single chain and rely on third-party liquidity for cross-chain transactions. River has chosen a third path—chain abstraction.

The core idea is to hide the boundaries between chains, allowing users to prepare capital and liquidity without needing to do so separately for different chains.

This is backed by the combination of LayerZero technology and the OFT standard:

· Deposit BTC, ETH, BNB, LST on any chain

· Mint satUSD natively on another chain

· No need for cross-chain, no need for Wrapped, safely circulate across ecosystems

It's like having a globally universal bank account, where you don't need to open a new account in every country, and you can settle, pay, and invest anytime.

River Product Launched, Accumulated $400 Million Total Locked Value

In the past two months, River's chain abstraction stablecoin system has accumulated:

· Over $400 million TVL (Total Locked Value)

· Over $100 million satUSD circulation

· Supports BTC, ETH, BNB, LST deposits as collateral

· Integrates with over 30 protocols (Pendle, ListaDAO, Solv…)

· Ranks first in CDP stablecoins across ecosystems like BNB Chain, Arbitrum, Hemi, BOB, etc.

This means that regardless of which chain your assets are on, they can be instantly activated and invested in multiple strategy scenarios.

Why Do We Need River Now?

As of today, DeFi TVL has surpassed $150 billion, and the total market capitalization of stablecoins has reached $270 billion.

In theory, the growth of market capitalization and TVL should lead to a more vibrant DeFi ecosystem, but the reality is:

· Liquidity is more dispersed

· Asset transfers are difficult

· Yield opportunities are concentrated in a few protocols

· The entry barrier for new users remains high

In the context of major DeFi and stablecoin giants, as well as publicly listed companies launching chains and building their own ecosystems, River's chain abstraction stablecoin system is positioned to solve the liquidity fragmentation problem in a multi-chain ecosystem, rather than adding new islands.

Chain Abstraction Stablecoin? Connecting Multi-Chain Ecosystem Liquidity and Value Circulation

River is not just a stablecoin; it uses "fully chain-native" technology to overturn the traditional logic of asset flow.

You can fork Ethena's hedging strategies, Liquidity's liquidation models, or Usual Money's stablecoin minting mechanisms; but you cannot fork the chain abstraction underlying architecture created by River.

All current stablecoins, in their initial design, did not consider "how to solve the integration of cross-chain assets, cross-chain liquidity, and cross-chain yields"; River's stablecoin satUSD has been aimed at a fully chain-native goal from Day 1, adopting the LayerZero structure and natively deploying the satUSD stablecoin system in OFT format, with no similar products emerging to date.

The seamless experience without cross-chain is something you can feel immediately; this experiential gap is akin to realizing the obsolescence of bank wire transfers when you first use cryptocurrency for peer-to-peer payments.

What River aims to do is not just issue a stablecoin, but to enable any asset in the world to participate in value creation and distribution without barriers, and to circulate wherever it is needed.

Let every on-chain asset flow to any user globally.

Connect with value, flow with River

This article is contributed and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。