Overview of RWA on Arbitrum, Projects and Initiatives Driving Its Development, Major Assets and Providers (Including Case Studies), as well as Related Risk Considerations and Future Outlook.

Written by: Castle Labs

Translated by: Saoirse, Foresight News

Abstract

For many, the ability to tap into the realm of Real World Assets (RWA) has become a benchmark for measuring whether cryptocurrencies have achieved mainstream adoption: only when we can connect the on-chain world with traditional finance can cryptocurrencies truly establish themselves as an attractive mainstream asset.

What was once a vision is gradually becoming a reality, with U.S. Treasury bonds, bonds, and even real estate being tokenized and brought on-chain.

Driven by clearer regulations and technological maturity, RWA is gaining significant momentum.

This article focuses on the Arbitrum ecosystem, a Layer 2 solution that has successfully launched multiple RWA-focused projects, with the total value locked (TVL) in RWA assets exceeding $350 million.

This article will outline RWA on Arbitrum, projects and initiatives driving its development, major assets and providers (including case studies), as well as related risk considerations and future outlook.

Overview of RWA on Arbitrum

The RWA market is thriving. Many early cryptocurrency adopters once envisioned a scenario where Wall Street elites would use cryptocurrencies. Today, this vision has been realized, and real-world assets have successfully been brought on-chain and are beginning to be widely adopted.

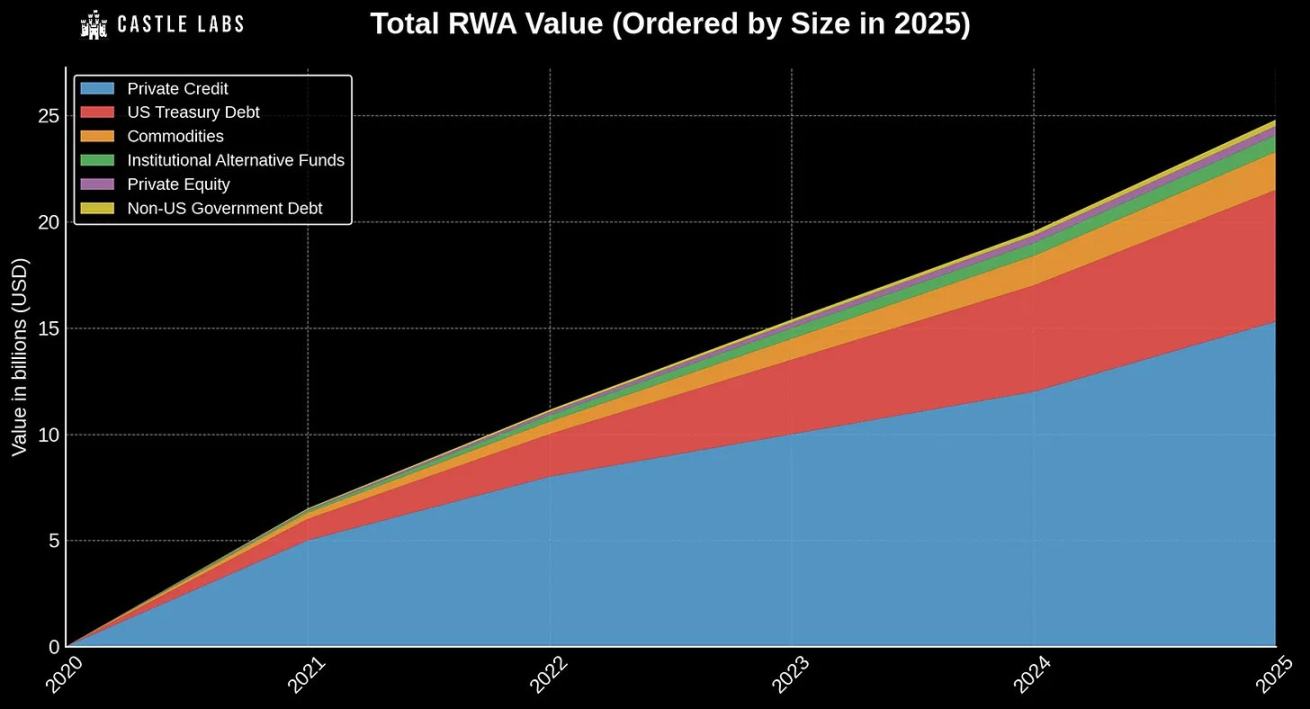

Source: rwa.xyz

Currently, the total value of RWA exceeds $25 billion, distributed as follows:

