Today's homework is relatively manageable, but many friends are more concerned about why there has been a decline. This is mainly due to multiple factors leading to a decrease in American investors' expectations for interest rate cuts in 2025, dropping from 100 basis points to 50 basis points. Many investors even believe that a 25 basis point cut would be good enough. This is the main reason; the reduction in interest rate cuts has caused some panic among investors.

This is also what we have been saying all along: the current main contradiction is the trend of monetary policy between Trump and the Federal Reserve. When the market leans towards the aggressive faction led by Trump, which can quickly cut rates, prices tend to rise. Conversely, when the market believes that the conservative faction led by Powell has the upper hand, prices tend to fall.

This is the main game at present. Looking at the data from the past week, it is indeed unfavorable for Trump and the rate-cutting faction. However, Trump himself does not seem to have much respect for the data; otherwise, he wouldn't have directly fired the head of the Bureau of Labor Statistics due to adjustments in employment numbers. As for the Federal Reserve, I don't think they care much about the data either.

Of course, if the data is not conducive to rate cuts, the conservatives will have it much easier, as they will have more substantial reasons to oppose Trump. Even if the data is not optimistic, they are also reluctant to cut rates, as it would appear to be yielding to Trump. So, overall, I believe the focus is not on the data itself, but rather on which side has more support from the delegates.

Today, I opened a long position at $117,333, which is a bit high, but since I've opened it, let's see how the trend develops. Of course, I am still worried about the risk of reduced liquidity over the weekend, so I have placed an order above the liquidation line.

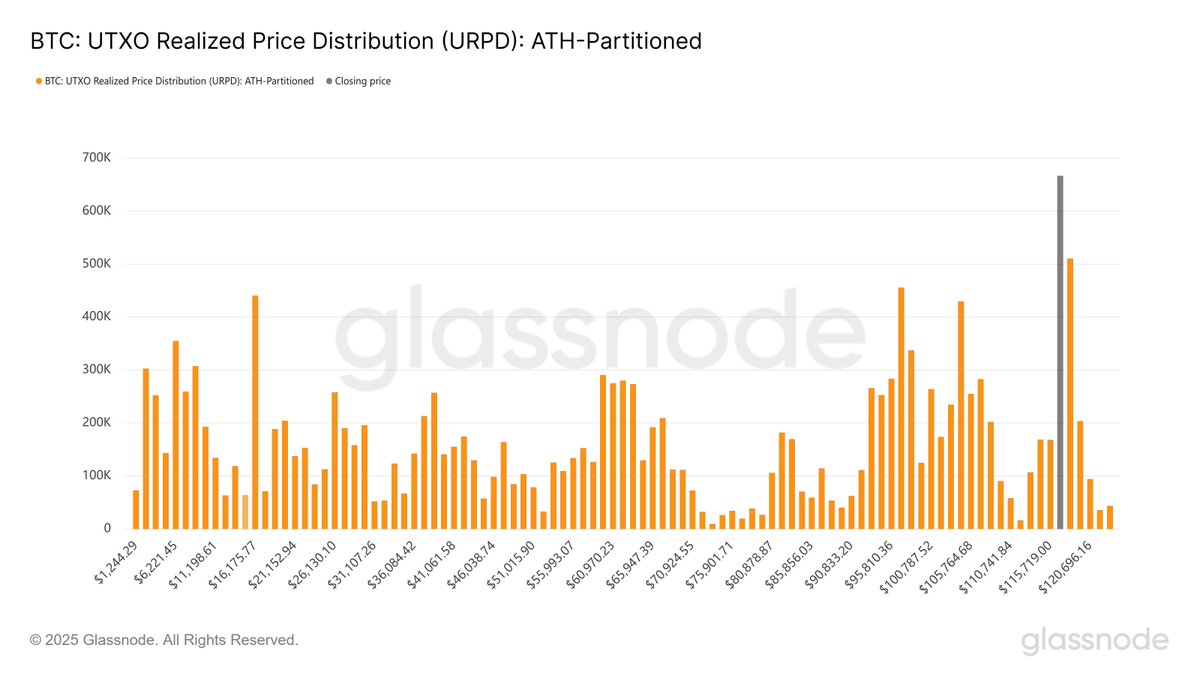

There is still no URPD data today; it should be available tomorrow.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。