Author: Biteye Core Contributor Viee

Editor: Biteye Core Contributor Denise

Recently, BNB has experienced a remarkable structural market trend. After reaching its ATH in July, it has once again broken through the ATH of $865.68 today. With several publicly listed companies in the U.S. making significant purchases of BNB as asset reserves, along with favorable news such as ETF applications, BNB, which was once viewed as a "exchange platform token" + "public chain ecosystem token," is now evolving towards becoming an "institutional reserve asset."

This wave of market activity may not just be a temporary hype, but rather a reassessment and repositioning of BNB's value. This article will delve into the "institutionalization" path of BNB and the various opportunities available for retail investors to participate.

01. Review of BNB's "Institutional Evolution" Path

In the past two months, three major events have occurred surrounding BNB:

Several U.S. companies have included BNB in their asset reserves: Since July, multiple publicly listed companies in the U.S. have announced plans to purchase or allocate BNB: for instance, CEA Industries, with support from Yzi Labs, plans to raise $500 million (up to $1.2 billion) to create the largest BNB reserve; Liminatus Pharma intends to invest up to $500 million in BNB for the long term; Windtree Therapeutics has approved up to $700 million for the acquisition of BNB; Nano Labs plans to invest $1 billion to gradually hold 5% to 10% of the circulating supply of BNB, having already purchased 128,000 BNB over-the-counter. This series of actions indicates that BNB is being viewed by some institutions as a reserve asset comparable to Bitcoin.

ETF Windfall: In early May, the well-known asset management company VanEck officially submitted an application to the U.S. SEC for a BNB ETF, which includes staking and other additional benefits. If approved, BNB is expected to become the focus of the next round of crypto ETF competition, following Bitcoin and Ethereum.

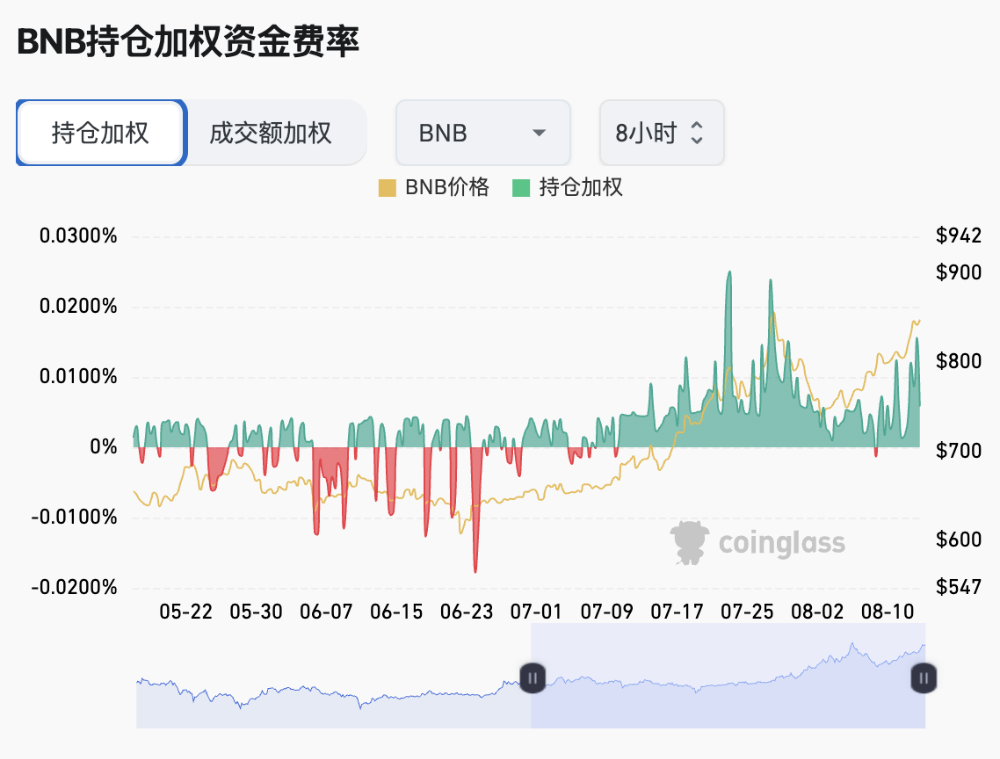

BNB price breaks historical high: In response to the aforementioned positive developments, BNB has continued to strengthen, climbing to a historical high of $865.68 on August 14. The chart below shows that since mid-July, the weighted funding rate for BNB positions has consistently risen from negative to positive, with multiple spikes between 0.015% and 0.03%/8h from July 23 to August 14, in sync with the price increase; during the pullback phase, it did not turn negative for long, indicating a bullish advantage, with both spot and leverage driving the price up, showing ample upward momentum and a relatively healthy structure.