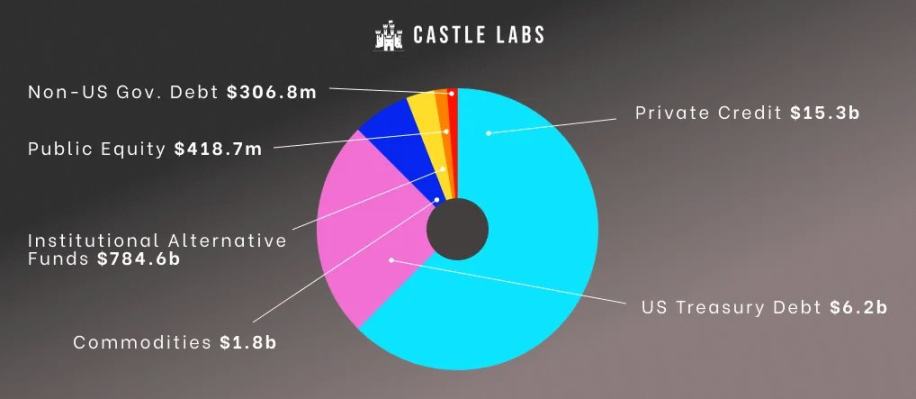

Source: rwa.xyz

Private Credit: $15.3 billion (60%)

U.S. Treasury Bonds: $6.2 billion (26.9%)

Commodities: $1.8 billion (7.2%)

Institutional Alternative Funds: $784 million (3.26%)

Private Equity: $418.7 million (1.71%)

Non-U.S. Government Bonds: $306 million (approximately 1.2%)

The on-chain success of RWA is attributed to a combination of factors:

The regulatory framework for digital assets is becoming increasingly mature

The technological infrastructure has reached production-level reliability

Institutional interest is rapidly increasing

Cryptocurrencies are gradually being accepted and integrated into regulatory frameworks, such as Europe’s MiCA and the recently passed U.S. GENIUS Act, indicating that these assets are progressively moving towards legalization in a broader financial context.

Meanwhile, networks like Bitcoin and Ethereum have been operating stably for over a decade, showcasing their security, activity, and decentralization.

However, due to their inherent characteristics, RWA requires higher assurances before being brought on-chain. Therefore, the emergence of Layer 2 solutions is highly attractive to institutional investors, as they can significantly reduce on-chain operational costs compared to the Ethereum mainnet.

Among various Layer 2 networks, Arbitrum is one of the fastest-growing Layer 2 solutions in the RWA space.

Why Choose Arbitrum?

Mature and reliable technology stack

Credible blockchain space neutrality

One of the largest capital pools in the cryptocurrency space

Arbitrum boasts a solid technology stack: it focuses on technology-driven development, with the launch of innovations like Stylus and Timeboost, making it an effective alternative to the Ethereum mainnet.

Additionally, Arbitrum's backend technology is used by projects like Hyperliquidx as a cross-chain bridge for USDC, extending beyond the functionality of its own ecosystem. This fully demonstrates Arbitrum's credible neutrality as a blockchain space. Credible neutrality refers to the principle that a blockchain network operates fairly, treating all participants equally without favoring any user, application, or outcome.

The Importance of Credible Neutrality:

Trust: Users and institutions are more willing to rely on a platform that does not arbitrarily change rules or favor one party.

Security: Neutral systems are better able to resist manipulation or centralization risks.

Composability: DeFi can thrive when developers are confident that no protocol will receive special treatment.

Institutional Confidence: For RWA, neutrality ensures that tokenized assets do not face hidden risks (such as censorship or biased governance).

Lastly, it is worth mentioning that Arbitrum has the sixth-largest capital pool in the field, with assets exceeding $1.17 billion, and also has one of the most mature stablecoin ecosystems.

