Original Title: Semiannual Report: "Inside Hyperliquid's Growth"

Original Source: GLC

Original Translation: Asher, Odaily Planet Daily

Editor's Note: In the first half of 2025, Hyperliquid continued to maintain its leading position in the decentralized perpetual contract market, with the platform's TVL, open interest, and trading volume all reaching historical highs. The HyperEVM ecosystem is rapidly expanding, Unit is driving spot trading implementation, and local applications and Builder Codes are accelerating user growth. The HYPE token has performed steadily, supported by a unique buyback mechanism and record revenues, while HIP-3 has opened up perpetual market deployment permissions, bringing new profit opportunities to the community. With strategic partners joining and more assets being on-boarded, Hyperliquid has immense growth potential in the second half of the year, shaping a new landscape for decentralized trading.

Hyperliquid On-Chain Metrics

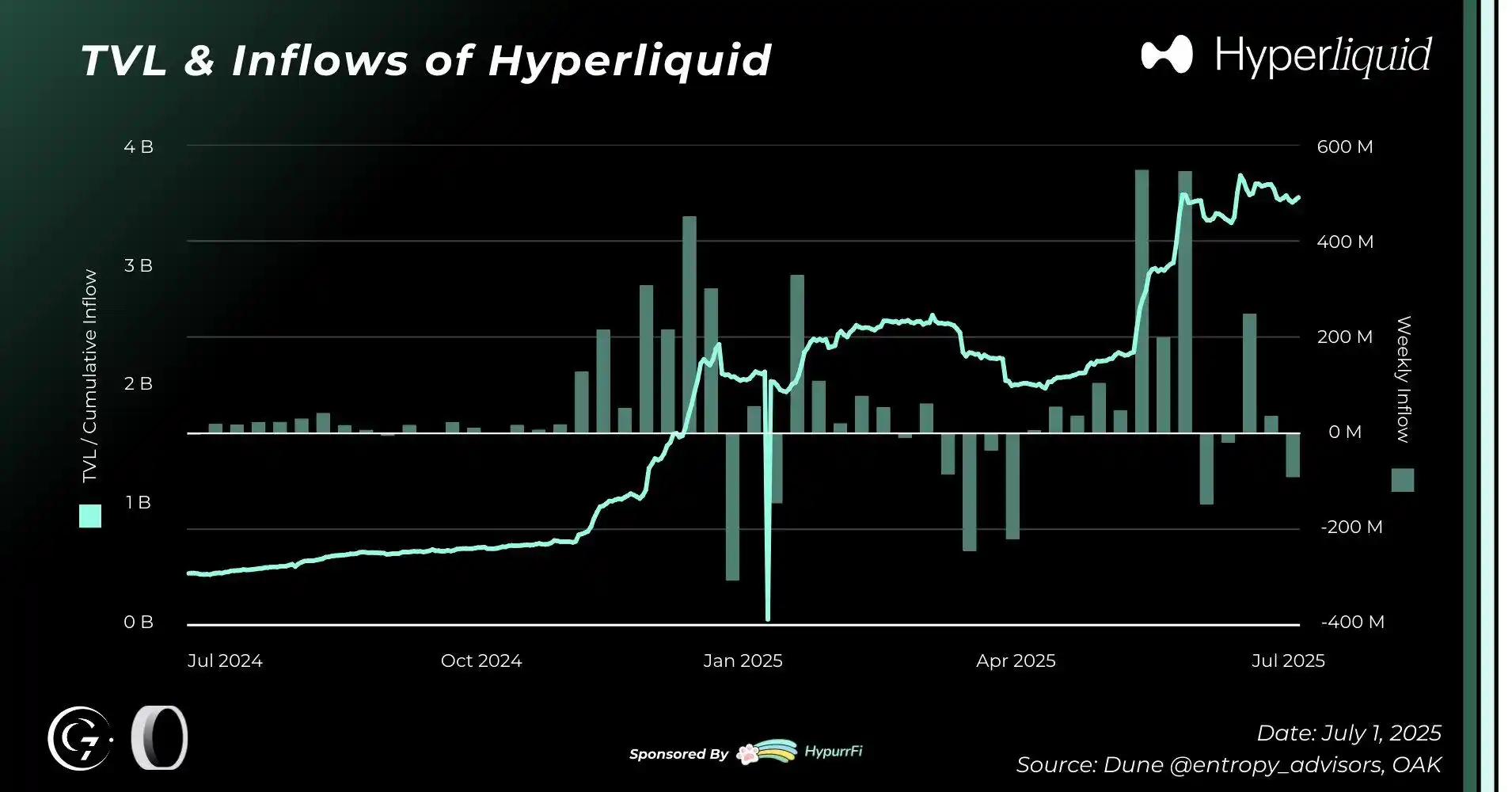

TVL and Capital Inflows

The launch of the HYPE token and the end of the airdrop did not lead to user attrition. On the contrary, Hyperliquid experienced astonishing growth starting in Q4 2024. Notably, capital inflows surged in November, with daily peaks exceeding $50 million, driving TVL from $564 million to over $2 billion, with a quarterly growth rate as high as 269%.