Source: Coinglass

The above events reflect the institutional transformation of BNB, expanding from a past reliance on the internal value support of the Binance ecosystem to a new phase where it is actively allocated by traditional institutions. When "Wall Street-style" buying pressure floods in, the value center of BNB gains structural upward momentum, providing a more long-term and stable source of demand. For retail investors, this is a time to reassess the long-term potential of BNB and share in the rising dividends of BNB through various avenues.

02. Retail Opportunity 1: On-Chain Play on BNB Chain

For retail investors, actively participating in the BNB ecosystem on-chain is an important way to gain value increment. This can be done through various methods such as DeFi, RWA, and Meme tokens.

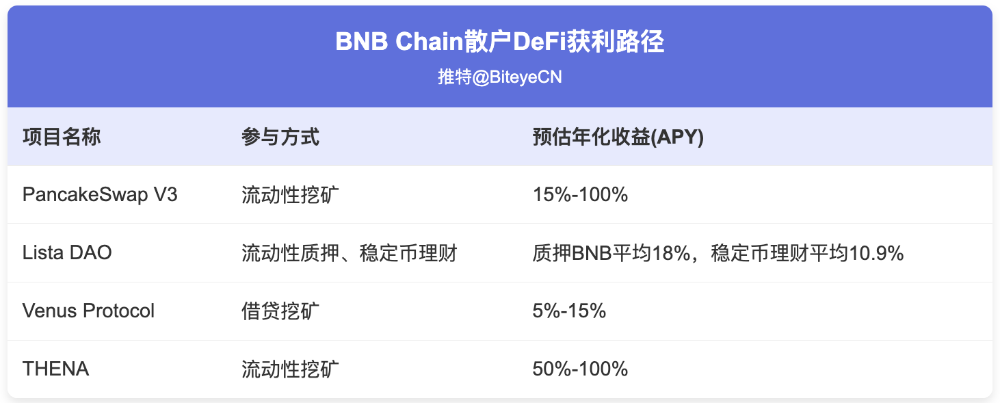

DeFi: The leading DEX and lending protocols on BNB Chain currently have TVLs ranking among the industry leaders. For example, the leading decentralized exchange PancakeSwap (V3) has a TVL of about $2 billion, providing liquidity pool yields for various trading pairs; the established lending protocol Venus supports lending for mainstream assets like BNB; Lista DAO's TVL has also reached $1 billion. Retail investors can choose suitable DeFi strategies based on their risk preferences (as shown in the chart below).

RWA: BNB Chain is rapidly becoming a new platform for RWA on-chain. In July, Ondo Finance announced the introduction of its tokenized products for over 100 U.S. stocks and ETFs to BNB Chain, allowing global users to trade some U.S. stock assets 24/7. Meanwhile, the xStocks program launched by Kraken and asset management company Backed will also be deployed on BNB Chain, supporting trading of over 60 U.S. stocks and ETFs. In terms of stablecoins, the Trump family company WLFI chose to launch its compliant stablecoin USD1 on BNB Chain, which has now integrated into the BNB Chain DeFi system and established a USD1 liquidity pool. Retail investors can more conveniently invest in U.S. stocks, U.S. bonds, etc., on BNB Chain, achieving diversified asset allocation.

Meme: At the beginning of the year, several phenomenal Meme tokens were born on BNB Chain, generating unprecedented market heat. If you are interested in trading Meme coins, you can scan the chain on the first Meme fair launch platform on BNB Chain, Four.meme, to follow newly deployed tokens. However, it is important to remember that the Meme market is highly volatile, and with current heat significantly declining, it is best to wait for a rebound in interest before investing. From a market opportunity perspective, the heat of Meme tokens can bring considerable trading volume and new users to the BNB Chain, further boosting the demand for BNB, which indirectly benefits BNB holders.