RWA can represent tangible assets and income-generating instruments while also providing the programmability and transparency of blockchain systems, offering institutional investors and decentralized autonomous organizations (DAOs) new opportunities for diversified investment, stable returns, and improved capital efficiency.

What Proposals Have Driven This Development?

This section briefly reviews the development of RWA within Arbitrum. The initial development of RWA in Arbitrum was jointly driven by the foundation and Arbitrum DAO.

The first major initiative by Arbitrum DAO in the RWA space began with the "Stable Treasury Endowment Proposal" (STEP), followed by the launch of the RWA Innovation Grant Program, treasury management proposals, and finally STEP 2.

STEP (April 2024)

This proposal plans to invest over $85 million (35 million ARB) into tokenized U.S. Treasury bonds and other real-world assets through institutional issuers.

Although the plan was initially just a pilot project, several providers were successfully selected after in-depth analysis of applicants:

Securitize's BUIDL

Ondo Finance's USDY

Superstate's USTB

Mountain Protocol's USDM

OpenEden's TBill

Backed's bIB01

The criteria for selecting applicants were as follows:

No investment restrictions

Clear organizational structure with no departmental silos

Significant asset management scale, with multiple International Securities Identification Numbers (ISIN) exposure and experienced teams

Use of public or decentralized tools and networks (rather than relying solely on proprietary tools and networks)

Avoid companies with additional layers of decentralized governance

Comprehensive and detailed documentation

Additionally, to ensure coverage is not limited to the above list, STEP also plans to invest 1% of the DAO treasury in tokenized real-world assets each year for the next five years. This plan also provides practical opportunities to gain deeper insights into the RWA space and balance ecosystem development with principal protection. Future iterations are expected to focus on one of these goals.

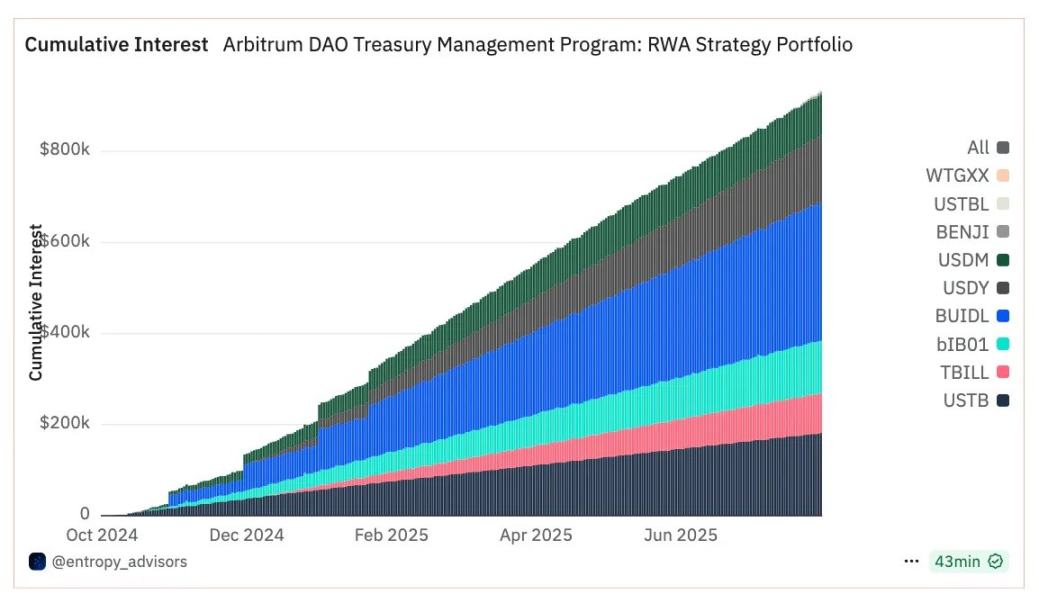

The STEP plan has achieved great success, bringing in $600,000 in interest income to Arbitrum DAO in less than a year.

