Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

The crypto market is about to welcome a new variable that deserves high attention.

World Liberty Financial (WLFI) official X has stated that it aims to open token trading by the end of August.

As an unprecedented experiment combining "political narrative + financial engineering," WLFI has been the focus of American crypto capital and market imagination since the second half of 2024. Now, with the team fully locked, public offerings being unlocked in batches, and the TGE imminent, it is necessary to reassess the current valuation logic of this project, the on-chain performance of its stablecoin USD1, and WLFI's capital actions and layout in the external ecosystem.

Considering these signals, WLFI's next phase may not just be a "tradeable governance token," but a "crypto-political structure" benchmarking TRUMP, mimicking the MSTR model, and binding USD1 across multiple chains.

How to Anchor Valuation: ALT 5, Justin Sun, DWF Labs, and Multiple Rounds of Price Games

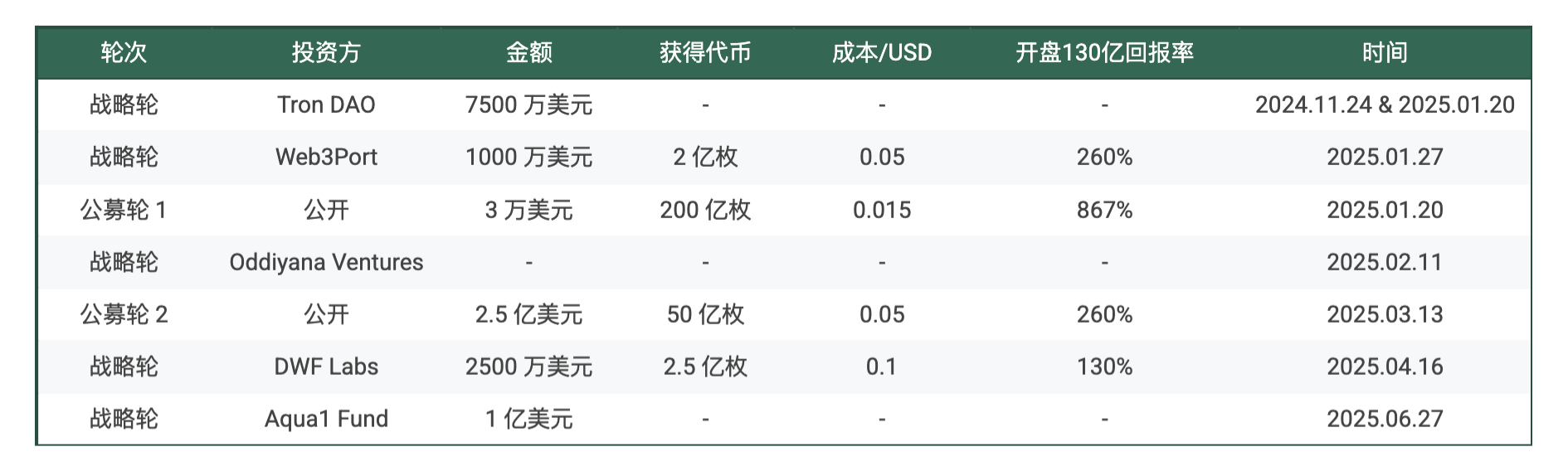

In October 2024, WLFI launched its first public offering at a price of $0.015, raising a total of $300 million; on the day of Trump's inauguration in January 2025, the second round was launched, with the price raised to $0.05, raising another $250 million. These two rounds attracted over 150,000 users, covering multiple markets in North America, Asia, and Europe, becoming one of the hottest initial fundraising events from late 2024 to early 2025.