Overall, the BNB Chain ecosystem is currently in a rising phase of traffic and value influx. For retail investors, this also means that on-chain opportunities are gradually emerging, allowing them to earn stable returns in blue-chip DeFi projects, try RWA plays, or even discover dark horse Meme tokens. As the core value carrier of BNB Chain, the prosperity on-chain will ultimately translate into value support for BNB. Therefore, by deeply participating in the BNB Chain ecosystem, investors are also growing alongside BNB.

03. Retail Opportunity 2: Coin-Stock Resonance, "BNB Concept Stocks" Stealth Strategy

In simple terms, when a publicly listed company announces a significant purchase of BNB or includes BNB in its financial strategy, the stock prices of these companies begin to correlate highly with BNB. When BNB surges, these stocks often experience synchronous or even disproportionate increases, and vice versa. Therefore, if you have confidence in BNB's fundamentals, you might consider stealthily investing in related concept stocks before the market starts to rally. For example, MicroStrategy's continuous purchases of Bitcoin mean that retail investors buying MicroStrategy's stock are indirectly betting on Bitcoin's price movements, and sometimes MicroStrategy's stock price can even exceed the Bitcoin price increase during the same period. Now, with the rise of institutional accumulation of BNB, a similar coin-stock resonance effect is expected to replicate.

As mentioned earlier, several companies plan to include BNB in their asset reserves (as shown in the image above), and their stocks are highly correlated with BNB. So how should retail investors operate and manage risks?

Grasp Information Rhythm: Closely monitor the announcement timing of these companies regarding BNB. Often, stock prices have already surged at the moment the news is released, increasing the risk of chasing high prices afterward. For example, pay attention to key nodes such as SEC filings, fundraising, and completion of purchases. Positioning at lower levels before the news can allow for phased profit-taking when the news materializes.

Focus on BNB Price Correlation: These stocks are highly correlated with BNB prices. For instance, when BNB broke through $800 at the end of July, stocks like CEA and Windtree also rose on the same day; conversely, stocks may experience some pullback. Therefore, BNB's market movements can serve as a leading indicator; if you judge that BNB is about to start a new wave of increases, you can correspondingly increase your holdings in related stocks and wait for resonance. However, be cautious that if BNB experiences significant volatility, stocks may undergo even more drastic fluctuations.

Pay Attention to the Relationship Between Concept Stocks and Binance: Some stocks have greater market confidence due to involvement from Binance or CZ. Therefore, you can monitor whether there is further cooperation or support from the official side for these companies, such as whether they provide custody, strategic guidance, etc. These signals will enhance market trust in concept stocks holding BNB, thereby boosting valuations.

It is worth noting that these opportunities carry dual risks, influenced both by the volatility of the crypto market and by factors inherent to the stock market (such as dilution from financing, etc.). It is recommended to try small positions, strictly control exposure, and timely track fundamentals.

04. Retail Opportunity 3: Exchange Play

In recent years, Binance has launched various activities such as Launchpad, Launchpool, and Megadrop, most of which are related to BNB. In fact, utilizing exchange plays transforms BNB from a purely investment asset into a tool for obtaining diversified returns, allowing investors to enjoy both the appreciation of BNB itself and additional earnings.

The table below summarizes several mainstream new mining activities on Binance, helping everyone choose suitable ways to earn based on their own situation.

You can choose a suitable strategy based on your capital size and time investment:

Conservative Holding: If you have substantial funds but do not wish to spend too much effort, you can adopt the "BNB Holding Party" strategy. This means holding a certain amount of BNB for the long term and actively participating in Launchpool and periodic HODLer airdrop activities. This strategy focuses on generating coins from coins, with returns coming from both the appreciation of BNB and the airdrop of new coins.

Active Participation: If you have limited funds but ample time and strong hands-on ability, you can try the "Alpha Points Party" route, aiming to reach the point thresholds for airdrops/TGE, Pre-TGE, and Booster. After completing the tasks, exit in a timely manner to lock in profits. It is important to emphasize that this strategy must calculate costs to avoid losses due to excessive trading fees and slippage.