The following is the cumulative amount reported monthly:

What makes STEP special is its adherence to clear principles when collaborating with institutional service providers:

Direct assessment and selection of income-stable assets without intermediary involvement

Use of a Request for Proposal (RFP) model, allowing protocol parties to submit product applications for review

Institutional participants apply directly in decentralized forums, with the plan aimed at creating sustainable income for the DAO

RWAIG Grant Program (June 2024)

The Arbitrum Foundation funded a series of innovative grant projects (RWAIG), a two-month pilot program conducted from June to August 2024, aimed at supporting RWA integration, analysis, and research within Arbitrum, with a budget of 300,000 ARB.

The main goals of these grant projects are:

Significantly enhance the activity of RWA within Arbitrum, gaining a competitive edge and ensuring "future growth of the platform"

Explore how to invest DAO treasury funds into RWA and how to initiate on-chain tokenization on Arbitrum

More broadly integrate RWA assets and tools into existing ecosystem applications like GMX, Aave, and Pendle

The program ultimately funded eight different projects:

RWA Research: Educating users about the field

PYOR: RWA analytics dashboard

Mystic Finance: A lending market allowing users to borrow stablecoins against RWA assets

Jia: Tokenizing small and medium-sized enterprise receivables

Truflation: Providing real-time inflation data

Backed Finance: Creating structured products that track securities

Infinfty: Developing ERC-6651 RWA tokens to track the entire lifecycle of product procurement, performance, ownership, and environmental impact

Treasury Management (December 2024)

By the end of 2024, a treasury management proposal emerged, aimed at complementing the preliminary work of STEP. This proposal focuses on generating passive income by utilizing on-chain strategies with ARB tokens, rather than leaving the tokens in the treasury idle.

Its goals include:

Asset Management: Manage 25 million ARB tokens to generate on-chain returns

Stablecoin Exchange: Simplify the process of exchanging ARB assets for stablecoins, minimizing slippage and market impact

Stablecoin Liquidity Deployment: Convert 15 million ARB into stablecoins and invest in low-risk income strategies to cover DAO expenses or service provider fees

Diversification and Stability: Focus on risk-adjusted returns while ensuring capital safety

This strategy is divided into two directions:

Treasury: Reserve 10 million ARB for pure ARB strategies, converting 15 million ARB into stablecoins as the DAO's "current account"

Growth: Allocate 7,500 ETH to the decentralized finance (DeFi) sector

STEP 2 (January 2025)

Inspired by the initial success of STEP, the STEP 2 proposal was approved, adding an additional 35 million ARB (approximately $15.7 million).

After carefully reviewing over 50 applications, the STEP committee decided to allocate assets as follows:

WisdomTree WTGXX: 30%

Spiko USTBL: 35%

Franklin Templeton FOBXX (BENJI): 35%

The importance of this plan is also reflected in the DAO's recognition of it.

STEP 2 was passed with an absolute majority, with nearly 89% of participants expressing support, 11% abstaining, and only 0.01% opposing.

These projects and initiatives have collectively driven the development of on-chain real-world assets on Arbitrum, increasing its total value locked (TVL) from nearly zero to over $70 million in less than a year.

So what is the current situation?

What does the RWA landscape on Arbitrum look like?

The next section will delve into on-chain data to explore RWA assets, asset providers, and the growth of RWA on Arbitrum.