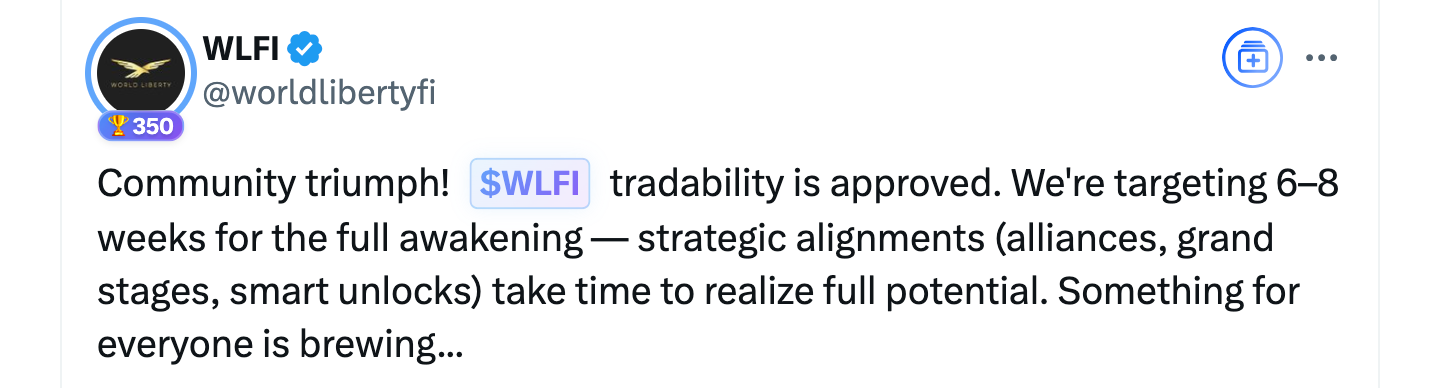

During the financing phase, the project adopted a strategy of "freezing circulation, betting on the future," meaning that tokens were set to be non-tradeable and limited to governance participation during fundraising. Although this mechanism faced market skepticism at one point, subsequent market performance showed that it effectively filtered out speculative trading, forming a more cohesive community structure. It wasn't until July 17 of this year that the community governance proposal was officially passed, followed by an official announcement on the 19th that the TGE may start around the end of August. (This timing is an estimate, not a specific date; the original text states that it could be completed in 6-8 weeks at the earliest from the date of the announcement.)

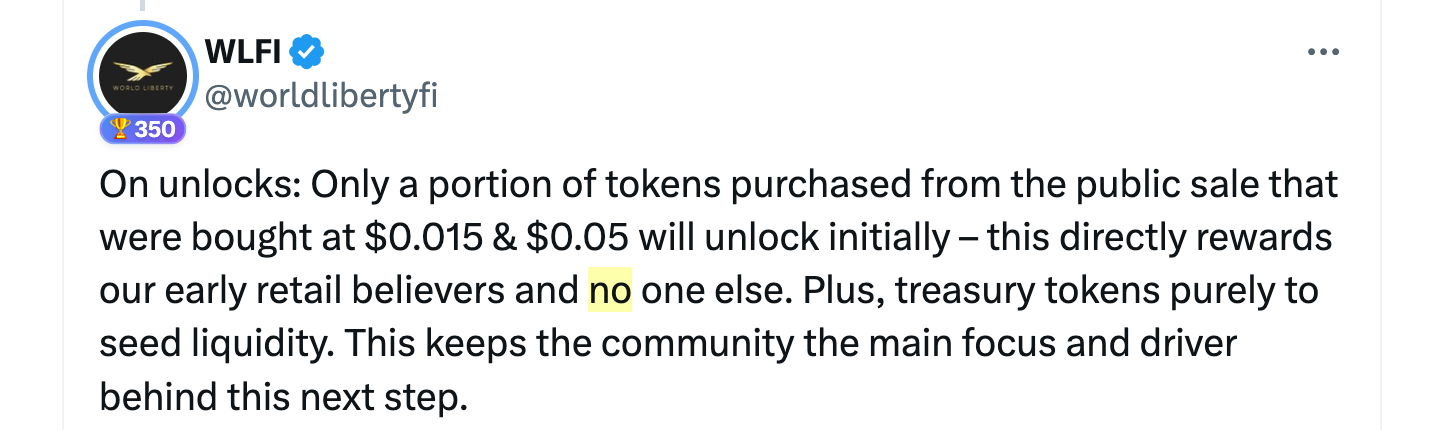

According to official statements and on-chain data, only early public offering shares will be partially unlocked, while the core team, advisors, and strategic investors will remain fully locked, with the future unlocking pace to be decided by community voting.