In addition to the main activities mentioned above, Binance also offers a series of benefits for BNB holders, such as VIP levels, fee discounts, voting for new listings, and Binance Pay cashback. For example, in Binance spot and futures trading, using BNB to offset fees can enjoy discounts. Additionally, BNB holders can participate in some exclusive financial products from Binance Earn, achieving multiple overlapping benefits.

05. Retail Opportunity 4: Hold BNB, Enjoy Deflationary Dividends and Token Economic Model

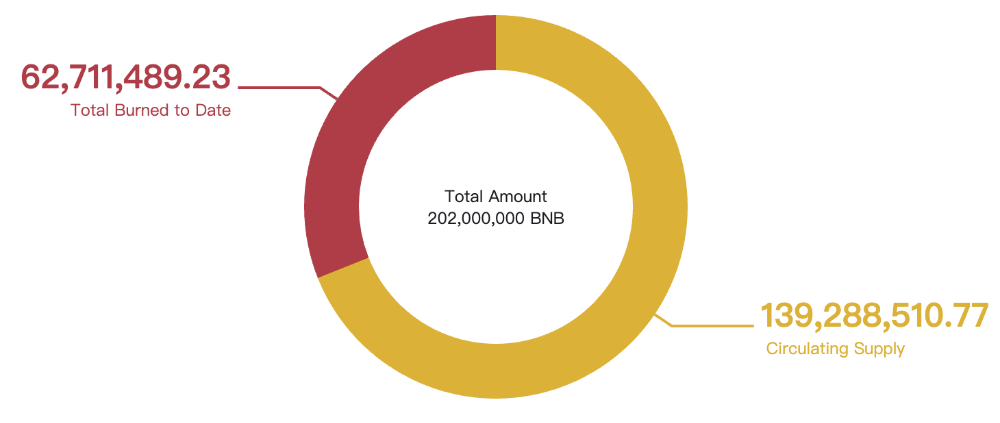

Regardless of the participation method, the vast majority of paths ultimately revolve around holding BNB. The reason why holding BNB is favored by many is primarily due to BNB's deflationary token economic model, which is the only deflationary token among the top market cap tokens. As of July 2025, approximately 60 million BNB have been burned (about 31% of the initial supply), reducing the circulating supply from 200 million to about 139 million. It is expected that in the coming years, BNB will reach a constant supply target of 100 million.

Source: bnbburn.info, Binance Research

Automatic Destruction Mechanism: The earliest destruction method for BNB was based on the trading volume of BNB on the Binance exchange. Starting from the fourth quarter of 2021, a new automatic destruction algorithm was introduced, dynamically adjusting based on the price of BNB and the number of blocks produced on the BNB Chain. For example, in the recently completed 32nd quarterly BNB burn, a total of 1,595,599.78 BNB was destroyed, valued at approximately $1.024 billion at the time of execution.

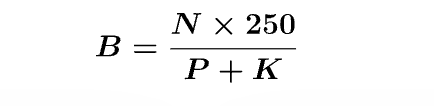

The formula for the automatic destruction mechanism is shown in the figure below, where B represents the number of BNB to be destroyed this quarter, N represents the total number of blocks produced on the BNB Chain during this quarter (the number is determined by a fixed block time), P represents the average price of BNB, and K is a constant (currently set at 250 after the hard fork upgrade). From the formula, it can be seen that when the price is higher, the amount destroyed is less, and conversely, it is more. The essence of this mechanism is to increase the intensity of deflation during market downturns by reducing circulation to maintain the value anchoring of BNB; while in a hot market, it automatically reduces the destruction intensity to avoid excessive tightening of supply.

Real-Time Destruction Mechanism: In addition to quarterly concentrated destruction, the BNB Chain introduced the BEP-95 protocol in 2021 to achieve real-time destruction on-chain. A fixed proportion of the Gas fees paid for each transaction on the BNB Chain is directly burned. The more prosperous BNB is, the more BNB is destroyed. In the long run, the increase in on-chain activity will also drive up trading volume, triggering more real-time destruction.