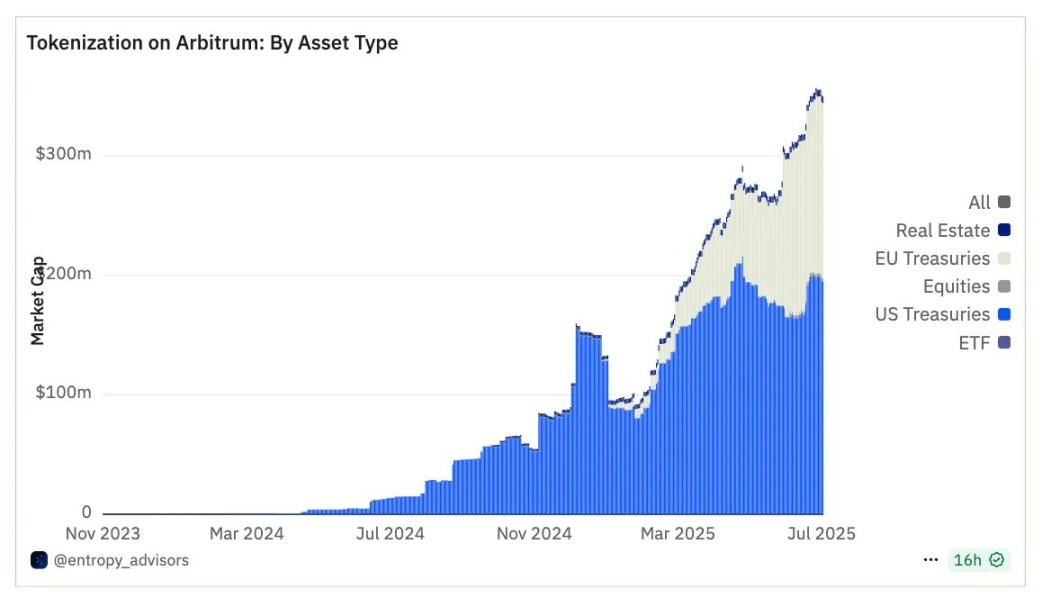

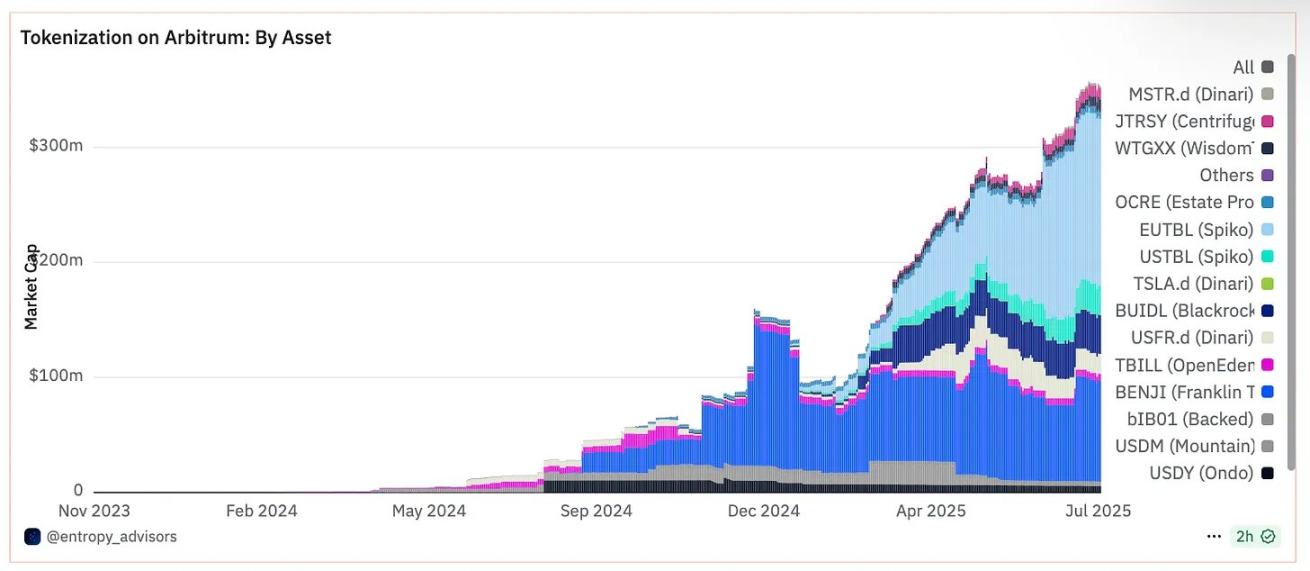

Growth of RWA on Arbitrum

With its low-cost, high-throughput architecture and credible neutrality, Arbitrum is rapidly building an ecosystem composed of issuers, infrastructure providers, and incentive programs to drive RWA on-chain at scale.

Although Arbitrum initially focused primarily on DeFi building blocks, DEXs, lending protocols, and yield aggregators, the concept of bringing off-chain assets on-chain began to gain attention after early experiments with tokenized U.S. Treasury bonds on Ethereum in 2022.