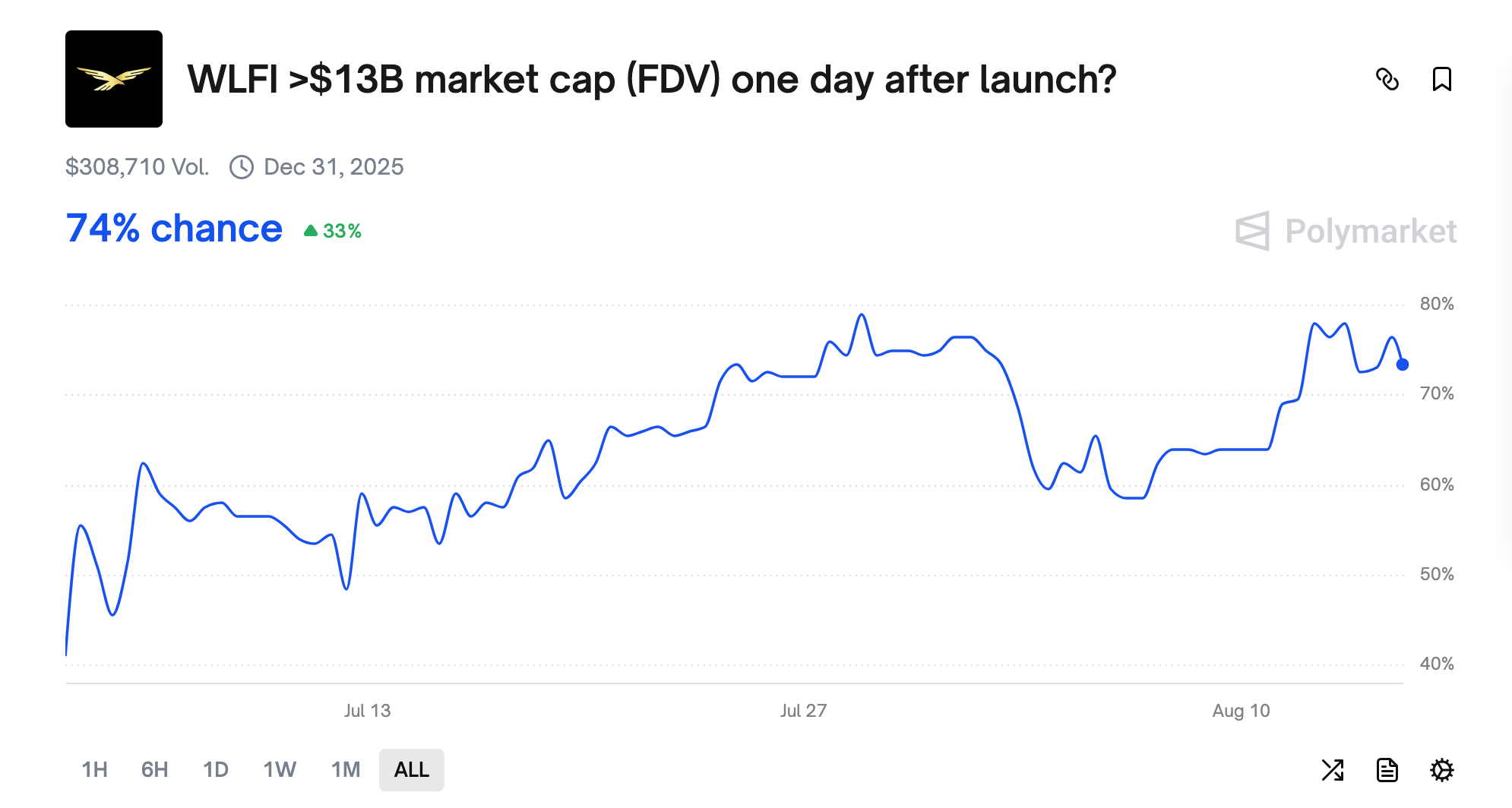

Based on this, a review of the over-the-counter trading data since July shows that WLFI's trading price has fluctuated between $0.8 and $1 (source: LBank Pro-Market data), and the probability of the prediction market Polymarket forecasting "TGE post-FDV exceeding $13 billion" is as high as 74% (data from August 14), suggesting that if this FDV level is compared, the returns for first-round investors could exceed 867%.

Additionally, public information shows that DWF Labs, Web 3 Port, Aqua 1 Fund, and others made significant purchases in the strategic round. Among them, Justin Sun purchased 300 million WLFI tokens at a low price through Tron DAO last November, with a cost even lower than the $0.015 public round, making him one of the largest independent holders currently. The entry of these capital players not only enhances WLFI's institutional credibility but also lays the "foundation for gaming" for the market performance after subsequent token unlocks.

This originally "unlisted" governance token, after the strategic allocation by ALT 5 Sigma, has obtained its first off-chain valuation anchor point at $0.20. According to the trading structure, ALT 5 will issue 200 million new shares, half of which will be directly used for token swaps with the WLFI project party, calculating a clear book valuation of $0.2 per WLFI based on a $1.5 billion valuation.