For retail investors, the deflation of BNB means increased scarcity. Assuming stable or growing demand, a reduction in supply will raise the intrinsic value of each token. This is similar to publicly listed companies continuously repurchasing their stocks, increasing earnings per share and net assets, thereby benefiting stock prices. It is worth noting that BNB's commitment is around 100 million tokens, and it will not decrease indefinitely to avoid impacting network operational security. Therefore, as it approaches 100 million tokens, attention should be paid to whether policy adjustments are made, such as shifting to maintain a constant inflation rate. However, at least in the coming years, the deflationary trend is clear.

06. BNB Value Reassessment and Future Outlook

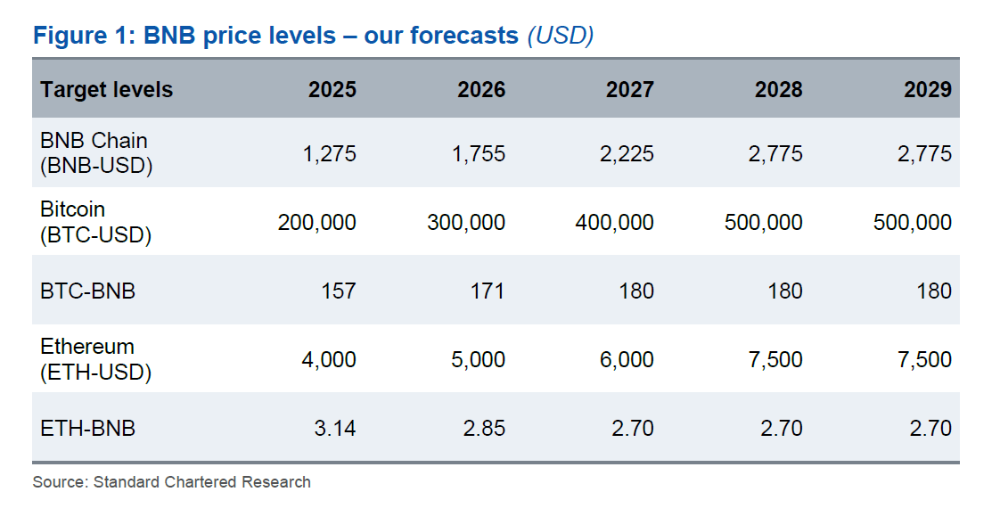

With the entry of institutions, traditional financial institutions are also changing their reassessment of BNB's value. For example, Standard Chartered Bank pointed out in a report this May that it expects the price of BNB to double by the end of 2025, reaching approximately $1,275, and further rise to around $2,775 by the end of 2028.

Source: Standard Chartered Bank (for reference only)

In addition, the development of BNB in the payment sector will also provide additional support for its value, further driving the market's upward adjustment of its valuation model. Binance's payment application, Binance Pay, has been promoted globally, making BNB one of the important settlement currencies. Data shows that Binance Pay has processed 300 million transactions, with a total transaction volume of $230 billion, a significant portion of which uses BNB for transactions. For example, in the French Riviera region, Binance has partnered with fintech company Lyzi to enable over 80 local merchants to support crypto payments, including various currencies such as BNB. If this trend continues, the demand for BNB will not only come from investment and trading but also from real commercial circulation.

Overall, as of mid-2025, BNB is in an upward channel of value reassessment. Institutional accumulation has endowed it with the narrative of "digital gold reserve," ecological prosperity has given it the narrative of "leading public chain," and payment expansion has provided it with the narrative of "utility currency." The accumulation of multiple narratives gives BNB the potential for further market cap growth. At the same time, it is essential to remain rational; the long-term value of BNB ultimately depends on whether the ecosystem can continue to build, maintaining innovation and stable operations in a constantly changing market.

07. Conclusion

From the initial platform token to a popular public chain token, and now becoming a crypto asset allocated by traditional institutional investors, BNB's transformation also reflects the maturity of the crypto industry. In the wave of institutional accumulation, retail investors can share in the value growth of BNB through various means such as deep on-chain participation, laying out related concept stocks, participating in exchange activities, and holding BNB. As the slogan goes, "Build and Build," the value of BNB will be shaped and participated in by everyone. Looking ahead, can BNB usher in a new era of innovative gold with the joint efforts of institutions and retail investors? Let’s wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。