Currently, the market capitalization of RWA on Arbitrum is close to $350 million, with over 129 assets tokenized. While this figure is impressive, it only represents about 1.39% of the total market capitalization of RWA assets, indicating strong growth potential for the future.

Despite varying predictions, several forecasts estimate the growth of the on-chain RWA sector as follows:

Reaching $16 trillion by 2030 (10% of global GDP)

Reaching $30 trillion by 2034

In the first scenario, the sector is expected to grow 40 times over the next five years.

As one of the most mature on-chain RWA networks, Arbitrum will gain a significant competitive advantage.

Growth Journey of RWA on Arbitrum

In just one year, 2024, the total value locked (TVL) in Arbitrum grew from nearly zero to nearly $85 million by the end of the year.

This growth journey can be divided into three phases, closely related to the key initiatives mentioned above:

Early Growth Phase (Q1 2024): The total value locked in RWA on Arbitrum surged from nearly zero to over $5 million, showing initial development momentum.

Significant Growth Phase (Q2 2024): In the first half of 2024, the total value locked grew from about $20 million to approximately $70 million, coinciding with the funding allocation timeline of STEP 1.

Continuous Expansion Phase: With increased DAO treasury allocations (STEP 2) and the addition of new RWA issuers (such as Spiko, WisdomTree, and BlackRock), 2025 is expected to maintain continuous growth.

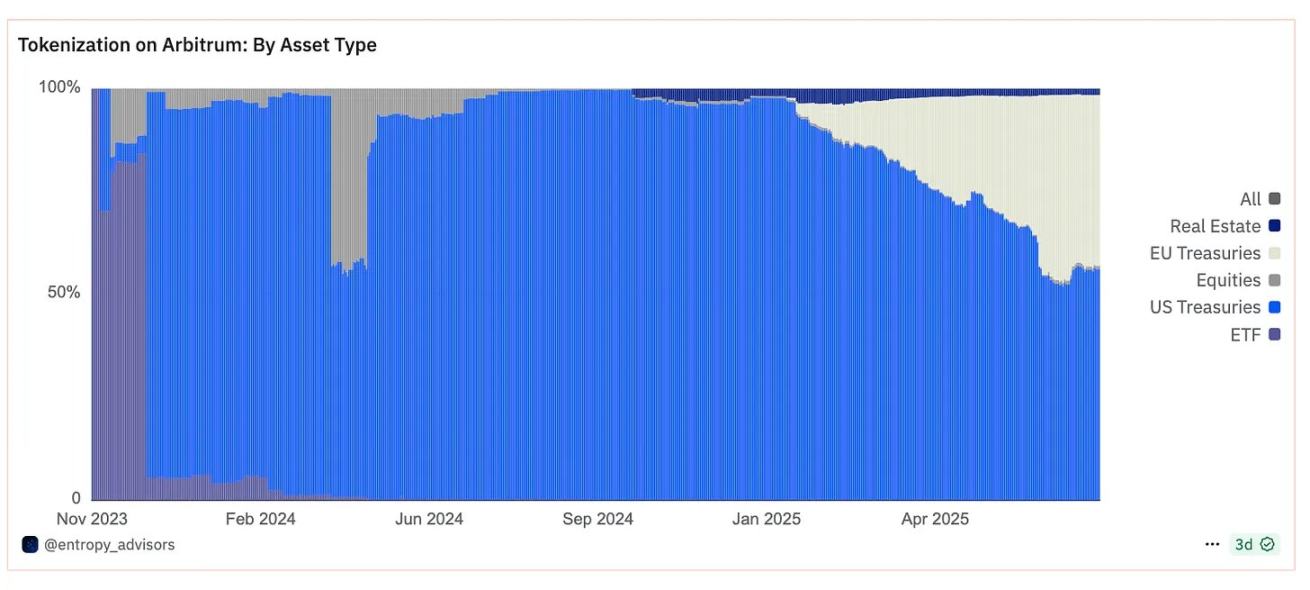

This development is also reflected in the types of assets supported on-chain. In 2024, most RWAs were still U.S. Treasury bonds. Over time, the variety of asset types has expanded to include new categories.

