In the past two years, the landscape of the Perp DEX track has rapidly evolved—from an early focus on security and basic functionality to a current competition in matching speed, liquidity depth, capital efficiency, and higher-level user experience and strategy tools. The competition in this track increasingly resembles a war for "high-performance financial infrastructure," where the winner must not only lead in performance but also occupy a position in product narrative and user mindset.

Hyperliquid's various data continuously suppress centralized trading platforms, with cryptocurrency prices repeatedly hitting new highs. Perp DEX has become one of the most profitable and fiercely competitive sectors in the crypto industry.

Pacifica was born in this context.

Pacifica Product Introduction

Pacifica is a perpetual contract DEX based on Solana, founded in January 2025 by three founders, including former FTX Chief Operating Officer Constance Wang. It launched its testnet in just two months and completed its mainnet launch on June 10. Two months after going live, the platform's trading activity rapidly increased, and by August 13, daily trading volume had surpassed $50 million, with active users exceeding 1,000, showing a very strong growth momentum.

Their goal is to create a platform that combines top trading performance, user-centric product design, and AI-driven smart trading tools, allowing anyone to easily execute complex trading strategies.

In terms of performance, Pacifica leverages Solana's high throughput capabilities, providing certain advantages in execution latency and order processing speed. Additionally, it integrates AI-assisted trading strategy generation and risk management to lower the barriers to strategy formulation.

Currently, due to being in the early stages of product development, the Pacifica mainnet only supports trading of three perpetual assets (BTC, ETH, SOL), with more cryptocurrencies to be listed in the future.

