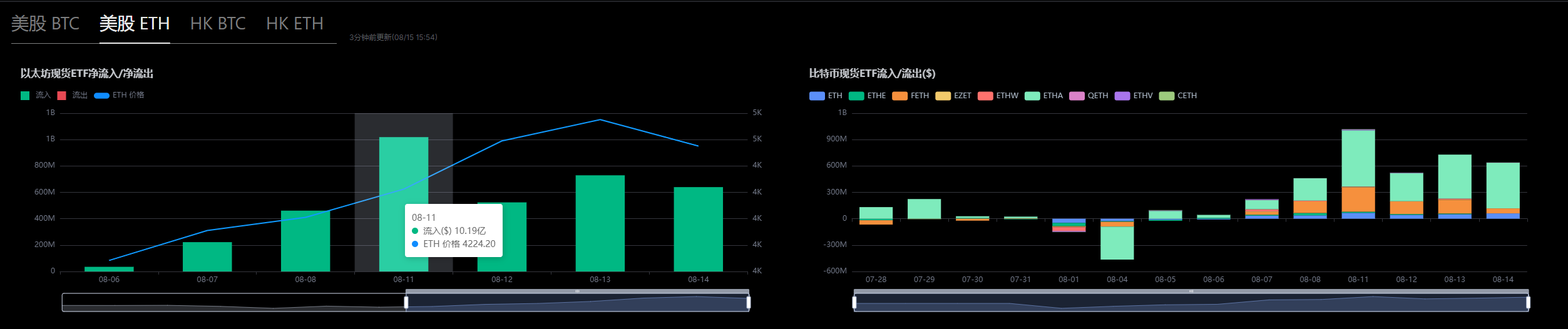

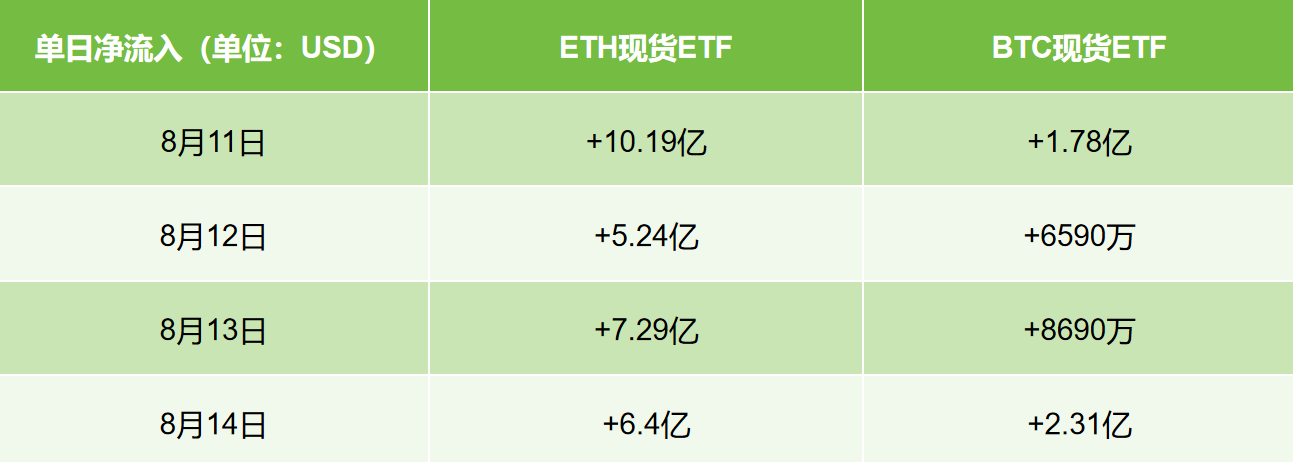

This week, the cryptocurrency market experienced a historic influx of funds. According to AICoin data, the net inflow of the US stock ETH spot ETF surged strongly, exceeding $1 billion in a single day at its peak, overwhelming the long-dominant Bitcoin (BTC) spot ETF.

Looking back at the fund flow data from August 11 to 14, the performance of the ETH spot ETF can be described as a "crowning moment." Over four days, the average daily net inflow of the ETH spot ETF reached $728 million, while the average daily inflow of the BTC spot ETF during the same period was $140 million, with the former being more than five times the latter.

Triple Drivers: The Core Logic Behind ETH's Rise

The rise of the ETH spot ETF is not a coincidence. The driving forces behind it are multidimensional:

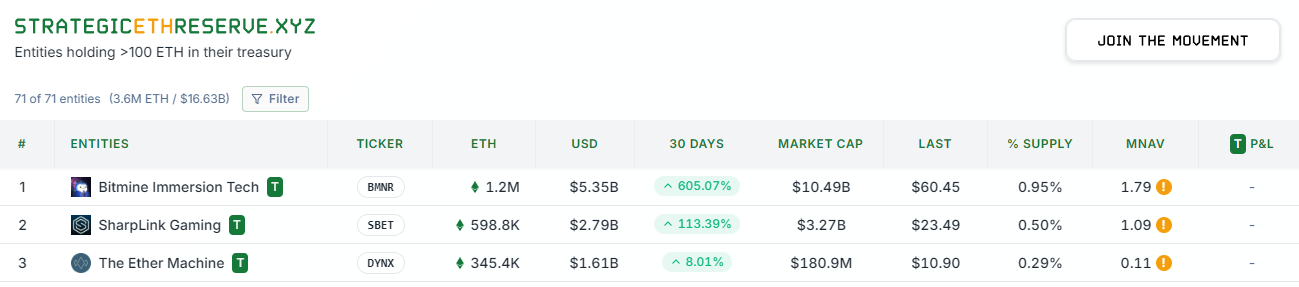

Institutional Strategy Shift: Similar to the "MicroStrategy" Bitcoin treasury strategy, more and more institutions are beginning to include ETH in their balance sheets. The rise of this "Ethereum treasury" strategy marks a shift in institutional investment from single assets to diversified portfolios. Ethereum's vast DeFi (decentralized finance), NFT (non-fungible token), and Web3 ecosystems provide a broader growth narrative than Bitcoin.

Technical Breakthrough: This week, the price of ETH broke through $4,300, reaching a new high since December 2021. This critical technical breakthrough attracted the attention of many technical traders, further fueling market optimism and attracting more funds.

Favorable Policies: The progress of stablecoin legislation in the US Senate and the Trump administration's friendly stance towards the crypto industry have created a more favorable macro environment for Ethereum as a smart contract platform, boosting institutional confidence.

New Market Landscape: The Era of BTC and ETH as Dual Titans

In contrast to ETH's strength, BTC's performance appears relatively mild. Although its price also broke through $124,000, the increase (15%) is far less than ETH's 93% (since July). ETH is transitioning from a follower to an independent leader driven by institutional funds. In the future, BTC and ETH are likely to play the roles of "digital gold" and "digital oil," respectively, forming the core crypto asset portfolio for institutional investors.

Of course, the excitement around ETH is not without risks. Technical indicators show that its relative strength index (RSI) has entered a severely overbought area, indicating a high risk of a pullback in the short term.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。