Although U.S. Treasury bonds still account for the majority of asset types ($197 million), EU government bonds closely follow ($150 million). Alternative assets such as real estate, stocks, and ETFs are also gradually gaining attention.

RWA Assets and Providers

This section will delve into these asset categories, highlighting the top ten RWA products ranked by total value and categorizing them by issuer.

Spiko

Spiko has created an on-chain securities token issuance and distribution platform.

The platform is licensed by the French Financial Markets Authority (AMF) and has launched two money market funds:

Spiko Euro (EUTBL)

Spiko Dollar (USTBL)

These funds are backed by a portfolio of short-term government bonds, with returns closely aligned with central bank risk-free rates. Currently, they are among the most widely used products, with EUTBL leading at $146 million in total value, and USTBL ranking fourth at $24.8 million, further proving that short-term government bonds are the most widely used assets in on-chain applications.

Franklin Templeton

Franklin Templeton is a well-known investment management company listed on the New York Stock Exchange (BEN).

To bring tokenized mutual funds on-chain, the company launched the BENJI mobile app, which supports tokenized securities and cryptocurrencies through its proprietary record-keeping system.

Each BENJI token represents a share of its Franklin on-chain U.S. Government Money Market Fund (FOBXX). Currently, BENJI is the second-largest RWA product on Arbitrum, valued at over $87 million.

Securitize

Securitize is a platform that provides access to tokenized securities for institutional investors.

On Arbitrum, the platform offers BlackRock's U.S. Institutional Digital Liquidity Fund BUIDL.

This is a tokenized product backed by short-term government bonds, focusing on providing dollar returns on-chain, with a total value exceeding $33 million.

Dinari

Dinari allows for the creation of tokenized stocks, ETFs, indices, etc., known as "dShares," which maintain a 1:1 full backing relationship with the underlying assets.

Dinari has launched several products on Arbitrum:

WisdomTree Floating Rate Treasury Fund (USFR.d): Provides a low-cost investment channel for U.S. government floating rate bonds, with a total value exceeding $15 million.

Tokenized MicroStrategy Stock (MSTR.d): Valued at $1.8 million.

Tokenized Tesla Stock (TSLA.d): Total value of $450,000.

Tokenized S&P 500 Index ETF Trust (SPY.d): An index composed of S&P 500 constituent companies, with a scale of approximately $141,000.

These assets highlight the potential of stocks and indices, but their proportion in Arbitrum remains relatively low.

OpenEden

OpenEden provides access to products such as tokenized U.S. securities. The platform is licensed by the Bermuda Monetary Authority and holds a digital asset operating license, receiving a "investment grade" rating from Moody's.

Currently, the platform is the most significant issuer of tokenized U.S. Treasury bonds in Europe and Asia. OpenEden has specifically launched the TBILL fund pool, where users can invest in short-term U.S. Treasury bonds.

Currently, deposits in this fund pool have exceeded $5.8 million.

Ondo

Ondo provides investors with opportunities to access institutional financial products.

On Arbitrum, its USDY product has received a positive response, currently valued at $5.7 million.

USDY is an income-generating stablecoin backed by U.S. Treasury bonds, with an annual yield of approximately 4.29%.

Although Arbitrum has a rich product and asset portfolio, the RWA ecosystem is still in its early stages.

Its future development will depend on:

On-chain asset expansion to meet broader demand

Strategic focus on RWA as a competitive area for Arbitrum

Collaboration among Arbitrum Alliance Entities (AAE)

Institutional promotion at the business development level

Future Outlook

The initial providers established by STEP 1 have been supplemented by a new batch of providers during STEP 2, enriching the types of assets and products on Arbitrum.

Based on the current growth rate of RWA's total value on Arbitrum, we can make the following predictions:

Formation of a billion-dollar RWA ecosystem

Inclusion of more asset categories (private credit, real estate, income-generating stablecoins, etc.)

Achieving deeper interoperability of these assets across networks

Despite having made some progress, Arbitrum still has significant room for growth if it wants to solidify its position in this niche. In fact, in the network ranking of total value of RWA assets, Arbitrum is currently ranked seventh; with a total locked value (TVL) of $350 million, it only accounts for 1.39% of the total market capitalization of on-chain RWA assets, which is a minuscule share.