Due to this continuous growth, Hyperliquid further solidified its dominance in the decentralized perpetual contract trading space in the first half of 2025. As of June 30, the platform's TVL reached $3.5 billion, a 70.8% increase from $2.1 billion at the beginning of the year. During the same period, despite experiencing a net outflow of $590 million in March, overall capital inflows remained strong, with an average weekly net inflow of $58 million.

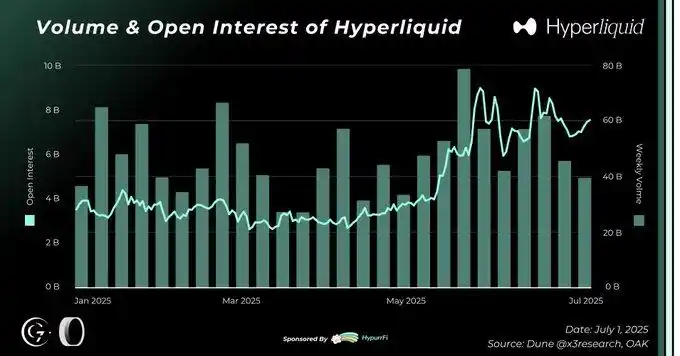

Open Interest and Trading Volume

From first breaking $1 billion in Q4 2024 to rising to $3.27 billion by the end of the year, Hyperliquid's open interest grew by approximately 227% in just a few months. Entering 2025, this figure continued to soar, currently reaching $15 billion, a year-on-year increase of about 359% compared to the end of 2024, equivalent to 61% of ByBit, 105% of OKX, and 120% of Bitget.

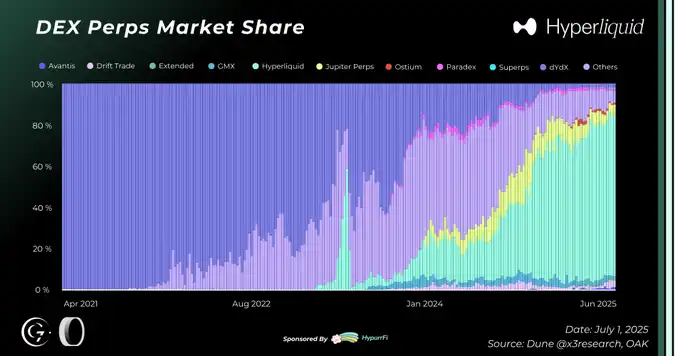

In Q4 2024, Hyperliquid's weekly trading volume was approximately $13 billion, which significantly increased to an average of $47 billion in the first half of 2025, peaking at a historical high of $78 billion in the week of May 12. Meanwhile, its market share also expanded, rising from about 56% at the end of 2024 in the decentralized perpetual contract trading platform to over 73% by the end of Q1 2025, further solidifying its industry-leading position.