More importantly, this round of trading is tied to more political and capital signals. ALT 5 is not only a capital injection party but also an important part of WLFI's governance structure. Members of the Trump family, including Eric Trump, WLFI CEO Zach Witkoff, COO Zak Folkman, etc., have joined the ALT 5 board, which also plans to include WLFI in its crypto treasury assets to build a new capital model for "decentralized company reserves."

It can be said that ALT 5's move not only provides WLFI with a valuation anchor but also establishes it as a "political capital anchor" in the Web 3 world.

Stablecoin USD1: From On-Chain Decoupling Tests to Volume Expansion of Points Program

The USD1, which is highly tied to WLFI, is also rapidly evolving.

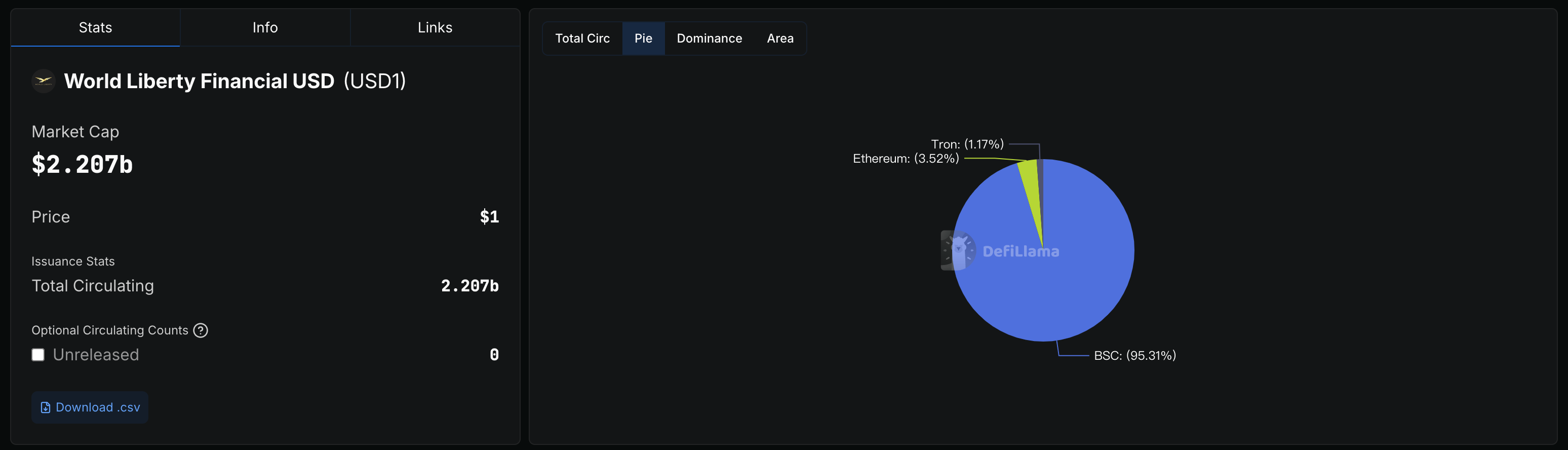

USD1 is WLFI's core tool in the stablecoin market, structured to be pegged 1:1 to the US dollar, with reserves consisting of US short-term treasury bonds and cash in USD, and the custodian being BitGo Trust Company. This model is similar to USDC, but its market expansion strategy leans more towards centralized platform integration and off-chain resource injection. Since its official launch in March this year, USD1 has quickly opened up the market with backing from fiat reserves, BitGo custody, security audit certification, and resources from the Trump family, with its circulating market cap exceeding $2.1 billion in just two months, making it the fastest-growing "latecomer" in the current stablecoin landscape.

On-chain distribution shows that USD1 mainly focuses on the BNB Chain, with about 90% of the token circulation occurring on this chain, while also completing compatibility deployments to Ethereum and Polygon through Chainlink CCIP, and has already launched on the Tron chain. Currently, USD1 has successfully connected to trading pairs on platforms such as Binance, HTX, MEXC, and has implemented functions such as staking, lending, and exchange through protocols like ListaDAO, StakeStone, and Falcon Finance.

However, the high-frequency usage has also exposed potential vulnerabilities in liquidity. On July 29, after the IKA Launchpad event on the Gate platform, a concentration of $200 million in redemptions led to a temporary decoupling, with the price dropping to as low as 0.9934 USDT. This sell-off caused by concentrated user redemptions was seen as a passive stress test for USD1 in a real market environment. (See: "Can USD1 from the Trump family stabilize after not being widely adopted and decoupling?")