To compete with these networks, Arbitrum needs to explore more opportunities and expand into areas such as private credit issuance products, bonds, precious metals like gold and silver, and stocks.

Given Entropy's deep involvement in treasury management and RWA-related affairs on Arbitrum, we consulted Matt for his views on the future development of RWA on Arbitrum. Here are his insights:

"Today, many RWA issuers are primarily focused on reducing operational costs associated with issuance and transfer, and there is still a long way to go to validate this at scale. Nevertheless, the next major breakthrough for RWA on Arbitrum will be to further enhance composability. This is not just about adding more asset classes or introducing new issuers; that is just the first step. The real breakthrough lies in ensuring that these assets can integrate with the more efficient on-chain building blocks that the industry has developed over the past decade: exchanges, lending protocols, index tools, liquidity pool optimization tools, and various innovations that may emerge in the future. The ultimate goal is to achieve open, permissionless transferability, allowing RWA to be combined freely like native crypto assets. We have not yet reached this stage (considering the current regulatory realities, this is a lofty goal), but it is our North Star. Encouragingly, industry giants like Franklin and WisdomTree have begun issuing tokens themselves. This is true institutional participation, and it is a trend I hope to see continue. If we can truly conduct RWA-related user activities (such as trading and lending) on-chain — even if these activities are abstracted through permissioned channels based on Arbitrum — it will open up new horizons."

We fully agree with Matt's perspective, especially regarding the composability and accessibility of these assets. Currently, the on-chain application potential of these assets is just beginning to emerge. We look forward to a future where treasury bills, bonds, stocks, and commodities can not only be tokenized on-chain but also integrated into various foundational components of the current DeFi landscape.

From a research methodology perspective, it is important to note that in this report focusing on RWA, we have not included stablecoins in the analysis, as the core purpose of the report is to highlight the various assets available on the Arbitrum platform.

Lastly, it is equally important to mention the associated risks and considerations in conjunction with this analysis.

Risks and Forward-Looking Considerations

Disconnection between tokens and ecosystems: The growth of real-world RWA will not directly translate into value appreciation of ARB tokens.

Asset concentration risk: Short-term government bonds still account for a very high proportion of the total locked value (TVL) in RWA, highlighting the necessity of diversifying into asset classes such as private credit, corporate bonds, and real estate.

Regulatory dynamic risk: Although the regulatory environment for cryptocurrencies is continuously improving and gradually moving towards legalization, the compliance framework for tokenized securities is still in development, and institutional issuance demands greater regulatory clarity and cross-jurisdictional coordination.

The expansion of asset issuers and the on-chain development of RWA categories such as private credit and real estate are expected to drive the total locked value (TVL) of the Arbitrum ecosystem close to $1 billion by the end of the year.

With the comprehensive advancement of treasury management plans and STEP 2, we expect to gain more information and insights that will not only further reveal the implementation results of the aforementioned plans but also provide references for future decisions and initiatives.

Conclusion

The total locked value (TVL) of RWA on Arbitrum has grown from nearly zero to $350 million in just over a year.

The STEP initiative and a series of DAO-led measures have played a key role in driving early growth. In this process, a diverse range of institutional-grade products has gone live on Arbitrum, such as short-term government bonds, money market funds, and tokenized stocks.

The entry of institutions like Franklin Templeton and WisdomTree further solidifies Arbitrum's core position as a "reliable, neutral, and low-cost network" in the institutional DeFi space.

However, this process has only just begun.

In addition to the aforementioned risks and issues, Arbitrum will face several strategic opportunities in the coming months.

These include expanding into RWA categories that are not yet fully covered, such as private credit, real estate, and commodities. More importantly, there is a need to enhance the composability of these new products and achieve deep integration with Arbitrum's core building blocks (decentralized exchanges, lending protocols, liquidity pools, etc.).

As the ongoing STEP 2 and treasury management plans continue to inject momentum and provide practical experience, the collaborative efforts between the DAO, alliance entities, and institutional participants will be key to maintaining Arbitrum's long-term leadership in the RWA space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。