In terms of user scale, the number of user addresses on Hyperliquid grew from 291,000 to over 518,000 in the first half of 2025, a six-month growth of 78%. This growth not only reflects the rapid expansion of the platform's user base but also corresponds to over $53 billion in liquidated positions, indicating active market engagement and depth.

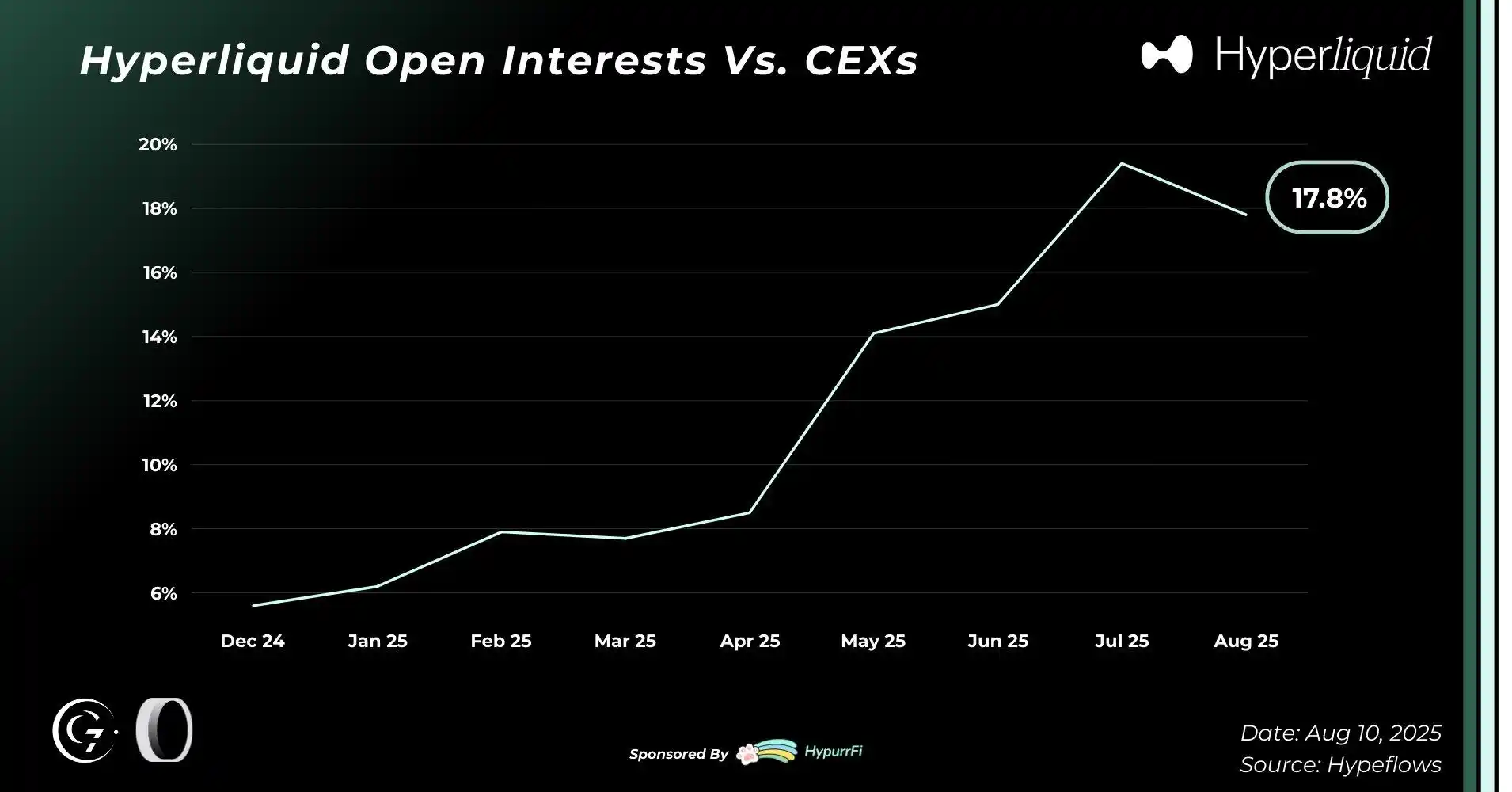

Hyperliquid vs. CEX Data Comparison

In the first half of 2025, Hyperliquid's growth relative to centralized exchanges (CEX) was particularly notable, as of now:

- Hyperliquid's trading volume share reached 6.1%, an increase of 3.9 percentage points since January this year.