Fortunately, the price stabilized at 0.9984 afterward and did not spiral out of control. On August 7, the project team promptly launched the USD1 Points Program, clearly stating that it would provide users with point incentives through trading, holding, and staking, launching simultaneously with several mainstream exchanges like OKX. Future plans include integration with the WLFI App and on-chain native DeFi projects, further solidifying the user stickiness and on-chain application layer of the stablecoin.

However, from the perspective of the on-chain ecosystem, the situation is not optimistic. Currently, the trading volume of USD1 within the Binance ecosystem is limited. Previously, meme coins like BUILDon, usd1doge, and wlfidoge saw increases ranging from several to dozens of times but then disappeared without any sustained momentum or "leading effect." Whether it can continue to thrive on-chain in the future may depend on the specific details of the points program.

But this does not change the fact that USD1 is no longer just "the affiliated stablecoin of WLFI," but is gradually becoming the on-chain pricing unit and financial intermediary of the Trump narrative.

Ecosystem Expansion: Multi-Round External Investments and Asset Acquisitions Under the Treasury Strategy

Compared to "telling stories," WLFI understands better how to "buy footnotes with money." The WLFI project has consistently emphasized the "crypto treasury model" and has adopted a multi-dimensional expansion strategy in practice.

In the first half of 2025, WLFI invested in or announced investments in the following projects:

- A strategic investment of $10 million in Falcon Finance, with USD1 becoming its official collateral asset;

- A commitment to invest $6 million in Vaulta (formerly EOS) to promote its Web3 banking module in the U.S.;

- Purchasing $6 million in Vaulta A and EOS through DEXs like Pancake and exSat;

