US Tariff Revenue Surge Hits $29.6B in 1 Month: Bitcoin Rise or Fall?

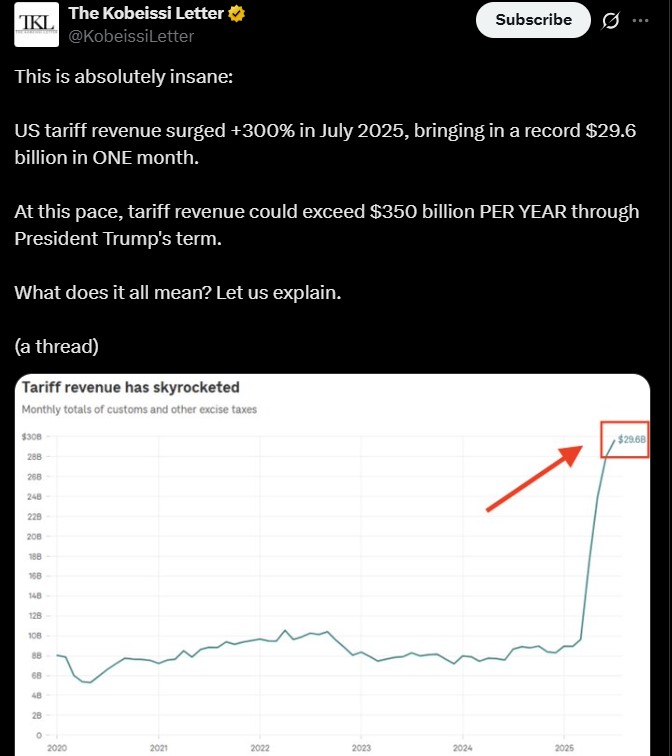

The latest U.S. trade data has shocked global markets — a US Tariff Revenue Surge in July 2025 brought in a record-breaking $29.6 billion in just one month.

According to The Kobeissi Letter , if this pace continues, total annual collections could surpass $350 billion during President Donald Trump trade policy.

These big numbers are making headlines in the world of economics, but they’re also shaking things up in the cryptocurrency market.

The Bitcoin USD price is reacting right away. According to CoinMarketCap, at the time of writing, it is priced at $121,039.85, up 1.06% in the last 24 hours.

US Tariff Revenue Surge: July 2025 Hits Record $29.6B

The July 2025 US Tariff Revenue Surge was one of the biggest jumps in American trade income in a single month. Compared to last year, it went up by 300%, which shows the U.S. is taking a tougher trade approach.

This change could affect global markets, including Bitcoin price analysis today. For people who invest in crypto, such a big increase can raise questions about where money will flow, the risk of inflation, and whether this currency will act as a safe-haven asset.

Higher US tariff July 2025 report can also make goods more expensive, putting pressure on traditional markets.

Why Global Trade Tensions Could Be Boosting Bitcoin Price Action Today

Rising US tariff revenue can spark economic uncertainty. Historically, periods of trade conflict have seen money flow into alternative stores of value — gold and, increasingly, BTC dominance.

At the time of writing, it is trading at $121,039.85, up 1.06% in the last 24 hours, with daily trading volume climbing 11.89% to $82.8 billion.

This time, the backdrop of a revenue surge combined with a strong BTC ATH breakout crypto cycle may be creating the perfect environment for an upcoming rally.

According to Bitcoinsensus, the currency's price has been climbing in a “staircase” pattern, breaking above resistance before mild pullbacks. Their analysis suggests a potential short-term retracement toward $109K before the next major push higher.

Why Is Bitcoin Going Up? $BTC Dominance Rally Nears

On the TradingView chart , BTC is now at $121,359, moving above short-term resistance near $120K and heading toward the $122K level.

-

RSI at 64.79 – This shows the token still has space to rise before it becomes “overbought.”

-

MACD bullish crossover – A sign that upward momentum is building, as the green bars on the chart grow.

-

High trading volume – More people are buying, which supports this recent breakout attempt.

In simple words, the chart is showing strength, and $BTC price still has room to move higher if this trend continues.

US Tariff Revenue Might Impact Bitcoin ATH Prediction Analysis

If the US Tariff Revenue Surge continues and trade tensions remain high, then the currency could benefit from the safe-haven narrative. Analysts suggest that holding above $122,000 might pave the way for a move to $128,000–$132,000 in the coming weeks.

If the token stays above $115,000 and the overall economy stays supportive, it could rise to $140,000–$150,000 before the end of the year.

If it breaks above $150K, it will enter what traders call a “price discovery” stage — meaning there are no past price points to guide the market, and it could aim for $170,000 or more, making Bitcoin price prediction 2025 true .

But it’s important to be careful. Big global events, like the US Tariff Revenue Surge, can quickly push prices up or down. For now, the way Bitcoin price reacts to this news will be one of the most watched stories in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。