- Hyperliquid's open interest share reached 17.8%, an increase of 12.3 percentage points since January this year.

Firstly, Hyperliquid offers the lowest costs for trading spot and perpetual contracts within its ecosystem while providing deep on-chain liquidity. For certain assets, the order book depth can rival that of leading CEXs. For example, during the launch of PUMP, the platform achieved the deepest market depth, highest trading volume, and tightest bid-ask spread, marking a first in DEX history.

Secondly, Hyperliquid has become the preferred platform for new coin launches. Since the launch of Trump Coin, the platform has consistently been the first to list perpetual contracts, a strategy that quickly attracted users and reinforced the platform's recognition as the go-to for new coin trading. Additionally, PUMP raised approximately $500 million in just 12 minutes, making Hyperliquid the first platform to simultaneously launch spot and perpetual contracts while providing pre-trading opportunities, validating its ability to attract users and liquidity.

Today, Hyperliquid matches leading CEXs in trading speed, liquidity, and user experience while retaining the advantages of decentralization: permissionless access, on-chain transparency, and native composability, allowing any asset, position, or trade to integrate directly with smart contracts, dApps, or other protocols on HyperEVM.

HLP: Core Liquidity Engine and Robust Returns

HLP (Hyperliquidity Provider) is Hyperliquid's core liquidity engine, providing USDC liquidity for order books, market making, and automated liquidation, while integrating various strategy returns to offer users non-directional exposure. HLP's TVL saw significant growth by the end of 2024, driven by the HYPE airdrop, increasing from $150 million at the end of November to over $400 million at the beginning of 2025, peaking at $512 million in May, and stabilizing at $372 million by the end of the first half.

During the same period, HLP's net profit rose from $50 million to $68 million, with users enjoying an average annualized return of about 11%. Despite the JELLY incident, the net yield in Q1 2025 was still 5.2%, with a decline of less than 3.5%.

Unit: The Key to Hyperliquid's Future

Unit was launched on February 14, 2025, as Hyperliquid's asset tokenization layer, supporting native deposits and withdrawals of various assets, and directly listing assets on the Hyperliquid spot market through an auction system, initially supporting BTC and later expanding to ETH, SOL, FARTCOIN, PUMP, BONK, and others.

Since its launch, Unit's TVL has reached $800 million, second only to Kinetiq; the volume of assets traded through Unit in the first half exceeded $15 billion. Nevertheless, Hyperliquid's spot trading volume still only accounts for 2% of the overall trading volume, far below the 15%–30% ratio of most centralized exchanges, indicating that it is still in the early stages.

HyperEVM On-Chain Metrics

HyperEVM was launched in February 2025, a blockchain compatible with EVM, built directly on Hyperliquid's infrastructure, supporting the deployment of smart contracts and decentralized applications.