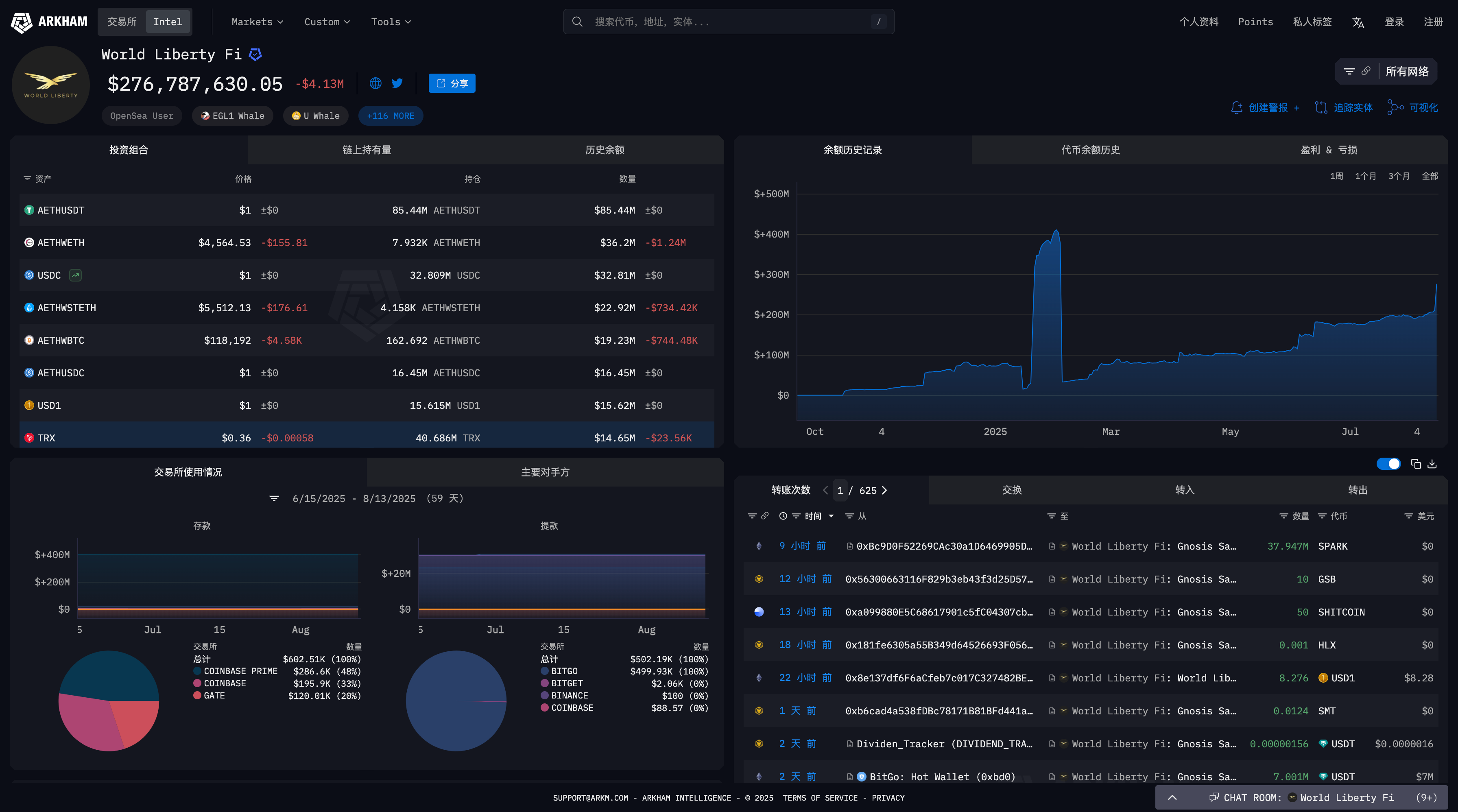

- Actively buying mainstream crypto assets such as LINK, TRX, AAVE, SEI, AVAX, MNT, ENA, ONDO, MOVE, with total expenditures exceeding $40 million.

Some of these assets (such as TRX, LINK, AAVE) have been included in WLFI's strategic treasury asset reserves to support stablecoin issuance and financial tool construction.

An even more important step is WLFI's capital reverse input into ALT 5. The project team obtained board seats at ALT 5 through a token swap model and is restructuring its crypto asset management business around WLFI. This approach serves as both a valuation anchoring tool and a community governance signal.

According to co-founder Zak Folkman, three U.S. publicly listed companies have expressed willingness to consider including WLFI in their asset reserves. He noted, "We are trying to replicate Michael Saylor's path, but we are taking a stablecoin-led route."

It is worth noting that most of these investments revolve around the actual circulation and payment scenarios of USD1, directly consolidating its position as a stablecoin intermediary.

The Crypto Experiment of Political Capital is Still Advancing

From the "non-tradeable" governance setting to the high expectations surrounding the imminent TGE, from the rapid volume expansion of the stablecoin USD1 to the broad capital layout of the ecosystem, from investors like Justin Sun, DWF Labs, Aqua Fund to users betting on its FDV exceeding $13 billion on Polymarket… the underlying logic of this series of actions is clear:

WLFI is attempting to convert political brand power into crypto financial traffic and build a complete closed loop from treasury mechanisms, stablecoin issuance, scenario construction to community governance.

In the short term, the market will continue to engage in games around TGE, unlocking ratios, and exchange launches, while in the long term, whether this "crypto experiment coming from Trump" can continue to earn market trust and withstand extreme volatility will depend on whether it can truly achieve a high coupling of political narrative and financial engineering.

The ecosystem built by WLFI is clearly not a single DeFi project but a "situational expression" of an embedded political capital mechanism in the Web 3 world. Behind it, there is not only the personal brand traffic of the Trump family but also a macro background of the new U.S. government's changing attitude towards the crypto industry (such as the GENIUS Act). Therefore, WLFI is not constructing a purely on-chain model of "anonymous community autonomy," but rather building a governance experimental field that spans chains and sectors.

If Polygon is a Web 3 model of Indian political and business technology collusion, then WLFI is an integrated rehearsal of "American crypto nationalism."

However, we must also recognize the risk factors: extreme unevenness in token circulation (high concentration of large holders); the project team's intensive actions in strategic investments, leading to significant asset risk exposure; the stablecoin USD1 is still in the early stages of on-chain development and has not yet passed the stability test of large market capitalization; while political labels can attract attention, they may also amplify regulatory pressure.

Whether WLFI can truly break through mere political traffic and establish financial inertia will still depend on two core paths: first, whether USD1 can truly form a mainstream on-chain payment and settlement network; second, whether the market circulation mechanism after TGE is stable and sustainable.

Conclusion: WLFI is destined to be more than just a token

World Liberty Financial is currently at a triple dividend point where policy shifts, narrative transformations, and market recoveries intersect. It carries the expectation of "transforming American political influence into on-chain order" while facing the skepticism of how "decentralized autonomy" can be taken over by real capital.

Can WLFI become the next TRUMP? Can it emulate MSTR to become a paradigm of corporate treasury cryptoization? Can it break the curse of "political crypto = emotional market value" and ultimately achieve a long cycle with financial compounding ability?

Regardless of belief, the era of WLFI is being activated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。