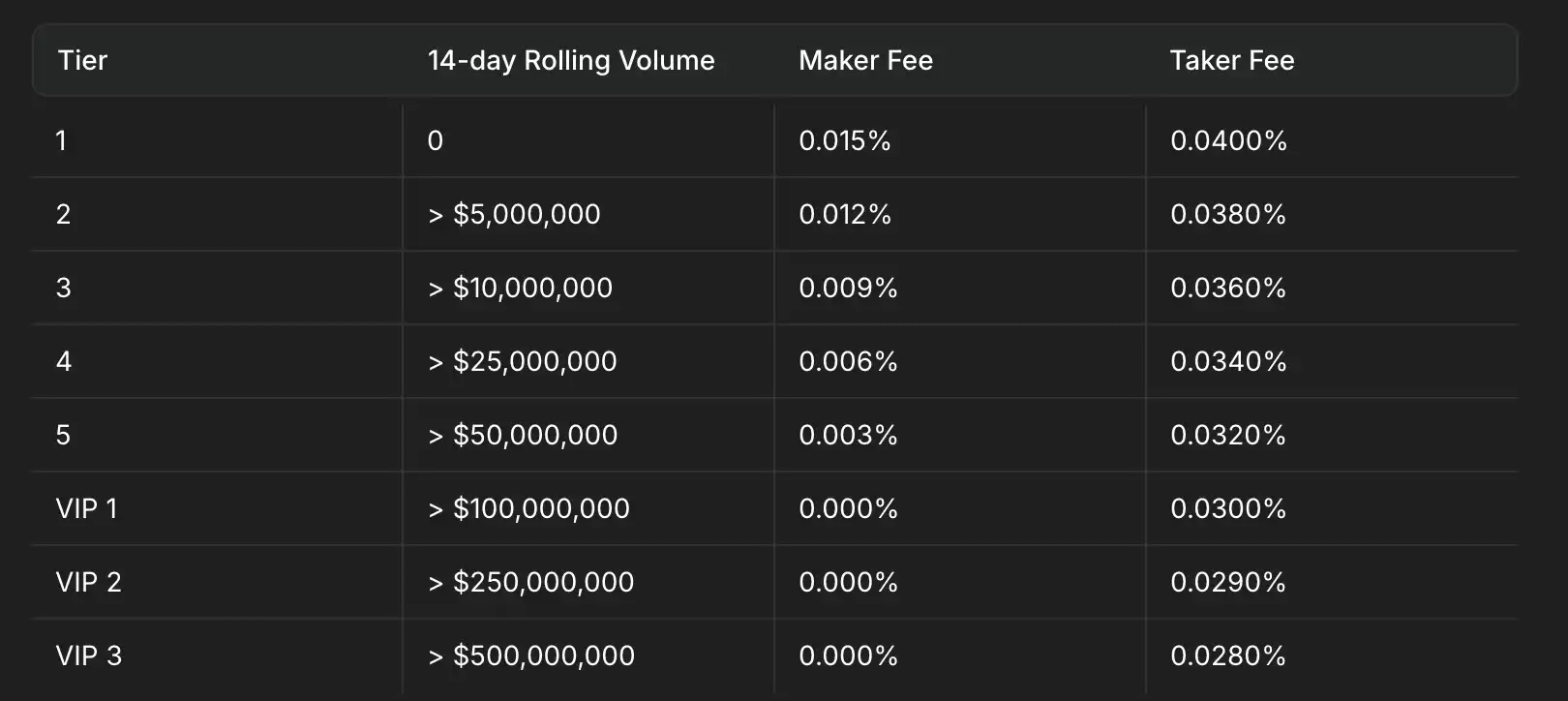

Pacifica's fee levels are entirely determined by trading volume, updated daily based on the account's trading volume over the past 14 days. All sub-accounts share the same fee level as the main account. The trading volume of sub-accounts is included in the total for calculating the main account's fees.

As this is a Perp DEX built on the Solana chain, a DeFi wallet compatible with Solana (such as Phantom, Solflare, Backpack, Ledger, etc.) and USDC collateral are required before trading.

For security reasons, as the scale of closed testing expands, Pacifica currently limits the maximum deposit amount to $5,000. Any deposits exceeding this amount will be restricted at the front end, and API deposits over this amount will be held in a pending state.

Team and Funding Background

According to the official website, Pacifica's core members come from top trading platforms in the crypto space such as Binance, FTX, Coinbase, NFTperp, as well as top financial institutions like Jane Street, Fidelity, and AI pioneers OpenAI, DeepMind, ByteDance, with academic backgrounds from MIT, Stanford University, National University of Singapore, and other leading institutions.

Pacifica's founder, Constance Wang, was the COO of FTX and co-CEO of FTX Digital Markets, and has also served as the head of business development at Huobi, with experience in risk control at Credit Suisse Private Banking. She has extensive experience in global trading platform operations, risk management, and business development.

Another co-founder, Jose (@The0xJose), founded NFTperp and successfully completed a $3 million funding round led by 1kx, familiar with the entire process of building a high-performance decentralized trading platform from scratch. At Pacifica, she focuses on optimizing the stability, efficiency, and scalability of the trading system, while also taking on the role of product narrative and user experience design.

Another core team member, Tony (@AsyncBlock), has not much information available, but is presumed to be mainly responsible for the technical development of Pacifica.

In terms of funding background, Pacifica has maintained zero external funding to date, clearly stating on its website, "We haven't raised external capital." The funds are entirely self-raised by the founding team, allowing for a more independent and controllable development pace.

Currently, Pacifica is attempting gamified marketing activities to build community interaction highlights and increase trading volume. The background of team founder Constance Wang at FTX has also sparked much discussion. Within the overall Solana DEX community, users have discussed the development threshold and ease of building, mentioning that the current development environment is becoming increasingly mature, implying expectations for high-performance DEX—this is a favorable background for Pacifica.

In the future, competition in the Perp DEX track will only intensify: the Solana ecosystem's advantages in basic performance and liquidity are amplifying, and AI-driven trading tools will accelerate the lowering of entry barriers for ordinary users into complex strategies. For Pacifica, opportunities and challenges coexist.

In this track where liquidity and speed are equally important, the market will ultimately reward those players who can "run fast" and "tell a good story." Whether Pacifica can grow from a "potential stock" to a "top player" remains to be seen as we move forward step by step.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。