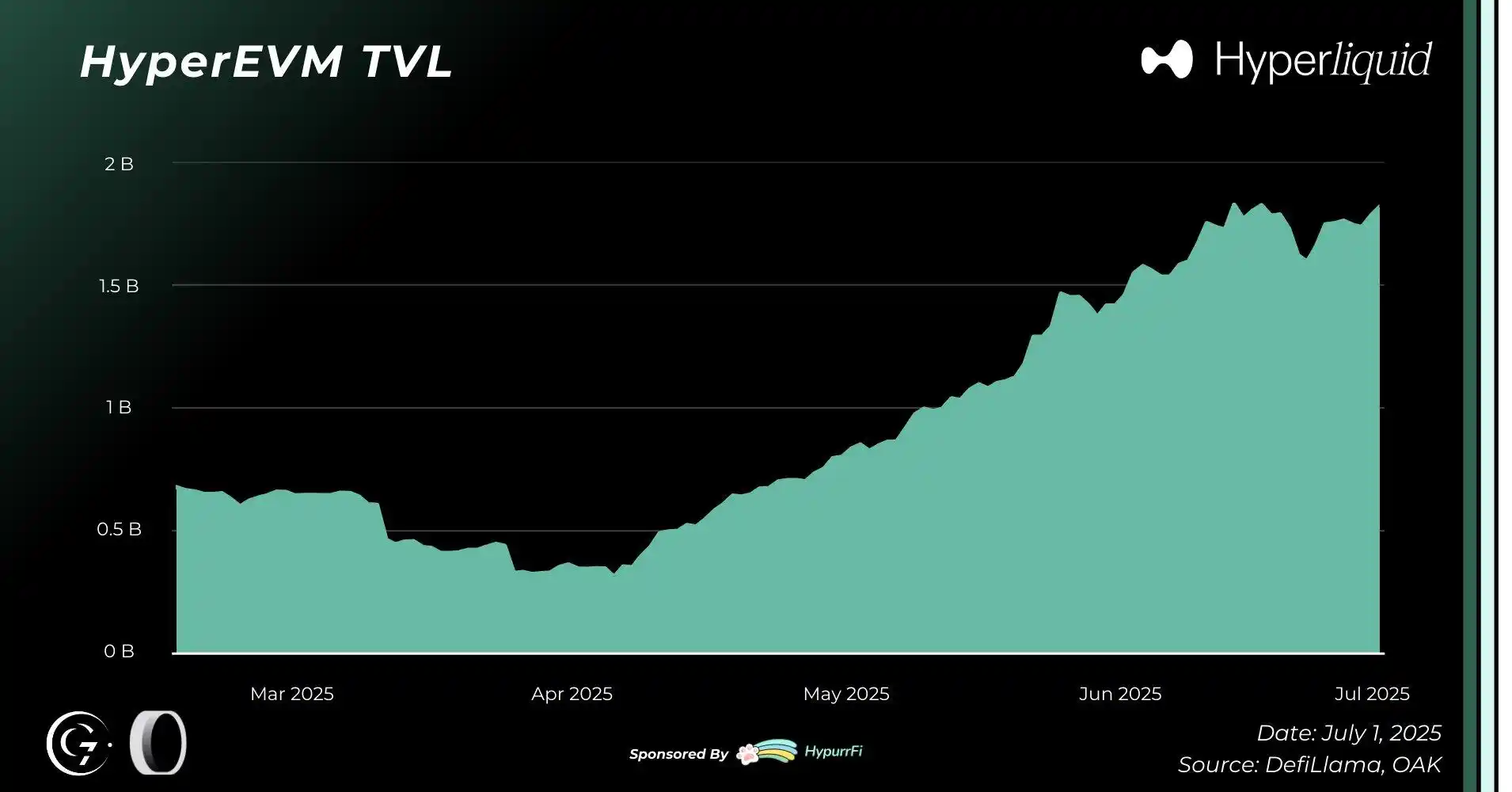

TVL

Although the TVL was less than $50 million at the beginning of February, just two months after the mainnet deployment (mid-April), the TVL surpassed $1 billion and reached $2.08 billion by June 30, achieving a doubling growth.

