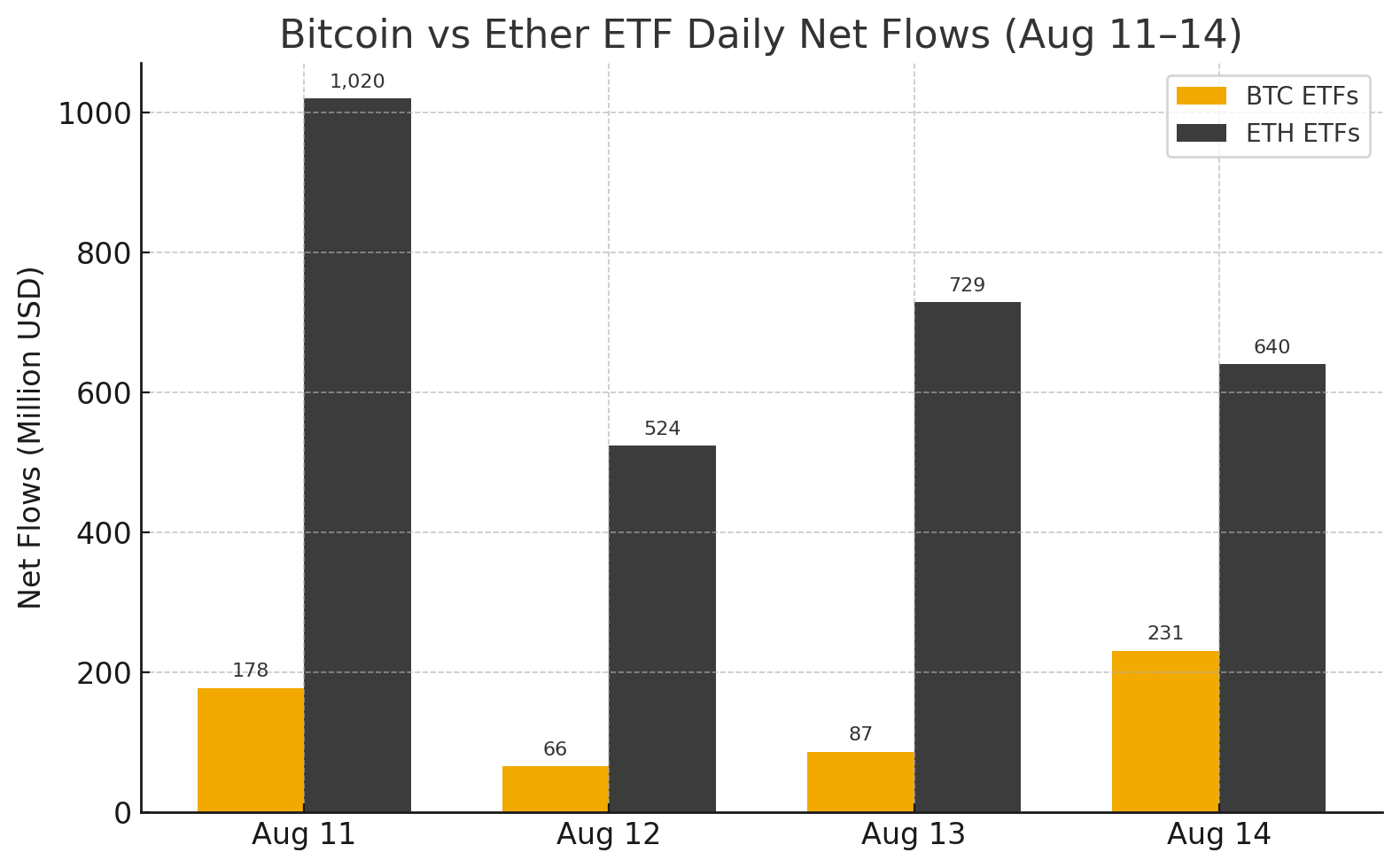

Crypto ETF momentum is refusing to cool. Thursday, August 14, saw ether ETFs bank another $639.61 million, extending their inflow streak to eight consecutive sessions, while bitcoin ETFs eked out $230.93 million to stretch their own run to seven days, despite heavy selling pressure in key products.

Ether ETFs continued their domination. Blackrock’s ETHA led with $519.68 million, followed by Fidelity’s FETH at $56.94 million. Grayscale’s Ether Mini Trust added $60.73 million, and Invesco’s QETH closed the list with $2.26 million. For the third day in a row, not a single ether ETF saw outflows. Turnover was a massive $4.22 billion, keeping net assets steady at $29.22 billion.

On the bitcoin side, Blackrock’s IBIT was the star, pulling in a staggering $523.74 million. Grayscale’s Bitcoin Mini Trust chipped in $7.32 million, but gains were challenged by sizable exits. Ark 21shares’ ARKB shed $149.92 million, Fidelity’s FBTC lost $113.47 million, and Bitwise’s BITB saw $30.87 million leave. Vaneck’s HODL also recorded a $5.85 million exit.

Even so, IBIT’s haul was strong enough to keep the day in the green. Trading activity hit a fresh record at $6.20 billion, though total net assets dipped to $153.43 billion.

Eight straight days of ETH inflows, record-high volumes, and BTC resilience in the face of selling, the ETF race is heating up fast.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。