Active Address Count

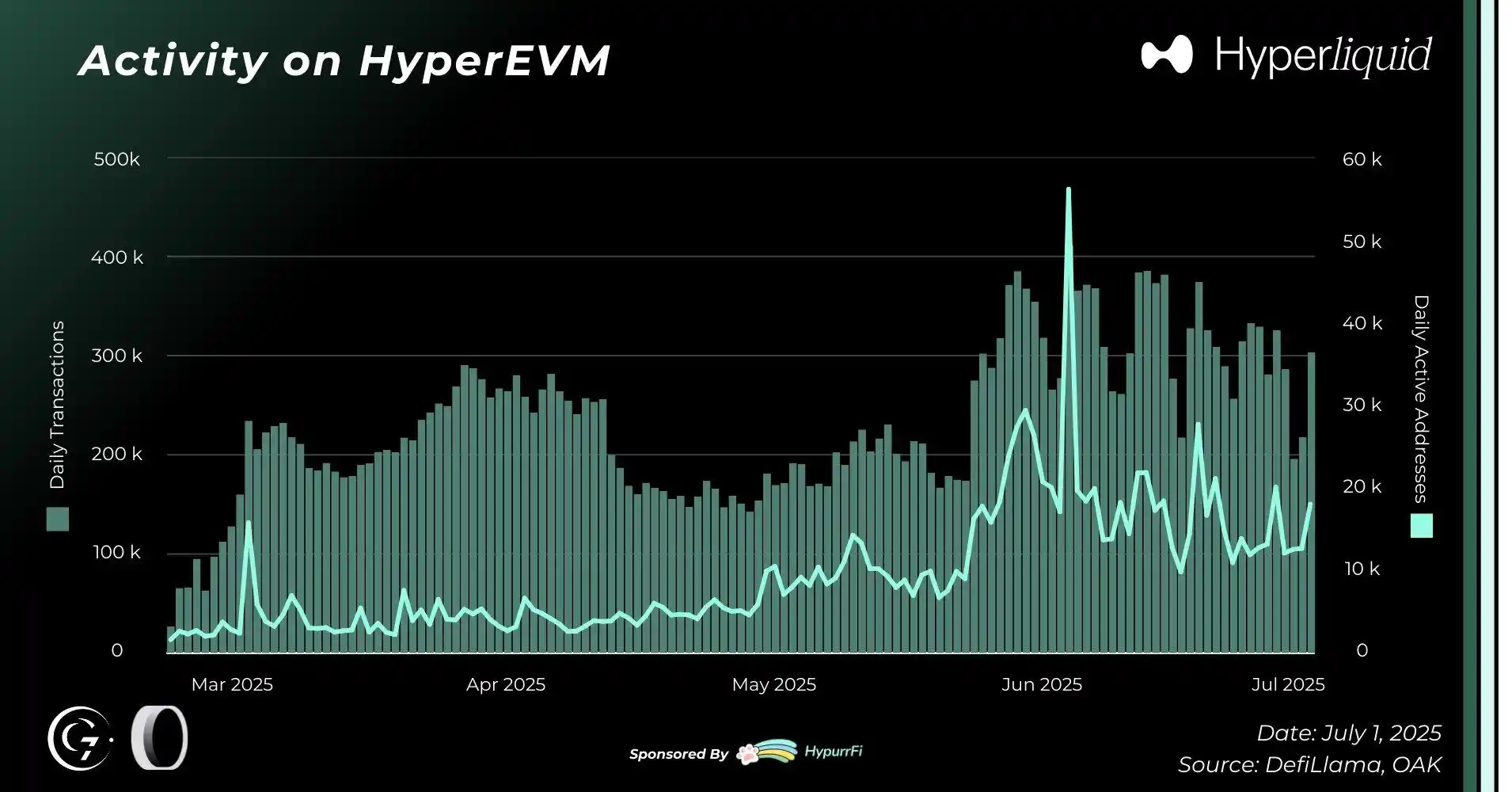

In the first half of 2025, HyperEVM's user activity steadily increased, with an average of about 33,000 active addresses daily, peaking over 44,000 in June.

Additionally, trading volume showed a similar trend, averaging about 208,000 transactions per day, with peak periods reaching 315,000 transactions.

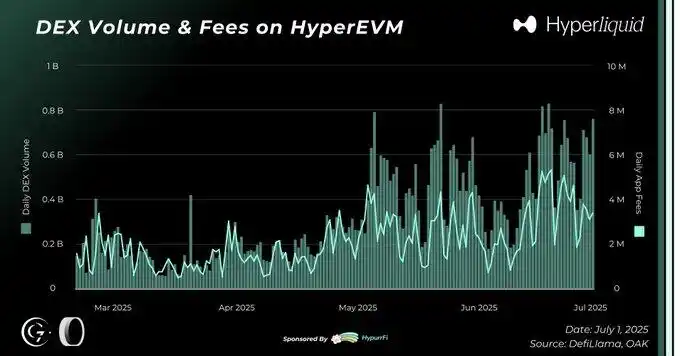

In terms of economic performance, applications on HyperEVM generated an average of about $1.927 million in fees daily, peaking at $4.855 million on May 21, with total accumulated fees reaching $256.2 million to date.

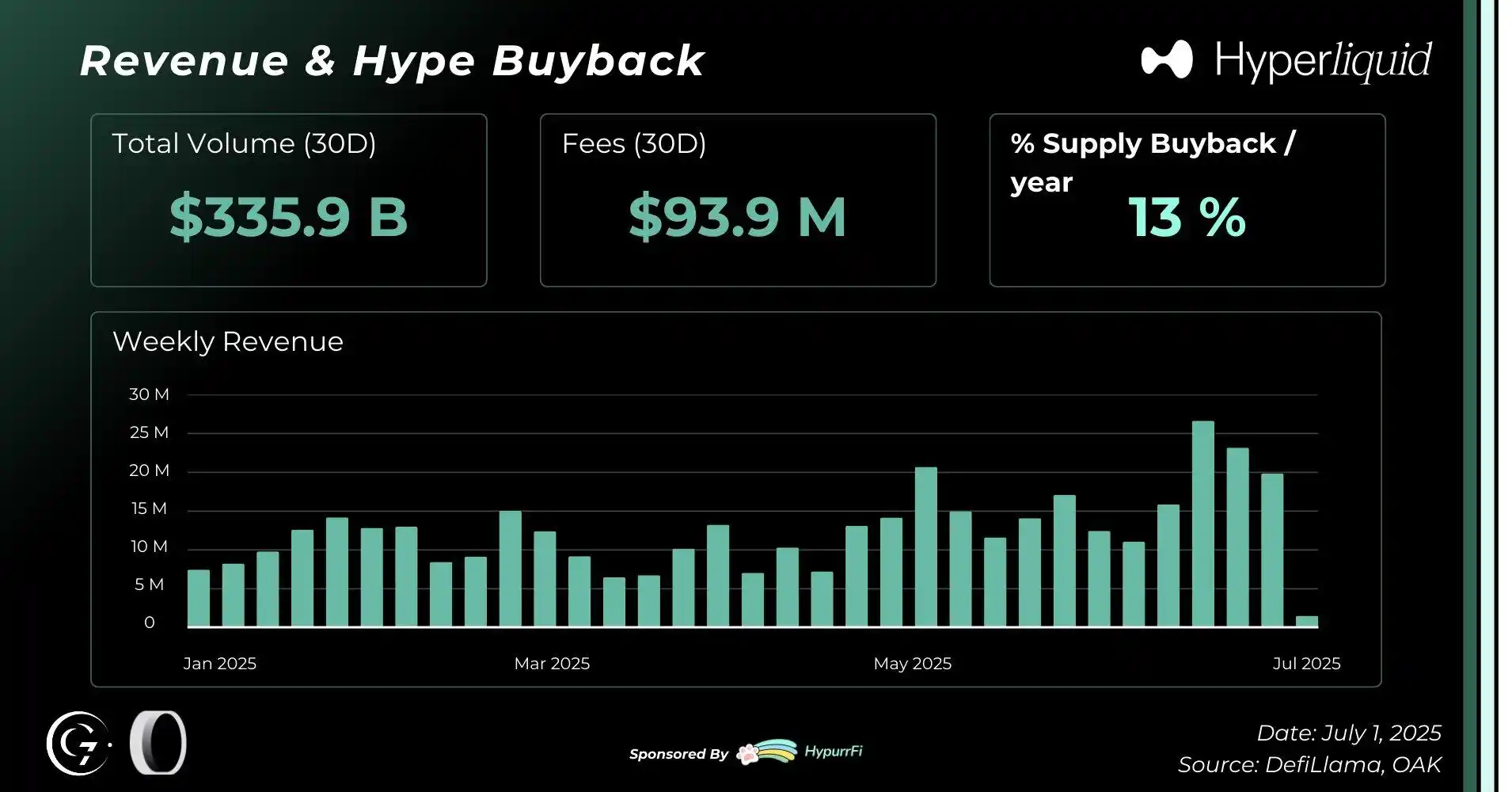

HYPE Revenue and Buyback

Unlike most DeFi protocols, the Hyperliquid team does not directly collect platform fees; all revenue is allocated to HLP and the Assistance Fund. HLP serves as the community treasury, providing market-making returns to users; the Assistance Fund is denominated in HYPE and acts as a liquidity reserve when needed.

Recent data indicates that about 92% of fees flow to the Assistance Fund, with the remaining 8% allocated to HLP. The Assistance Fund uses its income for a buyback program of HYPE tokens in the spot market, thereby supporting the HYPE price and directly benefiting token holders.

Since the beginning of 2025, Hyperliquid's total revenue has reached $406 million (annualized over $810 million), making it one of the most profitable protocols in the crypto industry, second only to Tether and Circle. In the first quarter, fees saw significant growth, rising from about $1 million per day to an average of $3 million, peaking over $5 million.

In addition, the Assistance Fund can repurchase approximately 13% of the HYPE supply annually. With the launch of HIP-3 and Builder Codes (represented by Phantom), Hyperliquid fees will further increase, thereby strengthening the buyback model and supporting token value (at the time of writing, based on data from the past 30 days, the annualized revenue is approximately $1 billion, which corresponds to a price-to-earnings ratio of about 15 based on the circulating supply).

Major Events of Hyperliquid in the First Half of 2025

In January 2025, Hyperliquid expanded its validators to 27 and launched the TRUMP perpetual contract, with trading volume exceeding $21 billion for two consecutive days.

In February 2025, Unit went live, achieving native asset deposits of $400 million and spot trading volume of $8.4 billion; HyperEVM was launched, with TVL reaching $2 billion.

In March 2025, the Jelly incident resulted in a loss of $12 million for HLP, with users compensated.

In May 2025, the HIP-3 testnet allowed the community to deploy new perpetual markets, while Staking Tiers and new stablecoins USDe and USDT0 were introduced.

In June 2025, several listed companies included HYPE in their corporate treasuries, with Hyperliquid's annualized revenue exceeding $800 million, 97% of which was used for HYPE buybacks.

In July 2025, CoreWriter went live, enabling bidirectional writing between HyperCore and HyperEVM, while Builder Codes integrated Phantom Perps, adding approximately 20,000 users, with expected annual revenue of $15 million to $30 million.

Summary

In the first half of 2025, Hyperliquid continued to solidify its leadership position in the decentralized perpetual contract market, with outstanding on-chain metrics, accelerated adoption of HyperEVM, and rapid expansion of the local application ecosystem. The HYPE token performed steadily, supported by a unique buyback mechanism and record revenues, demonstrating the sustainability of the protocol's economic model.

More broadly, Hyperliquid is continuously opening up new growth spaces by strengthening liquidity and infrastructure advantages while promoting the development of HIP-3, CoreWriter, and Builder Codes. With the addition of strategic partners like Phantom and the rise of HyperEVM native protocols, the network has robust growth potential for the second half of the year.

Among these, HIP-3 is a core driving force: any user holding 1 million HYPE can deploy perpetual contracts and earn up to 50% of trading fee revenue without bearing the infrastructure costs, as Hyperliquid provides full support. The integration with Phantom has already shown results, with this alone expected to bring a 2%–4% annual cash flow increase; if more wallets or front-ends follow suit, the potential will be further amplified.

With the U.S. SEC launching new on-chain asset programs, Hyperliquid is expected to support more asset types, unlocking further growth opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。